Updated April 2025

Zoetis is a company that operates behind the scenes, in a space most investors don’t think about daily—animal health. Since breaking away from Pfizer in 2013, Zoetis has grown into a dominant player, serving both pet owners and livestock producers with vaccines, diagnostics, and medicines across more than 100 countries. It’s a business with staying power, built on the fundamentals of steady growth, high margins, and the kind of cash flow that income-focused investors appreciate. If you’re looking for a dividend stock that prioritizes sustainability over sizzle, Zoetis might be your kind of story.

Recent Events

Over the past year, Zoetis stock has treaded water, down just over 1% while the S&P 500 marched higher. The current share price hovers around $162, well below its 52-week high of $200 but comfortably off the low of $144. That dip doesn’t reflect a broken story—it’s more a result of shifting investor sentiment and the market pulling back on higher-multiple stocks.

Financially, Zoetis continues to perform with a quiet strength. Revenue grew 4.7% year-over-year, and earnings climbed nearly 11%. These aren’t explosive numbers, but they reflect consistency. In a market full of volatility, that kind of predictability has its own appeal.

Margins remain robust. The company’s operating margin is just above 33%, and net profit margins are near 27%. Zoetis also maintains a strong return on assets at close to 15%, with return on equity hitting an impressive 51%. This shows the business not only earns well, but it puts its capital to work efficiently.

Key Dividend Metrics

💰 Forward Dividend Yield: 1.22%

📈 5-Year Average Yield: 0.72%

🧾 Payout Ratio: 31.59%

📆 Next Ex-Dividend Date: April 21, 2025

💵 Next Dividend Payment Date: June 3, 2025

📊 Dividend Growth Rate (5-Year): Consistent, solid pace

🛡️ Dividend Safety: Strong cash coverage and earnings support

Dividend Overview

Zoetis isn’t aiming to deliver the kind of fat dividend yield that catches the eye of high-income seekers. At just over 1%, the yield is modest—but it’s backed by rock-solid fundamentals. For long-term investors who value growth and stability over immediate gratification, that modest yield may be a fair trade-off.

What makes Zoetis stand out is how responsibly it manages its dividend. The payout ratio sits under 32%, suggesting the company is paying shareholders without compromising reinvestment or financial flexibility. That’s a healthy spot to be in—dividends are clearly a priority, but they aren’t being forced or overextended.

On the cash flow side, Zoetis generates more than enough to support its dividend. Free cash flow over the past year totaled about $2.37 billion. Considering its annual dividend commitment comes in around $896 million, there’s ample coverage. The dividend is well protected, with enough cushion for future increases even if business hits a rough patch.

Dividend Growth and Safety

Zoetis may not be flashy, but it’s reliable. Since its spin-off, the company has raised its dividend every year. That’s not a coincidence—it’s a reflection of a business that has quietly built a track record of performance and shareholder focus.

Over the past five years, dividend increases have come in at a pace that’s steady and meaningful. Not too fast to worry about sustainability, not too slow to be ignored. It’s the kind of growth that, over time, compounds into something much more attractive than it looks at first glance.

The safety of that growth rests on several pillars: strong profitability, low payout ratios, and consistent cash flow. With earnings growing over 10% year-over-year and a wide margin between earnings and dividends, Zoetis has room to continue its upward dividend path without taking on added risk.

Its balance sheet, while carrying a decent amount of debt—$6.8 billion at last check—isn’t overly stretched. The debt-to-equity ratio sits around 143%, but with nearly $2 billion in cash and a current ratio of 1.75, the company is in good shape to manage its obligations.

Return metrics like ROE and ROA help reinforce this story. A return on equity over 50% is no small feat—it shows management is getting strong results from the capital they have. That’s a good sign for dividend investors who care about efficient capital use.

Even when share prices fluctuate, as they’ve done over the last year, the dividend story remains intact. That kind of resilience is exactly what long-term income investors want to see: a company that doesn’t just talk about commitment to shareholders, but demonstrates it year after year.

Zoetis may not be delivering eye-popping dividend yields, but for those focused on long-term compounding and financial quality, it earns its place in the conversation.

