Updated April 2025

TowneBank isn’t trying to be flashy. It’s not the kind of stock that dominates headlines or pops up on every hot list. But that’s part of its charm, especially for dividend investors who appreciate consistency over buzz. Based out of Suffolk, Virginia, TowneBank has carved out a niche as a relationship-driven community bank serving areas across Virginia and North Carolina.

With a market cap just over $2.5 billion, it’s not the biggest player in the room, but it’s managed to build a reputation on reliability. It focuses on banking the old-fashioned way—through local connections, conservative growth, and careful capital allocation. And while that might not grab the attention of speculators, it speaks volumes to income-focused investors who value stable dividends backed by solid performance.

Recent Events

Over the past year, TowneBank has quietly outperformed. The stock is up around 25% over the last 12 months, a move that stands out when you compare it to the broader market’s gains. It’s a significant show of strength for a regional bank, especially in a higher interest rate environment that’s created headaches for many of its peers.

Earnings growth has been impressive—up over 43% year over year in the most recent quarter. Revenue is up nearly 15%. That’s not a coincidence. The bank’s focus on commercial lending in steady-growth regions like Raleigh and Richmond is paying off. Its customer base isn’t chasing speculative tech ventures. These are small and mid-sized businesses, homeowners, and long-term depositors. That kind of client mix brings resilience in uncertain times.

There’s also something to be said for its low volatility. With a five-year beta of 0.90, TowneBank has shown it doesn’t swing as wildly as the broader market. For those looking for a little less drama in their dividend portfolio, that’s worth noting.

Key Dividend Metrics

📈 Dividend Yield: 2.96%

💰 Forward Annual Dividend Rate: $1.00 per share

🔁 Payout Ratio: 46.51%

📅 Next Dividend Date: April 11, 2025

📆 Ex-Dividend Date: March 31, 2025

🕰️ 5-Year Average Yield: 3.15%

🧾 Dividend History: Last stock split in 2012 (103:100)

These numbers paint a picture of a company that’s comfortable with its identity. The nearly 3% yield is competitive, but more importantly, it’s dependable. There’s enough cushion in the payout ratio to support the dividend even if earnings were to slow.

Dividend Overview

TowneBank’s dividend is one of those that doesn’t need much flash to be attractive. At $1.00 per share annually, it’s paying out a respectable 2.96% based on the current share price. And the payout isn’t stretched thin. With earnings per share at $2.15, they’re only committing about 46.5% of profits to dividends. That’s a healthy balance—enough to reward shareholders while keeping capital available for growth or any bumps in the road.

That kind of balance is something dividend investors often overlook when chasing high yields. A payout ratio under 50% tells you the dividend has room to breathe. And the bank’s financials back that up. TowneBank holds over $217 million in cash and maintains relatively low debt levels for a regional player. Those are signs of a business that’s being run with long-term sustainability in mind.

The dividend isn’t just safe—it’s stable. And in a sector where dividends can sometimes feel like a moving target, that stability counts for a lot.

Dividend Growth and Safety

You won’t find massive year-over-year dividend hikes here, but that’s not the point. What you get with TowneBank is measured growth and dependable payouts. That’s not to say there’s no room for increases—in fact, with earnings growth accelerating, there’s plenty of potential for modest boosts. But they’re not going to overextend just to impress.

What stands out is how comfortably the dividend fits into the bank’s overall financial picture. Operating margins are close to 30%, and profit margins are north of 23%. That level of efficiency means TowneBank can keep delivering on its dividend promise without having to reach.

Return on equity comes in at 7.73%, and return on assets is just under 1%. Those aren’t aggressive numbers, but they reflect a conservative, deliberate approach. For a bank that’s built its business on community trust and long-term relationships, that’s exactly the kind of profile you want to see.

There’s also a degree of calm in the way the stock trades. With relatively low short interest and a stable float, it doesn’t get pushed around by big speculative moves. It just does what it’s always done—serving its markets, growing steadily, and returning value to shareholders.

For dividend investors who prefer consistency over excitement, TowneBank continues to look like a name that’s content staying in its lane—and doing so with a quiet kind of strength.

