Updated April 2025

Watsco is the biggest distributor of heating, air conditioning, and refrigeration equipment in the Americas. Watsco has quietly built a reputation for consistency and financial discipline. The business is built around a fundamental truth: when HVAC systems fail, they must be fixed. That kind of essential service creates a reliable stream of revenue, and Watsco has proven over time that it knows how to turn that into shareholder returns.

This isn’t a company that’s trying to reinvent the wheel. Instead, it’s focused on doing one thing very well—serving contractors and businesses across the U.S., Canada, Latin America, and the Caribbean with HVAC systems and parts they can count on. That steady demand forms the bedrock of Watsco’s strong cash generation and, ultimately, its dependable dividend.

Recent Events

Watsco’s recent financials tell a story of strength. Revenue is up 9.4% year-over-year, and earnings grew by 17.3%, which is no small feat given the broader market’s ups and downs. Margins are holding steady, with a profit margin around 7% and an operating margin just over 7.3%. Those aren’t jaw-dropping numbers, but they are stable and consistent—qualities that matter deeply for income-focused investors.

The company’s balance sheet also deserves a closer look. It’s sitting on nearly $782 million in cash with only $447 million in debt. That gives it a net cash position—something that’s become increasingly rare. The current ratio is a healthy 3.13, so liquidity isn’t a concern. More importantly, it has flexibility, and flexibility is key to sustaining dividends when the going gets tough.

Another standout is return on equity. At 22.4%, Watsco is clearly putting shareholder capital to productive use. It signals a well-run business with strong internal discipline—again, exactly the kind of characteristics long-term investors want to see from a dividend payer.

Key Dividend Metrics 📈

💰 Forward Annual Dividend: $12.00 per share

📅 Dividend Yield: 2.30% (forward)

📆 Ex-Dividend Date: April 15, 2025

📤 Payout Ratio: 79.3%

📈 5-Year Average Dividend Yield: 2.72%

🧮 Cash Flow Coverage: $773M in operating cash flow vs. $417M in dividends

🏦 Balance Sheet Strength: $781.9M in cash, $447.5M in debt

Dividend Overview

Watsco’s dividend policy is one of its defining features. The forward dividend sits at $12 per share, giving it a current yield of 2.3%. That’s not going to knock anyone’s socks off, but it’s the kind of steady, dependable income that dividend investors value. And unlike companies that fluctuate between cuts and increases, Watsco has made a habit of consistent, measured raises over time.

The trailing yield is slightly lower at 2.06%, but the upward bump in the forward payout is a clear signal of intent from management. The five-year average sits at 2.72%, so the current yield is hovering just under that historical range. It’s not screaming “undervalued,” but it’s comfortably within the kind of range that suggests the dividend is fairly priced.

The real strength here lies in the company’s predictability. Watsco isn’t using its dividend as a promotional tool. It’s simply part of the company’s DNA. Investors can rely on it not because of flashy increases, but because the fundamentals keep delivering. If you’re looking to build income over time, that kind of dependability matters more than anything.

Dividend Growth and Safety

Watsco’s dividend looks well-supported by the numbers. Yes, the payout ratio is just over 79%, which may seem a little high. But when you dig into the cash flow, the picture becomes much clearer. With $773 million in operating cash flow and $667 million in levered free cash flow, the dividend is covered comfortably. That cushion helps ensure that even if business slows down temporarily, there’s still plenty of room to keep those payments coming.

Dividend growth has been consistent. The increase from $10.55 to $12.00 represents nearly a 14% jump—a meaningful raise for investors who rely on this income stream. It’s also a sign that management sees ongoing strength in the business, not just in the numbers, but in the underlying demand for its products.

What really sets Watsco apart is its track record. During downturns and periods of volatility, the company has stuck with its dividend, making careful, sustainable increases without overextending itself. That kind of resilience can’t be faked—it has to be earned, year after year.

For dividend investors, it’s about more than just the current yield. It’s about the reliability of those payments over time and the opportunity for income to grow. Watsco checks both boxes. The company operates in a space that doesn’t lend itself to sudden disruption, and the financials suggest it’s got the capacity to keep rewarding shareholders for years to come.

In a market that often favors short-term thinking, Watsco is playing the long game. And that’s exactly what you want if dividends are at the center of your investment strategy.

