Updated April 2025

Worthington Enterprises has been going through some pretty big changes. After spinning off its steel processing segment into the newly created Worthington Steel, the company has narrowed its focus on building products. That move wrapped up in late 2023, and the market’s been recalibrating its view of the company ever since.

The share price has been a bit bumpy—down over 15% in the last year—and it’s currently sitting around the $48 mark. But when you zoom in, some of the fundamentals are actually pointing in a positive direction. Yes, revenue is down slightly on a year-over-year basis, slipping just under 4%, but the company has posted an 80% jump in quarterly earnings. It’s a reminder that you’ve got to dig a little deeper than just the top-line numbers when looking at this one.

Post-spinoff, Worthington is operating with a leaner structure. That’s helping its margins and giving it a cleaner financial profile, which is key for dividend-focused investors looking for stability and predictability.

Key Dividend Metrics

🧾 Forward Dividend Yield: 1.33%

💸 Annual Dividend (Forward): $0.68 per share

📈 5-Year Average Dividend Yield: 2.04%

🧮 Payout Ratio: 54.55%

📆 Next Ex-Dividend Date: June 13, 2025

🎁 Next Dividend Pay Date: June 27, 2025

📊 Trailing Yield: 1.31%

🔁 Recent Split: 1622:1000 on December 1, 2023

Dividend Overview

At first glance, Worthington’s dividend might not turn heads. A forward yield of 1.33% isn’t high enough to make income investors flock, especially when compared to some of the higher-yielding names out there. But what it lacks in flash, it makes up for with a solid foundation.

The payout ratio sits just above 54%, which means the dividend isn’t being strained. There’s plenty of room here for flexibility, especially with the company holding over $220 million in cash on its books. That’s a reassuring number when you consider that Worthington isn’t overleveraged—debt-to-equity is around 34%, which is manageable by most standards.

Consistency is another strong suit here. Worthington hasn’t missed a beat when it comes to paying its dividend, and that steady quarterly cadence is a nice touch for those who rely on predictable cash flow. The next payout is coming up at the end of June, with the ex-dividend date locked in for mid-June. So if you’re holding shares, you know what to expect.

Also worth noting is that the current dividend yield is running below the five-year average. That can be interpreted a couple of ways. Maybe the market is giving the stock some credit for its new structure, or perhaps investors are still trying to assess its long-term potential. Either way, the dividend doesn’t seem to be in jeopardy, and that’s the main concern for income-focused investors.

Dividend Growth and Safety

While Worthington isn’t the type to aggressively hike its dividend every year, there’s a quiet consistency to how it manages its capital. The growth may be gradual, but it’s there, and more importantly, it’s backed by solid fundamentals.

The balance sheet tells a pretty clean story. With a current ratio of 3.51, the company has more than enough short-term assets to cover its liabilities. It’s also sitting on nearly $223 million in cash while carrying just over $316 million in total debt. That kind of balance provides breathing room—not just for operational needs, but also for continuing to pay and possibly grow the dividend.

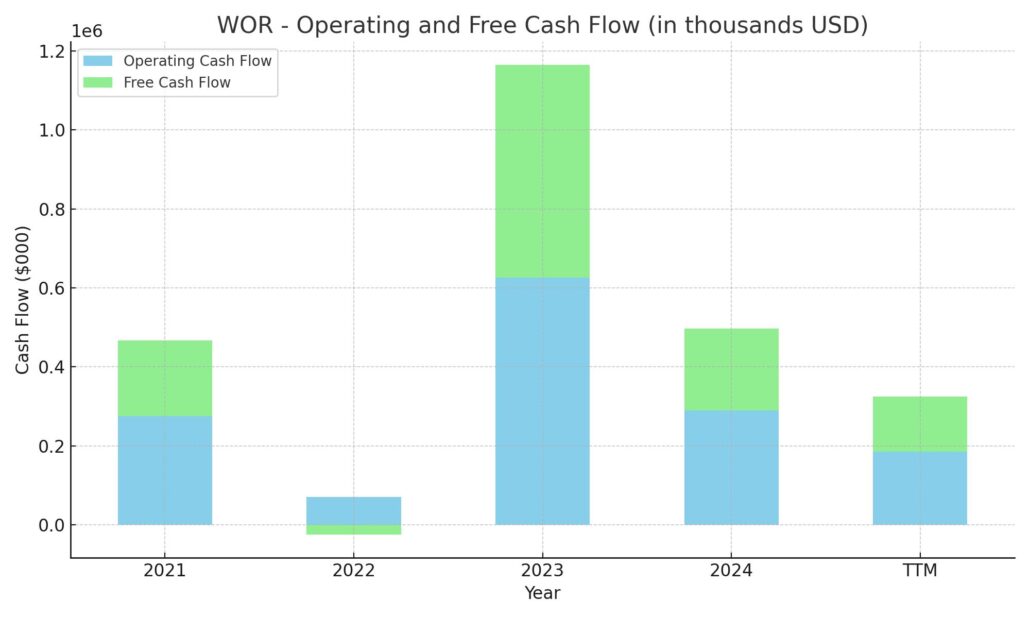

Operating cash flow over the past year came in at $192.5 million. Even after accounting for capital expenditures, the company still generated $64 million in levered free cash flow. That’s not enormous, but it’s certainly enough to cover the dividend with room to spare.

