Updated April 2025

The music industry has changed a lot over the past couple of decades. Gone are the days of record stores and CD towers—today, it’s all about streaming. Warner Music Group, one of the “big three” music companies globally, has leaned into this transformation and now finds itself at the crossroads of digital media and steady cash flow. You’ve heard of the artists in its catalog—Bruno Mars, Ed Sheeran, Dua Lipa—but the company behind the scenes has built a business around licensing and recurring revenue.

While it may not get as much attention as tech giants or consumer brands, Warner Music offers something that dividend investors are always hunting for: consistent payouts, a resilient cash engine, and a potential for slow but steady growth in yield. If you’re looking at it from an income perspective, this is a name worth diving into.

Recent Events

Over the past year, Warner Music Group’s stock has underperformed the broader market. It’s down a little more than six percent over the past 52 weeks, while the S&P 500 has climbed higher. Some of that dip can be traced to a softer revenue quarter, where sales declined by 4.7% compared to the previous year. That said, earnings jumped significantly—up more than 48% in the same stretch—suggesting that the business is still squeezing more from every dollar even if the top line took a hit.

Operating margins came in at a respectable 14.5%, showing that the company is still disciplined on costs. EBITDA stands at $1.28 billion on $6.34 billion in revenue—not bad for a business built around royalties, licensing, and content rights.

But debt is definitely a piece of this puzzle. Warner Music is carrying $4.22 billion in debt, with a debt-to-equity ratio that’s hard to ignore at over 600%. That makes the dividend conversation more nuanced, but not necessarily problematic, depending on how you view cash flow consistency and the stickiness of the company’s revenue model.

Key Dividend Metrics

📅 Dividend Yield: 2.31%

💰 Annual Dividend Rate: $0.72

📈 Dividend Growth Rate: Steady, modest pace

🎯 Payout Ratio: 71.43%

📉 5-Year Average Yield: Not available

💵 Free Cash Flow: $713 million

🧾 Next Dividend Date: March 4, 2025

📆 Ex-Dividend Date: February 24, 2025

Dividend Overview

Warner’s dividend might not grab headlines, but it’s been a steady performer since the company went public again in 2020. Right now, the forward dividend yield sits at 2.31%, which edges out many of the other names in consumer discretionary and media. The $0.72 annual payout is being maintained with discipline, reflected in a payout ratio just over 71%.

Yes, that ratio is on the higher side, but context matters. The business is generating $793 million in operating cash flow and nearly the same amount—$713 million—in levered free cash flow. That tells you this isn’t a stretch; Warner has room to keep the dividend flowing without dipping into reserves or compromising elsewhere.

For investors who value predictability in income, this kind of structure is attractive. Unlike many entertainment companies that live or die by their next big release, Warner’s licensing revenue gives it a recurring cash stream that’s surprisingly dependable. With streaming deals, international expansion, and a rich content catalog, the business model supports steady distributions.

Dividend Growth and Safety

When it comes to dividend growth, Warner Music isn’t sprinting ahead, but it’s not standing still either. There’s not a long history of raises to study, and that’s okay. The payout has been consistent, and the underlying financials support the idea that gradual increases could be on the table in the future.

Looking at safety, the numbers offer a mixed but manageable story. The payout ratio of 71% is elevated but well-supported by the company’s cash flow. Warner isn’t drowning in capital expenses or making risky bets. That’s good news if you’re depending on dividends for regular income.

Return on equity is striking—over 80%. But with a book value per share of just $1.05, that figure is skewed by how Warner reports its assets (mostly intangibles like publishing rights and artist contracts). Even so, it’s a sign the company is extracting meaningful returns from the capital it has.

One thing to watch is the current ratio, which is under 0.7. That means Warner has more short-term liabilities than assets at the moment—a potential tight spot if things get choppy. However, with strong free cash flow and stable licensing deals, this hasn’t raised red flags just yet.

Dividend growth potential is tied to revenue expansion, and that’s still on the horizon. As streaming continues to grow globally, Warner’s positioning in markets like Latin America and Southeast Asia could be a slow-burn tailwind. If that top-line number starts climbing again, dividend increases become a lot more likely.

All in all, Warner Music Group may not scream “dividend stock,” but for those looking under the radar, it offers a combination of consistency, cash flow, and quiet resilience that fits nicely into an income-oriented portfolio.

