Updated April 2025

Vistra Corp is becoming a serious force in America’s evolving energy sector. Based in Texas, Vistra operates one of the largest power generation fleets in the country, ranging from natural gas and coal to nuclear and renewables. Over the past several years, it has quietly transformed from a traditional utility into a cash-generating machine with a sharper focus on clean energy and shareholder returns.

For dividend-focused investors, Vistra may not have the highest yield on the surface. But beneath that modest payout lies a story of balance sheet strength, rising free cash flow, and a dividend that’s not just sustainable—but poised to grow.

Recent Events

It’s been quite the ride for Vistra. Shares ended April 2 at $127.19, posting a 4% gain on the day. But the real story is in the bigger picture: this stock has more than doubled over the past year, climbing over 80%. That kind of price appreciation isn’t common in the utility space, but Vistra isn’t your typical utility.

One major catalyst was its acquisition of Energy Harbor in late 2023. This deal added a fleet of nuclear generation assets to Vistra’s portfolio, positioning the company as a bigger player in the zero-carbon space. It’s a move that’s in tune with both regulatory and investor momentum pushing for cleaner energy infrastructure.

Financially, the company is firing on all cylinders. Over the past year, Vistra generated $4.56 billion in operating cash flow and kept $2.81 billion in levered free cash flow after all obligations. With that kind of liquidity, the company has been simultaneously paying down debt, buying back shares, and increasing its dividend—all without missing a beat.

Key Dividend Metrics

💸 Forward Yield: 0.70%

💰 Forward Annual Dividend: $0.89 per share

📆 Most Recent Dividend Date: March 31, 2025

📉 Payout Ratio: 12.48%

📊 5-Year Average Yield: 2.37%

⚙️ Dividend Growth (TTM): 2.30%

🧾 Ex-Dividend Date: March 20, 2025

Dividend Overview

At first glance, Vistra’s yield might seem underwhelming. It’s sitting at just 0.70%, a figure that may not catch the eye of income-focused investors used to seeing 3% or 4% from other utility names. But here’s where context matters.

That relatively low yield isn’t a reflection of weak payout—it’s the result of a red-hot stock. As the price of VST has surged, the yield has naturally compressed. What hasn’t changed is the dividend itself, which continues to rise. In fact, Vistra increased its dividend again this year, a quiet but clear signal of strength from management.

One look at the payout ratio tells the real story. At just over 12%, it’s among the most conservative in the utility sector. This means Vistra is only using a small slice of its earnings to fund the dividend, leaving a wide margin of safety. That breathing room gives the company flexibility to keep raising its payout without compromising reinvestment or balance sheet health.

This is a business with strong fundamentals and a payout that’s not stretched thin. For dividend investors, that’s the kind of setup that allows you to sleep well at night.

Dividend Growth and Safety

Vistra doesn’t behave like a typical slow-moving utility. While the dividend growth hasn’t been dramatic—the latest increase was about 2.3%—the company’s broader strategy shows a clear commitment to building a more valuable and balanced return for shareholders.

It’s important to remember that Vistra isn’t just about sending checks to investors. It’s in growth mode. The company is actively reinvesting in its nuclear and renewables operations while also working to bring down its considerable debt load, which sits at $17.41 billion. That may sound high, but Vistra is making measurable progress. As those obligations shrink, more room opens up for enhanced capital returns in the form of both buybacks and dividend hikes.

What stands out is how secure the current payout is. With $7.00 in earnings per share and a dividend of $0.89, the dividend is covered many times over. Even if earnings dip or cash flow softens temporarily, Vistra has more than enough cushion.

Its return on equity—an eye-popping 51.57%—underscores how efficiently it’s deploying capital. Combine that with a strong return on assets of 7.21% and over $1.2 billion in cash on the books, and it’s clear this is a business with the financial muscle to support and grow its dividend over time.

Even with a current ratio below 1.0, which is pretty standard for capital-heavy firms like utilities, there’s no major concern here. Vistra has consistent revenue, strong cash generation, and management that seems to know exactly where it wants to take this business.

This isn’t the kind of dividend story that jumps out at you immediately. It takes a little digging to appreciate the underlying quality. But for investors who like buying into stable companies with room to grow, Vistra’s dividend path looks both deliberate and promising.

