Updated April 2025

Headquartered in the small Ohio town of Martins Ferry, United Bancorp, Inc. (UBCP) isn’t out to grab national attention. Instead, it leans into its identity as a community-oriented banking company, serving parts of Ohio and West Virginia through its network of local branches. With a market cap just north of $76 million, it’s on the smaller end of the banking spectrum, but it doesn’t need size to make a dividend investor take notice.

UBCP operates with a simple, clear mission: deliver steady service to its customers and return capital to shareholders. And in an environment where consistency matters more than flash, that approach can be quite appealing.

Recent Events

Over the last year, UBCP’s stock has pulled back by about 11.6%. It’s been a quieter drift lower rather than a steep drop, shaped by broader headwinds across the regional banking sector. Interest rate pressures, more cautious lending, and tighter margins are affecting almost every bank of this size, and UBCP is no exception.

Revenue for the most recent quarter declined 3.5% year over year, and earnings took a bigger hit, down 22.6%. Despite those numbers, the business remains profitable, with net income over the trailing twelve months reaching $7.06 million and an EPS of $1.27. Its profit margin is a healthy 25.6%, and return on equity comes in at an impressive 11.7%.

There’s nothing in these numbers that suggests any trouble with the dividend. In fact, the company recently paid its latest dividend on March 20, continuing a track record that’s become a key reason why investors stick around. Management clearly understands the importance of reliable income for shareholders.

Key Dividend Metrics

📈 Dividend Yield: 5.70% (forward)

💵 Annual Dividend Rate: $0.73

📆 Recent Dividend Date: March 20, 2025

🧮 Payout Ratio: 55.5%

📊 5-Year Average Yield: 4.65%

📈 Dividend Growth Trend: Steady, modest increases

🏦 Cash per Share: $3.38

Dividend Overview

United Bancorp’s dividend profile is where the story really gets interesting for income-focused investors. With a forward yield of 5.7%, UBCP is offering a solid return just for holding the stock. That’s noticeably above its five-year average of 4.65%, which suggests there may be a value opportunity here for yield seekers.

The current annual payout stands at $0.73 per share, and the company is using just over half of its earnings to fund it. That 55.5% payout ratio hits a sweet spot: it’s generous enough to reward shareholders, yet conservative enough to provide flexibility in the business.

A closer look at the cash position shows $3.38 in cash per share, adding a cushion that supports dividend continuity even in tighter financial periods. Combine that with a relatively low trading volume—about 6,500 shares per day on average—and you get a picture of a stock that isn’t built for volatility. It’s built for long-term holders looking to collect consistent income.

UBCP also stands out for its insider ownership. Over 14% of the float is held by insiders, which adds a level of confidence that leadership’s interests are aligned with shareholders. When management has skin in the game, they tend to be more disciplined with decisions, including maintaining dividend reliability.

Dividend Growth and Safety

While UBCP isn’t going to wow anyone with massive dividend hikes, it’s got a steady hand. The bank has made a habit of increasing its dividend over time—modestly, yes, but consistently. Even during periods of economic strain or slowing earnings, it hasn’t pulled back on rewarding shareholders.

The recent increase to $0.73 per share annually continues that long-standing pattern. It’s the kind of bump that doesn’t grab headlines, but quietly builds wealth for long-term investors.

Safety is another piece of the puzzle, and it looks solid here. The payout ratio is well within sustainable limits. Earnings continue to support the dividend. And the company’s access to cash, along with prudent management of capital, suggests there’s little reason to worry about dividend cuts.

Return on equity near 12% reflects efficient use of capital. The profit margin sits at a strong level. And the bank continues to generate more than enough cash to keep paying—and growing—the dividend.

For investors who prioritize income, especially those drawn to regional banks with a traditional approach, United Bancorp remains a compelling choice. It may not move fast or make waves, but it does deliver what matters: a reliable and rewarding dividend.

