Updated April 2025

Thermo Fisher Scientific isn’t a household name for most dividend investors, but maybe it should be. This company is deeply embedded in the backbone of the life sciences industry. From pharmaceutical giants to hospitals and research labs, Thermo Fisher provides the instruments, diagnostics, and services that keep medical science moving forward. It’s a quiet powerhouse with an impressive track record and a strategic mindset.

What makes it especially interesting for income-focused investors is the consistent cash flow it generates, and how it handles that capital. While it’s not going to top anyone’s list for high yields, its dividend approach is thoughtful and growing. It’s one of those slow burners that rewards patience with steady increases and financial discipline.

Recent Events

Thermo Fisher’s stock has seen some turbulence over the past year, falling more than 16% from its peak. It’s now trading in the high $480s, down from a 52-week high of $627. That drop isn’t due to a company misstep—it’s more about the broader market’s shifting attitude toward large-cap healthcare and biotech names. As growth stocks get repriced and investors look for value, even strong operators like Thermo Fisher can take a hit.

But when you look past the share price, the business itself is solid. Quarterly revenue came in at $42.88 billion, showing a 4.7% gain over the prior year. Net income topped $6.3 billion, and earnings per share grew by more than 12% over the same stretch. These are not the numbers of a company in trouble.

Profit margins remain strong—operating margin is above 19%, and return on equity is over 13%. That strength flows directly into free cash flow, which sits at a healthy $6.6 billion. For dividend investors, that’s the kind of engine you want under the hood.

Thermo Fisher carries about $32.8 billion in debt, but it also has $5.5 billion in cash and a very manageable debt-to-equity ratio of 66%. With a current ratio of 1.66, it’s in a strong position to handle any short-term needs while continuing to invest in the future.

Key Dividend Metrics

📈 Forward Dividend Yield: 0.36%

💸 Annual Dividend Rate: $1.72

🕰 5-Year Average Yield: 0.22%

📅 Next Dividend Date: April 15, 2025

🚪 Ex-Dividend Date: March 14, 2025

🔁 Payout Ratio: 9.44%

🌱 Dividend Growth (5-Year CAGR): High single digits

📊 Free Cash Flow Coverage: Excellent

Dividend Overview

Thermo Fisher doesn’t shout about its dividend. It’s not flashy, and it’s definitely not designed to attract income seekers looking for a 4% yield. What it does offer is stability and long-term potential. At a forward yield of just 0.36%, it’s easy to overlook. But there’s more to the story.

This is a company that keeps its payout ratio extremely low—under 10% of earnings go toward dividends. That restraint isn’t a weakness. It’s a strategy. It leaves the business with room to reinvest in operations, pursue acquisitions, and still grow the dividend at a healthy pace.

The most recent dividend hike bumped the annual payout from $1.56 to $1.72. It’s not a massive leap, but it reflects a trend of consistent growth. For long-term investors, that’s a reassuring pattern. The dividend isn’t just maintained—it’s nurtured.

Another point worth noting: the reliability of payout timing. With the last ex-dividend date on March 14 and the next dividend scheduled for April 15, there’s a dependable rhythm to it. That consistency speaks to the underlying discipline in Thermo Fisher’s capital allocation approach.

Dividend Growth and Safety

Thermo Fisher’s dividend is less about what you get today and more about what you’re building for the future. Over the past five years, dividend growth has stayed in the high single-digit range. That’s solid, especially when you factor in the low payout ratio and the scale of the company.

Safety is not a concern here. With $6.6 billion in free cash flow and a small slice of it going toward dividends, there’s a wide cushion. The dividend isn’t at risk, even in a downturn. There’s flexibility in the business model that allows management to adjust capital deployment as needed without putting shareholder returns in jeopardy.

That level of safety combined with steady growth is a sweet spot for long-term investors. It might not produce eye-popping quarterly income today, but over time, that payout can compound into something meaningful—especially when reinvested.

The financial foundation is solid. Margins are healthy. Cash generation is strong. And the dividend strategy is careful and deliberate. That’s not something you see every day in a market where companies are often pressured to boost payouts unsustainably.

