Updated April 2025

Based out of Wheeling, West Virginia, WesBanco has built a reputation over the years for dependable performance with a regional focus. It’s grown its footprint gradually, stretching across the Midwest and Mid-Atlantic, combining traditional retail and commercial banking with trust and investment services. For investors hunting steady dividends, it’s worth giving this one a closer look. It’s not about flash with WesBanco—it’s about consistency, risk management, and that all-important dividend check landing every quarter.

Recent Events

This past year has been a bit of a ride for WesBanco shareholders. The stock recently closed at $31.05, recovering from a dip that brought it as low as $25.56 in the past 12 months. Even with a pre-market pullback to $29.88, the trend over the year has been positive, with shares up nearly 9%.

Financially, the company is showing strength. Earnings growth jumped 41.9% year-over-year, and revenue climbed 14% to nearly $587 million. That’s not minor progress. WesBanco is sitting on over $650 million in cash and turned out $211 million in operating cash flow over the trailing twelve months. That’s solid liquidity, especially when you consider the $1.61 billion in debt. It’s manageable, and nothing about the balance sheet raises red flags.

Meanwhile, the market has started to recognize some of that improvement. Valuation metrics like a forward P/E of 9.41 show the stock is still attractively priced relative to its earnings power. All of this provides a sturdy foundation for the dividend, which is where WesBanco starts to stand out.

Key Dividend Metrics

📈 Dividend Yield: 4.77%

💵 Forward Annual Dividend: $1.48

🧮 Payout Ratio: 64.16%

📊 5-Year Average Dividend Yield: 4.50%

📆 Ex-Dividend Date: March 10, 2025

📆 Most Recent Dividend Date: April 1, 2025

Dividend Overview

WesBanco’s dividend yield currently sits at 4.77%, which stands out even in a market offering some decent yields right now. This isn’t a one-time fluke either. The company has been returning capital to shareholders for years with a consistent payout strategy.

At an annual dividend of $1.48, investors aren’t getting rich overnight—but that’s not the point. What matters more is the dependability. Through different market cycles, WesBanco has kept its dividend moving in the right direction. No flashy jumps, just steady bumps upward as earnings allow.

The current payout ratio of 64.16% shows that the dividend is well-covered. It’s not too tight to worry about a cut if profits dip, and not so low that management isn’t rewarding shareholders. This kind of balance is what makes a dividend sustainable. The company seems focused on protecting its capital base, keeping the dividend intact, and avoiding overcommitment.

One other thing that’s worth noting—the stock is yielding more than its 5-year average. That’s often a quiet signal for long-term investors that the stock might be undervalued on a yield basis.

Dividend Growth and Safety

WesBanco’s dividend story isn’t built on breakneck growth. Instead, it’s about quiet, reliable increases. And in a market where some payouts feel shaky, that kind of slow-and-steady profile is refreshing.

Looking at the fundamentals, there’s nothing that screams risk. Return on equity comes in at 5.69%, and return on assets is 0.83%. These numbers are typical for regional banks that prioritize steady lending and conservative capital strategies. The price-to-book ratio of 1.12 tells you the market is placing a fair value on the company’s net assets—not overhyped, not discounted. It’s the kind of setup that appeals to risk-aware dividend seekers.

And then there’s valuation. A forward P/E under 10 suggests the stock isn’t being bid up unrealistically. That helps provide a cushion. Even if earnings were to pull back modestly, the dividend wouldn’t be the first thing on the chopping block.

Add to that a strong capital position—book value per share is over $39, well above where the stock is trading. This gap acts as a kind of buffer for dividend safety. As long as the bank maintains discipline on loan quality and capital deployment, there’s no real threat to the payout.

Cash flow supports this view. With over $200 million in operating cash flow, WesBanco has plenty of room to handle dividends, debt service, and reinvestment. And the low short interest (only about 1.5% of shares) tells you the market doesn’t see much risk here either.

All told, WesBanco is delivering a high yield, backed by sound financials and a steady hand at the helm. The dividend may not dazzle, but it does what it’s supposed to do—arrive on time, grow slowly, and give investors some peace of mind in a noisy market.