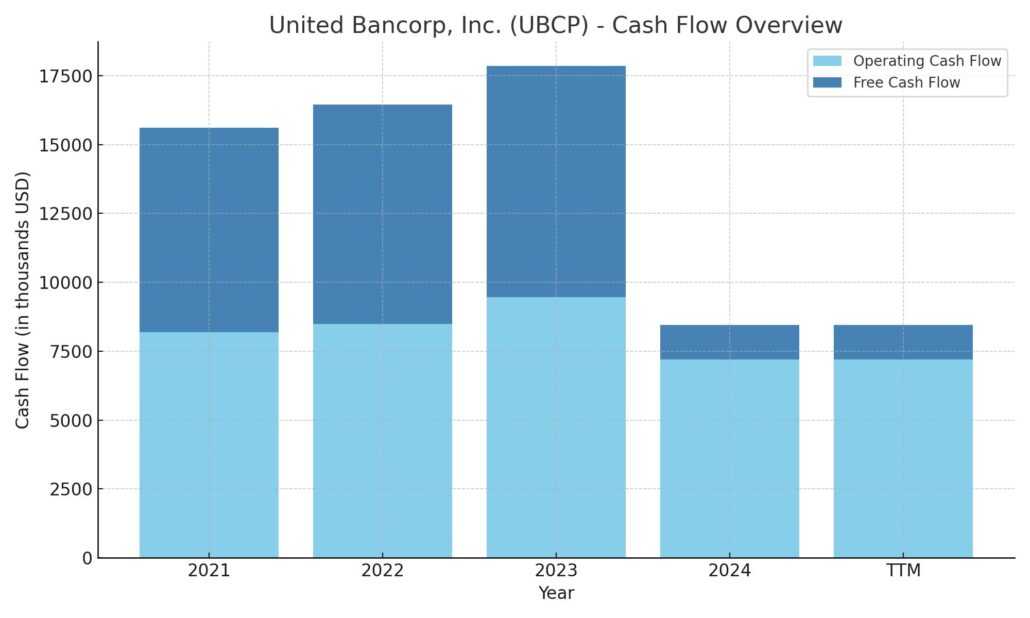

Cash Flow Statement

Over the trailing twelve months, United Bancorp, Inc. generated $8.45 million in operating cash flow, marking a slight decrease from the prior year’s $9.46 million. While not a drastic shift, it reflects the softer earnings environment regional banks are navigating. Capital expenditures climbed sharply to $9.7 million, up from just over $1 million the year before, resulting in negative free cash flow of $1.25 million. This shift from positive to negative free cash flow isn’t alarming in isolation, but it does suggest a year of heavier investment activity.

On the investing side, UBCP posted a cash outflow of $19.5 million, which, while improved from the previous year’s $48.5 million, still indicates ongoing capital deployment. Financing activities also swung negative with $10.1 million in outflows, a shift from previous years when the bank was raising capital—likely tied to earlier debt issuance of $75 million in 2022. The current cash position sits at $19.6 million, down notably from $40.8 million a year ago. While the bank still maintains a comfortable cash buffer, the combined impact of investment and financing decisions has clearly drawn down reserves over the past year.

Analyst Ratings

📈 As of the latest update, United Bancorp, Inc. (UBCP) has very limited analyst coverage, with only one analyst currently weighing in. 🧾 That analyst has issued a “Buy” rating on the stock, which stands as the sole opinion available right now. The 12-month price target set is $20.00, indicating meaningful upside from where shares are trading currently.

💡 The reason behind the bullish stance appears rooted in UBCP’s consistent profitability, stable dividend payouts, and conservative balance sheet. Even though the company operates in a modest regional footprint, it has managed to maintain solid returns on equity and has avoided the volatility seen in some other small-cap financial names. The rating also likely reflects confidence in the bank’s ability to navigate the current interest rate environment while continuing to support shareholder returns.

📊 That said, with only one analyst covering the stock, this is not a consensus in the traditional sense. It’s a single viewpoint, albeit a positive one. For investors, it serves as a signal that UBCP is flying under the radar but still being recognized for the strength of its fundamentals and income-generating potential.