Thermo Fisher doesn’t try to be a high-yield stock. What it offers instead is quiet strength, long-term growth potential, and a management team that understands how to reward shareholders while keeping the business nimble. For dividend investors who think in terms of decades rather than quarters, it’s worth watching.

Balance Sheet Analysis

Thermo Fisher’s balance sheet tells the story of a company that knows how to scale while keeping its financial house in order. As of the latest full year, total assets clock in just over $97 billion, showing a mild dip from the prior year but essentially steady over the past few cycles. That stability extends to liabilities too, which have decreased from over $54 billion in 2021 to about $47.6 billion now. Equity, meanwhile, continues to build, climbing to $49.7 billion from $40.9 billion three years ago. That kind of equity growth without wild asset swings shows a company that’s stacking strength, not just padding headlines.

Digging into the details, yes, Thermo Fisher’s tangible book value remains negative at nearly -$11.8 billion, but let’s not clutch our pearls just yet—that’s mostly the result of good ol’ fashioned intangible-heavy acquisitions. When your business lives in scientific innovation and intellectual property, intangible assets are part of the package. Total debt has come down from 2021’s nearly $35 billion to around $31.3 billion, and with over $8.8 billion in working capital and a healthy interest coverage ratio, there’s no panic button in sight. The steady uptick in share repurchases, reflected in the shrinking count of ordinary shares and growing treasury shares, quietly adds shareholder value without fanfare. In short, the balance sheet might not win awards for minimalist elegance, but it’s the kind of sturdy, well-managed setup that supports long-term compounding.

Cash Flow Statement

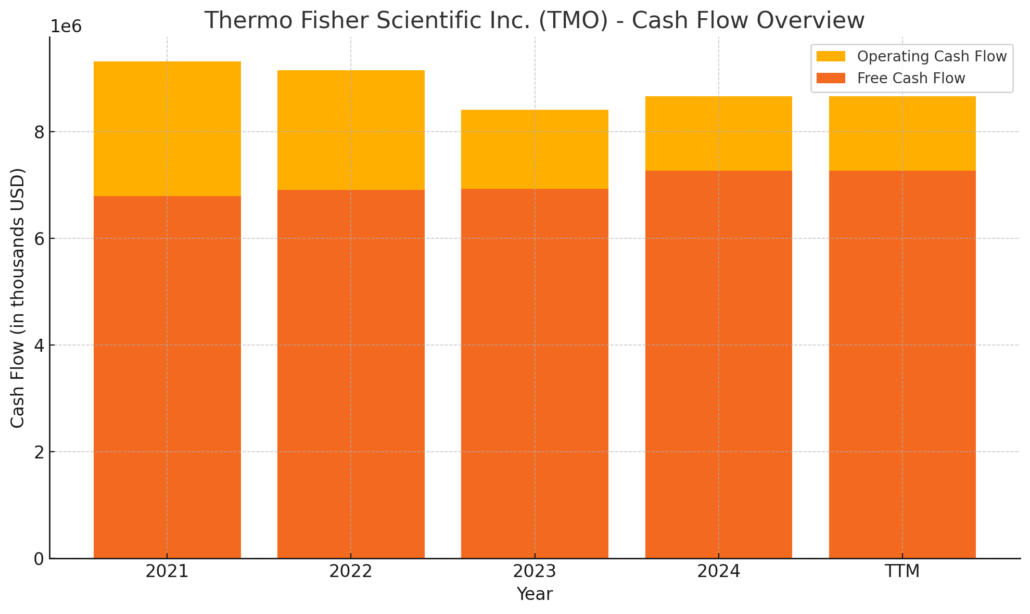

Thermo Fisher continues to show why it’s in a league of its own when it comes to cash flow discipline. Over the trailing twelve months, the company generated $8.67 billion in operating cash flow—a solid improvement from 2023 and just shy of 2021’s peak. Even with ongoing investments in growth and innovation, it still managed to deliver $7.27 billion in free cash flow. That kind of consistency makes it clear: TMO knows how to turn revenue into real, usable cash.

