Updated April 2025

Unity Bancorp isn’t the kind of stock that dominates financial headlines, and that’s exactly what makes it interesting. This New Jersey-based community bank has quietly built a strong, reliable business over the years, focusing on the basics—local lending, deposits, and conservative growth. There’s a kind of old-school steadiness here that income investors can appreciate.

While others chase scale with splashy acquisitions or digital overhauls, Unity’s approach has been more deliberate. The result? Solid returns and a growing stream of earnings that backs a quietly growing dividend. It’s not trying to be the next big thing, and that’s part of its charm.

Let’s take a closer look at what’s been happening with the stock, and what dividend investors should be paying attention to.

Recent Events

In its most recent quarter, Unity continued to post strong results, driven by consistent loan performance and well-managed margins. EPS landed at $4.06 over the trailing twelve months, up nearly 18% from the year before. Revenue also ticked up 9.3% year-over-year, which reflects steady growth in a challenging rate environment.

Net income for the period crossed $41 million—a solid figure for a bank of Unity’s size. What really stands out, though, is its return on equity. At 14.88%, it’s outperforming a lot of larger competitors, and doing it without taking on excessive risk.

Book value per share sits at $29.48, while the stock currently trades at around 1.41 times book. That’s not screaming cheap, but it’s a reasonable multiple for a business with this kind of performance. And with a 52-week gain of 55%, the market seems to be recognizing the story here—albeit quietly.

The company also maintains a strong cash position, holding over $180 million, giving it plenty of flexibility for both capital investment and shareholder returns. On the debt side, it’s carrying $235 million, a manageable figure given its cash flow and earnings base.

Key Dividend Metrics

📈 Dividend Yield (Forward): 1.35%

💸 Payout Ratio: 12.81%

📅 Next Dividend Date: March 28, 2025

📆 Ex-Dividend Date: March 14, 2025

🔁 5-Year Average Dividend Yield: 1.65%

🔨 Trailing Annual Dividend Rate: $0.52

🔮 Forward Annual Dividend Rate: $0.56

These numbers tell a story of a conservative dividend policy built for stability and sustainability.

Dividend Overview

Unity’s dividend isn’t about flash—it’s about consistency. At a 1.35% forward yield, it’s not going to turn heads among high-yield chasers. But what it offers instead is dependability and room to grow. The payout ratio is incredibly low at just under 13%, which suggests the company is only using a small slice of earnings to fund its dividend. That’s exactly the kind of breathing room long-term investors should want.

The annual dividend now stands at $0.56, paid out quarterly at $0.14 a share. That’s a step up from the prior year and reflects the kind of quiet confidence that characterizes Unity’s broader strategy. There’s no pressure here to overdeliver on yield just to attract attention. Management seems focused on sustainable growth rather than stretching too far.

The last dividend was paid on March 28, with the ex-dividend date set for March 14. If you’re thinking of locking in the next payout, that’s something to keep in mind.

Dividend Growth and Safety

Dividend growth has been steady, if not aggressive. But that’s not necessarily a bad thing. The growth in Unity’s payout has mirrored its earnings—incremental, predictable, and backed by real performance. While the 5-year average yield sits a little higher than today’s rate, the recent run-up in the stock has compressed the yield somewhat. That’s not a problem. It just means the underlying business is doing well.