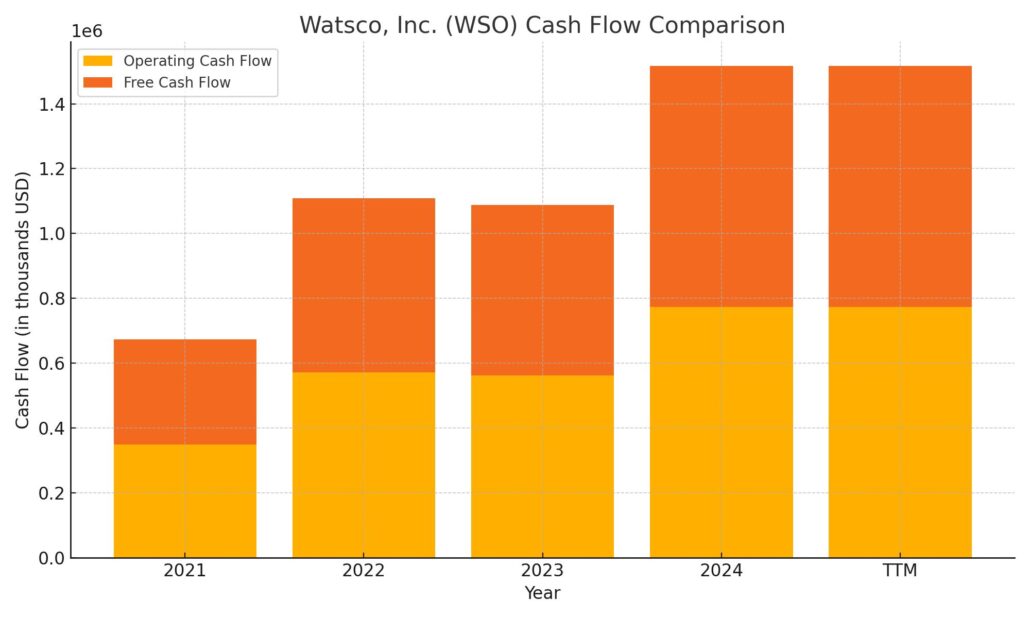

Cash Flow Statement

Watsco’s trailing twelve-month (TTM) cash flow paints a picture of a company generating solid, consistent cash from operations. Operating cash flow came in at $773 million, a significant increase from the $562 million posted in 2023 and $572 million in 2022. This improvement highlights not just stronger earnings but also better working capital efficiency. After accounting for $30 million in capital expenditures, free cash flow stands at $743 million—ample breathing room for dividends and strategic reinvestment.

On the investing side, Watsco deployed about $291 million, notably higher than the prior two years. That uptick likely reflects expansion or acquisitions aimed at shoring up future growth. Financing activities show a net outflow of $158 million, down significantly from previous years, signaling a lighter touch on debt repayments and stock repurchases. The company’s end cash balance now stands at $526 million, more than doubling its year-end 2023 figure. This kind of cash positioning enhances flexibility and reinforces the sustainability of Watsco’s dividend profile.

Analyst Ratings

📊 As of early April 2025, Watsco Inc. (WSO) is carrying a consensus analyst price target of around $509.56. That target reflects a fairly neutral outlook, suggesting analysts see the stock as reasonably valued at current levels. The range of expectations is wide, though, with targets spanning from $460.00 on the low end to $560.00 at the top, which shows some division in sentiment depending on how growth and margins play out over the year.

📈 Recently, there’s been movement in both directions. Baird lifted its price target to $560.00 in February, following strong quarterly results that beat expectations on both revenue and earnings. The firm cited improving demand trends across Watsco’s core markets and efficient cost controls as drivers of the more optimistic view. On the other hand, Loop Capital took a more cautious stance, reaffirming a hold rating with a lower target of $460.00. Their position appeared driven by valuation concerns, especially after the stock’s solid run over the past year.

💼 The divide in views seems rooted in how each firm weighs near-term earnings visibility versus long-term sector growth. Still, the stock’s consistent cash flow generation and resilient dividend track record continue to earn respect across the board.

Earning Report Summary

Watsco closed out 2024 on a high note, delivering a strong fourth quarter and setting new records across the board. Sales came in at $1.75 billion for the quarter, which was a clear step up from the same time last year. What stood out even more was how the company managed to widen its profit margins—always a sign that management is keeping a tight handle on costs while selling the right mix of products.