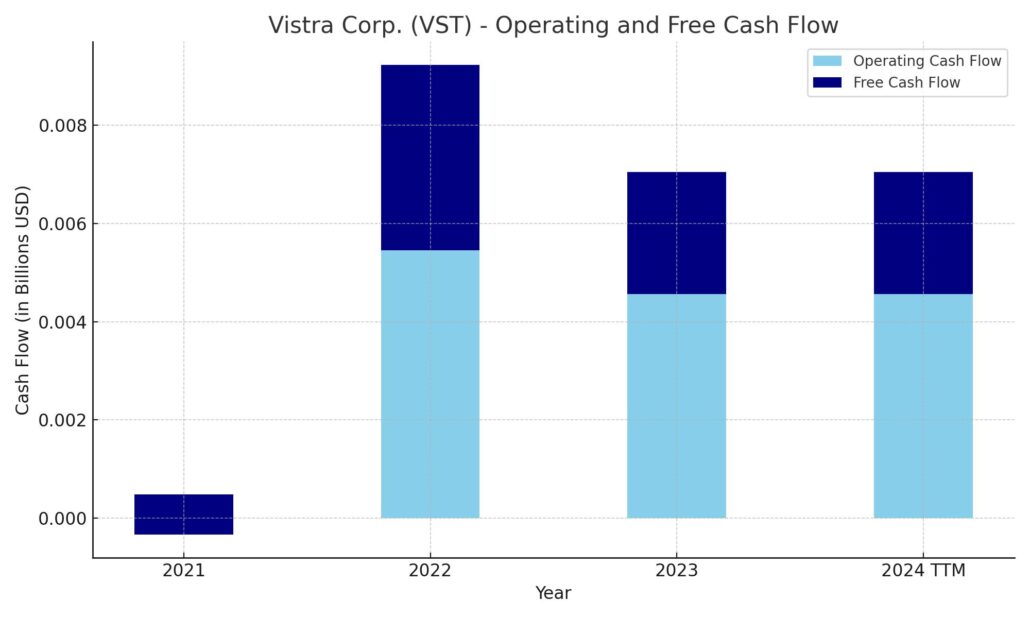

Cash Flow Statement

Vistra’s cash flow profile over the trailing twelve months reflects both its capital-intensive nature and its disciplined financial management. The company pulled in $4.56 billion in operating cash flow—an impressive figure that shows strong earnings quality and consistent demand in its power generation business. Free cash flow came in at $2.49 billion, comfortably covering dividends and share repurchases, even after $2.08 billion in capital expenditures. This healthy spread between operating and free cash flow gives the company real flexibility to invest, pay down debt, and return capital.

On the investing side, Vistra spent over $5.27 billion, significantly higher than in prior years, which likely reflects asset purchases related to its Energy Harbor acquisition and growth initiatives in its nuclear and renewables portfolio. Financing cash flow was negative $1.6 billion, driven by a mix of debt repayments, interest costs, and $1.27 billion spent on stock buybacks. The net result is a trimmed cash balance of $1.22 billion at year-end, down from $3.54 billion the year before, but the flow of funds shows a business deploying capital strategically rather than stockpiling it. Vistra is clearly in expansion mode, but it’s funding that growth without stretching itself thin.

Analyst Ratings

Vistra Corp. (NYSE: VST) has recently drawn a range of opinions from Wall Street, reflecting both confidence and caution around the stock’s future. 🧠 As of early April 2025, analysts have a consensus rating of “Moderate Buy” with an average price target of $163.50. 📈 That implies roughly 28% upside from current levels. Price targets stretch from a low of $82.00 to as high as $231.00, revealing a wide spread in expectations.

In late March, JPMorgan Chase & Co. maintained their “Overweight” rating but lowered their target from $203.00 to $186.00. 📉 The adjustment came as analysts factored in potential regulatory risks that could create some friction for the company’s growth plans—particularly as Vistra continues integrating nuclear and renewable assets into its portfolio.

Meanwhile, Bank of America took a more constructive view in early March. They upgraded Vistra from “Neutral” to “Buy” despite trimming their price target from $164.00 to $152.00. 🟢 Their call focused on the company’s consistently strong cash flow and the strategic advantage of its renewable energy build-out, positioning Vistra to benefit from the broader energy transition.

