Updated April 2025

The Hanover Insurance Group has been quietly building momentum, and that’s caught the attention of investors who appreciate consistency over flash. Over the past year, the stock has climbed more than 30%, comfortably beating the broader market. That kind of performance in the property and casualty insurance space doesn’t always make headlines, but it says a lot about the company’s operational discipline.

What’s driving this? Revenue is growing at a modest but steady clip, up 3.6% year over year. More impressively, earnings surged by more than 55% over the same period. That type of bottom-line expansion suggests the company is hitting a sweet spot operationally, and it’s managing expenses well despite a challenging macro backdrop.

THG recently paid out a dividend of 90 cents per share on March 28, maintaining its predictable quarterly payout rhythm. The ex-dividend date was March 14, so anyone holding shares before that date locked in the payment. This steady cadence of dividends reflects a long-standing commitment to returning value to shareholders.

The valuation also looks reasonable. With a forward price-to-earnings ratio just below 12 and return on equity over 16%, there’s evidence of both profitability and efficiency.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.06%

💵 Forward Annual Dividend: $3.60 per share

📊 Payout Ratio: 29.54%

📉 5-Year Average Dividend Yield: 2.34%

📆 Last Dividend Paid: March 28, 2025

📆 Ex-Dividend Date: March 14, 2025

🧾 Trailing Dividend Yield: 1.98%

🛡️ Dividend Safety Profile: Strong, with solid earnings coverage

📈 Dividend Growth Potential: Healthy, supported by earnings growth and a modest payout

Dividend Overview

Right now, THG’s dividend yield sits at 2.06%. That’s slightly below its five-year average, which suggests the stock has run up a bit faster than the dividend has increased. While some might see that as a downside, it’s actually a positive indicator—it shows the market values the company’s consistency and earnings power.

The payout ratio is comfortably under 30%, which is a good sign in an industry known for needing to keep capital on hand. THG is being cautious, not stretching itself to please shareholders. That kind of fiscal responsibility is worth noting for long-term investors who want income without worrying about cuts when the industry hits a rough patch.

There’s also the stock’s low beta—about 0.66—which means it tends to move less than the broader market. That makes a 2% yield look a little sweeter. When the market gets volatile, it’s reassuring to hold names that don’t swing wildly.

Dividend Growth and Safety

One of the most appealing aspects of THG for dividend investors is its long-term approach to increasing payouts. The company has a steady, no-drama track record of boosting dividends at a pace that matches earnings growth. This isn’t a company chasing headlines with big hikes, but one focused on reliable returns.

EPS currently sits at $11.69, while the annual dividend is $3.60. That means THG is holding onto nearly 70% of its earnings—a cushion that gives it plenty of flexibility to keep growing the dividend or reinvest in its business. That kind of buffer is what makes a dividend feel secure, especially during tough underwriting cycles or economic uncertainty.

Return on equity above 16% also points to a management team that knows how to put capital to work. It’s not just about retaining earnings—it’s about getting a solid return from them. That’s critical for dividend growth over time.

The balance sheet looks healthy. Total debt stands at $784 million, which is more than manageable relative to the company’s equity and cash flows. The debt-to-equity ratio is under 28%, and cash on hand tops $435 million. Operating and free cash flows are robust, with levered free cash flow coming in above $600 million. That’s far more than enough to fund the dividend without leaning on debt or cutting into reserves.

THG’s dividend policy seems built for the long haul. It’s not aiming to impress quarter to quarter—it’s trying to build something durable. For income investors, that’s often more valuable than the highest yield on the board.

If you’re looking for a dividend that comes with a little less drama and a lot of staying power, Hanover Insurance checks several important boxes. The numbers back it up. The company isn’t overextending itself, yet it’s delivering income in a very steady, shareholder-friendly way.

Chart Analysis

Price Trend and Moving Averages

The chart paints a picture of steady strength. Over the past year, the price has climbed from under $120 to nearly $180, with a smooth, stair-step ascent that’s hard to ignore. Both the 50-day and 200-day moving averages are sloping upward, and importantly, the shorter-term 50-day MA has remained above the 200-day MA since early August. That’s a sign of sustained positive momentum, not just a temporary bump.

