Updated April 2025

Tootsie Roll Industries is one of those rare companies that doesn’t chase headlines. Instead, it quietly continues doing what it does best—making candy people have loved for decades. From the classic Tootsie Roll and Tootsie Pop to Junior Mints and Dots, their products have a familiar, nostalgic charm. But for dividend investors, there’s more here than just a sweet tooth.

This is a company built on long-standing consumer loyalty, solid financials, and a management team that values discipline over flash. It’s not trying to reinvent the wheel—it’s focused on delivering dependable results and a reliable stream of income to shareholders. That simplicity, in a way, is its strength.

Recent Events

Looking at the latest numbers, there’s a bit of softness. Revenue is down slightly year-over-year, slipping 2%, while earnings per share have taken a larger dip of 23.4%. EPS now sits at $1.18 over the trailing twelve months. It’s not a cause for alarm, but it does reflect a tougher environment out there—rising costs and shifting consumer habits are taking a toll across the sector.

Despite these headwinds, Tootsie Roll remains highly profitable. Operating margins came in just shy of 21%, while net margins stayed solid at 12%. These are strong figures for a business that doesn’t rely on high-ticket items or fast growth. Cash flow tells a similar story, with nearly $139 million in operating cash flow and over $95 million in free cash flow, reinforcing the business’s underlying health.

In March 2025, the company announced a 103-for-100 stock split. While it doesn’t change the value of the investment, it’s the kind of move that helps maintain share accessibility, especially for smaller, long-term investors. It also signals that management is thinking about shareholder alignment, which is always encouraging.

Key Dividend Metrics

🍬 Forward Dividend Yield: 1.14%

📈 5-Year Average Yield: 1.06%

📅 Dividend Growth Streak: 20+ years

💵 Payout Ratio: 29.3%

🧾 Free Cash Flow Payout Ratio: Under 40%

💰 Next Dividend Date: March 27, 2025

📉 Ex-Dividend Date: March 5, 2025

Dividend Overview

Let’s be upfront—Tootsie Roll isn’t going to knock anyone’s socks off with its dividend yield. At 1.14%, it’s slightly above its five-year average, and it certainly won’t make income investors race to add it to their portfolios. But where TR shines is in the consistency and security of that payout.

A 29.3% payout ratio gives this dividend plenty of cushion. The company doesn’t overextend itself, and there’s no need to borrow or dip into reserves just to make a payment. That’s a refreshing change in a world where many companies overpromise and underdeliver on their dividend strategies.

Management has made it clear they take a conservative, long-term approach to shareholder returns. Whether through the regular quarterly dividend, the occasional stock split, or even a special dividend now and then, there’s a dependable cadence to how capital is returned to investors. The reliability is what makes TR so attractive to income investors who value stability over spectacle.

Dividend Growth and Safety

Tootsie Roll isn’t about flashy growth when it comes to dividends. If you’re looking for big annual hikes, you’re not going to find them here. What you do get is a carefully maintained payout that’s backed by one of the most conservative balance sheets in the industry.

The company holds nearly $195 million in cash and carries just under $15 million in total debt. That puts the debt-to-equity ratio at a remarkably low 1.7%. Liquidity is strong, with a current ratio of 3.82—numbers like these give investors confidence that the dividend isn’t just safe now but built to last through whatever market storms may come.

Free cash flow more than covers the dividend, and capital spending is modest. The business doesn’t require large reinvestment to keep running smoothly, which means more of the earnings can be returned to shareholders without compromising operations.

Growth in the dividend has been slow and deliberate. Some years see small increases; others hold steady. Occasionally, a modest stock split adds a little value for long-term holders. It’s a strategy rooted in patience, not impulse. That might not suit everyone, but for investors seeking consistency over decades, it’s a model worth appreciating.

What really helps anchor the dividend policy is insider alignment. With nearly 42% of shares held by insiders, management is heavily invested in the company’s long-term success. This kind of ownership structure tends to support cautious, shareholder-friendly policies. There’s no incentive to take on unnecessary risk when the people running the business have so much at stake themselves.

