Updated April 2025

WaFd, Inc. might not be splashed across financial headlines, but this Seattle-based regional bank has been playing the long game with impressive discipline. Formerly known as Washington Federal, it’s been in business for over 100 years, steadily building out a footprint across the western U.S. While many banks chase aggressive expansion or trend-driven growth, WaFd keeps things straightforward—measured lending, strong capital controls, and consistent shareholder returns.

For dividend-focused investors, that kind of approach can be a real asset. There’s a level of predictability in WaFd’s model that’s become increasingly rare. It doesn’t overextend. It doesn’t overpromise. And in today’s financial climate, that’s more valuable than ever.

Recent Events

In the latest earnings report covering the quarter ending December 31, 2024, WaFd showed a bit of softness. Earnings came in at $2.19 per share over the trailing twelve months, and quarterly earnings dropped around 19% year-over-year. Not ideal, but not catastrophic either—especially when taken in the broader context of regional bank pressures.

Despite the dip in earnings, the bank is still operating with solid profitability. Margins are healthy, with a 26.65% profit margin and operating margin just over 40%. These aren’t fluke numbers—they reflect a bank that knows how to run lean.

Return on equity stands at 6.9%, which is below the highs we’ve seen in stronger cycles, but still indicates decent capital efficiency. More telling is the balance sheet: WaFd is sitting on $1.74 billion in cash, which works out to over $21 per share. With the stock trading under $29, that’s a significant cushion.

Book value per share is north of $33, and the stock trades at a price-to-book ratio of just 0.86. That discount isn’t because of a credit crisis or missteps—it’s market-wide caution toward regional banks. For investors who value fundamentals, this kind of dislocation can be intriguing.

Key Dividend Metrics 📊

💵 Dividend Yield: 3.76% (Forward)

📈 5-Year Average Dividend Yield: 3.19%

🔁 Dividend Growth Rate (5-Year): Consistent, modest pace

📊 Payout Ratio: 47.49%

📆 Last Dividend Paid: March 7, 2025

📉 Ex-Dividend Date: February 21, 2025

📚 Price-to-Earnings (Trailing): 13.13

🏦 Price-to-Book: 0.86

Dividend Overview

WaFd’s dividend profile is one of stability over flash. The current forward yield is 3.76%, which is comfortably higher than its five-year average. That alone makes it interesting, especially when you see that the payout ratio is sitting under 50%. It’s not stretching to make those payments—it’s just steadily returning value.

This kind of profile is ideal for investors who prioritize consistent income without the anxiety of dividend cuts. WaFd hasn’t skipped or trimmed its dividend even in the more turbulent stretches of the banking cycle. While the stock has pulled back from last year’s highs—down from $38.62 to under $29 today—the dividend has remained steady.

With rising rates and tighter financial conditions hitting many regional lenders, WaFd’s measured approach is paying off in terms of reliability. Even as the market gets nervous, it keeps doing what it does best: generating free cash and distributing a piece of it to shareholders.

Dividend Growth and Safety

Dividend growth at WaFd won’t blow you away, but that’s not the point. It’s been quietly lifting its payout year after year. From $0.56 per share a decade ago to $1.08 now, the company has almost doubled its dividend. That’s roughly a 6.5% annual growth rate—not aggressive, but smooth and dependable.

And when it comes to safety, WaFd checks all the boxes. A massive cash position, conservative lending, and minimal exposure to risky markets give it a solid buffer. Even with some softness in recent earnings, the dividend is far from being at risk.

The bank’s payout strategy is balanced. It doesn’t hand out every dollar it earns, preferring to keep the payout ratio below 50%. That leaves room for reinvestment and stability during rough patches. It’s a blueprint that’s served long-term investors well so far.

Another positive? WaFd’s low beta of 0.78. It doesn’t swing wildly with the market, which adds a layer of comfort for dividend reinvestors. That’s especially appealing if you’re building out a portfolio for income and want fewer surprises along the way.

