Updated April 2025

With a business that’s been humming since 1918, this company has stayed true to its roots in leaf tobacco while slowly branching into adjacent areas like plant-based ingredients. It’s not chasing trends or growth-at-all-costs. Instead, it’s delivering the kind of consistency dividend investors crave.

Its story is one of slow, deliberate moves backed by stable cash flows and a payout history that spans decades. And right now, with shares yielding nearly 6%, it’s a name worth keeping on the radar for those focused on income and reliability.

Recent Events

Over the past year, UVV’s stock price has bounced between $45 and $59, settling in the mid-$50s range recently. That’s a pretty solid run for a company in a relatively slow-moving sector. What drove the move? Mostly fundamentals. Revenue jumped more than 15% year over year, and while margins remain slim—under 3% on the operating side—the business model isn’t designed for high-margin heroics. It’s about dependable volumes and relationships built over generations.

There’s been a little pressure on the balance sheet. Total debt now sits at about $1.23 billion, and the debt-to-equity ratio has crept toward 85%. But with over $100 million in cash and a current ratio of 2.6, the company has breathing room. That said, investors should keep an eye on those debt levels, especially in a rising-rate environment where interest costs can start to nibble away at earnings.

What’s perhaps more notable is that despite a negative free cash flow number for the trailing twelve months—about negative $114 million—the dividend doesn’t look at risk. UVV’s business sees big swings in working capital, especially with harvest cycles and customer delivery schedules, so one bad cash flow quarter isn’t the whole story.

Key Dividend Metrics

🧧 Forward Dividend Yield: 5.82%

💰 Annual Dividend Payout: $3.24 per share

📈 5-Year Average Dividend Yield: 6.12%

📊 Payout Ratio: 65.91%

📅 Ex-Dividend Date: April 14, 2025

📆 Next Dividend Payment: May 5, 2025

🔁 Consecutive Years of Dividend Increases: 53+

Dividend Overview

Universal has quietly built one of the strongest dividend track records out there. With 53 consecutive years of dividend hikes, it’s in a rare class of companies known as Dividend Kings. That means it has not just paid—but actually increased—its dividend every year for over five decades. That kind of consistency doesn’t happen by accident.

The forward yield of nearly 6% is attractive right out of the gate. And it’s not just about the size of the dividend—it’s the dependability. The company’s payout ratio, sitting around 66%, suggests it’s not overextending itself to maintain the dividend. There’s room to maneuver, even in more volatile years.

Despite a few recent headlines about cash flow dipping into the red, it’s worth remembering that UVV’s operations involve a lot of seasonal cash movements. Big harvests mean big inventories, which means cash gets tied up temporarily. But that doesn’t translate into long-term trouble unless the revenue side dries up—and so far, it hasn’t.

Dividend Growth and Safety

When a company has been increasing its dividend for over 50 years, you know it takes that commitment seriously. Universal doesn’t try to dazzle with giant dividend hikes. Most years, investors can expect a modest bump—usually just a few cents per share. But when your starting yield is near 6%, you don’t need big growth to build a strong income stream.

Over the past five years, the average annual increase has hovered in the low single digits. That’s not going to make headlines, but it’s enough to keep up with inflation and maintain purchasing power. What really matters here is the stability behind it. Universal’s board knows who owns this stock—income investors—and they act accordingly.

The dividend looks well-covered by earnings. With diluted EPS of $4.87 and a $3.24 dividend, the math works. Even with rising debt and some cash flow swings, there’s no sign of dividend strain. The company has the history, the operational discipline, and the financial structure to keep paying out—even when conditions get bumpy.

For investors looking to build or maintain a reliable income portfolio, UVV checks a lot of boxes. It’s not going to offer rapid capital gains or headline-grabbing innovation, but it will keep sending checks—and that’s the whole point.