What really stands out is how cleanly the stock has respected these moving averages—particularly during pullbacks. Dips toward the 50-day line were consistently met with buying interest, and even when the price flirted with consolidation zones, it didn’t break trend.

Volume Behavior

Looking at volume, the story adds another layer. There were clear volume surges during breakouts, particularly in mid-July and late October, confirming buyer conviction during those climbs. The volume isn’t overly aggressive, but that’s actually encouraging. It signals steady accumulation rather than speculative trading.

The lack of panic volume during brief pullbacks also reflects confidence. Traders weren’t rushing for the exits even when the price paused or dipped. Instead, volume generally faded during corrections and picked back up as the stock resumed its climb.

Relative Strength Index (RSI)

The RSI is hovering near overbought territory but hasn’t broken too far above the 70 level. That suggests strength, not euphoria. This isn’t a name that’s getting chased by speculative flows—it’s moving with underlying support and measured interest. Even when the RSI dipped to around 30 back in June, it was short-lived and quickly reversed higher.

Throughout the last several months, RSI has generally held between 50 and 70, which aligns with a stable uptrend. It’s not overheated, and it hasn’t shown real signs of exhaustion. In other words, momentum is strong, but still under control.

Recent Candles and Price Behavior

Zooming into the last five candles at the far right, they show a continuation of upward movement, with a push to fresh highs. The wicks are telling. There’s some upper shadowing, hinting at mild selling into strength, but none of it looks aggressive or heavy. Buyers continue to step in on dips, and closes have remained near the highs of each daily range.

That kind of tight price action near the top of a channel often reflects steady hands in control—not speculative froth. The pattern says there’s still interest at these levels, even with the stock making new highs.

Overall Impression

This chart reflects a mature uptrend built on consistent accumulation and patient buying. There are no erratic spikes or blow-off tops. The strength has developed in phases, with consolidations followed by renewed advances. From a price and volume standpoint, it shows stability and long-term participation, not just short-term hype.

Balance Sheet Analysis

Hanover’s balance sheet tells a story of quiet strength and measured growth. Over the past three years, total assets have steadily risen from just under $14 billion to over $15.2 billion. Liabilities have also increased—but at a slower pace—leading to a noticeable improvement in shareholder equity, which climbed from $2.3 billion in 2022 to nearly $2.84 billion by the end of 2024. That kind of capital build isn’t just for show—it reinforces the company’s ability to weather unexpected events without having to pass the hat around.

Debt, meanwhile, is practically napping. Total debt barely moved, creeping from $781.6 million in 2021 to $784.1 million today. When a company’s liabilities grow less than your grocery bill, it’s worth noting. Net debt actually declined over that period, and tangible book value has been on a solid climb, now standing at $2.66 billion. That suggests THG isn’t leaning on financial engineering or magic tricks to make things work—it’s running a tight, conservative operation with real assets behind it.