Cash Flow Statement

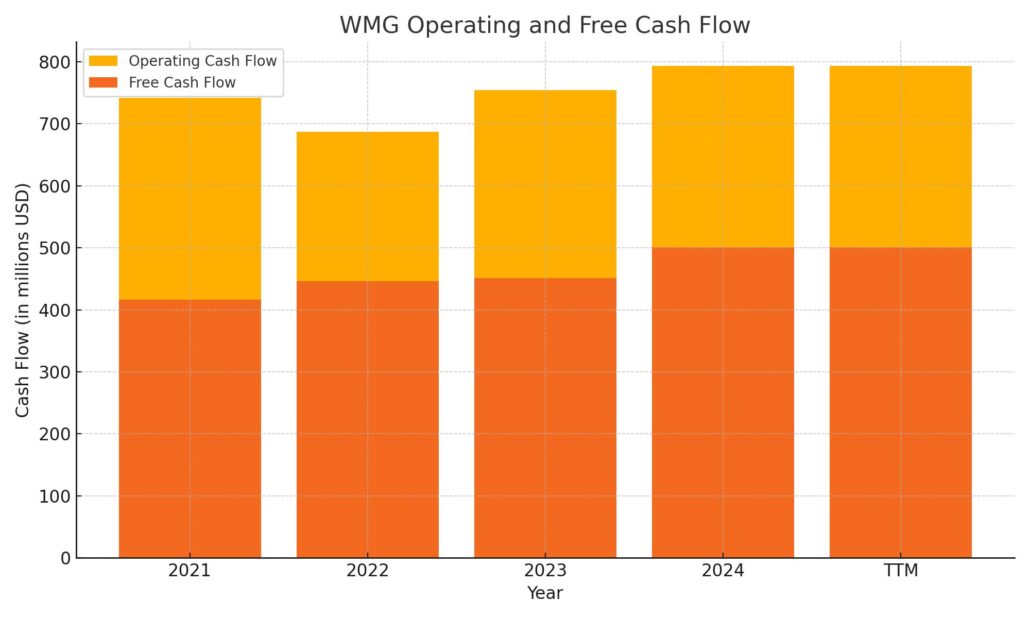

Warner Music Group’s trailing twelve-month (TTM) cash flow statement highlights a business with strong internal cash generation and improving liquidity. Operating cash flow reached $793 million, reflecting consistent upward momentum over the past few years. Free cash flow for the same period came in at $501 million, showing Warner’s ability to not only cover its dividend but also support debt obligations and potential reinvestment opportunities. This stability in free cash flow is especially notable considering the company’s capital expenditures, which have hovered close to $300 million annually.

On the financing side, cash flow was negative $430 million in the TTM, largely driven by continued debt repayment of $220 million and a notable absence of new debt issuance this time around. The company’s cash position has steadily improved year after year, ending the most recent period with $817 million in cash—up from $694 million the prior year. Investing cash flow remained in the red at $300 million, consistent with previous years, driven mostly by capital investments. Overall, the cash flow profile suggests a company that’s tightening up its operations while managing capital with a clear eye on maintaining flexibility and shareholder returns.

Analyst Ratings

📈 Warner Music Group (WMG) has recently seen some activity in analyst sentiment. As of early April, the stock is trading around $31.14. The average consensus price target from analysts sits at approximately $35.17, suggesting a potential upside in the near term.

🔼 In February, Citigroup moved its rating on WMG from Neutral to Buy and bumped the price target up to $42. The reasoning behind the upgrade came down to Warner’s improved licensing agreements with major streaming platforms, which are expected to bring in more predictable, higher-margin revenue. Analysts also pointed to solid execution on the digital strategy and expanding global market share as driving forces behind their renewed confidence.

🟢 UBS also reiterated its Buy rating, setting a $41 target. The firm emphasized Warner’s consistent cash generation and a growing dividend, noting that the business is starting to reflect more stability than many might expect from a media company.

🔻 Not all sentiment has been bullish, though. Back in October, BofA Securities lowered its rating from Neutral to Underperform and revised its target down from $33 to $30. That call reflected concerns about softening physical sales and intensifying competition in the streaming space, particularly among younger audiences shifting to alternative platforms.