Solid Earnings Beat

Earnings per share for Q4 hit $2.37, beating expectations. It wasn’t a massive surprise to longtime followers of the company, but it still shows Watsco’s ability to execute. Whether it’s streamlining operations or responding to shifting demand across the HVAC market, they’ve found a way to deliver. Cash flow also looked strong during the quarter, giving Watsco even more room to work with as it plans for the year ahead.

Record Full-Year Results

Zooming out, 2024 was a record-setting year. Full-year revenue topped $7.3 billion, with operating profit landing at $795 million. That kind of consistent growth, even in an environment with plenty of economic noise, shows the company’s steady hand. Their ability to scale while keeping the bottom line healthy really speaks to the strength of their distribution model and leadership.

One of the more tangible takeaways for investors was the dividend bump. Watsco’s board raised the annual payout to $12.00 per share, up 11% from the previous rate. That’s not just a payout—it’s a signal. It shows confidence in the company’s long-term trajectory and commitment to rewarding shareholders with consistent, growing income.

All in all, the latest earnings update showed a business that’s not just weathering the environment—it’s thriving. Watsco’s performance gives investors plenty to feel good about heading into the next fiscal year.

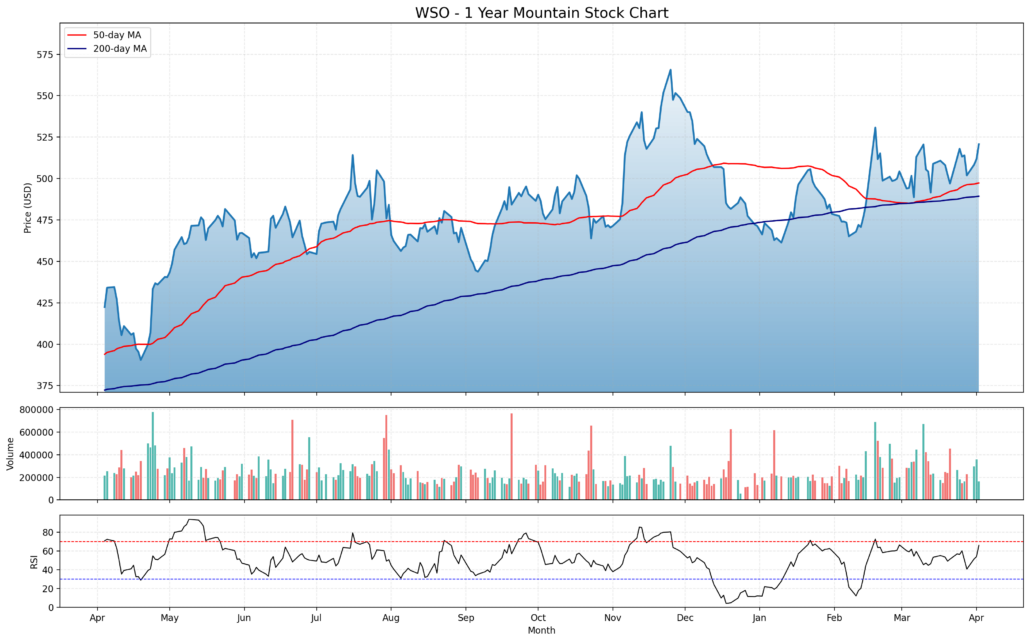

Chart Analysis

WSO has put together a pretty resilient technical performance over the past year. What stands out immediately is how well the stock has respected its 200-day moving average, using it as a base of support during moments of weakness. That long-term trend line has been rising steadily, reflecting the underlying strength and consistency of price action across the past 12 months.

Moving Averages and Price Behavior

The red line, which marks the 50-day moving average, shows shorter-term sentiment has been slightly more volatile. There were a few periods—particularly around January and late summer—when the price dipped below the 50-day but found footing right around the 200-day. More recently, the stock has regained both moving averages, which tend to act as positive technical signals. The current setup, with the price climbing above both averages, suggests upward momentum is returning. There’s also a visible compression between the two moving averages, which often precedes stronger moves.

Volume and Participation

Volume throughout the chart appears steady with a few noticeable spikes, especially during some of the larger moves in late October and mid-January. These spikes generally corresponded to price inflections, signaling that the market was actively reassessing valuation during those times. No abnormal surges in volume suggest a lack of panic or euphoric buying—just steady investor engagement.