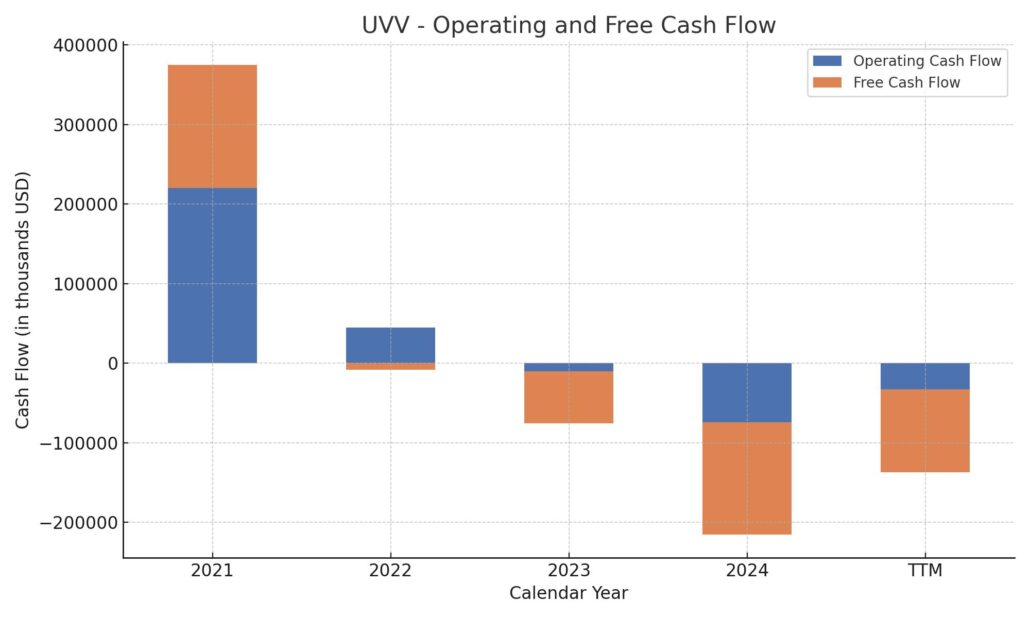

Cash Flow Statement

Universal Corporation’s trailing twelve-month (TTM) cash flow paints a picture of a company navigating through some working capital challenges. Operating cash flow came in at negative $33.2 million, which is a notable drop compared to the prior fiscal year’s negative $74.6 million but still far from the healthier levels seen in 2021. These figures suggest timing issues with receivables and inventory, likely tied to seasonal crop cycles and customer shipment schedules. The underlying business remains stable, but cash generation has been pressured in the short term.

Capital expenditures were steady, totaling $70.8 million in the TTM period. That level of reinvestment, combined with ongoing negative operating cash flow, led to a negative free cash flow of $104 million. However, UVV still managed a positive financing cash flow of $119 million—likely bolstered by strategic debt activity—which helped support a solid year-end cash position of $102 million. While not ideal, this kind of fluctuation isn’t unusual for a company like UVV, where working capital can swing significantly. The key point is that despite the strain, they’ve maintained liquidity without cutting their dividend or retreating on their core commitments.

Analyst Ratings

🔎 As of early April 2025, Universal Corporation (UVV) doesn’t have much buzz in the analyst world. 📉 Only one analyst is actively covering the stock, and they’ve issued a “Buy” rating, setting a price target of $59. That’s roughly 6% above where the stock is currently trading, sitting around $55.64.

🟢 The last known rating move goes back a bit. On September 12, 2013, UVV was upgraded from “Neutral” to “Buy.” Interestingly, that upgrade came just a few months after a downgrade to “Neutral” back in March of the same year. While the reasons at the time were tied to business momentum and margin visibility, there hasn’t been a steady stream of updates since.

📊 The lack of fresh analyst coverage may seem unusual, but it lines up with UVV’s profile—steady, low-drama, and a bit outside the high-velocity sectors that usually attract analyst attention. The business is consistent, and the dividend history speaks for itself, which might explain why institutions still hold a significant portion of shares despite minimal Wall Street chatter.

📌 For investors, this means doing a bit more legwork on fundamentals and staying current with the company’s own financial releases, since external analyst commentary is sparse.

Earning Report Summary

A Quarter of Growth With a Few Bumps

Universal Corporation wrapped up its third quarter of fiscal 2025 with solid revenue growth but also a few financial hiccups along the way. The company brought in about $937 million in revenue for the quarter ending December 31, 2024, which was up around 14% from the same period last year. That jump came from a better product mix and bigger, better-quality crops.

But while the top line looked good, the bottom line didn’t come through quite as strong. A chunk of that had to do with roughly $11 million in currency remeasurement losses in the Tobacco Operations segment. Despite that, the company kept its uncommitted inventory low—only about 10%—which shows solid inventory discipline and strong underlying demand.

Ingredient Segment Holds Steady

The Ingredients side of the business also had a decent showing. Sales volumes rose, helping to push revenues higher. However, margins felt a little squeeze from rising raw material costs and overall food inflation. That said, demand for higher-margin, value-added products remained strong. It’s clear that recent investments to strengthen this segment are starting to pay off, even if inflation has made some parts of the business harder to navigate.