Cash Flow Statement

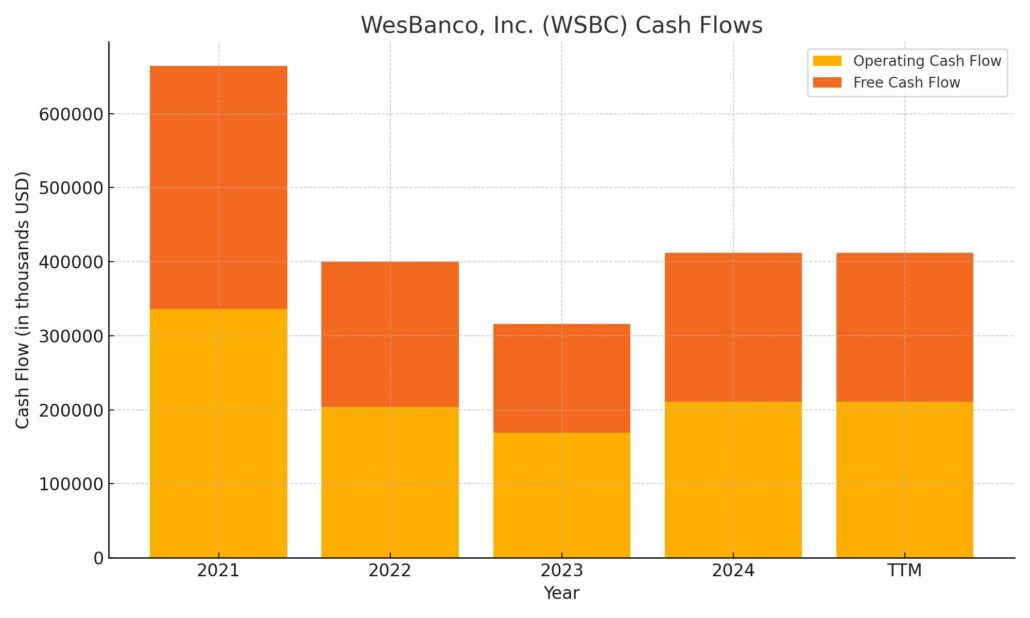

WesBanco’s trailing twelve months show a company with solid operating strength, generating $211 million in operating cash flow. That’s an improvement over 2023’s $169 million and a return to levels seen in 2021. Free cash flow also remains healthy at around $201 million, reflecting strong internal cash generation after accounting for modest capital expenditures of just over $10 million.

However, the cash flow from investing tells a different story. The company spent over $1 billion in investing activities over the past year, nearly doubling the previous year’s figure. This likely reflects a strategic shift or expansion—perhaps in securities purchases or lending—but it did impact the ending cash position, which dropped slightly to $568 million from $595 million. Financing activity partially offset this with $792 million in net inflows, driven by new debt issuance of $1.18 billion, although that was counterbalanced by $1.53 billion in debt repayments. Despite the movement, WesBanco remains well-positioned in terms of liquidity, with a balanced cash flow structure that supports its dividend and operational needs.

Analyst Ratings

WesBanco has recently caught the attention of several analysts, prompting a few notable shifts in its stock ratings and outlook. 📈 On December 6, 2024, Raymond James moved its rating on WSBC from “Outperform” to “Strong Buy,” setting a price target of $35. The firm pointed to improving loan trends and stronger-than-expected margin expansion as key drivers behind the upgrade. It’s a reflection of renewed confidence in WesBanco’s ability to navigate the current interest rate environment and still deliver growth.

🏦 In January 2025, D.A. Davidson also reiterated its “Buy” stance and bumped the price target up to $45. Analysts cited solid loan and deposit growth, alongside noticeable improvements in net interest margins. The update came on the heels of a pre-provision net revenue beat, and there’s optimism surrounding a pending acquisition that could be accretive to earnings per share over time. Management’s ability to drive earnings expansion while staying disciplined on credit quality added to the positive outlook.

💬 As of March 2025, the general sentiment among six Wall Street analysts leans toward a “Moderate Buy.” The average consensus price target is $40.83, with the highest estimate sitting at $45.00 and the lowest at $35.00. That represents about 28% upside from the current trading level, suggesting analysts see meaningful room for growth ahead.

