Updated April 2025

Walker & Dunlop, based in Bethesda, Maryland, has spent years carving out a solid position in the world of commercial real estate finance. They’re known for originating, selling, and servicing a wide mix of loans, especially in the multifamily housing space.

What’s helped WD stand out is how it’s evolved. It’s no longer just about lending. They’ve expanded into investment banking, asset management, and servicing—all while keeping real estate at the core. This gives them a bit more stability than you’d expect in a rate-sensitive business. And for dividend investors, that stability, along with a steadily growing payout, makes the stock worth a closer look.

Recent Events

Walker & Dunlop has had a bumpy ride over the past year. Shares are down about 11% from this time last year, which looks rough on paper. But peel back a layer and it’s not all bad. The real estate market has been under pressure with rising interest rates and tighter credit. That’s made financing deals harder and slowed down transaction volumes.

Still, WD managed to deliver a 25.8% jump in revenue year over year, and even more impressive—a 41.9% boost in earnings over the same stretch. That kind of growth in a tough market shows that this isn’t your average lender.

March 14 marked the latest dividend payout, a reminder that the company is sticking to its income promises. No talk of cuts, no signs of wavering. And with a forward yield over 3%, it’s currently throwing off a better yield than many of the usual suspects in the dividend universe.

Key Dividend Metrics

📈 Forward Yield: 3.15%

💰 Forward Annual Dividend: $2.68 per share

🔁 Payout Ratio: 81.5%

📆 Recent Dividend Date: March 14, 2025

🔍 5-Year Average Yield: 2.38%

📉 Stock Price Performance (12-mo): -11.11%

🏛️ Institutional Ownership: 84.7%

Dividend Overview

At around $85 per share, the forward dividend yield of 3.15% stands out in today’s market. It’s not just a number—it’s significantly higher than what this stock has averaged over the past five years. That makes it a bit more appealing right now for income seekers.

And yes, the payout ratio is on the higher side at 81.5%. But context matters. The company is coming off a rougher earnings period, and profits are just starting to bounce back. As the numbers normalize, the payout ratio should drift back into a more comfortable range.

More importantly, the company is generating cash. WD brought in over $129 million in operating cash flow over the last year. That means they’re not relying on debt to fund the dividend, even though they are carrying $1.66 billion in total obligations. With more than $300 million in cash sitting on the books, they’ve got breathing room to keep paying—and possibly growing—that dividend.

Dividend Growth and Safety

WD has been growing its dividend slowly but steadily. Earlier this year, the company nudged the quarterly payout up from $0.65 to $0.67 per share. It wasn’t a flashy move, just a 3% lift, but it reinforced something important: they’re committed to a reliable income stream.

That kind of measured growth is exactly what many dividend investors are looking for. No drama. No over-the-top hikes that might need to be walked back later. Just consistent, dependable increases backed by recurring cash flow.

That recurring cash flow largely comes from WD’s servicing portfolio. This part of the business isn’t flashy, but it’s steady. It gives the company a predictable revenue stream to lean on—even when loan originations slow down.

As for the outlook, things appear to be heading in the right direction. Earnings are expected to improve, helped by more favorable lending conditions and increased deal activity. The stock is trading at just under 11 times forward earnings, which suggests that the market might be underestimating the recovery.

Debt is always something to watch. With a debt-to-equity ratio of about 94%, WD is clearly using leverage. But a current ratio of 1.66 says they’ve got enough liquidity to handle near-term obligations comfortably. If rates stop climbing—or even start falling later this year—that could take some pressure off and give earnings even more room to run.

For investors focused on reliable income with a touch of growth potential, Walker & Dunlop’s current setup is hard to ignore. The stock may not be soaring, but the dividend keeps coming, and that’s exactly what a lot of long-term portfolios need right now.