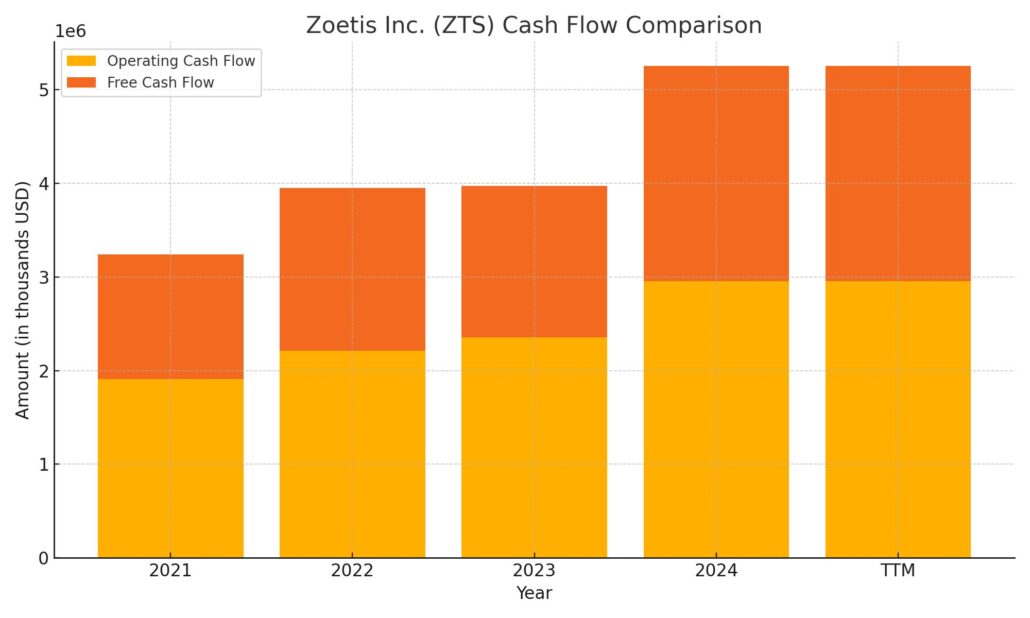

Cash Flow Statement

Zoetis has maintained a strong operating cash flow profile over the trailing twelve months, generating $2.95 billion—a meaningful increase from the $2.35 billion posted in the prior year. This uptick reflects improved earnings and solid working capital management. After capital expenditures of $655 million, free cash flow came in at $2.3 billion, a solid improvement from the $1.62 billion in 2023. This trend shows the company is effectively converting its income into real cash, reinforcing the reliability of its dividend program and funding for future growth initiatives.

On the investing side, outflows were relatively light at $315 million, down significantly from previous years, suggesting a more focused capital allocation approach. The company did step up its shareholder returns, spending nearly $1.86 billion on stock buybacks. Financing cash flow came in at a negative $2.66 billion, primarily due to these repurchases along with ongoing debt servicing. While the cash balance has dipped slightly to just under $2 billion, Zoetis still maintains a strong liquidity position and ample flexibility to manage future obligations or continue rewarding shareholders.

Analyst Ratings

📊 As of April 3, 2025, Zoetis Inc. (ZTS) is trading at $162.69. 📈 Analyst sentiment remains positive, with a consensus 12-month price target averaging $215.90, pointing to a potential upside of roughly 32.6%.

✅ In recent months, several analysts have reiterated their confidence in Zoetis. On February 27, 2025, one major firm reaffirmed their “Overweight” rating with a price target of $205. Around the same time, other big names in the financial world maintained similar “Buy” ratings, signaling a general agreement on the stock’s upside potential.

🔍 The overall mood from the analyst community leans bullish, with the majority offering “Buy” or “Strong Buy” ratings. This upbeat tone reflects confidence in Zoetis’s strong fundamentals, consistent revenue growth, and the durability of its business model. Analysts have also pointed to its expanding product pipeline and leadership in the animal health sector as key strengths supporting the stock’s valuation.

💡 There haven’t been major downgrades recently, which reinforces the idea that Wall Street continues to view Zoetis as a stable, high-quality name in its industry. Even without dramatic price moves, the company’s steady hand and clear visibility into future growth have kept sentiment strong across the board.

Earning Report Summary

Solid Quarter with Strong Pet Product Demand

Zoetis ended the fourth quarter of 2024 on a strong note, showing once again that its position in the animal health industry is anything but fragile. Revenue came in at around $2.3 billion, up about 5% from the same time last year. That growth was largely driven by the companion animal segment, especially in the U.S., where pet ownership and spending remain strong. Products like Simparica, the company’s popular flea and tick treatment, had a standout performance—growing 28% on an operational basis. Librela and Solensia, used for managing osteoarthritis pain in pets, also turned in an impressive showing with growth nearing 80%. Those numbers aren’t just good—they reflect a real shift in how people are caring for their pets.

Livestock Segment Holding Steady

On the livestock side, results were more mixed, but still steady. International business helped keep revenues from dipping, even as the company moved away from some lower-margin feed additive products. That move wasn’t a misstep—it was part of a broader effort to tighten the focus and lean into areas with stronger growth potential. It’s all part of Zoetis’ plan to streamline operations while staying ahead of evolving market needs.

Healthy Profit Growth and Outlook

Net income for the quarter came in at $581 million, which was a solid 11% bump from last year. Adjusted income hit $632 million—again, an 11% gain. For the full year, Zoetis posted $9.3 billion in revenue and $2.5 billion in net income. Adjusted earnings per share landed at $5.92, which is a 17% operational jump. Those numbers tell a clear story: the company is profitable and knows how to manage its costs.

Looking Ahead

For 2025, the outlook remains upbeat. Management expects revenue to fall somewhere between $9.225 billion and $9.375 billion, with organic growth projected in the 6% to 8% range. They’re guiding toward adjusted net income of $2.7 to $2.75 billion and earnings per share between $6.00 and $6.10. With continued momentum in key product lines and a sharpened strategic focus, Zoetis appears well-positioned heading into the new year.

