Updated April 2025

In a world where everyone seems to chase the next big growth story, there’s something quietly reassuring about a company like The York Water Company. Based in Pennsylvania and operating since 1816, this isn’t some flashy newcomer. It’s the oldest investor-owned water utility in the country, and it’s made a habit of rewarding shareholders with dividends for over two centuries—literally.

York Water serves more than 50 municipalities in south-central Pennsylvania, providing essential water and wastewater services. It’s a straightforward business, and that’s part of the appeal. For income-focused investors, the company’s commitment to stability over spectacle is what stands out. It may not swing for the fences, but it consistently gets on base—and for those seeking regular dividends, that matters.

Recent Events

The past year has been a bit of a rollercoaster for YORW’s stock price. It’s traded as low as $29.86 and as high as $41.96. Lately, it’s found a middle ground, sitting around $35.12. That bounce off the bottom comes even as the company reported a 14.5% drop in earnings year-over-year in its latest quarterly results. Despite that decline, revenue is still climbing, with a 4.3% gain—solid progress for a regulated utility.

York’s enterprise value is hovering around $700 million, and its forward P/E ratio sits at 25.45. Not cheap, but that valuation reflects how the market views the company’s predictability and reliability. One area to keep an eye on is debt. The company’s total debt has reached $205.95 million, with a debt-to-equity ratio of 89%. That’s not unusual in the utility sector, especially for companies investing in infrastructure, but it’s a number that deserves some attention.

Short-term liquidity is another factor to consider, with a current ratio of 0.90 suggesting a tighter balance sheet. Still, with a profit margin over 27% and a strong 36.4% operating margin, York’s core operations remain solid and profitable.

Key Dividend Metrics

📈 Forward Yield: 2.55%

💰 Annual Dividend: $0.88 per share

🧮 Payout Ratio: 59.97%

⏳ Dividend Growth (5-Year Avg): 1.90% yield

📅 Next Dividend Date: April 15, 2025

🔁 Dividend Frequency: Quarterly

🪙 Dividend Increase Streak: 20+ years

Dividend Overview

York Water isn’t chasing high yields to turn heads. Instead, it’s offering what many investors actually want—dependable income that doesn’t put the company’s financial health at risk. At a 2.55% forward yield, it’s not the flashiest dividend stock, but it’s reliable. The dividend comes out four times a year like clockwork, and the company hasn’t missed a payment since it started paying dividends over 200 years ago.

The payout ratio—sitting just below 60%—shows that management is taking a balanced approach. They’re giving shareholders a meaningful cut of profits without overextending. With the stock price having pulled back from its highs, the current yield offers a bit of an entry-point bonus for income-focused investors.

What York has going for it is consistency. The five-year average yield sits at 1.90%, so today’s 2.55% is a notable improvement. And with dividend hikes coming each year, even modest increases help maintain purchasing power and cushion against inflation.

Dividend Growth and Safety

York isn’t trying to grow its dividend by leaps and bounds. Instead, it sticks to slow, deliberate increases—usually around 3 to 4% a year. That may not be exciting, but it fits perfectly with the company’s broader strategy: stay conservative, manage costs, and focus on long-term sustainability.

Despite a dip in earnings, the dividend remains well-covered by earnings and cash flow. The company brought in over $30 million in operating cash over the past year, which more than supports its current dividend obligations. Free cash flow is currently in the red, but that’s due to ongoing investments in water infrastructure—an expected cost of doing business for a utility.

EBITDA is strong at $41.5 million, and the EV/EBITDA ratio of 16.09 tells us that York is still reasonably valued for a business with such predictable cash flow. Sure, the debt load is on the higher side, but not dangerously so. York has managed debt responsibly over the years, and there’s no indication that the dividend is in jeopardy.

With a beta of 0.66, the stock tends to move less than the market. That’s another layer of appeal for dividend investors. In volatile markets, York can act as a steady hand in a portfolio—delivering consistent income while avoiding wild swings in value.

Institutional ownership sits above 53%, a sign that larger investors see York as a long-term hold for dependable returns. Insider ownership is low, just over 1%, but that’s common for long-established companies like this where the founder’s ties are generations removed. What matters more is that institutions continue to support the stock, and that support has remained steady.

In the end, York Water isn’t trying to be anything other than what it is—a simple, well-run utility focused on doing one thing very well: delivering clean water and reliable dividends. For income investors who value consistency and long-term stability, that may be more than enough.

