Updated 7/17/2025

New Jersey Resources Corporation (NJR), a diversified energy company based in New Jersey, blends the dependable cash flow of its regulated natural gas utility with growth-driven segments like clean energy and energy services. With a current share price around $45.79, a 4% dividend yield, and a management team focused on steady execution, NJR offers a well-rounded profile for income-focused investors.

Earnings have shown consistent strength, supported by rate base growth, smart capital deployment, and a strategic solar portfolio sale. Leadership has raised full-year guidance, while maintaining a long-term earnings growth target of 7–9%, signaling confidence in the company’s momentum heading into the second half of the year.

Recent Events

This past year has been relatively strong for NJR. The company posted 23% revenue growth year-over-year, bringing in $2.07 billion in the trailing twelve months. Net income hit $415 million, reflecting a solid 20% profit margin—impressive for a utility. So while some numbers suggest rising costs or infrastructure spend (like the -7.47% operating margin), the big picture remains intact: NJR is turning a healthy profit.

On the valuation front, the stock trades at a trailing price-to-earnings ratio of 11.2, with a forward P/E closer to 14.6. That places it in a reasonable range for the sector, and definitely not overpriced for what it offers. At a $4.64 billion market cap and $7.94 billion enterprise value, it’s clear there’s debt on the books, but nothing out of the ordinary for a utility.

Earnings stability, valuation that doesn’t stretch the imagination, and continued investment in infrastructure—these are the kinds of updates long-term investors like to see.

Key Dividend Metrics

💰 Forward Dividend Yield: 4.02%

🔁 5-Year Average Yield: 3.54%

📈 Dividend Growth Rate (5-Year): Mid-single digits annually

🧮 Payout Ratio: 42.96%

📅 Next Dividend Date: July 1, 2025

⚖️ Dividend Coverage: Healthy and well-supported

These numbers aren’t just window dressing—they’re a snapshot of what NJR really offers to income investors. A 4% forward yield is hard to ignore, especially from a company that’s not taking on undue risk to get there. The payout ratio under 45% shows the dividend isn’t overextended. And that five-year average yield north of 3.5% gives investors confidence that this isn’t a short-term spike—it’s been consistent.

Dividend Overview

NJR’s dividend reputation has been quietly built over decades. The company currently pays an annual dividend of $1.80 per share, up a tick from last year’s $1.77. It’s not dramatic, but that’s not the point. They’ve steadily increased the payout over time, and they’ve done it without skipping a beat—even during turbulent economic stretches.

Quarter after quarter, NJR keeps that dividend flowing. There’s no theatrics. It’s just dependable income. That reliability is rooted in the nature of its core business—regulated utilities backed by predictable revenue—and reinforced by conservative management. The stock’s five-year beta sits at 0.64, meaning it tends to move less than the market. For dividend investors looking for calm in the storm, that low volatility adds to the appeal.

Dividend Growth and Safety

While NJR won’t blow anyone away with huge dividend hikes, the growth it does deliver is consistent. Over the past five years, investors have seen mid-single-digit increases. That’s comfortably ahead of inflation and far from stagnant. Crucially, the payout isn’t eating up too much of the company’s earnings. With a payout ratio sitting at 42.96%, there’s cushion. That’s the breathing room companies need when markets get rocky or capital costs rise.

