Updated 7/17/2025

NBT Bancorp (NBTB) delivers consistent earnings and a dependable dividend, backed by more than 150 years of community banking experience. With operations across the Northeast and Mid-Atlantic, it focuses on core lending, deposits, and wealth management—supported by disciplined underwriting and a strong balance sheet. Recent quarterly results showed 9% revenue growth and an 8.6% increase in earnings per share, reflecting solid performance in a higher-rate environment.

The dividend yield stands at 3.27%, with a conservative payout ratio of 44.22%, allowing room for continued increases. Leadership maintains a steady hand, emphasizing capital strength, deposit retention, and risk management as they position the bank for long-term shareholder value.

Recent Events

The past year has offered a mixed, yet generally favorable backdrop for regional banks like NBT. With interest rates remaining elevated, the bank has seen a lift in net interest income—a key tailwind for earnings. That said, the rising rate environment also puts pressure on credit quality and customer borrowing. So far, NBT has navigated that balance well.

Revenue in the most recent quarter grew 9% from the year before, which is solid by any measure. Net income followed suit, posting 8.6% growth on a year-over-year basis. Earnings per share now sit at $3.03 over the trailing twelve months, supported by a respectable profit margin of 25.2%. The bank continues to run lean, with a strong operating margin near 36%.

NBT ended the quarter with $341.1 million in cash and $399.8 million in debt, keeping leverage moderate. While some banks have leaned into risk to chase returns, NBT has kept its profile conservative, with a low 5-year beta of 0.57 indicating less price movement relative to the market.

Perhaps most notably, institutional ownership remains high at just over 60%. That tells you the smart money sees stability here. Meanwhile, insider ownership is below 3%, suggesting the company’s leadership has confidence in the public equity story and doesn’t rely heavily on stock-based compensation.

Key Dividend Metrics

📈 Forward Yield: 3.27%

💰 Annual Dividend (Forward): $1.36

📆 Dividend Growth (5-year average): 4.2%

🔁 Payout Ratio: 44.22%

💪 Dividend Safety: Backed by consistent earnings and low leverage

📊 5-Year Average Yield: 3.14%

📅 Next Dividend Date: June 16, 2025

📉 Ex-Dividend Date: June 2, 2025

Dividend Overview

At first glance, a 3.27% forward yield might not seem eye-popping. But when you factor in the company’s stability and consistency, it becomes more compelling. That payout is made even more attractive by the fact it’s coming from a company that’s quietly grown its earnings and managed risk effectively over time.

NBT currently pays out $1.36 per share annually, split across quarterly payments. The most recent ex-dividend date was June 2, with the next dividend scheduled for June 16. This cadence of predictable distributions is a major draw for income-focused investors looking for reliability rather than speculation.

Perhaps the most reassuring figure is the payout ratio: 44.22%. That means NBT is distributing less than half its earnings to shareholders, leaving plenty of room to handle economic slowdowns, reinvest in the business, or even increase dividends down the road. That kind of flexibility is a big reason dividend investors can rest easier with NBT in their portfolio.

The current yield is also slightly above the five-year average of 3.14%, which suggests the stock may be modestly undervalued or, at the very least, offering a more attractive income stream than usual.

Dividend Growth and Safety

NBT isn’t known for dramatic dividend hikes, but what it offers is even better—steady, repeatable growth. Over the last five years, the average dividend increase has hovered around 4.2% annually. It’s not flashy, but it’s sustainable. And more importantly, it’s dependable.

The bank hasn’t cut its dividend in decades, not even during more turbulent financial periods. Management clearly views the dividend as a core part of shareholder return, not just an afterthought. That long-standing commitment builds trust—something not every bank can claim after the chaos of the financial crisis or more recent regional bank upheavals.