Earlier in the year, BMO Capital Markets raised their price target from $151.00 to $191.00. 🚀 Their upgrade was based on strong operational performance and confidence in Vistra’s long-term ability to grow both earnings and shareholder returns, even amid sector volatility.

Altogether, these ratings suggest analysts are bullish on Vistra’s strategy but keeping one eye on external risks. The spread in price targets shows there’s still some debate around just how much upside is left, but the general tone remains positive.

Earning Report Summary

Vistra Corp. wrapped up 2024 with a strong finish, and its latest earnings report gives investors a lot to think about—mostly in a good way. The company came in with solid numbers, a few strategic wins, and some real momentum heading into 2025.

A Strong Fourth Quarter

Fourth quarter net income landed at $490 million, which is quite the turnaround from the $184 million loss reported in the same quarter last year. That kind of swing doesn’t happen by accident. A big part of the boost came from stronger demand for nuclear power, along with some smart cost control efforts on the operational side.

For the full year, Vistra’s adjusted EBITDA came in at $5.656 billion—right at the high end of its guidance. A key part of that strength came from a $545 million benefit tied to the nuclear production tax credit, which helped pad the bottom line and underscored the value of its growing nuclear portfolio.

Strategic Wins That Matter

There’s been a lot happening behind the scenes at Vistra. In 2024, the company picked up three nuclear facilities and added roughly one million retail customers. That’s not just growth—it’s smart, calculated expansion that positions them well in a shifting energy landscape.

Vistra also locked in a 20-year license extension for its Comanche Peak nuclear plant, giving it plenty of runway to generate value there. And on the renewables side, it signed some meaningful power purchase agreements with big-name corporate buyers—another sign that its green strategy is gaining traction.

The company continues to return capital aggressively. Since late 2021, Vistra has bought back about 160 million shares, trimming its total share count by around 30%. That’s not small potatoes. Management has also signaled plans to return at least $1.3 billion to shareholders in each of the next two years through a mix of dividends and buybacks.

A Few Bumps to Watch

Not everything was perfect. There are still some regulatory questions hanging over the company, and an issue at the Moss Landing battery storage facility reminded investors that the energy business is never without its challenges. But overall, Vistra appears to be handling its risks thoughtfully while staying focused on execution.

In short, Vistra’s latest earnings show a company that’s found its rhythm—generating strong cash, making smart investments, and keeping shareholders in focus.

Chart Analysis

Vistra Corp. (VST) has had a volatile but ultimately upward-sloping journey over the past year, and the chart paints a story of momentum shifts, consolidation, and now, potential reaccumulation. Let’s unpack it in a way that connects the dots beyond just price action.

Moving Averages Tell a Story of Cycles

The 50-day moving average (red line) spent much of last year rising steadily, particularly between August and January, following a breakout around early September. That surge aligned with a solid uptrend, reflecting strong market interest. However, since February, that shorter-term trend has flattened and now slopes downward, a sign that the rally has cooled.

The 200-day moving average (blue line) has been consistently rising throughout the year and continues to slope upward, which is often a sign of long-term strength in the underlying trend. Recently, the price bounced off this longer-term average after dipping below it in March—a possible indication of support being found at more foundational levels.

Volume and Participation

Volume remained relatively steady most of the year, though spikes in May and October stood out. Those bursts in trading activity often signal institutional involvement or news-driven moves. More recently, volume has quieted again, which is typical during consolidation periods, especially after a sharp drawdown like the one seen in February and March.

The lack of massive sell volume on the recent decline suggests that the pullback may not have been driven by broad distribution. Instead, it resembles a pause or shakeout—often a constructive development for longer-term positioning.

RSI and Market Sentiment

The Relative Strength Index (RSI) is now climbing back toward the 70 level, having bounced from below 30 just a few weeks ago. That kind of reversal suggests renewed buying interest, but it’s also entering a zone where momentum may begin to cool again. Earlier overbought readings in October and December preceded pullbacks, so it’s worth watching how price behaves around the current RSI levels.

