Updated 7/17/2025

The Bank of New York Mellon Corporation (BK) has steadily positioned itself as a dividend-paying financial powerhouse, with over $1.88 per share in annual payouts and a history rooted in both stability and transformation. Its forward dividend yield stands at 2.06%, backed by a conservative payout ratio just under 30%, giving the company room to continue rewarding shareholders while reinvesting for long-term growth.

Recent quarters have reflected the impact of strategic changes under CEO Robin Vince, including a platform-based model aimed at streamlining operations and boosting client service. With strong returns on equity, a growing cash position, and a disciplined approach to capital management, BK continues to attract investors looking for a mix of income, efficiency, and steady execution.

Recent Events

BK’s recent earnings gave investors more than just a reason to feel good—they gave a reason to trust the company’s path forward. First-quarter numbers showed a solid 19% jump in earnings from the year before, alongside a healthy 6% rise in revenue. Not fireworks, but definitely solid footing.

With a return on equity of 11.23% and an operating margin just above 32%, BK is showing that it’s running a tight ship. The bank is keeping costs in check while generating dependable profits. Add in a profit margin north of 25%, and you’ve got the kind of financial discipline that’s music to the ears of income-focused investors.

Even more telling is the cash position. BK is sitting on more than $171 billion—yes, billion—with a ‘B’. That doesn’t just provide security, it gives the company options. And with more than $1.88 per share being returned annually to shareholders in dividends, it’s clear those options include rewarding long-term investors.

The market seems to be catching on. Shares have comfortably climbed above both their 50-day and 200-day moving averages. Quiet strength, built on fundamentals—that’s what BK’s recent trajectory tells us.

Key Dividend Metrics 📊

📈 Forward Dividend Yield: 2.06%

💵 Annual Dividend Rate: $1.88

📆 Dividend Date: May 2, 2025

🚪 Ex-Dividend Date: April 21, 2025

🔁 Payout Ratio: 29.85%

📉 5-Year Average Dividend Yield: 2.85%

📈 Trailing Dividend Yield: 1.97%

🧮 EPS (Trailing Twelve Months): $6.54

Dividend Overview

If you’re looking for a flashy yield, BK isn’t going to knock your socks off at first glance. A 2.06% forward yield is modest, especially compared to some higher-yielding sectors. But here’s the thing—it’s not about chasing the highest payout. It’s about finding reliable income from companies that know how to manage through cycles. And BK checks that box.

The bank’s payout ratio is comfortably under 30%, which gives the dividend room to grow. It’s not stretching earnings to keep shareholders happy—it’s rewarding them with part of a sustainable, healthy profit stream. For income investors, that’s exactly what you want to see.

Now, if you compare the current yield to its 5-year average of 2.85%, it might look a little thin. But that drop is mostly thanks to a rising stock price. As BK’s valuation climbs, yield compresses. Still, what you’re left with is a stronger company than it was a year ago—and one that’s kept its dividend steady all the while.

This isn’t a company that’s paying a dividend because it doesn’t know what else to do. It’s paying because it can afford to, without compromising long-term strength.

Dividend Growth and Safety

When it comes to the safety of that dividend, BK gives plenty of reasons to sleep well at night.

While it might not have the decades-long dividend increase history of some blue-chip names, BK has steadily kept its payout on track—even through tougher market environments. And with its current payout ratio sitting below 30%, there’s ample headroom to continue that track record without needing perfect economic conditions.

It’s also worth highlighting that the company carries over $70 billion in debt—but don’t let that spook you. With more than double that amount in cash, BK’s balance sheet leans toward strength. They’re not borrowing to pay dividends; they’re earning their way to shareholder returns.

Institutional investors seem to agree. Nearly 89% of the float is held by large funds and institutions. That kind of backing often signals confidence in both the business model and the dividend stream.

For dividend-focused investors, BK offers a combination that’s becoming harder to find—dependable income, capital strength, and room for growth. It’s not trying to be the highest yielder on the block, but it does aim to be one of the most consistent. And sometimes, that’s exactly the kind of dividend payer you want in your portfolio.

