Updated April 2025

WD-40 is a stock that quietly earns a place in long-term portfolios. Most people recognize the blue-and-yellow can—it’s a staple in toolboxes, garages, and workshops across the world. But behind the brand is a business that’s laser-focused on what it does best: producing maintenance products with remarkable staying power.

Headquartered in San Diego, WD-40 Company isn’t just riding on a single product. Its portfolio spans a global market, with its flagship WD-40 Multi-Use Product available in more than 170 countries. For dividend investors, the story goes well beyond brand familiarity. It’s about the company’s consistent financial performance, shareholder-friendly mindset, and its rock-solid dividend track record.

Recent Events

WD-40’s latest quarterly update for the period ending November 30, 2024, showed the company moving steadily in the right direction. Revenue came in at $603.64 million over the trailing twelve months, marking a 9.3% increase compared to the same time last year. Net income was up too, reaching $70.84 million, with earnings per share rising to $5.23. That’s an 8.3% bump in year-over-year EPS growth—not flashy, but dependable.

Profitability metrics were solid. The company posted an operating margin of 16.37% and a profit margin of 11.78%, both of which reflect strong control over expenses and a healthy business model. Return on equity stood at an eye-catching 32.15%, while return on assets was 13.85%, signaling that the company knows how to make its capital work.

WD-40 also carries a manageable amount of debt. With $115.42 million in total debt and $54.91 million in cash, the company’s debt-to-equity ratio lands at 51%. Liquidity is strong, with a current ratio of 2.44—well above the red-flag zone and comfortably supporting operations and obligations.

Key Dividend Metrics

💵 Forward Dividend Yield: 1.52%

📈 5-Year Average Yield: 1.41%

🔁 Dividend Growth Streak: 14 years

📊 Payout Ratio: 67.43%

📅 Next Dividend Date: April 30, 2025

⏳ Ex-Dividend Date: April 17, 2025

💸 Forward Annual Dividend: $3.76 per share

Dividend Overview

WD-40 might not be offering a yield that grabs immediate attention, but what it does offer is reliability. The current forward yield sits at 1.52%, which slightly nudges past the five-year average of 1.41%. This shows that the company has maintained a steady pace when it comes to rewarding shareholders, even as the stock price fluctuates.

The payout ratio of 67.43% tells us WD-40 is handing out a decent share of its profits while still keeping some dry powder for reinvestment or unexpected bumps in the road. It’s a little higher than some dividend purists might like, but it’s supported by consistent earnings and a business model that doesn’t require heavy capital investment to keep going.

WD-40 has also shown it’s not just about maintaining the status quo. The company has raised its dividend for 14 straight years, giving investors a growing income stream they can rely on. It’s the kind of pattern that fits well in portfolios where income stability matters.

Dividend Growth and Safety

When it comes to dividend dependability, WD-40 checks the right boxes. Fourteen consecutive years of increases show that management takes shareholder returns seriously. And these aren’t symbolic increases—they’re backed by fundamentals.

Free cash flow tells the real story here. Over the past year, WD-40 generated $59.85 million in levered free cash flow. That’s more than enough to cover the annual dividend payout, which amounts to around $50.93 million based on 13.55 million shares outstanding. Even with a slightly elevated payout ratio, there’s a comfortable cushion.

The business model also plays a big role in how safe that dividend is. WD-40 isn’t chasing trends or tied to economic cycles the way some industrials are. Its products are used for upkeep, repair, and everyday maintenance. That means even when the economy slows down, demand for what WD-40 makes doesn’t go away.

Add to that a clean balance sheet and low beta (just 0.03), and you’ve got a company that’s not swinging wildly with the market. With over 91% institutional ownership, there’s a broad base of confidence in how this company is managed.

For income-focused investors looking for something that hums quietly in the background while delivering consistent payouts, WD-40 offers a reassuring rhythm.