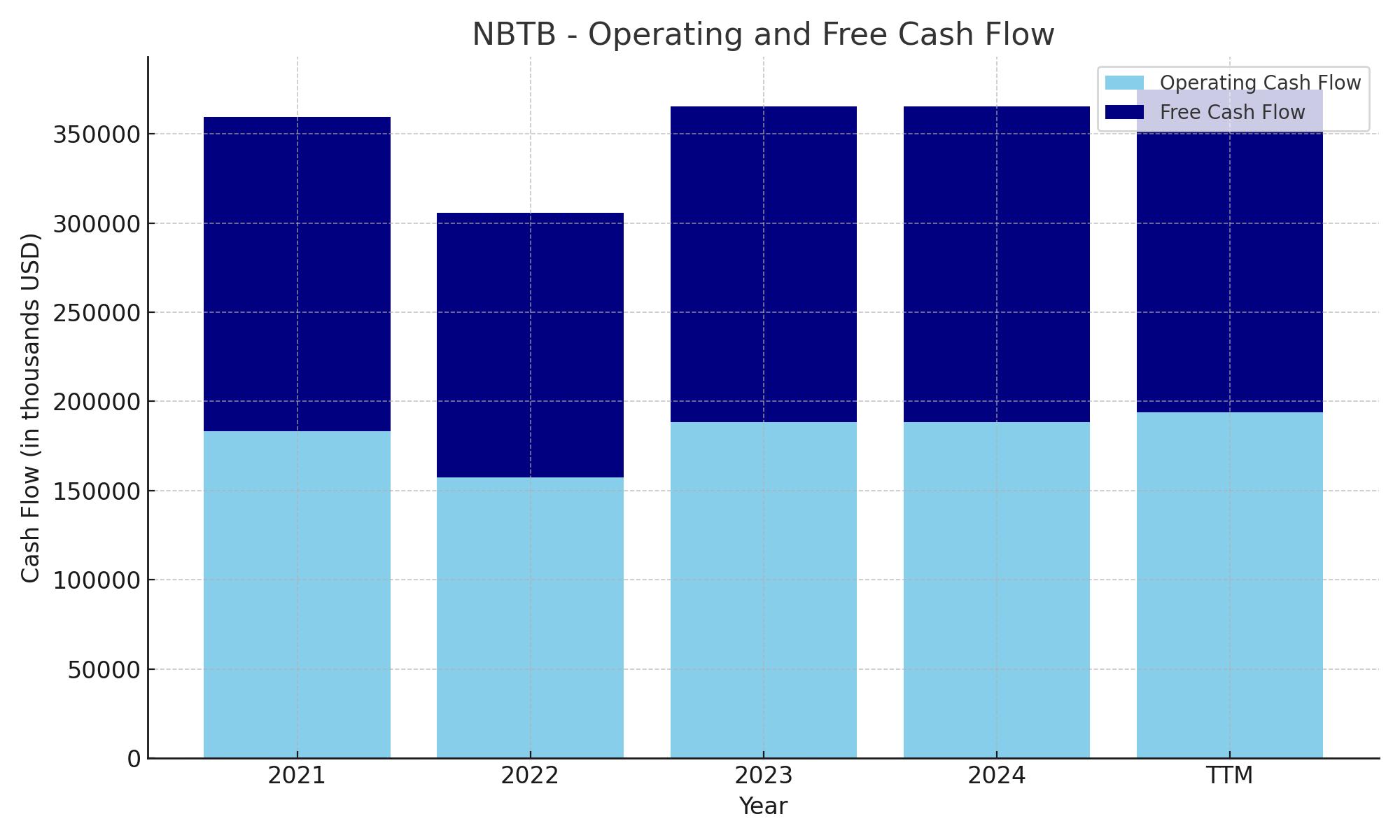

Cash flow tells the same story. NBT generated nearly $194 million in operating cash flow over the past year. With capex needs relatively low for a regional bank, most of that free cash supports either dividend payments or balance sheet strength. The company isn’t just earning money—it’s doing so in a way that supports consistent payouts without putting pressure on liquidity or leverage.

With a clean balance sheet, consistent profitability, and a cautious lending approach, there’s little reason to doubt the dividend’s durability. Even if interest rates shift or credit markets tighten, NBT appears well-positioned to maintain its payout—and continue its tradition of slow and steady growth.