On the investing side, cash outflows totaled about $5.8 billion, a reflection of continued capital allocation into the business. Financing cash flow was deeply negative at nearly $6.8 billion, thanks to steady debt repayments and a $4 billion stock buyback effort. The cash position dipped to $4 billion, down from the previous year’s $8 billion, but still strong enough to keep operations humming without sweat. Between paying down debt, reinvesting in growth, and returning capital to shareholders, Thermo Fisher is balancing the act like a company that’s done it a few times before—no drama, just reliable execution.

Chart Analysis

Price Trend and Moving Averages

The chart for Thermo Fisher shows a clear downward slope from late November through to the current date, after a period of stability and strength last summer. The stock had a notable run between July and October, trading above both its 50-day and 200-day moving averages. But things changed in late fall. The 50-day moving average crossed below the 200-day in early December—a bearish signal known for flagging longer-term momentum shifts. Since then, price has stayed below both lines, a sign that the trend hasn’t turned back in its favor yet.

The slope of the 50-day moving average continues downward, while the 200-day has started to flatten and slightly bend lower. That doesn’t suggest imminent recovery. The most recent price action shows a sharp drop to new 12-month lows, with price closing well under both moving averages. This extended stretch below key levels hints that sellers are still very much in control.

Volume Behavior

Volume has stayed relatively consistent, without major spikes outside a few isolated days. However, what stands out is the lack of heavy buying volume during rebounds. Most of the green bars in late January and March show moderate interest but not the kind of volume you’d associate with strong accumulation. That tells you buyers are hesitant, and demand isn’t overwhelming supply just yet.

Relative Strength Index (RSI)

The RSI has remained mostly under 50 since early March and is currently sitting close to the 30 level. That’s not technically oversold, but it’s hovering in that zone where price can drift lower unless demand steps in. The RSI reached overbought conditions back in February but quickly reversed, aligning with the latest price breakdown. That move lower in both price and RSI suggests there hasn’t been enough conviction on the buy side to create a durable bottom.

Final Notes on Price Behavior

The last five candles show a consistent pattern of selling pressure. Long upper wicks and relatively shorter bodies suggest attempts to rally have been rejected. Most of these sessions ended near their lows, and volume hasn’t picked up to support a bounce. It feels like a market trying to find support but not getting much help yet. Momentum remains weak, and unless the price can reclaim the 50-day moving average with some volume behind it, the trend remains under pressure.

Analyst Ratings

📈 Thermo Fisher Scientific has recently seen renewed attention from analysts, with several firms raising their price targets based on improving outlooks. UBS bumped its target from $700 to $715 and reaffirmed a buy rating, pointing to confidence in the company’s long-term growth path. Royal Bank of Canada also set a price target of $693 while maintaining a positive stance. Over at Morgan Stanley, analysts increased their target to $678, going so far as to name Thermo Fisher a “top pick” in their sector coverage. Wells Fargo followed suit, raising their target to $680 and keeping an “overweight” rating, signaling expectations that the stock could outperform the broader market.

💬 The sentiment overall from analysts leans toward a moderate buy, with the average consensus price target sitting around $653. That reflects a healthy premium over recent trading levels and suggests that Wall Street still sees value here, even amid recent stock price weakness.

📊 Much of the optimism comes from the company’s steady earnings growth, reliable cash generation, and strategic focus on expanding its product and service offerings. Thermo Fisher continues to deliver solid performance in its core segments and has shown resilience through market shifts. Its execution around acquisitions and innovation is also earning it points, with analysts highlighting its strong competitive position in the life sciences and diagnostics space. Despite the stock’s recent dip, the fundamentals continue to attract support from the analyst community.

Earning Report Summary

Solid Finish to the Year

Thermo Fisher wrapped up 2024 with a strong fourth quarter, showing it still knows how to deliver even in a choppy environment. Revenue came in at $11.4 billion, which was about a 5% bump from the same quarter a year ago. That growth didn’t come from just one corner of the business—it was broad-based, with good momentum across its core segments.

On the earnings side, things looked just as solid. Adjusted earnings per share landed at $6.10, which was not only higher than expected but also an 8% increase year-over-year. That kind of jump shows that the company is managing costs well and keeping margins healthy, even as it continues to invest in new areas.