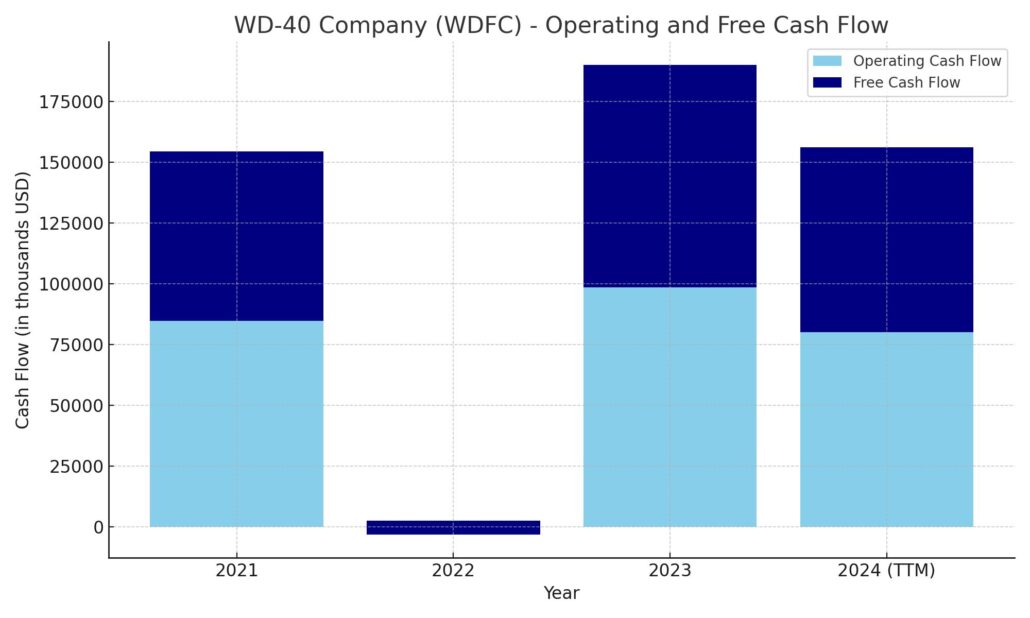

Cash Flow Statement

WD-40’s trailing twelve-month operating cash flow came in at $80 million, showing a moderate dip from the prior year’s $92 million. While it’s a step down from its 2023 and 2022 levels, it remains healthy enough to support dividends and core operations. Free cash flow for the same period stood at nearly $76 million, indicating that the business continues to generate surplus cash even after capital expenditures. The company’s capital spending held steady at just over $4 million, reflecting its low capital-intensive model.

On the financing side, cash outflows were substantial at $63.5 million, largely tied to dividend payments and share repurchases. WD-40 continues to allocate capital toward rewarding shareholders rather than growing debt, which remains minimal. Cash used for investing was modest at $9.6 million, consistent with prior years. The cash position at the end of the period was $57.2 million, up from $46.7 million a year earlier, showing that despite lower operating inflows, the company maintained strong liquidity.

Analyst Ratings

📊 As of April 3, 2025, WD-40 Company (WDFC) is trading at $247.84. 🧭 Analyst sentiment shows a “Moderate Buy” consensus, with an average price target of $301.00, suggesting a potential upside of roughly 21%. 🎯 The range among analysts stretches from a low of $280.00 to a high of $322.00, reflecting overall optimism balanced with caution.

🏦 Earlier this year, one firm reaffirmed its “Buy” rating on the stock, maintaining a target of $322.00. This confidence was rooted in WD-40’s solid operational performance and its disciplined approach to expanding market share globally. Continued earnings growth and robust cash flow support the bullish stance, especially as the company maintains a strong grip on margins.

🧮 On the other hand, another institution took a more conservative view, sticking with a “Hold” rating while nudging the price target from $250.00 to $280.00. Their reasoning pointed to rising costs in the supply chain and macroeconomic uncertainty, particularly in international markets where currency fluctuations and regional instability may pressure future results.

🧠 Overall, analysts appear aligned on the strength of WD-40’s brand and business model, though not without acknowledging the risks that could shape its near-term trajectory.