📊 Overall, the analyst consensus leans toward Outperform, with a mix of cautious and optimistic tones depending on how each firm weighs WMG’s evolving digital strategy and cash flow resilience.

Earning Report Summary

Revenue and Profit

Warner Music Group’s latest earnings came in with a bit of a mixed tone. Revenue dipped about 5% from the prior year, landing at $1.67 billion. The pullback was driven by some headwinds in digital music and a bit of currency pressure, which can sneak up on you when a chunk of your revenue is coming in from overseas. That said, there was a bright spot—net income actually climbed by 25%, hitting $241 million. That kind of jump shows that the company is managing its costs well, and some favorable currency moves helped out, especially on their Euro debt.

Segment Performance

On the Recorded Music side, revenue slid by nearly 7%. That drop came from weaker results in digital sales, licensing, and artist services. But not everything was soft. Physical music sales—yes, vinyl and CDs—actually rose by 7.8%, thanks in large part to strong releases in markets like the U.S. and Japan. Meanwhile, Music Publishing held up well, posting a 6.3% increase. Gains in digital and performance royalties really carried the load there, showing that the publishing side continues to be a reliable piece of the business.

Profitability and Cash Flow

Operating income did take a hit, falling 40% to $214 million. Part of that was due to some restructuring charges and one-time write-downs tied to the company’s efforts to realign its strategy. Adjusted OIBDA came in at $363 million, down 20% from the prior year. While those are some sizable drops, they weren’t totally unexpected given the changes Warner has been making.

What’s worth noting, though, is that operating cash flow went up—13% higher this time around, reaching $332 million. That signals strong working capital management, and it’s the kind of figure that makes dividend-focused investors a bit more comfortable. Capex also ticked up to $36 million, as Warner continues to invest in tech and infrastructure to stay competitive.

Financial Position

The company’s financial footing remains solid. Warner closed the quarter with $802 million in cash on hand and total debt just under $4 billion. It’s a leveraged balance sheet, no doubt, but one that’s manageable given their steady free cash flow and recurring revenue from publishing and licensing. Overall, the quarter had some soft spots, but also a few signs of resilience.

Chart Analysis

Price Movement and Trend

Looking at the chart for WMG over the past year, the stock has gone through some noticeable swings, but with a clear structure underneath. Early in the timeframe, prices were trending downward with a consistent loss of momentum, especially from April through late summer. The 50-day moving average (red line) stayed well below the 200-day moving average (blue line) for most of that period, reflecting ongoing bearish pressure. But around October, that dynamic started to shift. The price pushed above both moving averages, hinting at a potential recovery.

From late October into February, there was a more sustained uptrend. That rally even managed to pull the 50-day moving average above the 200-day line, forming a short-term golden cross, which often points to positive momentum. However, that bullish crossover didn’t hold for long. As March progressed, the price rolled over again, falling back below the moving averages. The current setup shows the 50-day average leveling off while the 200-day still trends slightly upward—suggesting a cooling period rather than a full breakdown.

Volume and RSI Behavior

Volume has been mostly stable, though a few spikes—especially in August and October—suggest institutional activity or reactions to major news or earnings. More recently, volume hasn’t been remarkable in either direction, which typically reflects indecision in the market rather than conviction.

The RSI (relative strength index) has been fluctuating within a healthy range for most of the year, rarely hitting extreme overbought or oversold levels. In October and again in March, RSI pushed above 70, signaling temporary overbought conditions. But both times, the stock pulled back shortly after, aligning with the typical behavior that follows RSI extremes. Presently, the RSI is hovering near neutral levels, which tells us the market isn’t showing strong directional bias.

Moving Average Context

The current price has dipped below both the 50- and 200-day moving averages again, suggesting the uptrend has lost momentum for now. While this doesn’t rule out a reversal, it often signals a period of consolidation or potential softness ahead. Long-term trends are shaped by how the stock behaves around these levels, and right now, WMG looks like it’s searching for direction.

The chart shows a name that had a decent recovery late last year but is now facing resistance in holding those gains. It’s a time for watching support levels and whether the price can regain strength above those moving averages again.