Cash Flow Statement

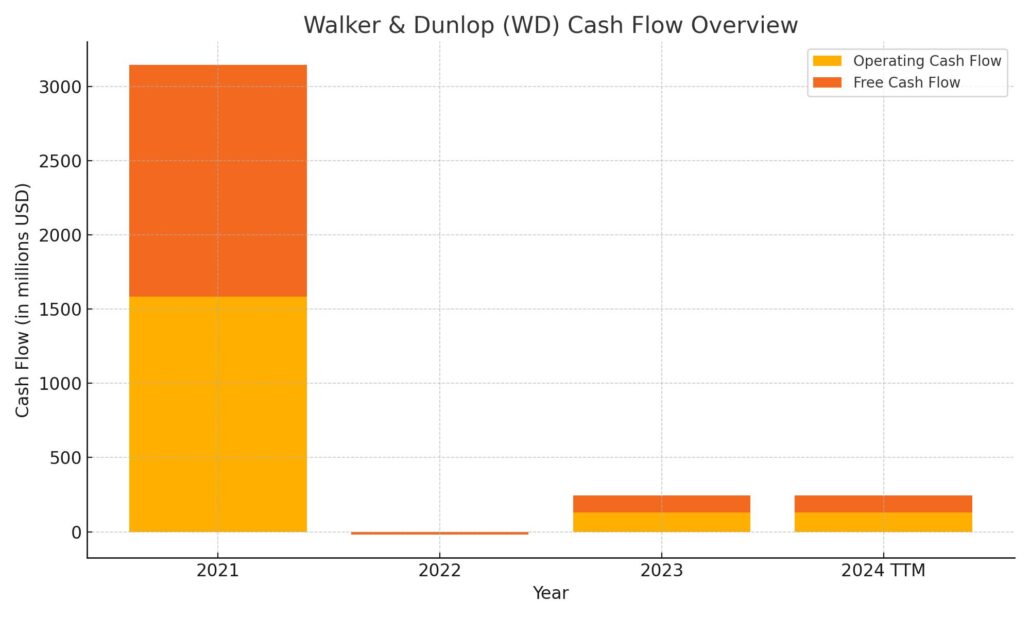

Walker & Dunlop reported $129.4 million in operating cash flow over the trailing twelve months, a sharp recovery from the small deficit posted in 2023. While it’s far below the exceptional levels seen in 2021, this positive swing reflects an improvement in the company’s core lending and servicing activities. Free cash flow followed suit, reaching $116.4 million, which supports WD’s ability to maintain its dividend and reinvest selectively, even in a higher-rate environment.

On the financing side, WD used more cash than it brought in, with $154.7 million in net outflows. Most of that came from debt repayments and a modest amount of share repurchases. The company’s investing cash flow was modestly negative at $38.1 million, largely tied to typical capital expenditures. The cash position at the end of the period stood at $327.9 million—down slightly from a year earlier but still healthy—signaling WD’s disciplined capital management during a time of tighter credit and economic uncertainty.

Analyst Ratings

📈 Walker & Dunlop (WD) recently received a notable upgrade from Keefe, Bruyette & Woods (KBW), which shifted its rating from “Market Perform” to “Outperform” and assigned a new price target of $105. This upgrade came on the back of Walker & Dunlop’s strong position in multifamily agency lending and a performance that’s remained surprisingly resilient despite industry pressures. Analysts highlighted the company’s steady profitability and its ability to navigate the higher-rate environment more smoothly than peers.

💼 Around the same time, WD’s senior secured bank credit facility received a credit rating boost to Baa3 from Ba1. The upgrade was attributed to improved expectations around Walker & Dunlop’s debt structure, which continues to strengthen as the firm refines its capital management strategy.

📉 That said, earlier in the year, KBW had revised its price target downward from $120 to $105 while maintaining a “Market Perform” rating. The reason? Slightly tempered earnings forecasts moving forward, especially as transaction volumes in the commercial real estate space remain uneven.

🎯 As it stands now, the consensus analyst price target for WD sits around $107.50. With the stock trading at roughly $85, analysts see meaningful upside from here—about 26%—assuming fundamentals continue trending in the right direction.

Earning Report Summary

Strong Finish to the Year

Walker & Dunlop closed out 2024 with a solid fourth quarter that showed real momentum in their core business lines. The total transaction volume jumped to $13.4 billion, up 45% from the same period the year before. That kind of growth doesn’t happen by accident—it was fueled by a big pickup in both agency lending and property sales. Fannie Mae originations nearly doubled, while Freddie Mac loans also moved higher by close to 20%. On the sales side, things looked equally strong, with commercial property transactions rising 20% to $3.5 billion.

Financials Moving in the Right Direction

From a bottom-line perspective, the company pulled in $44.8 million in net income for the quarter. That’s a 42% increase year-over-year, and it translated to $1.32 in earnings per share. Adjusted EBITDA came in at $95 million, which was up 8% from the prior year. One of the only soft spots was adjusted core EPS, which slipped 6% to $1.34, but overall the numbers tell a story of steady execution even in a challenging market.

Full-Year Highlights

Looking at the full year, Walker & Dunlop generated $1.1 billion in revenue, marking a 7% gain over 2023. The servicing portfolio grew as well, reaching $135 billion by the end of December. That’s a key area for WD—it brings recurring revenue and helps stabilize earnings when deal volumes get choppy. And with a record $329 million in adjusted EBITDA for the year, it’s clear the business remains on solid footing. This kind of performance gives them options, whether it’s reinvesting, paying dividends, or weathering short-term swings in real estate.

Chart Analysis

Price Action and Moving Averages

WD’s one-year chart tells a story of a stock that enjoyed strength through much of 2023 before giving way to a prolonged correction. From early spring through late fall, prices steadily climbed, moving above both the 50-day and 200-day moving averages. That upward trend began to lose steam in December, when price broke sharply below the 50-day moving average, followed shortly by a break under the 200-day. Since then, it’s been a sustained downtrend.

