Updated April 2025

When you’re investing with a focus on income, you’re not just looking for a company that pays a dividend—you want one that makes sense. That’s exactly where Tractor Supply Company comes in. It’s a retailer that lives far from the spotlight, catering to a slice of America that doesn’t chase trends. Instead, TSCO is rooted in the everyday needs of rural homeowners, hobby farmers, and folks who simply want to care for their land and animals.

Tractor Supply has been around since 1938, steadily building a network of over 2,200 stores that offer everything from feed and fencing to boots and barn tools. It’s not flashy. It doesn’t need to be. The brand is trusted, the stores are visited often, and the products are essential. If you’re looking for a business with staying power, especially in uncertain markets, this one fits the bill.

For dividend investors, TSCO offers something that’s getting harder to find—a company that quietly does its job well, consistently generates cash, and rewards shareholders without overpromising. Let’s break down the key happenings, the dividend setup, and what you should know before considering this one for your income portfolio.

Recent Events

Tractor Supply made a noteworthy move in December 2024 with a 5-for-1 stock split. That kind of move usually signals a company that’s confident in its trajectory. It’s not just about lowering the share price—it’s a message that management believes in the long-term growth story and wants to make shares more accessible to a broader investor base.

Financially, the company had a mixed fourth quarter. Revenue was up 3.1% year-over-year, which isn’t blockbuster growth, but it shows resilience. The more cautious note came from earnings, which slipped slightly by 4.6%. It’s not a major concern, especially when you factor in that they still generated $1.1 billion in net income over the trailing twelve months.

Margins have also come in a bit, with operating margin at 8.44%. That’s solid for retail, but it’s come off peak levels. The stock trades at a forward P/E of around 25, which tells us investors are still pricing in strength. But it also means expectations are high, and any stumble might get punished. For dividend investors, though, stability and consistency matter more than chasing upside.

Key Dividend Metrics

🪙 Dividend Yield: 1.67% (forward)

📈 5-Year Average Yield: 1.41%

🧮 Payout Ratio: 43.14%

📆 Dividend Date: March 11, 2025

🔄 Last Stock Split: 5-for-1 (December 2024)

💰 Free Cash Flow: $517.7 million (TTM)

🔒 Debt/Equity: 238.93%

🏦 Cash on Hand: $251.49 million

Dividend Overview

Tractor Supply isn’t the kind of stock you buy just for yield—but the dividend it offers is reliable, steady, and growing. The forward yield sits at 1.67%, which is actually above its five-year average. That tells you the company isn’t just coasting on past performance—it’s continuing to deliver.

What makes TSCO’s dividend attractive is its consistency. With a payout ratio just over 43%, there’s plenty of room to keep raising the dividend without stretching too far. Management isn’t overly aggressive, and that’s a good thing. They’re clearly focused on maintaining flexibility, even as they commit to returning value to shareholders.

This kind of approach shows up in the numbers. TSCO has managed to raise its dividend year after year, now going on 13 years without interruption. They’ve done it without gimmicks or buyback fireworks—just solid operations and dependable cash generation.

Dividend Growth and Safety

Here’s where TSCO really starts to shine for long-term dividend investors. The dividend growth track record isn’t just about annual increases—it’s about a consistent, disciplined approach. Management tends to raise the dividend right alongside earnings growth, which keeps things sustainable and investor-friendly.

That 43% payout ratio is comfortably middle-of-the-road. It means TSCO has room to maneuver if growth slows a bit. Add in free cash flow of over $500 million, and there’s clearly enough gas in the tank to keep those dividend checks coming without compromising the balance sheet.

Debt is one area worth watching. At nearly 239% debt-to-equity, it’s higher than what some dividend purists might prefer. But context matters. The company’s current ratio is a healthy 1.43, and they’ve got over $250 million in cash. They’re managing the load well, especially when you consider their consistent operating cash flow. So while debt is high, it’s not out of control.

Another layer of confidence? Look at who owns the stock. Over 99% of shares are held by institutions. That kind of backing suggests the big players have faith in the story and the financials.

Lastly, that recent stock split wasn’t just a cosmetic change. It’s a nod from management that they expect the business—and the dividend—to keep moving forward. You don’t split shares unless you see growth ahead and want to keep the stock attractive to a broader pool of investors.

In short, TSCO doesn’t dazzle—it performs. And for dividend investors who value consistency over drama, that’s exactly the kind of partner you want.