Cash Flow Statement

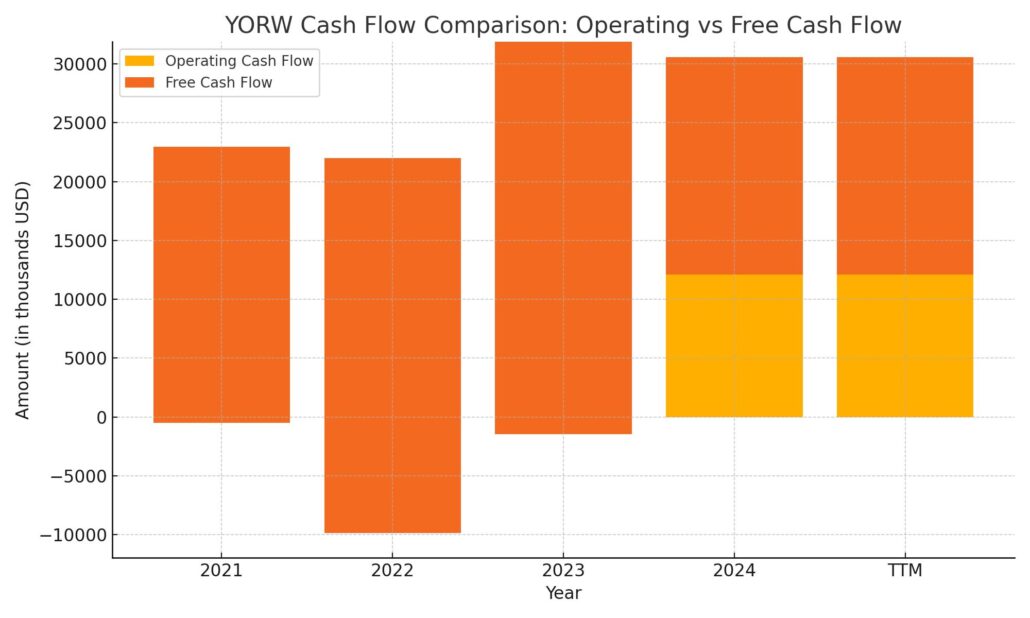

York Water’s cash flow profile for the trailing 12 months reflects the steady, capital-intensive nature of a regulated utility. Operating cash flow came in at $30.6 million, maintaining consistency with the previous year and comfortably outpacing figures from 2021. This highlights the resilience of York’s core operations, even as broader earnings declined. The business continues to generate reliable cash from its service-based model, essential for covering dividends and basic operational needs.

On the other side, capital expenditures remain high at $49 million, directly tied to infrastructure investments. These outflows, along with scheduled debt repayments of over $61 million, drove free cash flow deep into negative territory at -$18.5 million. Financing activity helped fill the gap, with $18.5 million brought in—likely from new debt issuance. Despite this back-and-forth between operating and capital demands, the company ends each period with just $1,000 in cash on hand. That’s not unusual for a utility, but it does underline how dependent York is on consistent cash generation and access to financing to fund long-term upgrades while maintaining its dividend commitments.

Earnings Report Summary

York Water’s latest earnings tell a story of a company that’s growing steadily, even if profits took a bit of a hit this time around. Revenue came in at just under $75 million for the year, up about 5.5% from the previous period. That bump was mostly thanks to a rate increase that kicked in back in March 2023, along with some help from their infrastructure surcharge and a customer base that continues to expand.

Profit Took a Breather

While top-line growth looked solid, the bottom line didn’t follow suit. Net income fell by about 14%, landing at $20.3 million for the year. That works out to $1.42 per share, down $0.24 compared to the year before. What drove the dip? Mostly higher costs. York saw an uptick in operating and maintenance expenses, as well as more depreciation and interest charges as their investments continued to grow. A lower allowance for funds used during construction also weighed on earnings.

Building for the Future

On the investment side, York Water didn’t hold back. They put over $48 million into upgrades, with a good chunk going toward the Lake Williams dam spillway project, improvements to wastewater systems, and replacing more than 50,000 feet of old pipe. These aren’t short-term wins, but they’re the kind of upgrades that should pay off for years to come.

They also picked up a few smaller water and wastewater systems—six in total—which shows they’re still looking for smart ways to grow the business. Looking ahead, the company has plans to keep investing at a steady clip, with around $46 million earmarked for 2025 and even more for the year after. It’s all aimed at keeping infrastructure up to date and expanding where it makes sense, so they can continue delivering reliable service across the board.

Chart Analysis

Price Action and Moving Averages

YORW’s one-year chart reflects a mix of resilience and soft patches. The stock saw strength through the first half of the year, peaking above $40 in late July. That run coincided with the 50-day moving average climbing steadily above the 200-day moving average—a bullish sign at the time. But that momentum didn’t last. As the second half of the year progressed, prices weakened, dipping below $31 in early 2024.

What stands out is how the 50-day moving average crossed below the 200-day around October, a technical signal often associated with longer-term downtrends. Since then, the red 50-day line has remained under pressure, but more recently it’s started to curl upward, showing some recovery. Price is now approaching both moving averages from below, with the potential to break higher if buying interest continues.

Volume and Relative Strength

Volume throughout the year remained mostly muted with a couple of sharp spikes—most notably in mid-July and again in January. These surges likely tie to company-specific events or earnings releases, but outside of those, trading activity has been relatively quiet. That’s not unexpected for a stock like this.

The Relative Strength Index (RSI) adds another layer to the picture. It spent a good chunk of the year hovering around or below the 30 line, especially through December and early January, which marked oversold territory. That coincided with the price bottoming out near $30. Since then, RSI has climbed back into the mid-50s range, suggesting momentum is recovering without signaling an overbought condition.