Cash Flow Statement

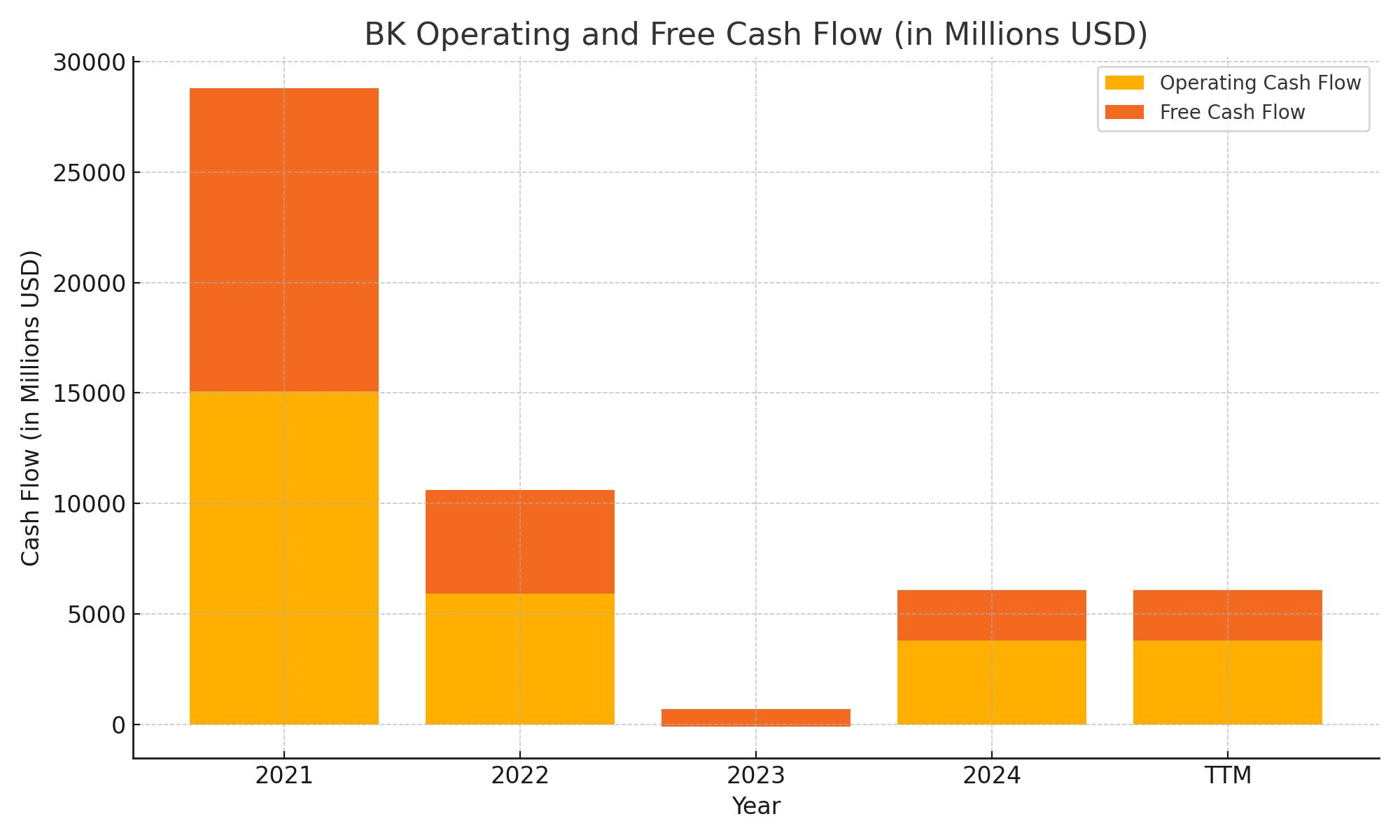

BNY Mellon’s trailing twelve months (TTM) show operating cash flow of $3.78 billion, which, while not as strong as the peak of $15 billion in 2021, reflects a steady recovery from a lower 2022 figure. Free cash flow sits at $2.29 billion for the same period, indicating a healthy ability to cover dividends and reinvest without stretching resources. Capital expenditures have remained relatively stable, with $1.49 billion in outflows, showing consistency in infrastructure and tech investment.

Investing cash flow was negative at $1.54 billion TTM, suggesting BK continues to allocate capital toward longer-term strategic assets, following a sharper pullback from a positive $19.87 billion in 2021. Financing cash flow came in negative at $995 million, as debt repayments outpaced issuances and share buybacks remained active. The company ended the period with $8.45 billion in cash, slightly higher than the previous year, pointing to prudent liquidity management despite fluctuations in financing activities.

Analyst Ratings

In mid-July, BK saw a round of analyst updates that pointed to a stronger near-term outlook. 🟢 Truist Securities bumped their price target from $97 to $100, driven by improvements in fee income across services like clearance and FX, along with stronger net interest income. They maintained a hold rating, but the upgraded target reflects growing confidence in the bank’s Q2 results.

Wells Fargo also made a move, increasing their target from $96 to $100. 📈 They kept their equal-weight rating but highlighted that the bank’s steady earnings recovery and solid fee income were encouraging. Over at Keefe, Bruyette & Woods, the optimism was more pronounced—they raised their target from $105 to $113 and maintained an outperform rating. 🔵 Their reasoning centered around BK’s strong returns on tangible equity and solid margin trends, which they see continuing through the back half of the year.

Back in March, Citigroup had adjusted their view slightly, raising their neutral price target from $82 to $85 after evaluating fee trends and overall revenue stability. 🟡

The consensus price target from analysts now hovers between $95 and $100, suggesting moderate upside from current levels. Overall, analysts appear cautiously bullish, supported by a combination of margin strength and consistent fee generation.