RSI and Momentum

The RSI plot shows a consistent rhythm between overbought and oversold conditions. It hasn’t lingered in overbought territory, even during upward moves, which implies price appreciation hasn’t been driven by excessive enthusiasm. Recently, the RSI has been climbing again but is still under the 70 level, indicating that while momentum is positive, the stock hasn’t yet hit overheated levels. This sets the stage for possible continuation without an immediate risk of sharp pullback due to overextension.

All in all, WSO’s chart tells a story of a stock that’s been slowly grinding higher with regular tests of support, maintaining a healthy balance between growth and consolidation. It’s shown the kind of calm, methodical price action that often reflects confidence in the fundamentals behind the move.

Management Team

Watsco’s leadership has built a long-standing reputation for steady execution and forward-looking strategy. Albert H. Nahmad has served as Chairman and CEO since 1972, guiding the company from its early days into what is now the largest distributor of HVAC/R products across North America. His tenure spans decades of consistent performance and thoughtful growth, balancing scale with operational discipline.

Alongside him is Aaron J. (A.J.) Nahmad, who took over as President in 2016 after joining the company in 2005. A.J. has led Watsco’s digital transformation, spearheading the company’s efforts to build out e-commerce platforms and digital tools that help contractors and dealers work more efficiently. It’s a modern approach layered over a deeply rooted business model.

Ana M. Menendez, the Chief Financial Officer since 2003, has been with Watsco for more than 25 years. Her financial oversight has helped keep the company’s balance sheet healthy and positioned for long-term investment. Executive Vice President Barry S. Logan rounds out the senior leadership team. He’s been with the company since 1992 and has played a central role in corporate strategy and business development.

This group brings both historical continuity and fresh perspectives, creating a leadership structure that supports long-term growth.

Valuation and Stock Performance

Watsco’s stock has delivered solid returns for long-term holders, climbing steadily over the past several years. With an annualized return near 19% over the last decade, it’s handily outpaced broader benchmarks, supported by stable cash flows and disciplined management.

As of early April 2025, the company trades at a forward price-to-earnings ratio in the upper 30s, which is on the high end of the spectrum. That level of valuation may not appeal to bargain hunters, but it reflects the premium the market places on Watsco’s quality, consistency, and leadership in its category. Investors are clearly willing to pay for reliability and execution.

The price-to-book ratio sits around 6.7, which again suggests a high market premium relative to net assets. While that can raise questions about valuation, Watsco’s strong return on equity and capital efficiency help justify it. Looking ahead, analyst estimates suggest the company could grow revenue at an annual rate of around 6.4% over the next three years—slightly ahead of the broader trade and distribution space.

Despite not being a typical high-growth tech stock, Watsco’s consistent earnings and cash generation have made it a reliable performer.

Risks and Considerations

Watsco’s strengths are clear, but it’s worth considering a few areas that could create headwinds. Like most companies in the HVAC industry, Watsco is closely tied to broader economic cycles. Any prolonged slowdown in new construction or remodeling activity could dampen product demand.

The company also faces the ongoing challenge of managing supply chain complexity. In recent years, global supply issues have tested the ability of businesses to source products on time and at consistent cost levels. While Watsco has navigated this well so far, it remains a potential vulnerability.

There’s also regulatory exposure. HVAC systems must comply with changing environmental standards, which can impact inventory, margins, or create added cost pressure on manufacturers and distributors alike. Keeping ahead of those shifts is part of the business, but it’s not without risk.

Competition is another consideration. While Watsco holds a leading market share, it operates in a fragmented industry with many regional players. Staying ahead requires continuous investment in customer service, technology, and operational efficiency.

Investors should keep these factors in mind as part of a broader view of the company’s long-term picture.

Final Thoughts

Watsco has built something that’s increasingly rare: a business that performs consistently, rewards shareholders, and still manages to innovate in a traditionally slow-moving sector. Its leadership has proven time and again that it can adapt to change without losing sight of what matters—serving customers and delivering results.

The current valuation might not leave a huge margin for error, but it reflects years of steady execution and confidence in what lies ahead. The dividend is healthy and growing, backed by real cash flow and a management team that prioritizes shareholder returns.

Yes, there are risks—from economic shifts to supply chain wrinkles—but Watsco has weathered these challenges before. It’s the kind of company that doesn’t chase headlines but quietly delivers. And for those looking for something dependable and durable, that might be exactly what they’re after.