Earning Report Summary

WesBanco wrapped up 2024 with a fourth-quarter performance that showed meaningful progress across the board. Earnings came in strong, driven by solid loan growth and a healthier balance between income and costs. For shareholders, the latest numbers point to a company that’s quietly executing on its strategy without a lot of noise—but with results that are hard to ignore.

Solid Earnings Momentum

Net income available to common shareholders hit $47.1 million for the quarter, or $0.70 per share. That’s a step up from $32.4 million and $0.55 per share in the same quarter a year earlier. The improvement speaks to better efficiency and stronger core operations. WesBanco isn’t chasing high-risk returns—it’s sticking to what it knows, and it’s working.

Loan Growth Driving the Engine

One of the standout points in the report was loan growth. Total loans rose by $1 billion year-over-year, an increase of 8.7%. Even on a quarter-over-quarter basis, they were up 6.6% on an annualized basis. The growth came largely from the commercial side, which shows that WesBanco continues to build meaningful relationships with its business clients. What’s more, this loan growth was fully matched by rising deposits, showing that the bank is keeping its funding sources stable and well-aligned.

Net Interest Income and Margin Improvement

Net interest income came in at $126.5 million, up 7.4% from the same quarter in 2023. This was helped by stronger yields on loans and securities, along with a strategic reduction in Federal Home Loan Bank borrowings. While deposit costs have crept up like they have across the industry, WesBanco managed to keep the balance in check. The bank’s net interest margin rose to 3.03%, which was up 8 basis points from the previous quarter.

Non-Interest Income Boosts the Bottom Line

Beyond traditional banking, WesBanco saw a nice lift in non-interest income, which grew 21% to $36.4 million. That growth came from higher swap-related income, better service charges on deposits, and improved trust fees. The added revenue here shows that WesBanco isn’t just leaning on loan growth—it’s diversifying its income streams, something that’s increasingly important in a changing rate environment.

All in all, WesBanco’s latest quarter suggests a company that’s navigating the current climate with a steady hand, keeping growth measured and margins healthy. It’s not trying to make headlines, but it’s clearly moving in the right direction.

Chart Analysis

WesBanco Inc. (WSBC) has had an eventful year based on the one-year mountain chart. Price action shows a clear upward trajectory from mid-2023 through early 2024, with a noticeable acceleration in momentum around July and another sharp move in October. While recent months have brought a bit more volatility, the broader trend still leans upward, though not without signs of pressure.

Moving Averages

The 50-day moving average (red line) sat comfortably above the 200-day (blue line) for much of the second half of the year. This kind of separation typically suggests the stock has been in a strong intermediate-term trend. However, the price recently crossed below the 50-day average and is hovering just above the 200-day. That’s a subtle warning that momentum may be cooling off. If the price falls below the 200-day and stays there, it could signal a deeper pullback or extended sideways action.

Volume Behavior

Volume throughout the year has remained moderate, with a few spikes during key price moves, especially in October and again in March. That March volume surge likely reflected either a reaction to earnings or a shift in broader market sentiment. But what stands out is that high-volume days have often aligned with big upward moves, which suggests accumulation by larger players.

RSI Patterns

The Relative Strength Index (RSI) has been fairly well-behaved, mostly ranging between 30 and 70—staying out of the danger zones of being too hot or too cold. It briefly touched overbought conditions in August and again in January but has cooled off and recently started to climb again. It’s now pointing upward but remains below overbought territory, implying there’s still room for price to move higher without hitting resistance from momentum traders.

Final Thoughts

WSBC’s chart tells a story of steady growth followed by some healthy consolidation. The price still respects the longer-term trend, and while the recent dips have challenged support levels, there’s been no clear breakdown. Watching how it behaves around the 200-day moving average in the coming weeks will be key to understanding where it heads next. The blend of stable volume, improving RSI, and a still-rising long-term average all suggest this isn’t a stock losing its footing—it’s just catching its breath.