Institutional ownership is relatively low—just under 30%—which reduces the chance of short-term pressure from funds chasing quarterly results. TR isn’t being pushed around by big investors with short time horizons. Instead, it’s guided by a long-view approach that values sustainability.

In short, Tootsie Roll Industries continues to be a quiet, confident holding for dividend investors who value safety, predictability, and time-tested stewardship. The yield may not dazzle, but the total package is one of enduring quality—and in this market, that’s something you can’t manufacture.

Balance Sheet Analysis

Tootsie Roll’s balance sheet is about as conservative as an accountant at a costume party—and that’s a good thing if you’re in it for the long haul. As of year-end 2024, total assets have climbed to just over $1.14 billion, a steady rise from previous years that shows quiet, consistent growth. Equity has also ticked upward to $870 million, reinforcing the company’s net-worth-first approach to running its business. Debt? Practically a rounding error. At under $15 million total, it’s the kind of number that feels like a formality more than a liability.

Working capital remains solid at $246 million, giving Tootsie Roll more than enough financial breathing room. Net tangible assets and tangible book value both clock in at $622 million, up from $575 million a year ago, reflecting solid retention of earnings and minimal write-downs. Shares outstanding have inched downward, suggesting the company is mindful of dilution. It’s not flashy, but there’s a certain old-school satisfaction in seeing a business just quietly take care of the basics. There’s no financial engineering or risky leverage games—just sturdy numbers and candy that practically sells itself.

Cash Flow Statement

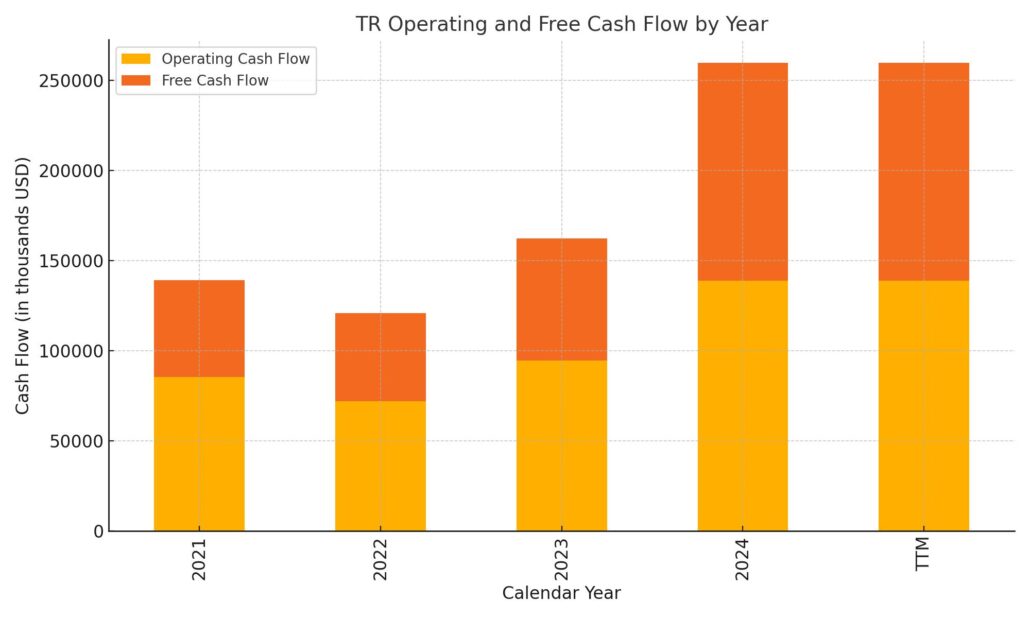

Tootsie Roll’s cash flow paints a picture of a business that knows how to generate money and keep it flowing. Over the trailing twelve months, operating cash flow hit nearly $139 million, a noticeable jump from $94 million the previous year. That kind of steady upward trend reflects disciplined operations and consistent consumer demand, even without wild swings in revenue. Free cash flow followed suit, reaching almost $121 million—a healthy surplus after accounting for capital expenditures, which were just under $18 million.