There’s also a refreshing absence of gimmicks. No splashy buybacks. No dividend hikes for the sake of headlines. Just a steady, investor-first approach that’s become rare in the banking space. For those who prioritize consistency and income, WaFd’s story may be worth tuning into.

Cash Flow Statement

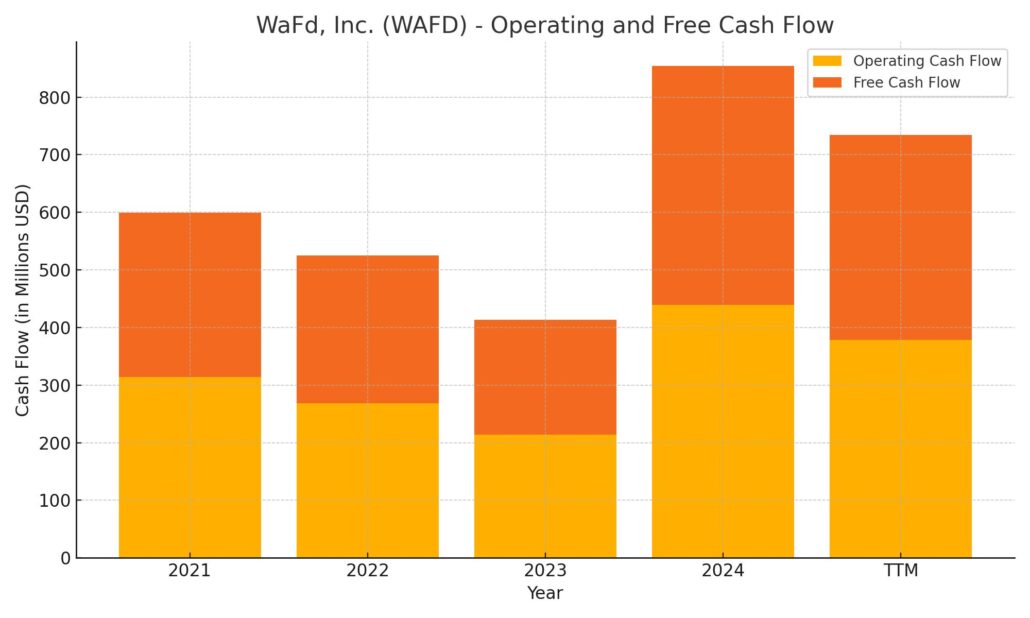

WaFd’s trailing twelve-month cash flow paints a picture of solid operating performance despite some recent headwinds. The bank generated $378 million in operating cash flow, down from $439 million the previous year but still well above pre-2023 levels. This indicates continued profitability and discipline in core operations. Free cash flow followed suit at $355 million, reflecting modest capital expenditures and overall efficiency in deploying capital. These figures point to a business that continues to produce dependable cash from its core lending and deposit operations.

On the investing and financing side, there’s a stark contrast. Investing cash flow swung sharply positive at $2.84 billion, largely due to a pullback from the heavy securities purchases seen in prior years. At the same time, financing cash flow turned deeply negative, showing outflows of $2.86 billion—driven primarily by aggressive debt repayments totaling over $15.6 billion, exceeding new debt issued. This rebalancing of the balance sheet indicates a conservative tilt in financial management, prioritizing deleveraging over expansion. Despite these movements, the bank ended the period with $1.5 billion in cash, a healthy reserve in today’s uncertain interest rate environment.