The valuation might raise some eyebrows. A trailing price-to-earnings ratio north of 40 seems steep, but that’s likely skewed by short-term earnings noise from the restructuring. The forward P/E of 15.8 is much more reasonable and gives a clearer picture of the company’s earnings power in its post-spinoff form.

There’s another layer of comfort here too. Insider ownership sits above 38%, which suggests management has real skin in the game. When insiders hold that much of the stock, it tends to lead to decisions that align well with long-term shareholder interests—including maintaining or growing the dividend. Institutions are in there as well, owning just under 53% of the float, which helps add a level of professional oversight.

In the end, Worthington’s dividend isn’t the kind that’s going to shoot the lights out. But it’s stable, supported by real cash flow, and managed with a level of prudence that long-term investors can appreciate. For those who care more about consistency than excitement, it quietly checks a lot of boxes.

Cash Flow Statement

Worthington Enterprises’ cash flow over the trailing twelve months shows a company operating with strong internal generation of cash but navigating a period of investment and debt management. Operating cash flow came in at $185 million TTM, a noticeable drop from the prior year’s $290 million, but still solid. Free cash flow remained positive at $139 million, reflecting a healthy margin after capital expenditures, which totaled about $46 million. While this is a step down from previous years—2023’s free cash flow stood at over $206 million—it still points to a business generating meaningful liquidity from its core operations.

On the investing and financing side, cash outflows have been substantial. The company used $144 million on investing activities, consistent with ongoing capital commitments and potentially internal growth initiatives. Financing cash flow was deeply negative at $278 million, driven primarily by debt repayments totaling $150 million and continued share repurchases. These moves signal a clear focus on strengthening the balance sheet and returning capital to shareholders, even at the cost of reducing the cash position, which now sits at $193 million. That’s still a comfortable level for a business of this scale and provides a solid backstop to ongoing obligations.

Analyst Ratings

📈 Worthington Enterprises (WOR) has recently attracted a mix of analyst sentiment, reflecting divided opinions on its near-term prospects. The average 12-month price target currently sits at around $54.20, suggesting a moderate upside from where shares are trading now. Estimates range from a low of $39.00 to a high of $69.00, indicating some uncertainty about where the stock might land over the next year.

🔍 One of the more bullish developments came from Seaport Global, which initiated coverage with a Buy rating and a target of $55.00. Analysts there pointed to improved operational focus following the company’s recent restructuring and spinoff activity. With a cleaner balance sheet and more targeted strategy in the building products space, the firm sees room for margin improvement and better capital allocation moving forward.

🟡 On the other side, some analysts are holding a more cautious view. BMO Capital has maintained its Market Perform rating, suggesting they expect WOR to move roughly in line with the broader market. This stance reflects a wait-and-see approach as the company continues to define its new identity post-spinoff.

📊 Overall, analyst sentiment is a mix of optimism and realism, with some expecting positive movement from internal improvements, while others remain neutral amid macro and sector-specific headwinds.

Earnings Report Summary

Solid Performance Despite Some Revenue Pressure

Worthington Enterprises wrapped up its third quarter of fiscal 2025 with numbers that showed resilience, even with a slight drop in revenue. Net sales came in at $304.5 million, down about 4% from the same quarter last year. That decline was mostly tied to the recent spinoff of its Sustainable Energy Solutions segment. Without that piece in the picture, it’s not a bad showing. Some of that lost ground was picked up by added volume and the recent Ragasco acquisition, which helped cushion the drop.

Profits and Margins on the Upswing

What really stood out in this report was the profitability. Pre-tax earnings climbed 30% to $52.6 million, thanks to a better product mix and improved efficiency across operations. Adjusted EBITDA reached $73.8 million, up 10% from the previous year, showing the company is doing more with less. Earnings per share from continuing operations jumped a strong 80% to $0.79, and on an adjusted basis, EPS hit $0.91, which was a 14% improvement.

On the cash flow front, Worthington had a solid quarter. Operating cash flow increased to $57.1 million, while free cash flow came in at $44.4 million, both showing double-digit growth. The company also returned cash to shareholders, repurchasing 150,000 shares for $6.2 million. There’s still plenty of room under their current buyback authorization if they choose to keep that pace going. And they kept the dividend steady at $0.17 per share, with the next payout set for late June.

Segment Growth Looks Promising

Looking at the individual business lines, the Consumer Products segment brought in $139.7 million in sales, a 4.9% increase. The Building Products segment did even better, pulling in $164.8 million, which was up over 11%. The Ragasco acquisition again played a role here, along with some organic market share gains.