Earnings Report Summary

WD-40 kicked off its fiscal year with a solid showing for the quarter ending November 30, 2024. Sales came in strong at $153.5 million, which was up about 9% compared to the same time last year. That growth was mostly fueled by a boost in their core maintenance products, which continue to carry the brand’s momentum across global markets. Gross margin ticked higher too, reaching 54.8%, a sign that the company is managing input costs better despite inflationary pressures in some regions.

Profit and Performance

Operating income hit $25.1 million for the quarter, a modest 4% increase year over year. On the bottom line, WD-40 posted net income of $18.9 million, which translated to $1.39 per diluted share. That’s up from $1.28 last year and reflects a 9% earnings growth pace—not flashy, but definitely consistent and in line with the company’s long-term, steady-growth narrative.

Regional Highlights

Sales growth wasn’t confined to one corner of the world. In the Americas, sales climbed 8%, with the ever-reliable WD-40 Multi-Use Product seeing a 9% jump. Europe, the Middle East, India, and Africa (EIMEA) put in a particularly strong performance with an 18% increase in sales, helped by strong numbers from distributors and markets like France. The only soft spot was the Asia-Pacific region, where sales slipped 4%, mostly due to some weakness in the distributor channels and Australia.

Expense Movements and Strategic Shifts

Spending did tick up this quarter. Selling, general, and administrative expenses rose 14% to $50.5 million. The company also spent more on advertising and sales promotions—$8.4 million this quarter, which made up about 5.5% of total sales. That said, this is part of their strategy to stay visible and competitive in core markets.

Another notable move: WD-40 reclassified its homecare and cleaning product lines in both the Americas and EIMEA as assets held for sale. This suggests a sharper focus on its higher-margin maintenance products and signals a continued commitment to tightening its product lineup around what it does best.

Management seems upbeat about the path ahead, especially with growth coming from its core product categories and strong regional momentum.

Chart Analysis

WD-40 Company (WDFC) has been through a noticeable shift over the past year, and the chart makes that journey pretty clear. After peaking near $290 in late 2023, the stock saw a consistent downward slide before finding its footing in the early part of 2024. What’s interesting is how that move ties into some key technical levels and sentiment indicators.

Moving Averages

The red 50-day moving average and the blue 200-day moving average tell a pretty compelling story. Last summer, the 50-day crossed above the 200-day in a classic bullish crossover, supporting the run-up that peaked in December. But that didn’t last. Early this year, the 50-day turned sharply lower and slipped beneath the 200-day again, creating a bearish crossover in February. Since then, the 50-day has flattened a bit, and price action is now moving back toward that level. A potential convergence or second crossover could be forming, which would suggest a shift in momentum if it plays out.

Volume and Participation

Trading volume remained fairly consistent, though it’s clear the biggest spikes occurred during moments of price volatility. A noticeable surge in volume hit during the late July rally, and again during the sharp drop in January, which aligns with investor reactions to either earnings or macro sentiment. Lately, volume seems to be picking up again, which might be a sign of renewed interest after a period of consolidation.

Relative Strength Index (RSI)

The RSI in the bottom panel adds a helpful layer. Back in mid-2023, RSI surged into overbought territory just before the stock topped out. Since then, it’s mostly oscillated in the midrange, but recently it’s crept back toward the higher end again. That upward push without breaching the 70 mark just yet suggests there’s strength building, but not to an extreme.

Price Structure

The price recently bounced off its March lows and has since been climbing, currently approaching both moving averages. This area around $245–$250 could act as a pivot point. If the price holds above these averages in the coming weeks, it might confirm a more stable trend. Until then, it’s a wait-and-watch area where the chart shows cautious optimism beginning to build.

Management Team

At the helm of WD-40 Company is a leadership group with deep roots in the business and a clear understanding of its culture. Steve Brass, now President and Chief Executive Officer, has been with the company since 1991. Over the years, he’s held several roles, including Chief Brand Officer and Division President for the Americas. His long tenure gives him a well-rounded perspective on the company’s operations, both domestically and abroad. Brass is known for prioritizing company culture and long-term strategic discipline.