Analyst Ratings

WaFd Inc. (WAFD) has recently seen a shift in how analysts view the stock. 🧐 On February 6, 2025, DA Davidson moved their rating from “Buy” to “Neutral” and dropped the price target from $35 to $32. The reasoning was tied to ongoing pressure on net interest margins, a concern that’s been echoing across the banking sector as rates fluctuate and loan spreads tighten. 📉

A couple of weeks earlier, on January 21, Piper Sandler also kept a “Neutral” rating but trimmed their target from $37 to $31. Their note highlighted slower expected loan growth and more intense competition in the regional banking space as key issues that could limit upside. 🏦

That same day, analysts at Keefe, Bruyette & Woods reiterated a “Hold” rating while nudging their price target lower from $42 to $34. Their caution was centered on some softening asset quality metrics and the potential regulatory shifts that could weigh on regional bank profitability in the near term. 📊

Right now, the overall consensus from analysts is “Hold” with a collective price target around $33.75. 📍 With the stock trading at $28.75, there’s some room for upside, but most analysts seem to agree that the bank is in a holding pattern until more clarity emerges on margins and loan activity.

Earnings Report Summary

Net Income Takes a Hit, But There’s More to the Story

WaFd’s most recent earnings report, covering the fiscal year ending September 30, 2024, wasn’t exactly a headline-grabber in terms of bottom-line growth. The bank posted net income of $200 million, or $2.50 per share, down from $257 million and $3.72 per share the year before. That kind of drop will naturally raise a few eyebrows, but there’s more context behind the numbers.

One of the biggest stories this year was the acquisition of Luther Burbank Corporation, a California-based bank. It was a major move, adding around $7.7 billion in assets to WaFd’s books. Of course, that sort of transaction doesn’t come cheap—$26 million in acquisition-related expenses made their way onto the income statement, and that weighed down the final earnings figure.

Balance Sheet Growth and Dividend Commitment

Despite the earnings decline, WaFd ended the year with total assets of $28.06 billion, up from $22.47 billion the year before. That’s a big jump, largely thanks to the Luther Burbank acquisition, but also reflects solid organic growth. Shareholders’ equity climbed as well, hitting $3 billion versus $2.43 billion a year ago. So even with some short-term costs, the balance sheet is stronger than ever.

The bank also stayed consistent on the dividend front, bumping the annual payout to $1.03 per share, up from $0.99 the year before. This marks the 168th consecutive quarterly dividend—a streak that speaks volumes about management’s commitment to returning value to shareholders even during transitional years.

A Dip in Profitability Ratios, But Strategy Is in Motion

Return on average equity slipped to 7.55%, down from 11.69% last year. That’s not unexpected given the acquisition costs and the earnings dip, but it’s something to keep an eye on. While profitability took a hit this cycle, the overall direction suggests WaFd is positioning itself for scale and efficiency gains down the road.

So, while the headline numbers might look a bit underwhelming at first glance, this report tells the story of a bank making strategic moves that may take time to fully pay off. For now, WaFd is playing the long game—and still paying shareholders to stick around.

Chart Analysis

Price and Moving Averages

Looking at the 1-year chart for WAFD, it’s clear the stock experienced a strong rally from late June through mid-October, peaking around the $35–36 range. That upswing was followed by a steady fade that lasted through the winter months. What stands out is the long, smooth climb in the 50-day moving average through that summer rally, eventually flattening and then turning sharply lower in December.

The 200-day moving average tells a different story—it climbed more gradually and has only recently started to flatten out, which suggests the longer-term trend is neutral to slightly bearish now. The fact that the price has remained below both moving averages since January doesn’t go unnoticed. That’s a sign the stock is still struggling to regain momentum after the correction.

Volume Behavior

Volume has been mostly quiet, with a few spikes scattered throughout the year. One of the more noticeable ones occurred in October, just as the stock began its downtrend. That kind of spike on a reversal often suggests distribution—larger players may have been trimming exposure into strength. Since then, volume has remained tame, even as the price drifted lower. It doesn’t look like sellers are panicking, but buyers haven’t exactly rushed back in either.

RSI and Momentum Shift

The RSI has been particularly revealing. It dipped into oversold territory a few times during the decline but never stayed there for long. Most recently, the RSI has climbed back above 60, showing a bit of strength returning to the name. That rising momentum is something to watch—it could indicate early signs of accumulation, especially if price starts to challenge the 50-day average again.