Balance Sheet Analysis

Tractor Supply’s balance sheet is solid, if not flashy—kind of like the folks it serves. As of year-end 2024, total assets rose to $9.8 billion, marking a steady climb from $7.7 billion in 2021. That growth wasn’t borrowed entirely, but debt did join the party. Total liabilities now sit at $7.5 billion, up from $5.7 billion just three years ago. And yes, debt has grown—total debt reached $5.4 billion, which is hefty—but TSCO has kept things under control with increasing net tangible assets and a modest rise in equity.

Equity crept up to $2.27 billion, a sign the company is still building value even as it takes on more leverage. Working capital dipped slightly from the prior year, now just under $1 billion, but it’s nothing to sweat over. Tangible book value came in at around $2 billion, showing TSCO isn’t just loading up on intangibles to dress things up. With net debt at $1.58 billion, they’re clearly putting their cash to work instead of hoarding it—because apparently, TSCO isn’t planning to open a vault and swim in it Scrooge McDuck–style. All told, it’s a balance sheet that shows some muscle under the hood, even if it’s wearing work boots instead of dress shoes.

Cash Flow Statement

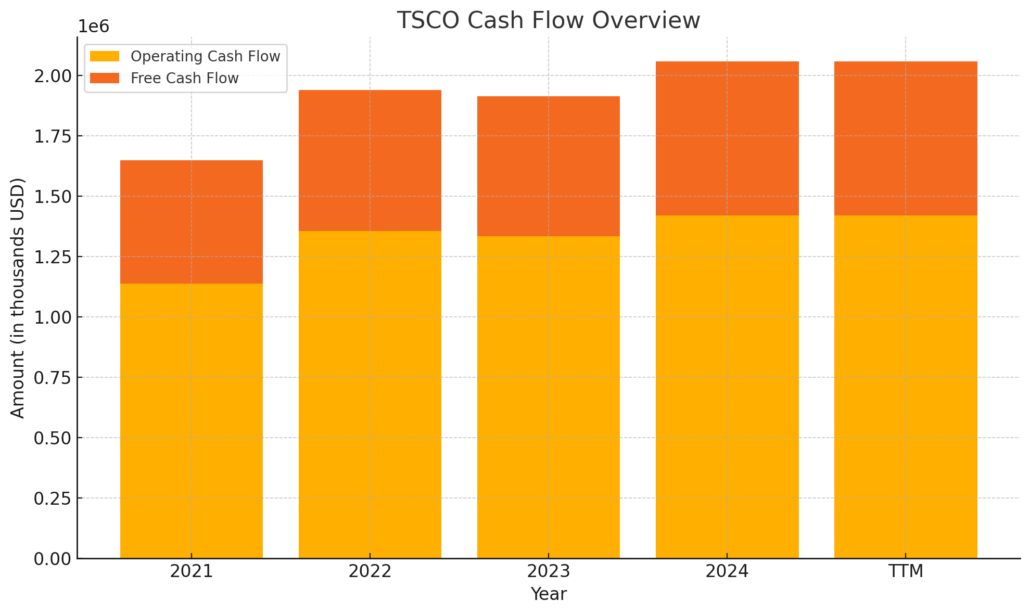

Tractor Supply continues to generate healthy cash from its operations, pulling in $1.42 billion in operating cash flow over the trailing twelve months. That’s a solid bump from the prior year and shows that despite a few earnings headwinds, the core business still runs efficiently. Free cash flow followed suit, landing at $636 million, giving the company room to keep investing in growth while returning cash to shareholders.

On the spending side, capital expenditures came in just under $784 million, a sign TSCO isn’t sitting still—it’s continuing to reinvest in stores, distribution, and infrastructure. Financing cash flow, as usual, was deep in the red at -$922 million, reflecting a mix of debt repayments and aggressive share buybacks. While the company did issue $785 million in new debt, it repaid nearly $690 million and still found time to buy back over half a billion in stock. Tractor Supply isn’t being timid—they’re managing their cash flow with purpose, striking a balance between growth, shareholder returns, and financial discipline.