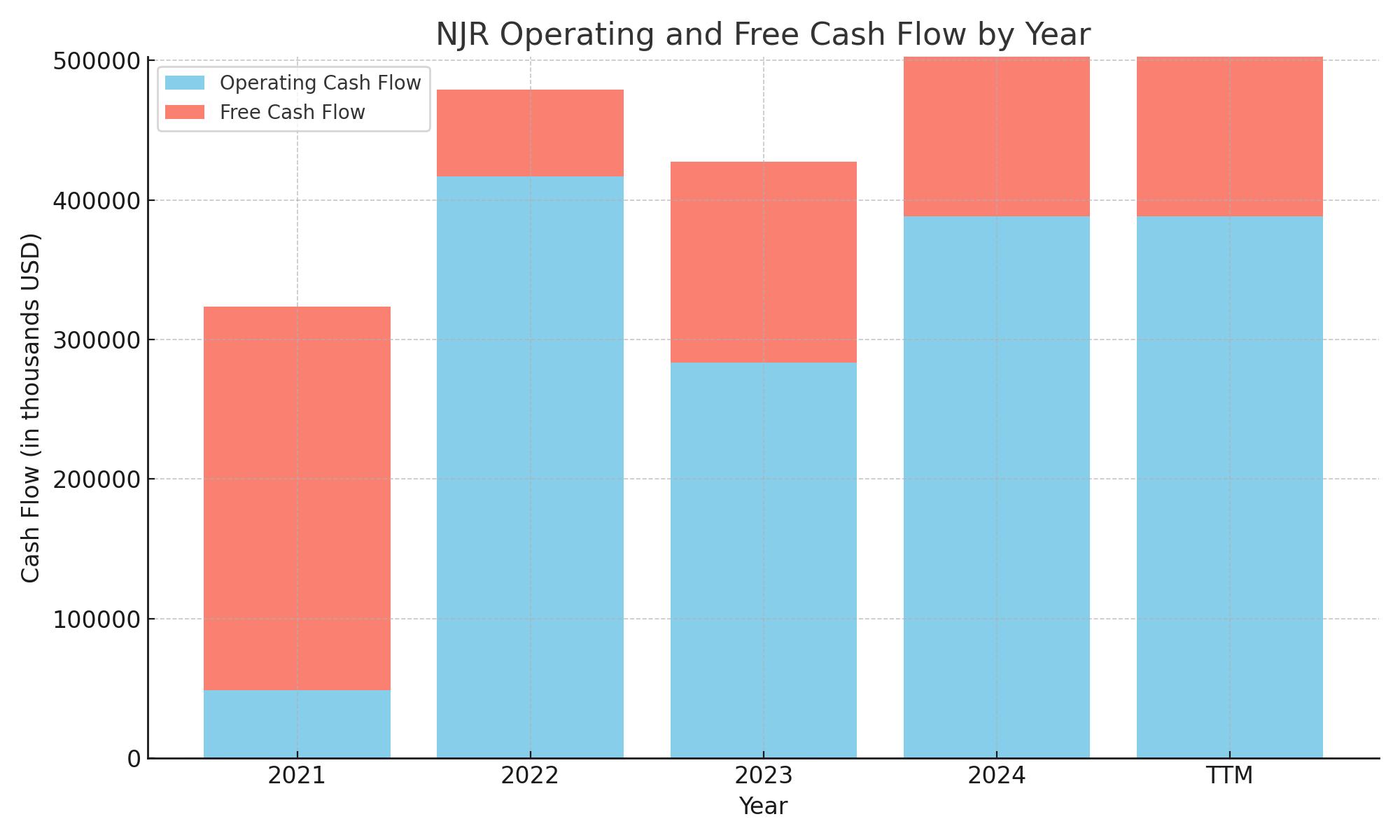

Cash flow tells another part of the story. NJR brought in $502.9 million in operating cash flow over the past year. Levered free cash flow dipped negative, coming in at -$136.4 million. That’s not ideal, but it likely reflects timing—especially if major infrastructure or clean energy projects are ramping up. Historically, free cash flow has been sufficient to support dividends, and there’s little to suggest that’s changing in a meaningful way.

From a capital structure standpoint, NJR runs a tight but steady ship. While detailed debt figures weren’t included this time around, its long-term debt ratios have been in line with peers. A current ratio of 0.93 suggests liquidity is tight in the short term, but again, this isn’t uncommon for utilities with stable receivables and well-planned financing.

One last thing worth noting: institutional investors hold over 78% of NJR stock. That kind of ownership usually comes with expectations around risk control, earnings quality, and dividend sustainability. It’s a good sign when the big money is aligned with what dividend investors care about—stable income and long-term value.