Financial Position Remains Strong

Worthington continues to carry a strong balance sheet. The company ended the quarter with nearly $223 million in cash and $293.9 million in long-term debt, giving it flexibility to keep investing in growth or continue rewarding shareholders. Management sounded optimistic, and based on the numbers, they have good reason to be.

Chart Analysis

Price Momentum and Moving Averages

WOR has had a volatile stretch over the past year, with the price sliding from just over $60 down to around $38 before staging a sharp recovery in recent weeks. That late surge pushed it close to $52 before easing back slightly. The 50-day moving average, which had been well below the 200-day moving average for much of the year, is now curling upward and has just about caught up—suggesting a shift in short-term sentiment. The price is currently trading above both the 50- and 200-day moving averages, which often signals strength and renewed interest from market participants.

Volume and Participation

There’s a noticeable spike in volume that aligns with the sharp move higher in the last part of the chart. That suggests the price jump wasn’t just a low-volume anomaly—it had conviction behind it. It’s worth noting that volume had been relatively muted for much of the year, so the recent spike is a standout and points to something structurally changing in how this stock is being viewed.

RSI and Momentum

Looking at the RSI, the stock has entered overbought territory with the recent rally. The indicator pushed above the 70 level, briefly approaching the 80 mark, which typically suggests the stock may be due for a breather. However, in a trending environment, RSI can stay elevated for longer periods. The key is that the stock has broken out of its earlier range where it hovered near the lower half of the RSI band for months, reinforcing that the momentum has shifted decisively.

Broader Trend Outlook

The longer-term picture still carries the weight of that sustained downtrend from earlier in the year, but the recent strength is notable. For most of the past 12 months, WOR was under pressure with lower highs and lower lows. That pattern appears to have been broken with the recent breakout. If the price can hold above its moving averages and volume remains supportive, this could be a base for a more sustained trend upward. The technicals are no longer leaning against the stock as they were before, and for the first time in a while, momentum seems to be working in its favor.

Management Team

Worthington Enterprises has made notable changes to its leadership, signaling a fresh chapter for the company. As of November 1, 2024, Joseph B. Hayek took over as President and CEO. Before this role, he served as Executive Vice President and CFO, and his long-standing experience within the organization gives him a clear perspective on its operations and strategy. His financial acumen and familiarity with the business position him to lead with both continuity and a forward-looking vision.

Colin J. Souza stepped into the CFO role on the same date. At 36, he brings over a decade of experience with the company, most recently serving as VP of Finance. His background spans financial planning, corporate development, and strategic initiatives, giving him the kind of hands-on expertise needed to navigate growth and maintain fiscal discipline.

The rest of the leadership team includes experienced professionals like Patrick J. Kennedy, Vice President and General Counsel. With a mix of institutional knowledge and fresh energy, the team appears aligned around driving value and sharpening Worthington’s strategic focus.

Valuation and Stock Performance

WOR has been trading around the $50 mark, with a market cap sitting near $2.55 billion. Over the last year, the stock has moved between a low of $37.88 and a high of $62.56. The volatility has been shaped by macroeconomic trends, sector pressures, and internal shifts post-spinoff. While the stock isn’t far from the middle of that range right now, its price-to-earnings ratio of just over 60 does stand out. It’s significantly above the average for its sector, signaling that the market expects continued growth and improved earnings performance in the near future.

Revenue for the most recent fiscal year was $1.15 billion, with net income of about $60 million. EPS came in at $1.21, and analysts are looking for that to rise to $3.08 in the next year. If that forecast holds, it would represent a meaningful jump in earnings and could help justify the elevated valuation.

The current trading range is largely in line with analyst expectations, with many placing the stock’s fair value somewhere in the $41 to $42 range. That suggests the market may already be pricing in some of that anticipated growth, and further upside could depend on the company delivering consistent results over the coming quarters.

Risks and Considerations

There are a few things to keep in mind when looking at Worthington Enterprises as an investment. Leadership transitions always carry some uncertainty. While the new executive team has strong internal experience, any shift in direction or execution strategy comes with a learning curve. Investors will want to keep an eye on how quickly new leadership settles in and starts to deliver.

Another consideration is valuation. With a high P/E, the stock is priced for growth. If results fall short of expectations, the downside could be more pronounced than with a more conservatively valued name. That said, if the company delivers, the market may reward it further.

External factors are always in play, too. The business operates in segments tied closely to construction and industrial activity. Changes in interest rates, economic slowdowns, or disruptions in supply chains could all impact performance. Worthington has navigated these pressures before, but they remain part of the picture.

Final Thoughts

Worthington Enterprises is stepping into a new era, with a leaner structure, fresh leadership, and clear goals. The fundamentals are in decent shape, and the recent performance suggests the company is focused on executing. Valuation is on the higher end, but that’s often the case with companies in transition that are showing signs of momentum. As always, keeping a close eye on how management follows through in the coming quarters will be key to understanding where the story goes from here.