Chart Analysis

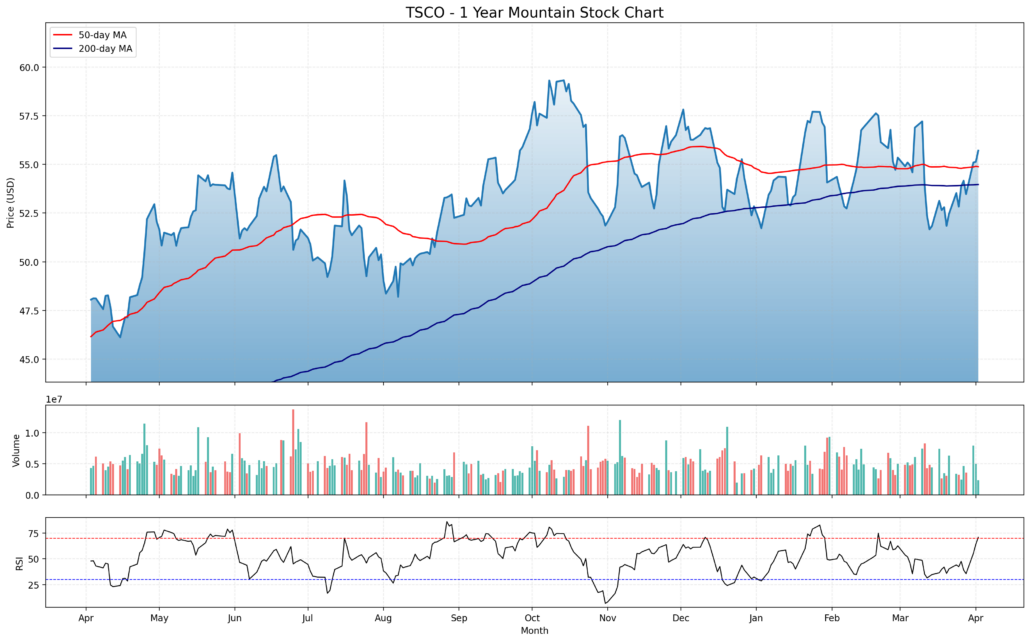

Price Action and Moving Averages

Over the past year, TSCO’s price action has shown a steady grind higher, with healthy pullbacks along the way. The stock bounced from the low $45 range last spring and climbed as high as just under $60 in late fall. It’s since consolidated, but what stands out is how well the price has respected both the 50-day and 200-day moving averages. The 200-day moving average has kept a solid upward slope for months, which says a lot about the overall trend strength. The 50-day got a bit choppy over the winter, but recent price movement is now reclaiming that line with some momentum. That’s a positive sign for anyone focused on long-term stability.

Volume Behavior

Volume has remained pretty consistent, with a few spikes that likely tie to earnings or broader market catalysts. Importantly, there’s no pattern of panic-selling or volume breakdowns. Instead, the buying and selling have remained balanced, which tends to reinforce price stability. Volume upticks during rallies suggest that buyers are still willing to step in when momentum builds, especially on moves above key averages.

Relative Strength Index (RSI)

The RSI has hovered in the middle range for most of the year, bouncing between 40 and 70. Recently, it’s crept up close to that 70 level again, which reflects stronger momentum. It’s not screaming overbought yet, but it’s something to monitor. Historically, the stock has pulled back slightly when the RSI gets too hot, but these have been short-lived.

Candle Behavior

Looking at the last five candles, the price action has been constructive. There’s a mix of lower wicks and solid closes near the highs of the day, pointing to buyers showing up on dips. The upward bias in these candles reflects renewed interest just as the price reclaims key moving averages. That usually means there’s conviction building behind the scenes.

Analyst Ratings

📊 Tractor Supply Company (TSCO) has recently attracted a mix of analyst opinions that reflect both cautious optimism and long-term confidence in the stock. The current consensus among 21 analysts is a “Moderate Buy,” with 13 buy ratings, 6 holds, and 2 sell ratings sprinkled in. The average price target is $59.22, pointing to a modest upside of around 6.3% from where shares are trading now.

🔍 In the most recent updates on January 31, 2025, several firms stuck with their previous views but made small adjustments to reflect recent earnings and market sentiment. JPMorgan maintained its “Neutral” rating while nudging its price target slightly higher from $58 to $59. Over at Truist Securities, the “Buy” rating stayed in place, although they trimmed their target from $63 down to $60. Guggenheim held steady with a “Buy” and kept their target at $60, showing consistency in their expectations. Telsey Advisory Group also stuck with an “Outperform” rating, keeping their target at $67.

💡 These ratings highlight a sense that TSCO remains a dependable performer in the retail space, especially given its rural niche and customer loyalty. While no one’s expecting a breakout run, analysts seem comfortable with its trajectory and the way it’s managing costs, debt, and cash flow. The cautious tweaks to price targets reflect a market that’s adjusting expectations without losing faith in the core story.

Earning Report Summary

Solid Year-End Finish

Tractor Supply closed out 2024 on a steady note, showing that even in a choppy retail landscape, there’s still strength in sticking to your roots. Fourth quarter sales hit $3.77 billion, a modest bump from the year before. That growth was helped along by the company opening new stores and getting a slight boost in comparable store sales, up just 0.6 percent. Earnings per share ticked down slightly to $0.44 from $0.46, mostly because the company is still investing heavily in building out its future growth plans.