When you look at NJR as a whole, it’s not trying to dazzle. It’s trying to deliver—quarter after quarter, year after year. And for dividend-focused investors, that quiet consistency might be exactly what they’re after.

Cash Flow Statement

New Jersey Resources generated $502.9 million in operating cash flow over the trailing twelve months, up from $427.4 million the year before. That’s a meaningful improvement and reflects the strength of its core utility operations. Despite that, capital expenditures remained heavy, totaling $617.6 million over the same period. As a result, free cash flow came in at a negative $114.7 million, continuing a trend of negative free cash flow seen in recent years. This isn’t unusual for a capital-intensive business, especially one investing in infrastructure and energy assets with long-term payoff horizons.

On the financing side, the company raised $377.7 million through new debt and brought in another $58.6 million via stock issuance. Debt repayments totaled $228.7 million. The cash balance at the end of the period landed at $84.7 million—much higher than recent years, signaling improved liquidity. NJR also paid out $124.9 million in interest and around $21.3 million in taxes. While negative free cash flow might raise eyebrows in some sectors, for a regulated utility reinvesting in its asset base, it often reflects a growth-oriented strategy rather than financial stress.

Analyst Ratings

📈 In mid-2025, several firms weighed in with fresh views on NJR. Raymond James started coverage on June 13 with an outperform rating and a $49 price target, signaling quiet confidence in the stock’s potential. A few weeks earlier, on May 28, J.P. Morgan reaffirmed its overweight stance but slightly lowered its price target from $56 to $51. The adjustment came amid cautious commentary about near-term pressures in the energy space that could limit upside for now.

📉 On the more conservative end, Mizuho revised its neutral rating target from $52 down to $50 on May 15. Their tone reflected some concern about rising infrastructure costs and the regulatory environment, which may weigh on returns in the coming quarters. That said, they didn’t downgrade the stock—just dialed back expectations.

🔄 Wells Fargo, meanwhile, took a slightly more upbeat position on May 7, bumping its target from $51 to $53 while maintaining an equal-weight rating. Their outlook was driven by stronger-than-expected demand and operational steadiness across NJR’s natural gas segments.

🎯 Right now, the average analyst price target sits around $51.30. That implies about 12% upside from where the stock is currently trading. The range stretches from $49 on the low end to $54 on the high end, with a general lean toward cautious optimism. Overall sentiment reflects confidence in NJR’s core business, balanced against near-term variables like capex timing and broader energy market shifts.

Earning Report Summary

Solid Quarter with a Jump in Earnings

New Jersey Resources turned in a strong showing for the second quarter of fiscal 2025. Net income climbed to $204.3 million, or $2.04 per share, up from $120.8 million, or $1.23 per share, in the same quarter last year. On an adjusted basis, which strips out one-time items, earnings came in at $1.78 per share—well ahead of last year’s $1.41. Revenue reached $913 million for the quarter, benefiting from strong utility demand and some well-timed activity in its energy services business.

What really stood out was the impact of higher base rates on the regulated utility side, along with a meaningful gain from selling off its residential solar portfolio. That one-time boost helped push results beyond expectations and gave the company a little more financial flexibility heading into the back half of the year.

Leadership Commentary and Outlook

CEO Steve Westhoven spoke positively about the quarter, noting the strength of NJR’s diversified business model. He pointed to the company’s infrastructure and the performance of its Energy Services unit, which took advantage of winter gas market volatility. Clean Energy Ventures, which had been a drag in prior quarters, saw better results this time around—nearly breaking even thanks to more solar energy sales and lighter depreciation costs.

Capital spending came in around $287 million for the first half of the year. Most of that was funneled into infrastructure and clean energy projects. Operating cash flow has also picked up—rising to $414 million from $339 million a year ago. That boost gives the company more room to keep investing while maintaining a steady dividend and balance sheet.

Looking ahead, NJR raised its full-year earnings guidance to between $3.15 and $3.30 per share, up from the previous range. They’re also standing by their long-term goal of 7 to 9 percent annual earnings growth. Management credits the increased outlook to solid execution across segments and confidence in the rest of the year.