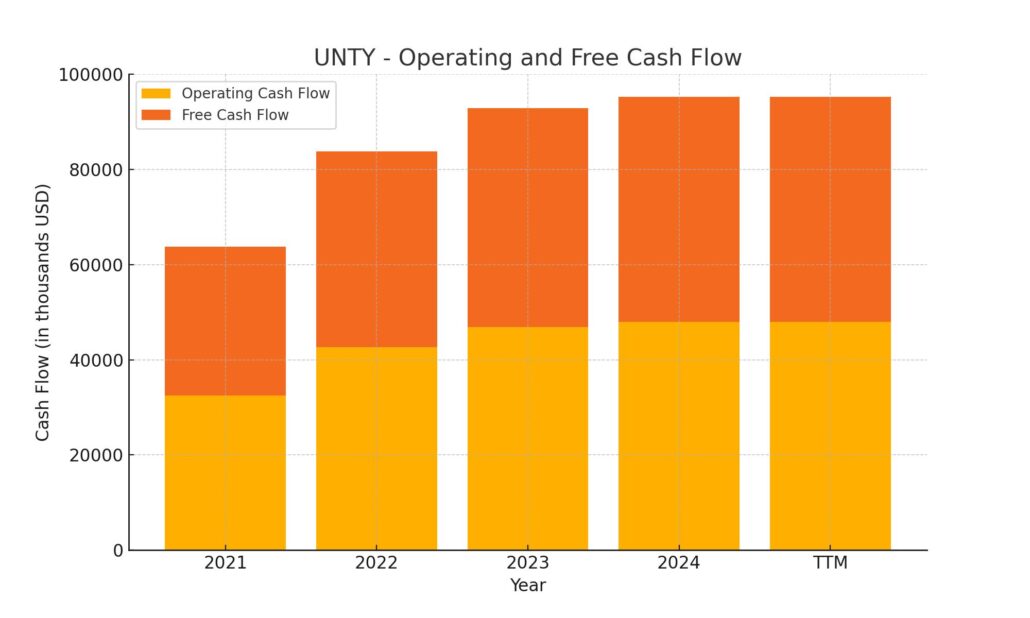

Operating cash flow came in at just under $48 million over the past year. That’s more than enough to support the dividend with room left for growth or potential share buybacks down the line. Importantly, the balance sheet remains in good shape, with no signs of strain or overreach.

There’s also meaningful insider ownership, with management holding more than 28% of the company. That kind of alignment matters, especially when it comes to dividend decisions. If leadership is relying on the same income stream you are, they’ve got every reason to keep things steady—and growing.

While some banks reached for yield or took on too much duration risk in recent years, Unity stayed focused on the fundamentals. That’s now paying off in the form of a safe, reliable dividend that has room to expand. It may not be the highest yield out there, but for patient investors looking to anchor a portfolio with dependable income, Unity Bancorp has a lot going for it.

Cash Flow Statement

Unity Bancorp’s trailing 12-month cash flow paints a picture of a well-managed bank that’s effectively converting earnings into cash while maintaining operational discipline. Operating cash flow for the TTM came in at nearly $48 million, a slight uptick from the previous year and a strong continuation of the bank’s multi-year growth in core cash generation. Free cash flow closely tracked this figure at $47.3 million, reinforcing the efficiency of its capital-light model—especially with minimal capital expenditures of just $693,000.

On the investing side, Unity saw a cash outflow of $92.8 million, which reflects a heavier investment stance compared to prior years, though still modest relative to its balance sheet. Financing cash flow added back $30.5 million, which helped offset some of the investment activity. Notably, the company repaid $137 million in debt during the year while also repurchasing over $6 million in stock, signaling confidence in its valuation and balance sheet. Even with that level of capital return and debt reduction, Unity ended the period with over $180 million in cash, preserving flexibility moving forward.

Analyst Ratings

Unity Bancorp has recently received favorable attention from analysts, leading to a couple of upward price target revisions. 📈 Keefe, Bruyette & Woods raised their target to $55, up from $51, while Piper Sandler adjusted theirs to $54, previously set at $53. Both firms maintained a Buy rating, which reflects a growing level of confidence in Unity’s performance and future earnings trajectory.

The broader analyst sentiment aligns with this optimism. The current average 12-month price target sits at $54.50 🧭, suggesting a potential upside of nearly 28% from recent levels. Analyst expectations are centered within a narrow range—from $54.00 to $55.00—indicating consensus strength and reduced uncertainty around the bank’s valuation.

Why the bullishness? A few key reasons are surfacing. Unity has delivered consistent earnings growth and maintained excellent asset quality despite broader volatility in the financial sector. Its community banking model, focused lending approach, and clean balance sheet are standing out in an industry where some peers have stumbled. The bank also benefits from a strong insider ownership position, which further reinforces confidence in its long-term strategy. 📊 These elements have made Unity Bancorp a name analysts are watching more closely than before.

Earnings Report Summary

Strong Finish to 2024

Unity Bancorp wrapped up 2024 with a solid performance, showing steady growth across key metrics. For the fourth quarter, the bank reported net income of $11.5 million, or $1.13 per diluted share. That’s a step up from $10.9 million and $1.07 per share in the third quarter. Over the full year, net income came in at $41.5 million, which works out to $4.06 per share—up 4.4% compared to the prior year. Nothing flashy, just reliable, disciplined growth.

Net Interest Margin Makes a Move

One of the more impressive areas was the improvement in the net interest margin. It rose to 4.37% in Q4, a 21 basis point jump from the third quarter. That gain came mainly from a lower cost of liabilities and a slight improvement in asset yields. Net interest income followed suit, reaching $26.5 million—up from $24.9 million. This kind of movement in the margin shows Unity is managing its balance sheet well despite a tricky interest rate environment.