Technical Takeaway

This chart paints a picture of a stock that’s been through a cooling-off period and is now starting to firm up. Price has lifted off its lows, the short-term average is curling higher, and RSI suggests renewed strength without excess. There’s still work to be done technically—the stock hasn’t yet reclaimed the 200-day—but it’s moving in the right direction. If this slow grind upward continues, it could eventually rebuild the kind of steady price base that supports its broader stability.

Management Team

At the helm of The York Water Company is a group of seasoned professionals dedicated to steering the company through the evolving landscape of the water utility industry. Leading the team is Joseph T. Hand, who serves as President, Chief Executive Officer, and Director. Hand brings a wealth of experience and a deep understanding of the company’s operations, having been with York Water since 2008.

Supporting Hand is Matthew E. Poff, the Chief Financial Officer and Treasurer. Poff has been instrumental in managing the company’s financial health since his appointment in 2018. His expertise in financial management ensures that York Water maintains a balanced approach to growth and fiscal responsibility.

The legal and administrative facets are overseen by Alexandra C. Chiaruttini, who holds the dual roles of Chief Administrative Officer and General Counsel. Chiaruttini joined the company in 2020, bringing extensive experience in legal affairs pertinent to environmental and utility sectors. Her guidance is vital in navigating the complex regulatory environment that governs water utilities.

In 2024, the company welcomed Ashley M. Grimm as Vice President of Human Resources and Corporate Secretary. Grimm’s background in human resources and corporate governance adds depth to the leadership team, emphasizing the company’s commitment to its workforce and ethical operations.

The operational aspects are managed by Matthew J. Scarpato, Vice President of Operations, and Mark S. Snyder, P.E., Vice President of Engineering. Their combined efforts ensure that the company’s infrastructure and service delivery meet the high standards expected by customers and regulators alike.

This cohesive leadership team, with its diverse expertise, positions The York Water Company to effectively address current challenges and seize future opportunities in the water utility sector.

Valuation and Stock Performance

The York Water Company’s stock, trading under the ticker symbol YORW, has experienced fluctuations reflective of both company-specific events and broader market trends. As of April 3, 2025, the stock is priced at $35.40, showing a modest uptick from the previous close.

Over the past year, YORW has traded between a low of $29.86 and a high of $41.96. This range indicates periods of both investor optimism and caution. The stock’s beta of 0.61 suggests that it is less volatile than the overall market, a characteristic often appealing to conservative investors seeking stability.

In terms of valuation metrics, the company’s price-to-earnings (P/E) ratio stands at 24.27, which is lower than its five-year quarterly average of 31.0. This reduction may reflect a market reassessment of the company’s growth prospects or broader sectoral shifts. Additionally, the price-to-book (P/B) ratio is 2.14, indicating that the stock is trading at a premium to its book value, a common occurrence in the utility sector where stable earnings justify higher valuations.

It’s also noteworthy that the company has a long history of dividend payments, having consistently paid dividends for over 200 years. This remarkable track record underscores the company’s commitment to returning value to shareholders.

Risks and Considerations

Investing in The York Water Company, like any investment, comes with its set of risks and considerations. One significant area is financial risk. The company carries a notable level of debt, with a debt-to-equity ratio of approximately 89%. While leveraging can facilitate growth and infrastructure improvements, it also means that a substantial portion of cash flow is allocated to debt servicing. This allocation could limit financial flexibility, especially in scenarios of rising interest rates or unexpected expenses.

Operational risks are also present, particularly concerning infrastructure. The aging nature of water distribution systems can lead to increased maintenance costs and potential service disruptions. Addressing these issues requires significant capital investment, which, if not managed prudently, could strain the company’s financial resources.

Environmental considerations are increasingly coming to the forefront in the water utility industry. Emerging contaminants, such as per- and polyfluoroalkyl substances (PFAS), pose challenges in water treatment and regulatory compliance. York Water actively monitors these developments, but evolving regulations could necessitate additional investments in treatment technologies and infrastructure.

Market risks, including regulatory changes and economic downturns, could also impact operations and financial performance. As a regulated utility, changes in legislation or rate structures can affect revenue streams. Economic downturns may lead to reduced water consumption, impacting sales and profitability.

Investors should weigh these factors carefully, considering how they align with their individual risk tolerance and investment objectives.

Final Thoughts

The York Water Company stands as a testament to resilience and stability in the utility sector. With a leadership team that brings a wealth of experience and a clear vision for the future, the company is well-equipped to navigate the complexities of the water utility landscape. Its stock performance reflects a balance of consistent dividend payouts and prudent financial management, appealing to investors seeking steady returns.

However, it’s essential to acknowledge the inherent risks, including financial leverage, operational challenges, and environmental considerations. A thorough understanding of these factors is crucial for making informed investment decisions.

In essence, The York Water Company embodies a blend of historical significance and forward-looking strategies, making it a noteworthy entity in the realm of utility investments.