Management Team

At the helm of WesBanco is Jeffrey H. Jackson, who took over as President and Chief Executive Officer in August 2023. Jackson joined the bank a year earlier as Chief Operating Officer, bringing years of experience from previous leadership roles at regional banks. His focus has been on modernizing operations while staying grounded in the bank’s community-first approach.

Supporting Jackson is Robert H. Friend, the Chief Credit Officer since mid-2022. Friend brings deep expertise in credit risk and commercial lending strategy, helping to guide WesBanco’s loan growth in a way that balances opportunity with discipline. His approach has been to prioritize quality underwriting while continuing to build out the bank’s commercial relationships.

Rounding out the executive team is Jan Pattishall-Krupinski, who joined as Chief Administrative Officer in late 2024. Her role centers on organizational management and streamlining the bank’s internal processes. This recent addition reflects a focus on operational efficiency as WesBanco positions itself for its next stage of growth.

Collectively, this leadership team blends strategic focus with operational depth. They’ve helped drive the bank’s recent performance, managing to grow its footprint and earnings while keeping risk in check and staying aligned with long-term financial goals.

Valuation and Stock Performance

WesBanco’s shares recently traded at $31.05, sitting within the upper third of its 52-week range between $25.56 and $37.36. Over the past year, the stock has shown resilience, climbing from a rough patch in the spring of 2023 to a more stable and upward trajectory into 2024. It hasn’t been immune to broader market pullbacks, but it’s held its own, particularly in light of rising rates and tighter credit conditions.

The bank’s current valuation suggests there’s room for upside. Its trailing price-to-earnings ratio is around 13.5, while the forward-looking number drops to under 10. That kind of discount typically implies investor caution—but it can also be a sign the market is overlooking solid fundamentals. Book value per share stands well above the stock price, with a price-to-book ratio hovering around 1x, a level that points to fair value with potential for re-rating if fundamentals stay strong.

Analysts appear to agree. While not overly aggressive in their forecasts, they’ve generally maintained positive outlooks and even nudged price targets higher. The most recent consensus sees the stock pushing above $40, which would represent a meaningful gain from current levels. For income-focused investors, the 4.77% yield only sweetens the story, offering a steady income stream supported by healthy earnings coverage.

Risks and Considerations

Every stock carries risk, and WesBanco is no exception. The most immediate concern for a bank like this remains interest rate sensitivity. Net interest income is at the heart of its business, and sudden shifts in monetary policy or prolonged rate changes—especially if the yield curve remains inverted—can compress margins and weigh on earnings.

Credit quality is another factor to watch. As the bank expands its loan book, especially on the commercial side, it’s natural for credit risk to rise. If the economic environment softens or if specific industries face pressure, that risk can become more pronounced. So far, the bank’s underwriting standards and credit controls have kept things in check, but rising delinquencies would be a sign to monitor closely.

There’s also the matter of regulatory and compliance costs. Banking remains a tightly watched sector, and with new rules often rolling out, especially after industry shakeups, operational adjustments are inevitable. While WesBanco has navigated past transitions well, ongoing regulatory pressure could weigh on future earnings.

Lastly, broader macroeconomic risks—like a slowdown in economic growth, inflationary trends, or shifts in employment—can influence both investor sentiment and borrower behavior. A sudden contraction in lending demand or unexpected defaults could change the outlook quickly, and even a well-run bank isn’t fully immune to these external forces.

Final Thoughts

WesBanco continues to operate with a clear strategy and measured execution. It’s not chasing rapid expansion or overly aggressive growth, but rather building on a stable foundation, one quarter at a time. The bank’s leadership has focused on expanding loan relationships, improving margin performance, and keeping a tight grip on credit quality—all without losing sight of capital return to shareholders.

The valuation remains reasonable, the dividend is well-supported, and the long-term trend for the stock has been encouraging. While macro risks are always in play, WesBanco has shown the kind of discipline that helps weather storms. The management team’s ability to deliver consistent performance without overextending is part of what makes this bank stand out in its category.

It’s not the flashiest stock in the sector, but it doesn’t need to be. The fundamentals are solid, and the pieces are in place for continued, steady execution. Investors looking for clarity, consistency, and a bit of income in their portfolio may find that WesBanco checks more boxes than initially expected.