Earning Report Summary

A Look at the Bottom Line

United Bancorp, Inc. wrapped up the fourth quarter of 2024 with net income of $1.85 million, which came out to $0.31 per share. That’s a step down from the same time last year, but it actually edged up slightly compared to the third quarter. For the full year, earnings came in at $7.4 million, or $1.27 per share. It wasn’t a record year by any means, but considering the broader environment for regional banks, it wasn’t a bad showing either.

Loan Growth in a Tough Environment

One of the more encouraging signs in the report was the continued growth in the loan portfolio. Loans rose by $16 million in the fourth quarter alone, which translates to a solid 13.4% annualized growth rate. That kind of expansion shows there’s still demand in the communities UBCP serves—and that the bank is still comfortable putting capital to work.

At the same time, the overall asset base continued to grow, landing at $825.5 million by year-end. Not massive, but steady. While that’s happening, the net interest margin—the spread between what the bank earns on loans and what it pays on deposits—ticked down from 3.65% to 3.51% over the year. That’s been a common theme in the sector, as higher rates have made depositors more rate-sensitive.

Credit Quality and Dividends Hold Steady

Credit quality didn’t raise any red flags. Nonperforming assets made up just 0.46% of total assets, which suggests the loan book is holding up well. That’s a key metric for banks, and UBCP seems to be keeping a close handle on risk.

As for the dividend, the company stayed true to form. It paid out a regular dividend of $0.705 per share over the year and added a special dividend of $0.15. That brought the total to $0.855 per share for 2024—an attractive yield for income-focused investors.

So while earnings did slide a bit, UBCP showed it can keep lending, stay disciplined, and reward shareholders, even when the environment isn’t exactly cooperative.

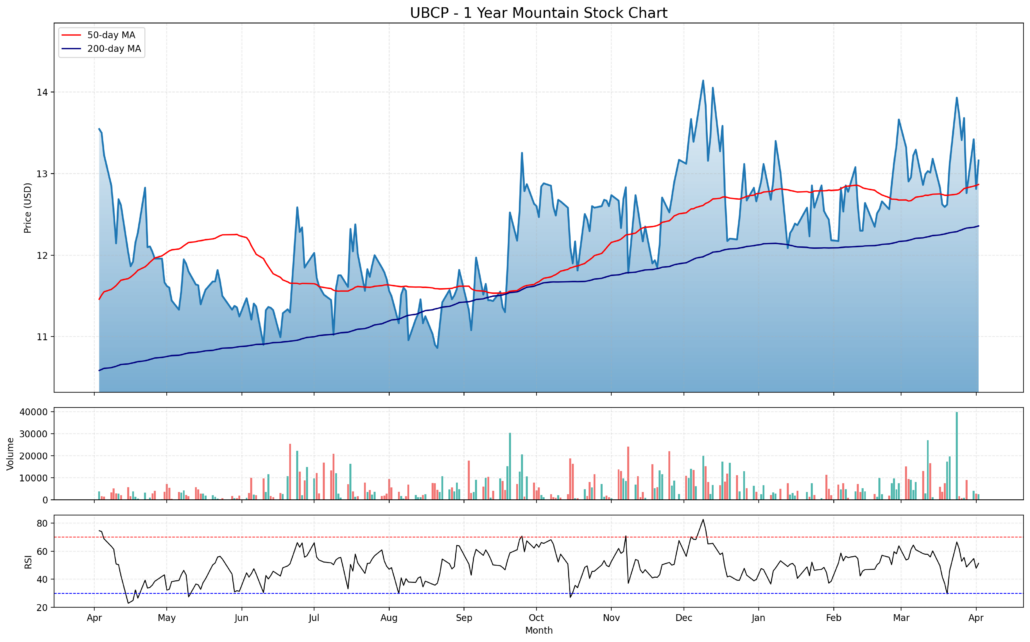

Chart Analysis

Price Action and Moving Averages

Over the past year, the stock has steadily shifted from a base-building phase into a more upward-sloping trajectory. The 200-day moving average (blue line) has been in a consistent uptrend since early summer, which shows gradual, sustained strength. The 50-day moving average (red line) dipped below the 200-day for a stretch between spring and late summer, but it regained footing and has since remained above, forming what many see as a sign of positive price momentum.