Loan and Deposit Growth Steady

Loan growth continued at a healthy clip, with total loans rising by $88.6 million, or about 4.1%, compared to the end of 2023. The increase was mostly in commercial lending, while areas like residential construction and SBA loans pulled back a bit. Deposits also moved in the right direction. They jumped by $176.2 million, or just over 9%, with demand deposits contributing $16.8 million of that in the fourth quarter alone. That’s a good sign customers are staying engaged and trusting Unity with their money.

Some Pressure on Noninterest Income

Not everything moved higher. Noninterest income dipped to $1.9 million in the fourth quarter, down from $2.8 million in the previous one. Most of that drop came from fewer gains on securities and lower fee income. On the expense side, noninterest expenses edged up to $12.6 million. That increase was mostly due to a one-time adjustment related to the company’s executive retirement plan—so not something likely to repeat.

Balance Sheet Holding Up Well

Credit quality stayed strong, with loan loss reserves at 1.18% of total loans. Shareholders’ equity rose to $295.6 million, helped by earnings growth even after accounting for share buybacks and dividend payouts. Book value per share now sits at $29.48, up from $25.98 a year earlier.

Overall, Unity’s earnings story in 2024 was one of stable, careful execution. No drama, just strong fundamentals pushing the business forward.

Chart Analysis

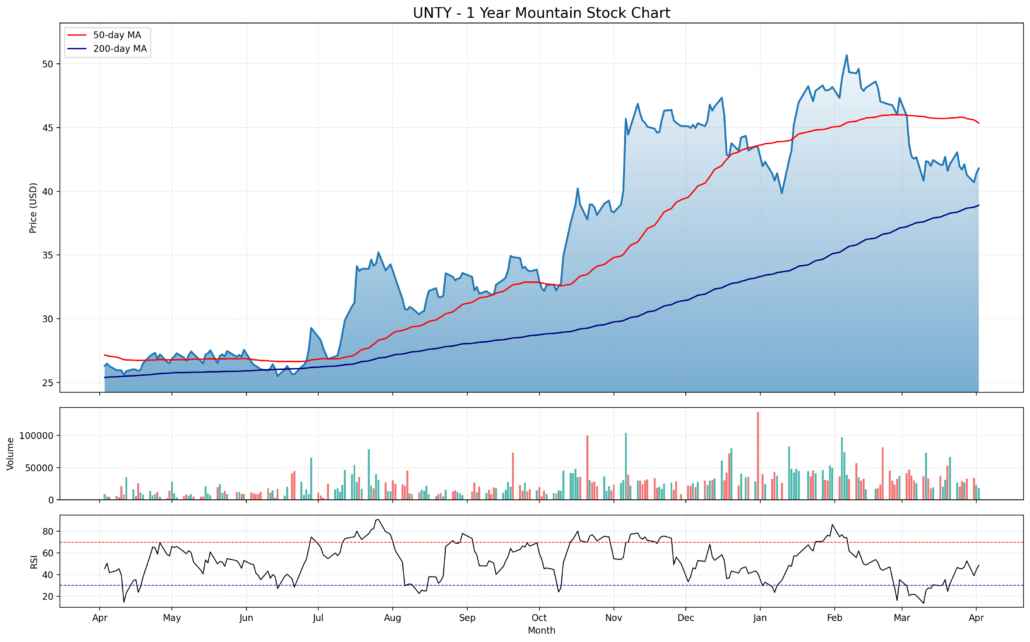

Price Action and Trend Overview

The chart shows a steady upward climb in price from late spring through the end of the year, with a notable surge starting in July. That jump took the stock from the high $20s to the mid-$30s, with another leg higher in December pushing it into the $40+ range. After peaking early in the year, the stock has since pulled back a bit but is still holding well above its longer-term average. The recent dip appears more like a pause in the trend than a reversal.

The red 50-day moving average rose sharply from July through February, reflecting strong short-term momentum. However, that line has started to flatten and even curl slightly downward—something to watch. On the other hand, the 200-day moving average continues to climb steadily, a sign the broader trend is still intact. The stock is still trading well above that longer-term average, which tends to suggest strength, even if near-term momentum has cooled off.

Volume and Participation

Volume picked up meaningfully during the July breakout and again during December’s surge. Both periods saw sustained buying pressure, with taller green bars suggesting healthy accumulation. In contrast, the recent dip in price hasn’t been accompanied by a spike in red volume bars. That suggests the pullback is more about a lack of aggressive buying than panic selling. Participation seems to remain stable, even if enthusiasm has waned short-term.