Overseeing growth outside the U.S. is Christophe Cloëz, Managing Director for the EMEA region, which includes Europe, India, the Middle East, and Africa. Cloëz has helped expand WD-40’s footprint across diverse and complex markets. His experience managing across regions and fluency in several languages have supported the company’s international growth, especially in distributor-driven markets.

On the technology side, Doug Cyphers leads the way as Vice President of Global Information and Technology. He’s responsible for aligning tech systems with WD-40’s operational goals. With over 30 years of experience in IT leadership roles, Cyphers brings strong support for the company’s shift toward smarter global integration and digital infrastructure.

This leadership team blends a deep internal understanding of the company’s heritage with a strategic outlook aimed at sustainable growth across geographies.

Valuation and Stock Performance

As of early April 2025, WD-40 shares are trading around $247.84. Over the past year, the stock has seen some notable swings, with highs brushing $292 and lows dipping just above $211. While not immune to broader market trends, the stock has shown resilience in periods of pressure and a tendency to regain its footing after pullbacks.

From a valuation standpoint, the stock trades at a trailing price-to-earnings ratio near 46 and a forward multiple just under 43. Those are definitely on the higher side, signaling that investors are placing a premium on the company’s predictability, earnings stability, and consistent dividend policy. The price-to-sales ratio sits around 5.4, while the price-to-book is about 14.5—both elevated, but not unusual for a business with such high returns on equity and strong brand equity.

Analyst consensus currently points to a price target of $301, which implies about 21 percent upside from current levels. Targets range from $280 to $322, reflecting slightly different assumptions about growth pacing and margin expansion. Investors appear to be balancing near-term caution with long-term confidence in the brand and business model.

WD-40’s dividend policy also supports the valuation. The stock doesn’t offer a high yield, but the company has steadily raised its dividend over the past 14 years. With a payout ratio near 67 percent and ample free cash flow to cover distributions, income-focused investors view it as a steady contributor.

Risks and Considerations

While WD-40 has built a strong case for consistency, there are some risks to consider. The first is valuation. With multiples as high as they are, there’s limited room for error. If earnings were to miss expectations or if revenue growth slowed meaningfully, the stock could be more sensitive than others to downside moves.

There’s also geographic exposure to think about. The company generates a significant share of sales outside the U.S., especially in Europe and parts of Asia. That brings in currency risk, regulatory differences, and geopolitical uncertainty. Any disruption in these markets could weigh on performance, even if operations remain solid domestically.

Another key factor is product concentration. The WD-40 Multi-Use Product remains the centerpiece of the portfolio, and while it continues to perform well, the brand does carry some risk of over-reliance. A shift in consumer behavior, increased competition, or failure to innovate could impact volumes over time.

Costs are another variable. Supply chain dynamics and raw material pricing have been volatile in recent years, and while the company has managed these pressures well so far, there’s no guarantee that will always be the case. Any significant increase in costs could compress margins if pricing power weakens.

Environmental and regulatory pressures also come into play. As a chemical-based manufacturer, WD-40 has to comply with numerous environmental laws globally. Changes in regulation or tightening standards could result in higher costs or adjustments to formulations and production methods.

Lastly, while WD-40 holds strong market share in its niche, competition is always evolving. Private-label and low-cost alternatives can chip away at market position over time, particularly in price-sensitive regions.

Final Thoughts

WD-40 Company stands out as a steady performer in a world that often chases the next big thing. It doesn’t make a splash, but it delivers what many long-term investors value—consistency, discipline, and a product that remains in demand through all market cycles. The leadership team knows the business inside and out, and their focus on operational efficiency and global expansion is well-calibrated for the future.

The stock isn’t cheap, but that’s often the case with companies that offer a strong balance of income and growth potential. It has its risks—no business is without them—but WD-40’s resilience and commitment to shareholders help put those into context. Whether it’s through measured expansion or continued focus on its flagship product line, the company seems intent on doing what it’s always done: sticking to what works and delivering on its promises.