Balance Sheet Analysis

TowneBank’s balance sheet shows the kind of quiet strength that dividend investors like to see—less drama, more durability. Total assets ticked up to just over $17.2 billion as of the end of 2024, up from $16.8 billion the prior year. That’s a steady climb, not a sprint, and it reflects a business that’s growing at a healthy, manageable pace. On the liability side, things look just as contained, with total liabilities coming in at $15.1 billion. That leaves a cushion of over $2.1 billion in equity—comfortably higher than previous years and a sign that TowneBank is consistently building book value without over-leveraging itself.

Total debt, notably, has been trimmed down significantly—from $459 million in 2023 to just $263 million in 2024. That’s not just a healthy move; it’s a flex in a rising rate environment. Tangible book value is sitting at $1.62 billion, up year over year, and net tangible assets are following the same path. So yes, they may not publish this in neon lights, but the underlying financial foundation is strong. And while “working capital” appears as a mystery entry with a blank line—maybe even TowneBank prefers to keep some things to itself—the rest of the balance sheet shows a bank that’s operating with financial clarity and prudence. You don’t get wild swings here, just a quietly growing institution that looks like it balances its checkbook with care and maybe even a little pride.

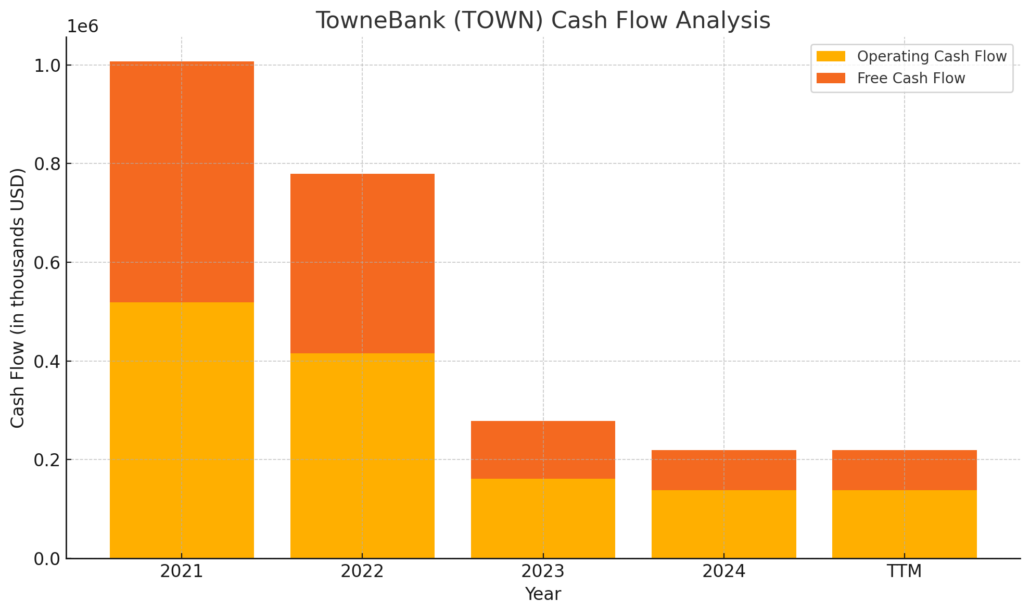

Cash Flow Statement

TowneBank’s cash flow activity over the trailing twelve months paints a picture of a company that’s managing its capital with a measured hand. Operating cash flow came in at $138 million, a drop from the previous year, though still a solid figure that covers the dividend comfortably. Free cash flow followed a similar trend, landing at $81 million. Not eye-popping, but more than enough to support ongoing shareholder returns without stretching the bank’s finances.

On the investing side, outflows totaled about $203 million—significantly less intense than the prior year’s hefty $335 million. So, while still investing actively, they’ve clearly toned down the pace. Financing cash flow is where things picked up, rising to $275 million, signaling some strategic funding and likely positioning for growth or liquidity enhancement. Despite all the moving pieces, TowneBank closed out with $1.34 billion in cash, well up from last year’s $1.13 billion. In short, it’s not splashing cash everywhere, but it’s keeping the vault comfortably stocked.

Chart Analysis

Price Movement and Trend

The chart reflects a steady upward trajectory over the past year, with price action gradually climbing from around $26 to a peak near $38 before pulling back slightly into the $33–$34 range. That’s a pretty respectable run for a regional financial stock. What stands out is the relatively smooth price climb beginning in early summer, followed by a strong surge into late July and August. This momentum shift coincides with the 50-day moving average crossing above the 200-day—an encouraging signal that the trend had real legs.