Management Team

Warner Music Group (WMG) has made notable shifts at the leadership level to align with the changing dynamics of the music business. In early 2023, Robert Kyncl stepped in as CEO. He brings a deep understanding of the digital ecosystem from his time at YouTube, where he played a key role in building out its content and monetization strategies. His arrival marked a clear signal that Warner is prioritizing innovation, creator relationships, and tech-forward initiatives.

Alongside Kyncl, the executive team includes Bryan Castellani as CFO. Castellani offers a strong financial foundation and has experience navigating complex balance sheets and market transitions. On the publishing side, Carianne Marshall and Guy Moot serve as Co-Chairs of Warner Chappell Music. Together, they continue to push WMG’s publishing segment forward with a blend of artist development and strategic global licensing.

WMG has also invested in expanding its digital capabilities. Ariel Bardin, the President of Technology, is focused on operational enhancements through tech infrastructure, while Carletta Higginson, as Chief Digital Officer, is working to deepen the company’s footprint across streaming platforms and global content distribution.

This group brings together traditional music industry expertise with forward-looking digital leadership, creating a mix that’s well-suited for the streaming age.

Valuation and Stock Performance

As of early April, WMG shares are trading just above $31. The stock has moved within a range of $27 to $36 over the last year, showing a fair amount of volatility but also the potential for recovery. It currently trades closer to the low end of that range, though still well off the 52-week bottom, which may suggest stabilization.

The company is valued at around $16.2 billion, with a forward P/E of roughly 21. That places it somewhere between growth and value territory, depending on how you interpret its digital exposure and royalty-driven revenue streams. Its trailing twelve-month earnings per share is just under one dollar, and the valuation reflects a premium placed on steady cash flow and predictable income.

Analysts have set a consensus price target around $35 to $36, indicating mild upside from current levels. That figure reflects expectations for continued performance in publishing, licensing stability, and modest improvement in recorded music. While not overly aggressive, the target suggests a reasonable outlook for the year ahead.

The stock performance has been a bit choppy, and while it hasn’t outperformed the broader market recently, it hasn’t collapsed either. It’s shown enough strength to remain relevant on the radar, especially for those looking at more than just near-term momentum.

Risks and Considerations

Warner Music Group carries some risk, and it’s important to view those clearly. Debt is one of the bigger factors. With nearly $4 billion in total debt and around $800 million in cash, the company is leveraged. That doesn’t mean it’s in trouble, but it does mean management needs to continue being careful with capital allocation, especially in an environment where interest rates remain elevated.

Then there’s the industry itself. Music consumption is more digital than ever, and while that brings recurring revenue, it also means staying relevant in the algorithm-driven world of streaming. Labels have less control over discovery than they used to, and they’re increasingly competing with independent artists and creators who can self-publish and build audiences without traditional backing.

Regulatory issues and copyright management are also ongoing challenges. As WMG expands globally, it deals with a patchwork of laws, licensing frameworks, and cultural differences in consumption. That complexity creates friction that has to be managed well.

On top of that, you’ve got unpredictable variables like artist disputes, contract negotiations, and macroeconomic sensitivity. When consumer confidence dips, entertainment spending is often one of the first things people pull back on, and that includes things like subscription services or digital downloads.

Lastly, while climate and ESG risks are more indirect in this industry, they’re not irrelevant. Tours, events, merchandise logistics—all of those are impacted by supply chain changes, environmental policies, and broader global disruption. Any hiccups there could influence earnings in ways that are hard to model.

Final Thoughts

Warner Music Group is a modern rights-driven music business built for the digital world. The company has transitioned from legacy music label to a platform monetizing content across every format—from TikTok clips to streaming playlists to live tours. Its leadership is tech-savvy, and the business structure leans into cash generation and licensing, which gives it a level of income predictability that’s not always common in the entertainment space.

Even with its debt load and market competition, Warner has done well to remain relevant and profitable. The stock hasn’t been a breakout performer, but it’s also shown resilience, holding its ground through changing consumption patterns and macro shifts. The consistency in free cash flow and stable dividend can provide a level of comfort in uncertain times.

Going forward, the focus will likely remain on deepening digital engagement, growing international revenue, and managing costs without sacrificing growth. WMG has the infrastructure, content catalog, and leadership in place to do that—it just needs to keep adapting in an industry where disruption is part of the business model.