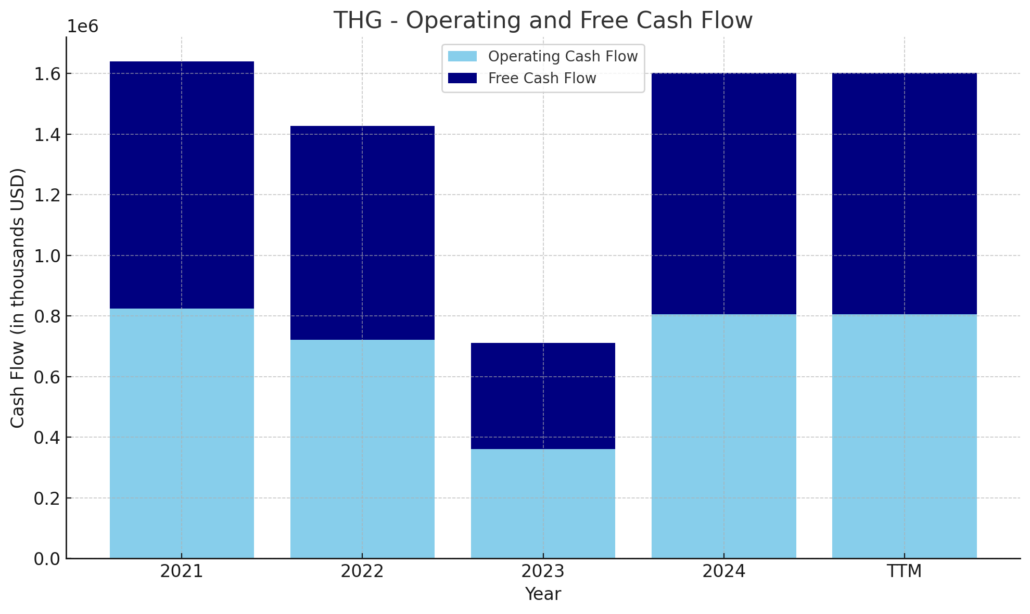

Cash Flow Statement

Cash flow from operations over the trailing twelve months tells a solid story for Hanover, hitting just over $806 million. That’s more than double what it generated in 2023, signaling a bounce-back in efficiency and core earnings power. Free cash flow follows closely at $796 million, showing the business isn’t just making money—it’s keeping it. Capital expenditures remain low and steady, around $10 million, which means the company doesn’t need to pour massive amounts back in just to keep the lights on.

On the investing and financing side, things stay fairly uneventful—which, in this case, is a good thing. The outflows from investing activities have increased compared to last year, mainly from portfolio management typical of an insurance firm. Financing activity also leaned negative, thanks to share repurchases and dividend payouts. But with a rising cash balance now sitting at $435 million, it’s clear Hanover isn’t scrambling for liquidity. Instead, they seem to be steering with a steady hand, keeping enough cash on hand while returning capital responsibly.

Analyst Ratings

📊 In recent months, The Hanover Insurance Group (THG) has been the subject of shifting analyst sentiment, as Wall Street digests its steady performance and ongoing valuation climb. As of early April 2025, the consensus from nine analysts sits at a “Hold” rating, with an average price target of around $179.00. That’s just a small step above the current price, suggesting most expect limited near-term movement, but no serious downside either.

🚀 On the bullish side, Piper Sandler bumped their price target from $190.00 to $205.00 while maintaining an “Overweight” rating. That kind of upgrade doesn’t come lightly—it reflects their confidence in THG’s earnings strength and balance sheet resilience. Another slight push came from Keefe, Bruyette & Woods, who nudged their target up to $179.00 in February and reaffirmed a “Market Perform” stance. Not exactly a cheerleader, but definitely not pessimistic either.

🧐 Meanwhile, a more cautious tone came from Janney Montgomery Scott late last year. They downgraded the stock to “Neutral” with a $176.00 target, signaling that they see the current price as mostly fair and not overly compelling for new buyers.

📈 Taken together, these views paint a picture of a stock that’s well-respected but not flying under the radar anymore. It’s earned its recent gains, and while a few analysts see room for more, most are watching to see if fundamentals continue to justify further upside.

Earning Report Summary

Strong Finish to the Year

The Hanover Insurance Group wrapped up 2024 on a high note, turning in a solid fourth-quarter performance that showed real strength across the board. Net income came in at $167.9 million, or $4.59 per share, which is a healthy jump from $107.9 million, or $2.98 per share, this time last year. Operating income followed suit, landing at $194.6 million, or $5.32 per share, compared to $113.1 million in the prior-year quarter.

That kind of earnings growth doesn’t happen by accident. A big part of it came from strong premium growth. Net premiums written were up 7.4% year over year, crossing the $1.5 billion mark. More importantly, the company improved its combined ratio to 89.2%, down from 94.2%. For folks who track insurance metrics, that’s a clear sign Hanover is underwriting with more precision and less risk exposure.