Price levels have bounced off the 200-day average multiple times, particularly in the early part of the chart, acting like a slow-moving floor. Since October, the stock has been trading mostly above both key moving averages, with some pullbacks that look more like healthy consolidations rather than signs of breakdown.

Volume and Relative Strength Index

Volume remained fairly subdued for much of the year, but there have been occasional spikes—particularly during upward price movements in late summer and again in the first quarter of this year. Those bursts of activity during rallies suggest a mix of accumulation and increased interest at key levels.

Looking at the Relative Strength Index (RSI) at the bottom, the stock has mostly avoided overbought territory, hovering in the mid-to-upper 40s and 50s range. It had a few brief dips into oversold territory last spring, followed by a clear recovery. Lately, RSI has shown steady but not overheated strength, aligning with the broader narrative of a stock that’s building on a stronger base.

This combination of rising long-term averages, modest but growing volume, and balanced momentum points to a name that’s slowly but surely gaining traction. There’s no dramatic price surge, but there’s stability and signs of accumulation over time, which often precedes steady upward moves.

Management Team

Leading United Bancorp, Inc. is a team that blends local insight with long-term operational experience. Scott A. Everson holds the dual role of Chairman and CEO, bringing stability and a steady hand to the bank’s strategic direction. His leadership has been focused on maintaining the institution’s community-first identity while ensuring sound financial management. Randall M. Greenwood, the CFO and Treasurer, plays a central role in overseeing the company’s balance sheet and guiding its financial strategy, with a clear emphasis on conservative growth and shareholder value. Rounding out the core leadership is Matthew Fredrick Branstetter, who serves as COO. He ensures operations remain aligned with both the company’s strategic goals and the needs of its regional customers. Altogether, this management team is closely tied to the markets they serve, and they’ve shown a consistent ability to deliver stability through changing environments.

Valuation and Stock Performance

United Bancorp’s stock has traded between $11.40 and $14.94 over the past year, with the current price sitting at $13.16. That puts it right in the middle of its recent range—not overextended, not beaten down. With a market cap hovering around $75 million, it’s a micro-cap bank, which naturally means less analyst coverage and lighter trading volume. But the fundamentals are worth a second look. The price-to-earnings ratio is sitting in a reasonable zone relative to peers in the regional bank space, and the stock’s yield is a standout. At a forward yield of 5.7%, the dividend alone gives investors something tangible while they wait for the stock to move.

The 200-day moving average continues to trend upward, reflecting a longer-term bias toward stability. It’s not a momentum play, but the chart shows a clear shift from last year’s consolidation to a more positive slope over time. Volume spikes during periods of price strength hint at some institutional accumulation, or at least growing interest when value becomes clear. And with insider ownership above 14%, there’s added reassurance that those running the show are also invested in its performance.

Risks and Considerations

Even with its positives, there are a few risks worth keeping in mind. As a smaller bank, United Bancorp doesn’t have the same financial flexibility or geographic diversification that larger institutions enjoy. That means it’s more sensitive to local economic shifts. A downturn in Ohio or West Virginia could weigh more heavily on its loan book or deposit base than it might for a larger peer spread across multiple markets.

Interest rate shifts also play a big role. While a rising rate environment has helped in past quarters, if deposit costs climb too quickly, it could squeeze margins. The recent dip in net interest margin suggests some of that pressure is already showing up. There’s also the usual regulatory risk that comes with the banking industry—changes in capital requirements, lending standards, or fee structures could hit the bottom line.

And finally, low trading volume can make it harder to enter or exit larger positions without affecting the stock price. That’s not an issue for long-term holders, but it’s something to consider if liquidity is a concern.

Final Thoughts

United Bancorp isn’t trying to be something it’s not. It’s a well-run, regionally focused bank that puts steady performance and shareholder return ahead of flash or fast growth. The management team is experienced, the dividend is consistent, and the business has shown it can navigate changing rate environments with discipline. There are risks, of course, especially tied to its smaller size and limited market exposure. But for those looking for an income-generating name with a steady operational foundation, United Bancorp continues to show why it’s earned the loyalty of its investor base.