Segment Strength and Margin Growth

The Lab Products and Biopharma Services division led the charge, growing by about 4%. This part of the business plays a big role in supporting clinical trials and drug development, which continue to be areas of steady demand. Other divisions held up well too, giving the company a nice balance across its portfolio.

Margins also moved in the right direction. Adjusted operating income hit $2.72 billion for the quarter, pushing the operating margin up slightly to 23.9%. It’s a small move, but when you’re talking about billions in revenue, that efficiency adds up.

Innovation and Strategy on Display

One of the more exciting parts of the quarter was the launch of a few new products, including the Iliad Electron Microscope and the Stellar mass spectrometer. These aren’t household names, but they matter a lot in scientific and industrial research, and they show Thermo Fisher is still pushing boundaries.

Also worth noting—Thermo Fisher closed its acquisition of Olink during the quarter. This move gives it a stronger foothold in the fast-growing field of proteomics, and it fits well with the company’s ongoing strategy of adding high-impact capabilities through M&A.

Even while investing in growth, the company didn’t forget about shareholders. It returned $4.6 billion through a mix of dividends and buybacks over the year. That kind of capital return, alongside business growth, is the kind of balance long-term investors like to see.

All in all, the latest report paints a picture of a company that’s executing well, staying innovative, and keeping its financials on track.

Management Team

At the helm of Thermo Fisher Scientific is Marc N. Casper, who has been leading the company as President and Chief Executive Officer since 2009. His long tenure speaks to a steady hand at the wheel, guiding the company through expansion, innovation, and a series of strategic acquisitions. In 2021, the leadership team got a refresh with Alan Sachs shifting from Chief Scientific Officer to Chief Medical Officer, and Karen E. Nelson stepping in as the new CSO. This move was more than just a title change—it reflected a broader shift in how the company aligns its executive structure with emerging opportunities in science and healthcare.

Rounding out the team are key figures like CFO Stephen Williamson and Mark Stevenson, who leads the Life Sciences Solutions division. Their mix of financial discipline and sector-specific knowledge gives Thermo Fisher a balanced leadership dynamic. The board also continues to evolve, bringing in voices with diverse experience, including the recent addition of Karen S. Lynch, further strengthening governance and strategic direction.

Valuation and Stock Performance

Thermo Fisher’s stock has had a choppy run over the past year. Trading at $489 in early April, it’s off from its 52-week high of $627 but still well above the lows. This kind of range-bound movement reflects both market rotation and shifting investor sentiment toward healthcare and growth stocks in general.

With a market cap close to $191 billion, Thermo Fisher remains a heavyweight in its space. The average price target from analysts sits around $653, which shows there’s still plenty of confidence in the company’s long-term path. That optimism is built on strong financials, consistent free cash flow, and moves like the recent acquisition agreement to pick up a bioprocessing-focused business. It’s the kind of strategic bet that expands capabilities without overreaching.

Risks and Considerations

Like any company operating at global scale, Thermo Fisher isn’t immune to challenges. Regulatory risk is always present, especially in areas like diagnostics and pharmaceuticals where FDA scrutiny is part of the game. One of its facilities did face compliance concerns related to a respiratory therapy product, though those issues were ultimately resolved. Still, it’s a reminder of the vigilance needed when you’re producing at this level.

Macroeconomic factors also come into play. Currency swings, trade policies, and supply chain fluctuations can all affect operations. Thermo Fisher does take a proactive approach to risk, with strong internal controls and an emphasis on operational resilience. But no system is perfect, and surprises can happen—even to well-managed companies.

Final Thoughts

Thermo Fisher continues to be a standout in the life sciences industry, combining deep technical expertise with a clear sense of where the market is headed. Its leadership team is experienced and steady, its financials are solid, and its long-term strategy is all about staying at the center of science and innovation.

Yes, there are risks—regulatory, economic, and operational. But the company’s track record of managing through complexity gives it a strong foundation. As it continues to invest in its future while returning capital to shareholders, Thermo Fisher remains a name to watch for anyone with an eye on the intersection of science and business.