Investment Income and Segment Strength

Another bright spot was investment income, which rose more than 23% in the fourth quarter. Over the full year, it grew 12%, thanks in part to the company’s decision to shift away from lower-yielding fixed income assets. That gave earnings an extra lift and speaks to some smart calls being made behind the scenes.

Drilling into specific segments, both Core Commercial and Specialty performed well. Core Commercial brought in $71 million in pre-tax operating income, up from $52.8 million, while the Specialty line climbed to $83.3 million from $70.5 million. Both areas also reported better combined ratios, showing tighter execution and improved margins.

All in all, Hanover ended 2024 with some real momentum. Growth wasn’t just about collecting more premiums—it came with stronger underwriting results, better investment returns, and solid gains across business units.

Management Team

The Hanover Insurance Group’s leadership is built on deep industry experience and long-standing commitment. At the top is President and CEO John C. Roche, who joined the company in 2006 and stepped into the chief executive role in 2017. His background spans decades in insurance, and his steady leadership has been a key part of Hanover’s strategy. CFO Jeffrey M. Farber brings a sharp financial lens to the table, overseeing everything from capital allocation to risk modeling. On the legal and compliance side, Dennis F. Kerrigan serves as Chief Legal Officer, keeping the regulatory and corporate governance structure in check. Richard W. Lavey leads the agency-facing parts of the business as President of Hanover Agency Markets, building on strong relationships with brokers and agents across the country. The team’s structure reflects balance—finance, legal, operations, and distribution all working in lockstep. That alignment has been instrumental in Hanover’s recent run of profitable quarters and operational stability.

Valuation and Stock Performance

As of early April 2025, Hanover shares closed at $174.95, just a hair below the 52-week high of $176.16. Over the past year, the stock has gained over 31 percent, handily outperforming the broader market. The price has moved steadily higher, with no wild swings, and that’s matched by strong fundamentals.

The trailing price-to-earnings ratio sits at 14.98, while the forward P/E is lower at 11.86. That suggests analysts see room for continued earnings growth. The price-to-book ratio is currently 2.22, which means the stock trades at more than twice its book value—reasonable for an insurer with a track record of profitability. The company’s market cap is around $6.3 billion, keeping it in the mid-cap space, though it punches above its weight in terms of return on equity and margin consistency.

Volatility is low, with a five-year beta of 0.66. That stability, paired with consistent earnings, may explain why the stock has attracted attention from both income-focused and conservative growth investors. Analyst sentiment is mixed but leaning positive, with most calling the stock fairly valued at current levels. The average target price is hovering just below where the stock currently trades, implying expectations of modest gains ahead unless new catalysts emerge.

Risks and Considerations

Even the best-run insurance companies face their share of risk. Natural disasters, unexpected litigation, and sharp changes in claims patterns can all impact results. Hanover has done well to keep its combined ratios in check, but underwriting is never foolproof. There’s also the interest rate environment to consider. While higher rates have helped boost investment income lately, any sudden moves in bond yields or macroeconomic policy could shift that dynamic quickly.

Regulatory risk is another area to watch. Insurance companies operate under tight rules, and even small changes at the state or federal level can have ripple effects across underwriting, reserving, and capital requirements. And of course, the competitive landscape is always shifting. Larger players with more scale can undercut pricing, while smaller, more nimble firms might carve out niches in specialty markets. Hanover’s strength lies in its balanced portfolio and strong distribution network—but even those advantages require regular fine-tuning to maintain.

Final Thoughts

Hanover continues to deliver a solid mix of growth and consistency. Its leadership team knows the business inside and out, and the financials back that up. The valuation seems grounded in reality—not overly stretched, not undervalued. That positions the company well for steady performance, assuming macro conditions don’t shift too dramatically.

It’s not a stock that tries to steal the spotlight, but that’s part of the appeal. It’s well-managed, deliberate, and focused on long-term execution. While no company is without risks, Hanover has demonstrated it can navigate the landscape with discipline and strategy.