What’s been happening more recently is a little consolidation. Price has cooled off from the highs, but it’s still comfortably above both moving averages. The 50-day line has flattened a bit, suggesting the pace of gains has slowed, but there’s no sharp breakdown either. In fact, the price continues to hug the higher end of the range, hinting at underlying support and a reluctance from the market to give up much ground.

Volume and Participation

Volume spikes in mid-summer and early fall line up with that burst in price action, which is typically a sign that the move had some real interest behind it. Since then, volume has normalized, but it’s remained steady—no signs of panic selling or wild swings in participation. The consistency here suggests that the market isn’t in a rush to exit, and those holding shares are likely in no hurry to offload them.

RSI and Momentum

The Relative Strength Index (RSI) has danced between overbought and neutral territory throughout the year. There were a few brief dips near oversold levels—late October and again in March—but neither led to major breakdowns in price. Most of the time, RSI has hovered in a healthy middle ground, occasionally approaching 70 but rarely staying there long. That’s the kind of movement you want to see when momentum is being maintained without overheating.

All in, the chart tells a story of strength, some well-earned cooling, and a stock that’s still comfortably within an upward structure. No fireworks, just a clear sense of upward direction with healthy pauses along the way.

Analyst Ratings

📈 In recent months, TowneBank has received a mix of opinions from analysts, reflecting a balanced view of its financial health and forward-looking potential. The current consensus is a “Moderate Buy,” with one analyst rating the stock as a hold and another suggesting a buy. 🎯 The average price target stands at $40.50, indicating an estimated upside of around 16.5% from its current level near $33.89.

🔼 Back in October 2024, one firm upgraded TowneBank from “Market Perform” to “Outperform” and raised their price target to $40. This move came on the back of the bank’s strong earnings momentum and its stable financial profile. A solid balance sheet, healthy net interest margin performance, and consistent dividend coverage likely played a role in swaying sentiment more positively.

🔽 Around the same time, another analyst trimmed their price target slightly from $37 to $36, though they maintained an “Outperform” rating. That modest revision may have been a response to tightening economic conditions or sector-wide caution, rather than a reflection of any material change in TowneBank’s fundamentals.

💬 Overall, the mixed but largely positive outlook reflects confidence in TowneBank’s strategy and execution, even if expectations are being managed conservatively by some.

Earning Report Summary

Strong Finish to the Year

TowneBank wrapped up 2024 on a high note, delivering solid growth across the board in its most recent earnings report. Net income for the fourth quarter came in at $41.3 million, up quite a bit from $28.8 million in the same quarter a year ago. That’s a healthy jump, and it pushed earnings per share to $0.55 compared to $0.39 previously. The uptick wasn’t just about cost-cutting or accounting tricks—it was driven by real growth, especially in net interest income, which climbed nearly 10% to $118 million.

For the full year, earnings reached $161.8 million, rising from $153.7 million in 2023. Diluted EPS also nudged up from $2.06 to $2.15, which might not set records, but shows consistent progress. Revenue for the fourth quarter came in at $177.2 million, a strong 13.9% increase. What’s interesting here is how much of that came from noninterest income—up over 23%, hitting $59.1 million. It shows TowneBank isn’t leaning solely on loan income to drive its growth.

Margin Improvement and Steady Asset Growth

One standout metric was the net interest margin, which improved to 3.02% from 2.86% a year ago. That kind of movement suggests they’ve done a good job managing their loan book and deposit costs, especially in a market where rates have been anything but stable. Total assets climbed to $17.25 billion, and deposits grew too, hitting $14.44 billion—another sign that customers are sticking with them and that new business is still coming in.

Keeping It Clean and Capital Strong

Asset quality continues to be a non-issue. Nonperforming assets made up just 0.05% of total assets, right in line with last year. That low level is no accident—it points to consistent underwriting discipline. On top of that, the bank’s capital ratios have improved, with total risk-based capital rising to 15.68%. That’s a solid cushion and gives them flexibility to grow without taking on unnecessary risk.

All in all, TowneBank seems to be doing exactly what you want from a well-run regional bank—growing at a reasonable pace, keeping risk low, and delivering steady returns.