Earning Report Summary

BNY Mellon delivered a strong second-quarter performance, showing real momentum on both sides of its business. Total revenue came in just over $5 billion, which is a new record for the firm and reflects about a 9% jump from the same period last year. Net interest income grew by 17%, and fee-based revenue wasn’t far behind with a 7% lift. Areas like asset servicing and issuer services played a big role in that, helping drive overall growth. Earnings per share hit $1.93, which is a solid 27% increase from a year ago, and the return on tangible common equity pushed up to nearly 28%.

Leadership’s Take

Robin Vince, the CEO, pointed out that this quarter felt like a real turning point for the company. He talked about the success of their new platform model, which is changing how they operate internally and deliver services. According to him, this approach is speeding things up, improving service quality, and making it easier to bring new ideas to market. He mentioned that this was the second straight quarter of record-breaking sales under that model, and they’re seeing early signs that it’s helping improve outcomes for both clients and the company itself.

Cost Discipline and Balance Sheet Strength

What really stood out this quarter was the efficiency. Even as revenue climbed, non-interest expenses were held to just a 4% increase. That kind of control gives BK some nice operating leverage and shows management is staying disciplined. Deposits also moved up about 5%, hitting $300 billion, and their Tier 1 leverage ratio rose to 6.1%, which is solid for a bank of this size. They’re in a good spot from a capital perspective, and they’re not afraid to use that strength to reward shareholders.

Looking Ahead

Management made it clear they’re staying aggressive with capital returns. The payout ratio for the year is hovering around 92%, and the plan is to return nearly all earnings to shareholders. They also see more upside ahead. The expectation is that net interest income will keep climbing at a high single-digit pace, and fee revenue should remain on a steady growth path as well. Even with some uncertainty in the broader economy, BK seems confident in its ability to keep pushing forward.

Management Team

BNY Mellon’s leadership team blends deep financial experience with a forward-looking approach. CEO Robin Vince has taken a hands-on role in steering the bank’s strategic evolution, particularly through its shift toward a more integrated, platform-driven model. He’s focused on making the organization faster, more efficient, and better aligned with modern client needs. His approach has already started to show up in stronger earnings and smoother operations across business lines.

Supporting him, CFO Luca Volpicella has continued to maintain a firm grip on the bank’s financial health. Under his direction, the company has managed deposit growth and improved its capital ratios, all while keeping operating expenses under control. Together, Vince and Volpicella form a steady and focused leadership core. They’ve also surrounded themselves with key leaders in asset servicing, issuer services, and technology who are pushing to modernize the bank’s client platforms while preserving the financial prudence that defines BNY Mellon’s identity.

Valuation and Stock Performance

BNY Mellon’s stock has been on a steady upward climb, reflecting improved financial results and more optimism about the bank’s long-term direction. The shares are trading near their 52-week high and well above their longer-term moving averages. The forward price-to-earnings ratio sits around 14, which places it slightly above the average for peers, though investors seem comfortable with that given the improvements in net interest income and overall efficiency.

The market has begun to reward BK’s consistency and strategic clarity. Price-to-book value has moved up over the past year, now near 1.8, suggesting that investors are recognizing stronger return potential from each dollar of equity. Volume trends also suggest that institutional buyers have been accumulating shares, especially after the stock cleared the $95 level and stayed above that range. Analyst targets currently cluster between $95 and $100, with some bullish calls stretching as high as $113. While this implies more modest upside from current levels, the foundation for future growth appears increasingly solid.

Risks and Considerations

Even with momentum on its side, BNY Mellon isn’t without its challenges. Interest rates are always a wildcard for a bank of this size. The recent gains in net interest income have come in part thanks to higher rates, but that could shift quickly depending on monetary policy changes. If the rate environment softens faster than expected, income from interest-bearing assets might come under pressure.

Another area of risk is global market behavior. As one of the world’s largest custodial banks, BK’s fee income is tied to transaction activity and asset flows. If financial markets go quiet or turn volatile, some of that high-margin fee income could shrink. There’s also operational risk. The shift to a more platform-driven model is promising, but any delays, system issues, or cost overruns could weigh on the bank’s near-term efficiency gains.

The company also carries exposure to foreign economies and regulatory shifts. Although its risk management approach is conservative, unexpected events overseas or within large institutional client portfolios could create surprises. Still, the balance sheet remains strong and highly liquid, which gives the bank breathing room in uncertain environments.

Final Thoughts

BNY Mellon has moved into a different phase—less about defending its position and more about evolving it. The consistent improvements in profitability and margin structure are beginning to match the forward-looking tone coming from leadership. The dividend remains well-supported by cash flow and earnings, and the bank is increasingly structured to adapt to whatever market conditions lie ahead.

While the stock may not have runaway upside from current levels, it offers a steady, dependable profile with just enough strategic ambition to keep investors interested. The commitment to capital return, paired with a sharp focus on modernization, suggests that BNY Mellon is working to stay relevant not just today, but well into the next cycle. For investors who value consistency with a side of quiet progress, that combination is tough to ignore.