The 50-day moving average, now sloping downward, continues to sit well below the 200-day average—a technical setup that typically signals caution. The longer these two averages stay this way, the harder it is for the stock to regain upward momentum. The good news? WD appears to be stabilizing in the low $80s. There’s some evidence of buyers stepping in at this level over the past few months.

Volume and Market Participation

Trading volume has been relatively muted for most of the year, with occasional spikes that didn’t lead to sustained moves higher. What stands out is that even during pullbacks, volume didn’t explode to the downside, which suggests there wasn’t widespread panic selling. This kind of behavior points to a wait-and-see approach by market participants rather than a rush for the exits.

RSI and Momentum Clues

Looking at the RSI, the stock has bounced in and out of oversold territory a few times this year. Currently, RSI is climbing toward the mid-range, hinting that momentum might be shifting, though not decisively. There’s no sign of overbought conditions right now, which gives the stock room to move higher if sentiment improves.

Overall, the chart shows a name that’s gone through a period of reset. It broke trend, found some footing, and is now trying to establish a base. With no signs of extreme buying or selling pressure, the next few weeks could be key in determining whether WD starts a slow recovery—or continues to drift sideways until broader market dynamics shift.

Management Team

Walker & Dunlop’s leadership has remained steady, experienced, and growth-oriented. At the center of it all is Willy Walker, who has served as Chairman and CEO since 2007. His long tenure has given the company consistency at the top, and his focus on innovation and expanding the firm’s footprint has helped Walker & Dunlop evolve from a traditional mortgage lender into a broader commercial real estate finance and services platform.

Greg Florkowski, the current Chief Financial Officer, has been with the company in various roles since 2010. He stepped into the CFO role in 2022, bringing years of internal financial leadership into the top finance seat. His familiarity with the business and strong accounting background add a layer of discipline to Walker & Dunlop’s capital management and strategy.

The rest of the executive team includes a blend of long-time insiders and external hires from across the real estate and financial services sectors. Their collective expertise has allowed the company to weather industry cycles, pursue acquisitions intelligently, and invest in technology while maintaining a disciplined operational approach.

Valuation and Stock Performance

WD’s stock has had a choppy year. It’s currently trading around $85, and over the past twelve months it’s ranged between roughly $61 and $114. That kind of movement reflects not only shifting sentiment around real estate and interest rates, but also evolving expectations around the company’s earnings power.

Looking at valuation, the forward price-to-earnings ratio sits just under 11, which is well below the sector average and suggests the stock is attractively priced relative to expected earnings. On a trailing basis, the P/E ratio is over 26—reflecting the dip in earnings that occurred as higher rates temporarily weighed on originations. The price-to-book ratio stands around 1.65, and the price-to-sales ratio is 2.49. None of these numbers are screaming cheap, but they also don’t look stretched considering the company’s margins and long-term potential.

With a market cap just under $3 billion and institutional ownership hovering near 85%, WD is followed by a range of analysts and institutional investors who generally consider it a core player in the multifamily finance world. Still, short-term swings in stock performance may continue as investors digest macro headlines and adjust to a more rate-sensitive environment.

Risks and Considerations

No investment is without risk, and Walker & Dunlop is no exception. The most obvious challenge is its sensitivity to interest rates. Rising rates can reduce refinancing activity and chill transaction volumes, both of which are critical to WD’s revenue mix. While the company has a sizable servicing portfolio that generates recurring fees, that alone can’t fully insulate earnings from downturns in lending.

Another risk is tied to commercial real estate more broadly. Although Walker & Dunlop focuses largely on multifamily—arguably the healthiest part of the sector—any broad slowdown or repricing in commercial real estate assets could impact origination volumes and deal flow. Office space continues to be a wildcard for the sector overall, and while WD doesn’t have heavy exposure there, general risk sentiment around CRE still filters through.

Competition is another factor to weigh. WD operates in a field with both large banks and nimble private lenders. It needs to continue innovating, particularly through technology and advisory services, to keep its competitive edge. Regulatory changes are also a persistent background risk, especially given the company’s reliance on agency-backed lending.

Final Thoughts

Walker & Dunlop is not a flashy name, but it has built a strong reputation in its corner of the real estate finance world. The leadership team is seasoned and thoughtful, with a track record of managing through rate cycles and maintaining dividend consistency even in softer periods. The stock has come under pressure recently, largely due to macro factors, but the company itself continues to post solid earnings and build on its servicing platform.

The current valuation suggests that much of the uncertainty may already be priced in. Whether you’re watching for income, long-term appreciation, or simply seeking exposure to multifamily real estate through a financial intermediary, WD offers a blend of attributes that make it worth monitoring. As with any investment, staying focused on the fundamentals while keeping an eye on macro shifts will be key moving forward.