Management Team

TowneBank’s leadership team has a long track record of consistent direction and community-centered decision-making. At the top, Executive Chairman G. Robert Aston Jr. continues to be a steady influence. He’s been part of the bank’s DNA since its founding and still plays an active role in strategy and culture. His experience spans decades, and it shows in the bank’s conservative but effective growth approach.

Running the day-to-day operations is Billy Foster, who took over as CEO after nearly two decades inside the bank. He’s known for his methodical style and deep ties to the regional markets TowneBank serves. He doesn’t chase trends—he builds relationships. That tone filters down through the organization. The team surrounding him isn’t stuffed with outsiders on short stints. It’s built with long-time insiders who understand both the business and the communities they serve. The mix of mortgage, commercial, and retail banking leadership has kept TowneBank nimble enough to grow but grounded enough not to overreach.

This is not a team that’s trying to reinvent banking. They’re focused on doing the basics well—earning trust, making responsible loans, and returning capital where it makes sense. That may not sound exciting, but it’s exactly the kind of temperament that’s helped the bank navigate the last few years without a hitch.

Valuation and Stock Performance

TowneBank’s stock has had a quiet but impressive climb over the last year, rising from the low $26s to current levels around $33 to $34. It peaked near $38 not long ago before pulling back a bit, which is expected after that kind of run. But even with the pullback, shares are up over 25% year-over-year, which outpaces many other regionals and even the broader market.

The stock is trading at just under 16 times trailing earnings, which puts it on the lower end of the P/E spectrum compared to the S&P 500. For investors who like to buy earnings growth at a reasonable price, that ratio makes TowneBank feel more like a value name than a momentum play. Its price-to-book ratio hovers around 1.2, which suggests it’s not trading far above the actual value of its assets—again, reinforcing a sense of financial stability.

Looking at the longer-term chart, TowneBank doesn’t trade with a ton of volatility. Its beta under 1.0 backs that up. It tends to move more moderately than the broader market, which can be a draw for investors seeking a steadier ride. Combine that with a nearly 3% dividend yield and consistent capital return, and it becomes clear why some are choosing to stick around for the long haul.

Risks and Considerations

No bank is immune to risk, and TowneBank does have a few. One of the main ones is regional concentration. While its roots and growth have been tightly focused on Virginia and North Carolina, that also ties the bank’s performance to those specific economies. If either area faces a localized downturn—say, a pullback in real estate, slower job growth, or a sector-specific issue—it could hit TowneBank harder than a more geographically diverse institution.

Interest rate risk is always lurking in the background too. Like most banks, TowneBank earns money on the spread between what it pays on deposits and what it earns on loans. While it’s managed that gap well, a significant shift in rates or a flattening yield curve could compress margins. That’s especially important now, as we’re in a phase where rates may level out or even begin to fall in the near future.

There’s also the broader risk tied to the competitive landscape. Bigger banks have more resources, more tech, and can sometimes outpace smaller players in attracting certain kinds of business. That said, TowneBank has leaned into its local-first approach, and its community loyalty has served as a defense against being outmuscled.

Operational risk, including cybersecurity, is another area that banks can’t ignore. TowneBank has invested in fraud prevention and digital security, but as banking shifts more online, that’s an area that will require continued attention and resources. A misstep here could erode the trust it’s built up over decades.

Final Thoughts

TowneBank isn’t chasing growth through risky acquisitions or leaning heavily into speculative lending. It’s taking a more measured approach, growing by building deeper relationships and expanding steadily across a region it knows well. That kind of strategy doesn’t always grab headlines, but it tends to create dependable results.

From a valuation perspective, the stock looks fairly priced or even a bit undervalued depending on how you view its earnings growth. It’s not priced for perfection, which leaves some room for upside if performance continues to outpace expectations. Add to that a steady dividend yield, a healthy payout ratio, and a leadership team that values sustainability over splash, and you’ve got a recipe that leans toward long-term confidence.

Of course, nothing is without risk. Concentration in two core states, rate sensitivity, and the pressure to keep up with digital expectations all need to be watched. But there’s also strength in knowing who you are—and TowneBank seems to have a good handle on that.

In a market that often rewards fast movers and flashy headlines, TowneBank has taken a different route. It may not be the loudest name in the sector, but it’s built a reputation on stability, service, and careful execution. That kind of approach tends to outlast the noise.