Full-Year Highlights

For the full year, net sales came in at just under $14.9 billion, a small but meaningful climb of about 2.2 percent. Comparable store sales didn’t move much, up only 0.2 percent, but that’s not surprising given the kind of year it’s been across retail. What stands out more is that earnings per share for the year managed to inch up to $2.04. The company also held onto a healthy gross margin of 36.3 percent, which shows it’s managing costs well even as prices shift across the board.

One of the more eye-catching parts of this report was how much cash Tractor Supply returned to its shareholders. They bought back over 10 million shares for roughly $561 million and paid out close to $473 million in dividends. Altogether, that’s over a billion dollars handed back to investors. That kind of consistency sends a strong message about where management stands on financial discipline and long-term value.

Looking Ahead

The road ahead looks like more of what’s worked so far. The company plans to open around 90 new Tractor Supply stores along with 10 new Petsense locations this year. It’s a clear signal they’re still seeing opportunity to expand their reach, especially in the rural and suburban communities they know best.

All in all, this wasn’t a blow-the-doors-off kind of report—but it didn’t need to be. Tractor Supply is playing the long game, and they’re doing it with the kind of steady hand that keeps the shelves stocked and the dividends flowing.

Management Team

Tractor Supply Company is steered by a seasoned leadership team that brings a wealth of experience to the table. At the helm is Hal Lawton, who has been serving as President and CEO since January 2020. Before joining Tractor Supply, Hal was the President of Macy’s and held various leadership roles at eBay and Home Depot. His diverse background in retail and e-commerce has been instrumental in driving the company’s strategic vision forward.

Supporting Hal is Kurt Barton, the Executive Vice President, Chief Financial Officer, and Treasurer. Kurt has been with the company since 1999 and took on the CFO role in 2019. His deep understanding of Tractor Supply’s financial landscape ensures robust fiscal management and strategic planning.

The executive team also includes Noni Ellison, Senior Vice President, General Counsel, and Corporate Secretary, who brings extensive legal expertise to the company. Seth Estep serves as the Executive Vice President and Chief Merchandising Officer, overseeing product selection and supplier relationships. John Ordus, as the Executive Vice President and Chief Stores Officer, manages store operations and customer experience across all locations.

This cohesive leadership team has been pivotal in navigating the company through various market dynamics, focusing on growth while maintaining the core values that resonate with their customer base.

Valuation and Stock Performance

As of April 2, 2025, Tractor Supply’s stock (TSCO) is trading at $55.62. The stock has experienced fluctuations over the past year, reaching a high of $61.53 and a low of $48.30. This positions the current price approximately 10% below its 52-week high.

In terms of valuation, the stock’s price-to-earnings (P/E) ratio stands at 27.02, with a forward P/E of 25.45. The price-to-sales (P/S) ratio is 2.00, and the price-to-book (P/B) ratio is 12.91. These metrics suggest that the stock is trading at a premium compared to some of its peers in the retail sector.

Analyst sentiment reflects a consensus price target of $59.22, indicating a modest potential upside from the current trading price. The consensus among 21 analysts is a “Moderate Buy,” comprising 13 buy ratings, 6 holds, and 2 sells.

The stock’s beta is 0.84, indicating lower volatility compared to the overall market. This lower beta suggests that the stock may be less susceptible to broad market swings, aligning with the company’s stable performance in the retail sector.

Risks and Considerations

Investing in Tractor Supply comes with its set of risks and considerations. One notable factor is the company’s sensitivity to weather patterns. As a retailer catering to outdoor and agricultural needs, unseasonal weather can impact sales and supply chains. Extreme weather events also pose risks of store closures and inventory damage.

Economic fluctuations present another consideration. Changes in consumer spending, especially in rural communities where discretionary income may vary, can influence sales performance. Additionally, the company’s expansion plans, while indicative of growth, require significant capital investment and come with the inherent risks of entering new markets.

The company’s recent reversal of its diversity, equity, and inclusion (DEI) initiatives has also drawn attention. Initially, Tractor Supply had committed to DEI goals but faced backlash from certain activist groups, leading to a publicized withdrawal from these initiatives. This move has sparked discussions about the company’s corporate social responsibility stance and could influence public perception and employee morale.

Final Thoughts

Tractor Supply Company stands as a robust player in the rural lifestyle retail sector, backed by a seasoned management team and a clear strategic vision. The company’s consistent financial performance and commitment to shareholder returns highlight its operational strength. However, potential investors should weigh the valuation metrics, market dynamics, and recent corporate decisions when considering an investment in TSCO. As always, aligning investment choices with individual financial goals and risk tolerance is paramount.