Over the past year, RSI has respected both oversold and overbought zones well, offering reliable signals for turning points. Its current trajectory supports the idea of price recovery in progress rather than a full-blown reversal just yet.

Final Thoughts on Price Structure

Price recently found support near $110, just above the rising 200-day moving average. The current rebound appears to be testing former support-turned-resistance near the $125–$130 range. If the price consolidates here with moderate volume and holds above the long-term average, it could be building a new base for a larger move.

The chart reflects a stock that’s been through its markup, corrected meaningfully, and may now be stabilizing for whatever comes next.

Management Team

Vistra Corp. is led by a well-established executive team with deep experience across the energy and utility space. At the top is Jim Burke, who took over as President and CEO in August 2022. Burke has been with Vistra and its predecessor organizations for several years, giving him a strong understanding of the business and a steady hand in managing its strategy through both transition and growth phases.

Supporting him is Stacey Doré, who holds the dual role of Chief Strategy & Sustainability Officer and Executive Vice President of Public Affairs. She plays a key part in guiding the company’s long-term energy transformation efforts and stakeholder engagement. Her work has helped position Vistra as a leading voice in the shift toward lower-carbon solutions.

The broader leadership bench includes Carrie Kirby, Executive Vice President and Chief Administrative Officer, and Andrew Cherry, the company’s Chief Financial Officer. With backgrounds in finance, operations, HR, and legal strategy, this group brings a multidimensional approach to navigating the ever-changing landscape of the power generation and retail electricity markets.

Valuation and Stock Performance

As of early April 2025, Vistra shares are trading around $127.19. Over the past 12 months, the stock has been anything but quiet—rising dramatically from a 52-week low of $64.26 to a peak of nearly $200 before pulling back. That swing reflects how the market has digested a mix of strong fundamentals, headline-driven volatility, and evolving sentiment around the company’s role in clean energy.

From a valuation perspective, Vistra’s current price-to-earnings ratio is near 18, which sits in line with broader market averages and reflects the company’s transition from a deep-value name to one priced more for growth and consistency. The company’s market cap is now hovering above $43 billion, cementing its place among the more significant players in the utility and energy infrastructure space.

Analysts remain largely positive, with a consensus price target of roughly $163.78. That suggests room for upside, even after the recent run-up. The stock’s beta of 1.23 shows it trades with a bit more volatility than the overall market—a factor that long-term holders will want to keep in mind, especially during periods of uncertainty or market corrections.

Risks and Considerations

There are real advantages to a business like Vistra’s—scale, diversity of generation assets, and strong cash flow—but it’s not without its challenges. The company is heavily exposed to changes in energy pricing and regional demand dynamics. While this can be a tailwind when conditions are right, it also means that operational execution has to be sharp to protect margins.

Regulatory risk is another factor. Vistra operates in a tightly regulated space, and changing policies around emissions, transmission standards, or tax incentives can shift the economics of its business fairly quickly. As the company grows its nuclear and renewable segments, it’s also facing steeper capital requirements and additional oversight.

The power generation industry also carries operational risks. Equipment failures, outages, or unforeseen events like what occurred at the Moss Landing battery facility can all have financial and reputational consequences. Vistra’s broad asset base gives it some cushion, but the nature of the business means that incidents—though rare—are still part of the equation.

Capital allocation is something to watch as well. The company has been very aggressive with share buybacks, which has boosted per-share metrics and helped reduce float. But investors will want to monitor whether that pace is sustainable, especially if cash needs to be redirected toward new investments or regulatory compliance.

Final Thoughts

Vistra Corp. has made meaningful progress over the past few years, growing its footprint while reshaping its business model for a future that leans increasingly on clean energy. The management team has executed well, and the company’s financial performance backs that up. Shareholders have been rewarded—not just through price appreciation, but through consistent capital returns.

Still, this is a business operating in a fast-changing environment. Regulatory shifts, energy market volatility, and the demands of infrastructure investment will continue to shape its path. Investors should remain attentive to how Vistra manages these moving parts and whether it can maintain both its operational rhythm and financial discipline.

Overall, the story here is one of a company evolving with its industry, backed by a solid team, supported by strong cash flows, and navigating the balance between risk and reward in a space that’s anything but static.