On the spending side, investing cash flow came in at a negative $36 million, driven mostly by reinvestment in the business, though not at an aggressive pace. Financing activities saw a net outflow of $39 million, mostly from continued share repurchases and steady dividend payments. Tootsie Roll doesn’t borrow much, and when it does, repayments keep the balance sheet looking lean. At the end of the day, the company is sitting on $139 million in cash—plenty of cushion and more than enough to keep the dividend sweet.

Chart Analysis

Price Movement and Trends

The chart shows a fairly orderly rebound over the past year. After bottoming around the $26–$27 range last summer, the stock began to build a slow but steady climb. What’s worth noting is the crossover that occurred in the fall—where the 50-day moving average (red line) pushed above the 200-day moving average (blue line). That’s typically seen as a positive technical shift, often suggesting that momentum is tilting to the upside.

Since then, prices have spent most of their time above both averages, which is generally a healthy technical position. The $31 range has started to act as a bit of a ceiling, with a few failed attempts to push through it cleanly. Still, dips toward $29 have been bought relatively quickly, hinting at underlying support. This type of sideways-to-slightly-up price behavior can be typical of a company that isn’t being chased by traders, but is still quietly accumulating interest.

Volume and Participation

Volume remains light overall, with a few isolated spikes. The low average daily volume suggests this stock isn’t dominated by fast-moving institutional flows, which often keeps volatility contained. The summer volume spikes likely coincide with earnings or other company-specific events, but there’s no evidence of panic-selling or outsized distribution.

RSI and Momentum

The Relative Strength Index (RSI) tells a story of moderation. For much of the past year, it has stayed between 40 and 70, spending very little time in overbought or oversold territory. This signals balanced buying and selling, and hints that the stock is not being chased irrationally. There were brief dips into the 20s during the early part of the chart, followed by recovery, which adds to the impression that any weakness has been met with buying, not avoidance.

The most recent RSI movement suggests the stock is approaching renewed strength, but it isn’t overheated. That lines up with what’s visible in price action—stability, a touch of momentum, and no signs of excessive enthusiasm.

Analyst Ratings

📈 Recently, Tootsie Roll Industries received a modest bump in sentiment. On March 21, 2025, the company’s Value Trend Rating was upgraded from D to C, signaling an improvement in underlying fundamentals and a stronger outlook for potential price appreciation. This reflects a more optimistic view on the company’s balance sheet health and operational consistency.

🧊 Despite that upgrade, the broader analyst community isn’t exactly jumping on the bullish bandwagon. The current consensus rating leans toward a cautious ‘Sell,’ with a consensus price target sitting at $12.56—well below its current market price around $31.33. That sharp contrast suggests analysts are skeptical about the stock’s valuation and believe it’s priced beyond what its growth prospects justify.

🔍 The reason for the mixed signals lies in the details. The Value Trend Rating shift was supported by signs of stability in the company’s cash flow and improvements in return on capital metrics. However, the consensus downgrade stems from a broader concern that Tootsie Roll’s long-term growth trajectory remains limited, particularly in an environment where input costs and distribution challenges are weighing on margins.

💡 These conflicting views create a divide—where fundamental metrics suggest the company is on steady footing, but the projected upside appears capped in the eyes of analysts watching from a valuation standpoint.

Earning Report Summary

Slower Sales, but Still Holding Steady

Tootsie Roll’s most recent earnings came in with a few bumps, but nothing that screams trouble. In the fourth quarter of 2024, the company brought in $191.4 million in net sales, a slight dip from $195.4 million the year before. Earnings also cooled a bit, coming in at $22.5 million for the quarter, compared to $29.4 million last year. On a per-share basis, that worked out to $0.32, down from $0.41.

Looking at the full year, total sales landed at $715.5 million, a 6% decline from 2023’s $763.3 million. Annual earnings followed a similar path, slipping from $91.9 million to $86.8 million. Earnings per share for the year came in at $1.22, down from $1.28 the year before.