Balance Sheet Snapshot

Universal ended the quarter with a decent cash cushion, holding roughly $215 million in cash and equivalents. Accounts receivable landed at about $651 million, and inventories were just over $1.1 billion. The company’s debt load included around $539 million in notes payable and overdrafts, plus $618 million in long-term debt. They still had access to about $270 million from their credit line, giving them some financial flexibility going into the final stretch of the fiscal year.

Moving Forward and Addressing Challenges

Management remains optimistic about how the year will close out. They’re continuing to fine-tune the tobacco side of the business, grow their ingredients segment, and explore synergies between the two. It’s a slow-and-steady approach aimed at boosting customer value and keeping shareholders happy.

On the sustainability front, the company is making strides. Over 93% of the tobacco they process is now coal-free, and they’re on track with their goal to cut greenhouse gas emissions by 30% by 2030. They’ve also trained over 175,000 farmers on sustainable and ethical farming practices—part of their broader push to strengthen the supply chain.

One issue hanging over the quarter was a discovery of embezzlement by a former finance employee in Mozambique. About $16.7 million in unauthorized payments were found, spread across several years. The company is still investigating and working to recover those funds, including insurance claims. They’ve delayed the full earnings release and investor call for the quarter, but they don’t expect this issue to materially impact their fiscal 2025 numbers. More updates will come once everything is sorted out.

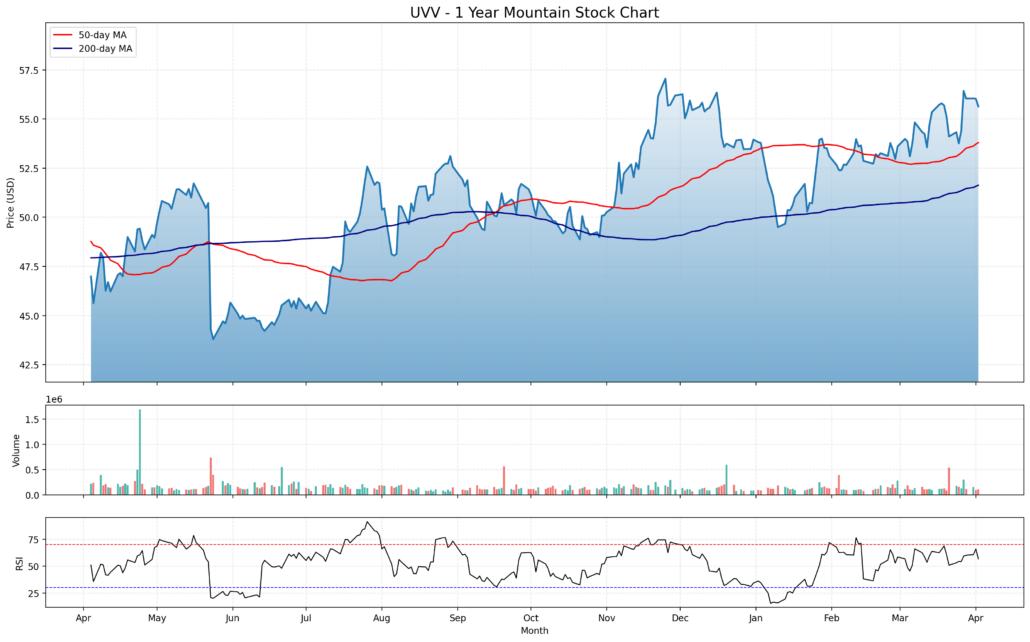

Chart Analysis

Price Trend and Moving Averages

Over the past year, the stock has shown a fairly constructive upward trend, especially noticeable from late October onward. After bottoming out in the summer months, prices began a steady climb, pushing above both the 50-day and 200-day moving averages. The red 50-day moving average has recently leveled out a bit but remains above the 200-day, suggesting momentum is still on the side of the bulls, albeit more modestly.

The fact that the 200-day average has now turned upward confirms a longer-term trend shift. That shift started gaining traction around November, where price consistently held above both moving averages. This kind of price behavior tends to point toward stability rather than speculation, reflecting gradual accumulation rather than aggressive trading.

Volume Activity

Volume has remained relatively muted, with only a handful of spikes scattered throughout the year. This type of low-volume stability often signals a shareholder base that isn’t easily shaken. It’s also worth noting that even during periods of price dips, volume didn’t spike dramatically, suggesting there wasn’t widespread panic or dumping of shares.

Spikes in May and January are the few outliers where activity picked up, likely tied to earnings or dividend-related events. Outside of those windows, trade volume has kept a low, consistent rhythm.