Chart Analysis

Price Action and Moving Averages

Looking at the chart for ZTS, the stock has spent the better part of the past year moving through a noticeable shift in momentum. From early spring through late fall, the price steadily climbed and peaked around October, brushing up near $195. But since then, it’s been under pressure, drifting lower and holding mostly below both the 50-day and 200-day moving averages.

The 50-day moving average (red line) crossed below the 200-day (blue line) late in the year—what traders often refer to as a death cross. While that’s generally viewed as a bearish signal, it’s not necessarily a long-term concern unless the trend persists and is accompanied by fundamental weakness, which isn’t the case here.

Volume and Participation

Volume tells another part of the story. There were a few notable spikes, especially during selloffs in February and again in early December, showing some heavier trading during down days. But outside of those bursts, volume has been relatively stable. That suggests the selling hasn’t been panic-driven, but more likely due to rotation or profit-taking.

Relative Strength Index (RSI)

The RSI indicator spent much of the summer and early fall above the midline, indicating strength. Since then, it’s dipped into oversold territory multiple times, with brief rebounds into the 60s, showing that while buyers are stepping in periodically, the momentum hasn’t fully shifted back in favor of the bulls. More recently, RSI has climbed again, but not yet to overbought territory. That puts the stock in a middle zone—not aggressively bought or sold, but sitting in a spot where a stronger move in either direction could take shape.

General Takeaway

ZTS has clearly come off its highs and is working through a period of consolidation. The long-term averages are flattening out, suggesting the prior uptrend has paused but hasn’t broken down entirely. Price sitting below both moving averages does indicate caution, but with no signs of capitulation, and given the stock’s longer-term resilience, this may simply be a cooling-off phase.

It’s not in rally mode, but it’s not collapsing either—just digesting past gains while waiting for its next cue.

Management Team

At the helm of Zoetis Inc. (ZTS) is Chief Executive Officer Kristin Peck, who has led the company since 2020. Peck has played a major role in driving innovation while expanding Zoetis’s presence globally. Her leadership style leans heavily on strategy and execution, and she’s focused on strengthening the company’s market position without losing sight of operational efficiency.

Supporting her is Glenn David, the Chief Financial Officer and Executive Vice President. David has been with Zoetis since it spun off from Pfizer, and his deep knowledge of the company’s financial structure has helped shape a disciplined approach to growth. His role has been essential in keeping balance sheet strength and capital allocation aligned with long-term business goals.

The broader executive team includes experienced leaders across research, commercial operations, supply chain, and international markets. Together, they’ve developed a cohesive strategy that blends innovation with financial discipline, helping the company maintain a strong competitive edge.

Valuation and Stock Performance

Zoetis currently trades near $163, with a trailing price-to-earnings ratio just under 30. That puts it on the higher end of the valuation spectrum compared to broader market averages, which often indicates investors are willing to pay a premium for a business with consistent earnings and leadership in its field.

Over the past year, the stock has been on a bit of a ride, peaking above $200 and dipping as low as $144. Despite that range, it’s managed to maintain a sense of stability, with price action that reflects investor confidence even in more cautious market conditions.

Looking ahead, the forward P/E drops slightly, suggesting expected earnings growth. The company also trades at a price-to-book ratio above 15, which might raise eyebrows in more asset-heavy sectors, but makes sense here considering Zoetis’s intangible assets like intellectual property, proprietary research, and strong brand presence in the animal health space.

Risks and Considerations

Even with its strong fundamentals, Zoetis isn’t without its challenges. One of the most recent concerns has come from reports tied to Librela, its arthritis treatment for dogs. Following incidents related to seizures and loss of muscle control, the FDA requested updates to product labeling. While this doesn’t spell doom for the product, it’s something that could slow momentum or prompt tighter scrutiny from veterinarians and pet owners alike.

Beyond product-specific concerns, broader risks in the animal health sector remain. Regulatory hurdles, disease outbreaks, and shifting consumer behavior all come into play. Zoetis has been proactive—for example, recently obtaining a conditional license for its avian influenza vaccine for poultry—but these moves come with execution risks and dependency on government decisions and animal health trends.

Other considerations include global economic conditions, which may influence Zoetis’s pricing power and operating costs. Currency fluctuations and potential supply chain bottlenecks could also weigh on near-term performance, particularly as the company continues to serve over 100 markets worldwide.

Final Thoughts

Zoetis has shown that it can maintain a steady hand through various cycles. It’s a company built around a stable and growing niche—animal health—and one that continues to benefit from structural trends in pet care and protein production.

The management team has executed consistently and stayed focused on long-term goals. Financially, the business is sound, with cash flow strength and a measured capital return policy. Valuation remains elevated, but that’s often the trade-off when dealing with category leaders that deliver on earnings and growth.

While there are always risks to watch, especially in a regulated space like this, Zoetis appears well-prepared to manage them. Its recent moves and product development pipeline show an active, forward-looking strategy. For investors following this name, it remains a company worth tracking closely over the next few quarters.