What’s Behind the Numbers

A few things factored into the softer performance. Volume was down, which means fewer candies rolling out the door. Fixed costs didn’t budge much, so even small dips in sales hit the bottom line a bit harder. And like a lot of food producers, Tootsie Roll felt the sting of higher ingredient prices—cocoa and chocolate costs were particularly tough.

That said, not everything went sideways. Gross profit margins actually improved, which is a nice surprise. The company managed to raise prices just enough and run its manufacturing more efficiently, so even though it sold a little less, it squeezed more out of what it did sell. Investment income was up too, and the company got a bit of help from currency exchange tailwinds.

Still in a Solid Spot

All in all, it wasn’t a blockbuster year for Tootsie Roll, but it also wasn’t a meltdown. The company is keeping its footing, trimming costs where it can, and sticking to its predictable, steady style. For a business that thrives on consistency and long-term focus, that kind of performance still fits the playbook.

Management Team

At the helm of Tootsie Roll Industries is Ellen R. Gordon, serving as Chairman and Chief Executive Officer. Her leadership has spanned decades, and under her guidance, the company has remained committed to its time-tested business model. There’s a clear preference for consistency over flash, and that’s been a defining trait of the company’s culture. Alongside her is G. Howard Ember Jr., Vice President of Finance, who plays a key role in managing the company’s strong financial discipline. Manufacturing operations are led by Stephen P. Green, whose oversight ensures smooth production in a business where efficiency matters as much as quality. Together, this small but experienced team sticks to what they know, keeping the ship steady and the candy flowing.

Valuation and Stock Performance

Tootsie Roll’s stock has traded in a fairly tight range over the past year, moving between $26.78 and $33.22. Recently, it’s hovered around the $31 mark. With a trailing P/E ratio around 26.65, the stock isn’t cheap by most traditional standards. It trades at a premium, which suggests investors place value on its consistency and dividend history more than its growth prospects.

Its beta is just 0.19, pointing to low volatility and a slower response to market swings—something that may appeal to those looking for a calm corner in their portfolio. But that quietness also comes with the question: how much upside is really left? The market seems to be valuing Tootsie Roll more for its reliability than any expectation of breakout growth. Some observers believe that kind of pricing may be a little rich for what the company realistically delivers.

Risks and Considerations

While there’s plenty of good with Tootsie Roll, there are a few things worth keeping in mind. The company earns almost all of its revenue in the U.S., which means it doesn’t have much of a cushion if domestic demand starts to shift. Its presence internationally is minimal, leaving growth potential on the table in markets where candy consumption is on the rise.

The product lineup, while beloved, is pretty focused. Classics like Tootsie Rolls and Junior Mints are household names, but they haven’t evolved much. In a food industry that’s rapidly responding to consumer shifts toward health-conscious choices or novelty snacks, that narrow focus could become a headwind. Larger competitors are constantly pushing out new variations and healthier alternatives, while Tootsie Roll has kept it simple—perhaps too simple for the pace of today’s market.

Operationally, the company has dealt with challenges tied to ingredient sourcing and supply chain hiccups. Input costs for items like cocoa and packaging materials have risen, and while the company has managed so far, there’s always a risk that disruptions could pressure margins more significantly in the future.

Final Thoughts

Tootsie Roll Industries feels like an old friend—dependable, familiar, and content to keep doing what it’s always done. That has its advantages. For investors who appreciate predictability and a business model that doesn’t chase trends, there’s something comforting about how the company runs. The management team reflects that mindset: steady hands focused on keeping the core business healthy.

But there are trade-offs. The stock’s valuation suggests the market already appreciates what it brings to the table, and any upside may be limited by its slow-moving approach. Risks like limited product innovation, geographic concentration, and margin pressure from rising costs are worth keeping an eye on.

In the end, Tootsie Roll isn’t trying to be something it’s not. And for those who find value in that, the stock continues to offer what it always has—stability in a world that rarely sits still.