Relative Strength Index (RSI)

The RSI has mostly hovered in the mid-to-upper range for the past several months, rarely dipping below the neutral 50 line. There were a few moments of overbought signals in August, February, and again recently in March, but none resulted in a steep or prolonged selloff. In fact, the stock seems to cool off just enough to stay out of overheated territory without losing much ground.

This steady RSI action combined with price support near the moving averages is a positive sign. It suggests that gains have been measured, with pauses along the way, rather than sharp bursts that tend to burn out.

Overall Price Behavior

From a broader perspective, this chart reflects a steady hand behind the price movement. It’s not explosive, but it’s consistent. The upward curve over the last five months, combined with tame volume and resilient RSI behavior, reflects quiet confidence. There’s no panic, no froth—just a measured upward trend that continues to respect key technical levels.

Management Team

In October 2024, Universal Corporation made a key leadership change. Preston D. Wigner, a long-time company insider with more than twenty years under his belt, stepped into the top role as Chairman, President, and CEO. He brings continuity and institutional knowledge, which matters when leading a company with global operations and a complex supply chain. Alongside him is Airton L. Hentschke, who serves as Chief Operating Officer and Senior Vice President. Johan C. Kroner holds the position of Chief Financial Officer and also serves as a Senior Vice President. Together, this team blends operational know-how with financial discipline, helping guide the company through both steady and uncertain times.

The management approach has remained conservative and pragmatic. There’s a focus on cash flow, protecting the dividend, and expanding the company’s capabilities in value-added ingredients. At a time when many firms are chasing trends or restructuring aggressively, Universal’s leadership appears focused on steady growth and protecting its long-term foundations.

Valuation and Stock Performance

Universal Corporation shares are currently trading around $55.64. The stock has moved within a 52-week range of $45.19 to $59.13, which reflects a relatively stable trading band with measured volatility. The stock’s beta of 0.77 suggests it moves less dramatically than the broader market, something that tends to appeal to more risk-averse investors.

From a valuation perspective, the company’s trailing twelve-month P/E ratio sits at 11.45. That’s below the broader market average and also conservative compared to peers in the consumer goods space. It may indicate undervaluation, or simply reflect the steady, low-growth nature of the business. Either way, the current price does not suggest investors are paying a premium.

The dividend remains a highlight. At a forward yield of 5.82%, the payout offers one of the more attractive income streams in the equity market. For those focused on capital preservation and income, the stock’s yield, combined with its consistent dividend history, continues to offer value.

Risks and Considerations

Universal doesn’t come without risks. Its core business still leans heavily on tobacco, a sector that faces regulatory scrutiny and long-term demand headwinds. Although the company has made strides in diversifying into plant-based ingredients and food-related products, tobacco remains the foundation. Any large regulatory changes or shifts in global health policy could weigh on revenues and margins.

There’s also the global supply chain to think about. Agricultural operations are naturally exposed to weather patterns, crop conditions, and geopolitical issues. A poor growing season or delays at a port can ripple through financial results in a meaningful way.

Currency exposure is another factor. With operations and customers spread across continents, earnings can be affected by exchange rate fluctuations. This was especially evident in the recent quarter, where foreign currency remeasurement caused notable losses.

The internal embezzlement investigation in Mozambique adds one more wrinkle. It doesn’t appear material to the overall business, but it’s a reminder that internal controls in global subsidiaries need to be constantly monitored. While management is actively addressing the issue, it highlights the importance of vigilance.

Finally, leadership transitions always bring a degree of uncertainty. While Preston Wigner has deep institutional experience, any change at the top can mean shifts in strategy or execution. Investors will want to keep an eye on how he steers the business over the next few quarters.

Final Thoughts

Universal Corporation has carved out a reputation for being steady, resilient, and income-focused. It may not capture the market’s attention like high-growth tech names, but that’s part of its identity. The stock offers consistent dividends, a relatively low valuation, and a management team that seems committed to balancing tradition with measured evolution.

The company’s future won’t be without its hurdles. Regulatory pressure, agricultural exposure, and operational risk are baked into the nature of the business. But the combination of a stable dividend, long-term contract-based revenue, and modest valuation could offer appeal for investors looking for reliable income and measured capital preservation.

The path ahead will likely depend on how effectively the company can grow its Ingredients business, while managing risk on the tobacco side. With experienced leadership now in place and a track record of delivering through various cycles, the foundation looks solid enough to keep delivering what it has long promised—stability, predictability, and income.