Relative Strength Index (RSI)

The RSI shows a pattern of peaks and valleys throughout the year, with frequent moves above 70, indicating overbought levels, especially in July, September, and February. Those periods coincided with the sharpest rallies. The most recent dip brought RSI below 30 briefly in March before bouncing back to more neutral ground. As of now, RSI sits in the mid-50s range—not overheated, not oversold—just sitting in a balanced zone. That reset may provide room for the next leg higher, depending on how the price reacts near current levels.

Overall, the chart reflects a healthy uptrend with some signs of cooling after a strong year. Momentum has eased, but the long-term structure remains constructive. Price is above long-term support, volume trends are stable, and there’s no major breakdown in sight. The stock looks like it’s digesting gains rather than falling apart.

Management Team

Unity Bancorp’s leadership is made up of banking veterans with deep roots in finance and community banking. At the center is James A. Hughes, who has been serving as President and Chief Executive Officer since 2000. With previous roles at Summit Bancorp and a background in accounting, Hughes brings a steady hand to the company’s strategic direction. He’s known for running a tight operation focused on long-term value rather than short-term flash.

The broader executive team adds to that stability. Names like David D. Dallas, Mark S. Brody, and Raj Patel sit on the Board of Directors, offering a variety of perspectives from both financial services and other industries. On the commercial lending side, James Donovan leads a strong team that emphasizes relationship-building with business clients. The SBA lending division, led by Charles Goldbach, highlights Unity’s commitment to supporting local businesses with targeted financial solutions.

Altogether, this leadership team has built a reputation for combining conservative management with steady growth. Their experience in navigating credit cycles and regulatory shifts gives the bank a clear sense of direction. More importantly, their local-first approach has helped Unity maintain a loyal customer base without needing to chase risky trends.

Valuation and Stock Performance

Unity Bancorp’s share performance over the past year reflects growing confidence in its fundamentals. The stock has moved from a 52-week low of $25.60 to a high of $51.22, delivering strong returns for investors who’ve been holding through the upswing. The momentum has cooled slightly in recent weeks, but the long-term trend remains positive.

Valuation-wise, Unity is trading at a trailing price-to-earnings ratio of just over 10. That’s modest when compared with the broader market and not far off its sector peers. The price-to-book ratio is around 1.6, suggesting the stock is trading at a premium to its tangible book but still within a reasonable range for a bank of its size and profitability.

The stock’s beta sits below 1, around 0.96, which means it generally moves in line with the market but with a touch less volatility. That lower beta adds some appeal for investors looking for stability rather than rapid swings. Taken together, the valuation and performance trends paint a picture of a stock that’s grown steadily while maintaining a grounded price relative to earnings.

Risks and Considerations

While Unity has delivered reliable growth, there are a few areas worth watching. One of the bigger exposures is its commercial real estate lending portfolio, which makes up more than half of total loans. In good times, these loans generate solid yields. But during downturns, especially if commercial property values take a hit, the impact could be meaningful. Any stress in the broader real estate market—whether from higher vacancies or declining valuations—could pressure Unity’s loan quality and margins.

Regulatory risk is another factor that comes with the territory. The bank operates in a tightly regulated space where even small changes to compliance standards or capital requirements can create operational challenges. Keeping up with new rules, stress tests, and evolving oversight requires constant attention and resources.

There’s also the competitive landscape to consider. Regional banks like Unity compete on service, speed, and relationships. But they’re up against much larger institutions with broader tech platforms, as well as smaller local banks that may be more nimble in their communities. Unity has to keep balancing scale with personal service to maintain its edge.

Lastly, while the bank has done a good job of managing interest rate exposure, any sharp shifts in rates—especially unexpected ones—could influence deposit behavior or loan demand. The recent environment has been volatile, and staying adaptable will continue to be important.

Final Thoughts

Unity Bancorp stands out for its steady approach and disciplined execution. It’s not trying to reinvent the wheel or dominate headlines, but instead focuses on delivering consistent performance for shareholders through traditional banking practices. Management knows the business well, the balance sheet is healthy, and earnings continue to grow.

Yes, there are risks. Commercial real estate exposure and regulatory compliance both come with their own set of challenges. But the team running Unity has shown they can manage those risks while continuing to grow the bank’s footprint and its earnings power.

For those looking at the fundamentals, the stock’s valuation seems fair relative to its performance. And with solid leadership and a community-focused model that’s still working, Unity Bancorp looks like a name that will continue to quietly get the job done.