Cash Flow Statement

NBT Bancorp generated $193.8 million in operating cash flow over the trailing twelve months, marking a steady increase from the $188.6 million posted in 2024 and continuing its post-2022 recovery. Free cash flow over the same period came in at $180.8 million, reflecting the bank’s ability to translate earnings into real cash without excessive reinvestment demands. Capital expenditures were modest at just over $13 million, consistent with NBT’s historically lean capital profile.

Investing activities saw a sharp outflow of $499.2 million, notably higher than the previous year’s $399.2 million, likely reflecting loan growth or securities purchases typical for banks during expansion phases. On the financing side, NBT pulled in $240.4 million, supported by reduced debt repayments and steady capital management. Despite aggressive investment activity, the bank maintained a healthy ending cash balance of $254.1 million, providing flexibility heading into future quarters. The combination of rising free cash flow and disciplined financing suggests a solid foundation for sustaining its dividend and weathering shifts in the rate or credit environment.

Analyst Ratings

📈 DA Davidson recently reiterated its buy rating on NBT Bancorp, though it adjusted the price target slightly downward from $57 to $53. The firm remains optimistic about the bank’s prospects for improved loan growth and consistent net interest margins, but it flagged rising credit costs as a potential headwind that could temper near-term performance.

🔍 Piper Sandler initiated coverage with a neutral stance, rating the stock a hold and setting a target of $47 as of July 8, 2025. While they acknowledged NBT’s steady earnings and strong historical performance, they expressed caution around the impact of prolonged higher interest rates potentially dampening new loan demand.

⬆️ Stephens & Co. made a more bullish move earlier in the year, upgrading the stock from equal weight to overweight in January. Their outlook was shaped by expectations for further margin expansion and solid capital positioning, which they believe offers a buffer against any macro softness.

⚖️ Raymond James shifted its rating from outperform to market perform in mid-2024. The rationale? Asset quality remained solid, but the analysts felt the near-term earnings growth could plateau unless the bank delivers stronger loan growth momentum.

🏦 Meanwhile, Keefe, Bruyette & Woods gave a slight boost to its price target to $55 in late 2024, citing encouraging trends in deposit growth and continued focus on expense control.

💬 The current analyst consensus target price hovers around $51.40, implying a potential upside in the 17–20% range from recent trading levels. While not universally bullish, sentiment leans positive with analysts recognizing NBTB’s disciplined management and earnings consistency.

Earning Report Summary

Solid Quarter with Steady Growth

NBT Bancorp’s latest earnings showed more of the quiet strength long-time shareholders have come to expect. Revenue was up 9% from the same time last year, mostly thanks to higher net interest income. That makes sense in today’s rate environment, where the bank has been able to carefully grow its loan book without chasing risk. It’s been a measured, deliberate strategy—and so far, it’s working.

Earnings per share came in at $0.76 for the quarter, bringing the trailing twelve-month figure to $3.03. That’s about an 8.6% improvement over last year. Profit margins stayed solid, with over 25% of revenue making it to the bottom line. Operating margins hovered around 36%, showing the bank is managing expenses well even as it continues to invest in core areas of the business.

Management’s Take on the Results

NBT’s leadership team sounded confident when discussing the quarter. The CEO pointed to solid loan demand, especially in commercial and mortgage segments, while acknowledging that consumer lending has cooled a bit. He emphasized that underwriting remains tight, and they’re watching credit conditions closely. There’s a sense of cautious optimism—growth is happening, but they’re not taking their eye off risk management.

On the financial side, the CFO noted the company’s healthy liquidity. With $341 million in cash and $400 million in debt, the balance sheet is still in a strong position. She talked about maintaining flexibility in case credit conditions change, and it’s clear the bank wants to stay prepared for whatever the economy throws its way.

Deposit Base Holding Up

Deposits were relatively stable, even if the growth pace has slowed. NBT seems to be benefiting from long-term customer relationships, especially in its wealth management division, which helped keep core deposits steady. Leadership didn’t seem too concerned about deposit outflows and stressed that retention remains strong.

Cost Control and Long-Term Investment

Expenses were under control again this quarter. While costs edged up slightly, they rose more slowly than revenue. The president highlighted continued investments in lending tech and infrastructure, making it clear these aren’t just short-term plays. The goal is to stay efficient and nimble while keeping client service front and center.