While this isn’t a stock flashing aggressive reversal signals just yet, the recent price stabilization around the $27–$29 zone, along with a gentle uptick in RSI, suggests the selling pressure may be easing. If the price continues to hold this base and volume picks up slightly, it could set the stage for a longer-term recovery attempt.

Management Team

WaFd Inc. is led by a management team with deep experience in the financial industry. At the center is Brent Beardall, who joined the company in 2001 and has steadily climbed the ranks. He served as CFO for over a decade, was named President in 2016, and took over as CEO in 2017. That kind of internal progression is rare these days and reflects a leadership style built on long-term thinking and operational familiarity.

Backing him is Kelli J. Holz, the Executive Vice President and current Chief Financial Officer. She brings financial oversight and strategic discipline to the organization. Other key executives include Cathy Cooper, overseeing retail banking operations, and Vincent Beatty in a senior finance role. Together, this team blends institutional knowledge with a clear sense of purpose, helping steer WaFd through evolving market dynamics.

The board of directors supports the executive leadership with a broad mix of expertise, offering guidance that draws from multiple industries. The combination of continuity, financial acumen, and governance discipline adds a level of confidence in how the business is run.

Valuation and Stock Performance

WAFD has had an uneven run over the past 12 months. The stock traded as high as $38.62 and as low as $25.79 during that span, reflecting a mix of regional bank headwinds, investor sentiment swings, and broader macroeconomic factors. As of early April 2025, shares are hovering around $28.75, which puts them toward the lower end of their recent range.

Looking at valuation, the trailing P/E sits at about 13. That’s not stretched by any means, especially when you consider the stock’s current price is trading below book value with a price-to-book ratio of 0.86. That discount to book may signal that investors are being overly cautious, or it could reflect the lingering uncertainty around regional banks and net interest margins. Either way, it leaves some potential room for re-rating if fundamentals stabilize.

The dividend yield is holding strong at 3.76 percent, and that alone keeps some investors engaged. Combine that with a solid cash position and historically conservative balance sheet management, and it becomes clearer why this name still has relevance despite a choppy chart.

Risks and Considerations

No bank is without risk, and WaFd is no exception. One of the more persistent concerns is tied to its loan book. If underwriting becomes too lenient or if loan performance deteriorates in a weaker economy, losses could eat into earnings quickly. While WaFd’s underwriting standards have historically been solid, that doesn’t eliminate credit risk.

Another consideration is the integration of Luther Burbank Corporation. Mergers bring potential benefits, but they also come with execution risk. Aligning operations, systems, and personnel can be messy, especially when cultural differences come into play. If that integration runs into unexpected costs or delays, it could affect earnings and operational momentum.

The regulatory environment is also a moving target. Capital requirements, liquidity rules, and changing stress test assumptions can all shift the ground beneath a regional bank’s feet. Then there’s the interest rate backdrop—lower or more volatile rates can pressure margins, while rising rates could tighten lending activity. These are variables that management has to manage carefully in real time.

Final Thoughts

WaFd Inc. isn’t built for drama. It’s a bank that operates with a long-term mindset, aiming for consistent execution rather than short-term flash. The leadership team has been in place long enough to understand the business deeply, and they’ve navigated economic cycles before.

The stock’s valuation appears undemanding, particularly given its below-book pricing and steady dividend yield. But like all investments, it comes with trade-offs. Regional bank sentiment remains fragile, and future growth depends in part on how effectively WaFd absorbs its latest acquisition and adapts to macro shifts.

Still, with a solid balance sheet, a conservative approach to risk, and a long dividend track record, WaFd continues to represent a steady hand in a sometimes unpredictable sector. For those who value measured growth and income over headline-grabbing volatility, this name may be worth keeping on the radar.