All in all, this was a confident report from a company that’s been steadily building value through its core utility operations while making smart moves in the clean energy space.

Management Team

New Jersey Resources is led by a steady and experienced leadership team focused on long-term value and operational consistency. Steve Westhoven, the company’s CEO, brings over 20 years of experience with NJR and has served in the top role since 2019. His approach has been to balance the predictable performance of the core utility business with forward-looking investments in renewable energy and infrastructure. With a background in engineering, Westhoven’s leadership style is grounded in practical execution and a focus on long-term planning.

He’s supported by a leadership group that has been with the company through multiple market and regulatory cycles. Their strength lies in disciplined financial management, a deep understanding of the regulatory landscape, and a methodical approach to capital deployment. The team has successfully guided NJR through industry changes while maintaining steady earnings growth and a reliable dividend strategy. They continue to prioritize core operations while selectively growing in areas like clean energy that align with the company’s broader vision.

Valuation and Stock Performance

As of the latest trading, NJR shares are priced at $45.79. That puts the stock a bit below its 52-week high of $51.95 but comfortably above the low of $42.33. The current valuation reflects a trailing price-to-earnings ratio of 11.2, with a forward P/E just under 15. That signals expectations of continued earnings stability, and possibly modest growth, in the near term. For investors seeking dependable value without overpaying, NJR offers a relatively balanced price point compared to broader utilities.

Over the past year, the stock has gained just over one percent. That’s slower than the overall market, but NJR isn’t built for high-speed growth. The strength here is total return—driven primarily by its dividend, which currently yields around 4 percent. It’s the kind of stock investors lean on for income and downside protection, especially in uncertain markets. Its beta of 0.64 reinforces the idea that NJR tends to move more calmly than the broader indices.

From a technical angle, the stock is hovering just below its 200-day moving average of $47.14. While that doesn’t create a breakout scenario, it does suggest a fairly valued position where downside looks limited and upside could materialize with improving sentiment or stronger earnings updates.

Risks and Considerations

Like any utility, NJR faces its share of challenges. Regulatory risk tops the list, as natural gas utilities are highly influenced by state-level decisions. If there’s a push toward more aggressive decarbonization or regulatory changes around rate structures, earnings could be impacted. That said, NJR has long maintained good relationships with regulators and has navigated similar policy environments in the past.

Capital requirements are another key consideration. The company continues to invest heavily in infrastructure and clean energy. While that should support future growth, it also leads to negative free cash flow in the near term. Financing those projects depends on a healthy balance of debt and equity, and rising interest rates can complicate that formula. For a business like NJR’s, higher borrowing costs can tighten margins, even if revenues stay consistent.

The Energy Services segment adds a layer of unpredictability. It performs best in volatile gas markets but can struggle when pricing is flat. That creates some earnings variability outside the stable utility core. Weather is another wildcard. Milder winters may reduce demand for heating and cut into throughput, though rate-based revenue helps cushion that impact.

None of these risks are unusual for a utility, but they’re important for investors to keep in mind—especially those relying on NJR for income and capital preservation.

Final Thoughts

New Jersey Resources isn’t a stock that makes a lot of noise, but it continues to do exactly what many dividend-focused investors want. It offers consistent earnings, a strong dividend yield, and a management team that knows how to navigate both regulated markets and growth investments. The company has a well-balanced approach to capital allocation, combining steady core performance with strategic pushes into renewables and infrastructure upgrades.

The stock trades at a valuation that makes sense, not overpriced but not in distress either. It may not outperform in bull markets, but it delivers where it matters most for long-term holders—dependability, yield, and a disciplined path forward. Even with some short-term pressures around regulation, interest rates, and capital spend, NJR appears well-positioned to keep delivering what it has for years: stability, income, and gradual growth.

For investors looking to hold a name that leans conservative but still evolves with the times, NJR remains a stock worth keeping on the radar.