Looking Ahead

The team’s outlook for the rest of the year was measured. They’re not expecting a surge in growth, but they do see room for steady progress. Margins are still holding up, and the loan pipeline looks encouraging. They’re especially focused on credit trends in more vulnerable areas and adjusting as needed.

On the dividend front, the message was clear—they’re committed to keeping it strong. With a payout ratio under 45%, there’s room to continue rewarding shareholders. Management signaled they’re comfortable with the current level and would consider raising it again if earnings stay consistent. All in all, the tone was businesslike and grounded. No fireworks, just solid results and a clear plan forward.

Management Team

NBT Bancorp’s leadership team is grounded, experienced, and refreshingly no-nonsense. The CEO brings a thoughtful, steady hand to the helm, focusing on core banking principles over risky plays or trendy financial products. He continues to stress the value of strong customer relationships and local market knowledge, a theme that runs through the company’s culture. His message is consistent: focus on sustainable growth and disciplined lending.

The CFO echoes that philosophy with an emphasis on managing liquidity and capital conservatively. She’s been vocal about keeping the bank financially agile, ensuring that it has the resources to weather interest rate shifts and credit cycle changes. Meanwhile, the bank’s president plays a pivotal role in operations and strategy. He’s focused on process improvements, digital efficiency, and enhancing the customer experience without inflating the cost structure. Altogether, this team presents a unified message built around risk management, operational consistency, and long-term shareholder value.

Valuation and Stock Performance

NBTB trades at a level that suggests quiet confidence from the market. With a forward price-to-earnings ratio around the low-to-mid teens, the stock doesn’t seem stretched by any means. It’s priced like the steady performer it is—one that may not light up growth charts but continues to deliver earnings and dividends without drama.

In the last year, the stock has seen moderate movement, generally trading in a tight band. That reflects the nature of the company—modest growth, low volatility, and a dependable dividend. It’s not chasing momentum, and for income investors, that can be ideal. At just over 3 percent, the yield is not only higher than the S&P 500 average but also comfortably supported by earnings and cash flow.

Looking at price-to-book, which sits around 1.4, investors are still paying a fair premium for quality. The bank’s solid loan book, prudent capital management, and consistent profitability justify that multiple. If economic conditions improve and lending picks up again, there’s room for some valuation lift. But even without that, the stock remains an attractive hold for income-oriented investors who prioritize safety and consistency.

Risks and Considerations

There are risks, even in a conservative story like NBTB. One of the most immediate is credit risk. As the economy slows or shifts, some loan segments—especially commercial or consumer lines—could face pressure. NBT’s past discipline helps, but no bank is fully immune to rising delinquencies or defaults if conditions worsen.

Interest rate volatility is another factor. NBTB has benefited from recent high-rate tailwinds, especially in net interest income. But if the Federal Reserve changes course unexpectedly or if rate competition intensifies, deposit costs could rise faster than loan yields, squeezing margins.

Deposit retention is worth watching, too. While management has done well keeping customer relationships sticky, industrywide pressure from online banks and high-yield alternatives is growing. A tighter deposit market could push up funding costs or slow balance sheet growth.

And finally, valuation risk exists if investor expectations become disconnected from the bank’s actual growth potential. NBT isn’t a growth stock—it’s a stable dividend payer. If market sentiment starts demanding more than the bank’s current model offers, it could lead to unwarranted disappointment.

Final Thoughts

NBT Bancorp stands out as a quiet but solid choice for income investors. Its leadership is focused on long-term results, not quarterly flash. Its balance sheet is strong, its loan book is well managed, and its dividend is not only consistent but comfortably covered by earnings. There’s nothing speculative here—just steady returns and a clear approach to risk.

The stock’s current valuation reflects that approach. It’s not cheap, but it’s reasonable given the quality and stability on offer. While the upside might be capped without a broader macro tailwind, the dividend and predictability offer their own kind of reward. For investors looking to anchor their income strategy with a name they can count on, NBTB continues to deliver what it promises—quiet strength, financial discipline, and a shareholder-friendly mindset.