Updated 7/17/2025

National Fuel Gas Company (NFG) offers a combination of stable utility operations and a growing natural gas production business, underpinned by more than 50 consecutive years of dividend increases. With a forward dividend yield of 2.5% and strong free cash flow generation, the company continues to reward long-term shareholders while executing on disciplined capital investments.

Recent production outperformance in Pennsylvania and a solid balance between upstream and midstream segments have helped drive a 47% increase in the stock over the past year. Backed by a seasoned management team, positive earnings momentum, and consistent dividend growth, NFG remains firmly rooted in a strategy focused on dependable returns and operational execution.

Recent Events

NFG’s performance over the past year has been anything but quiet. Shares have surged more than 47% in the last 12 months. That strength comes from multiple fronts—solid growth in natural gas production, better energy pricing, and the steady cash flows coming from its utility and pipeline units.

In its most recent quarter, which ended in March 2025, NFG reported a year-over-year revenue increase of nearly 16%. Earnings per share jumped over 30%—a notable improvement that shows operating leverage is firmly in play. It’s a reflection of both higher production and cost efficiency, particularly in its exploration segment.

Investors responded. The stock is now trading just a hair under its 52-week high of $88.34, closing recently at $88.03. And for income-focused investors, the company stuck to its usual schedule, paying out its most recent dividend on July 15th after going ex-dividend at the end of June.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.53%

💵 Annual Dividend Rate: $2.14

📆 Dividend Growth Streak: 53 consecutive years

📊 Payout Ratio: 447.8% (trailing EPS basis, but not representative of cash flow health)

📅 Most Recent Dividend Paid: July 15, 2025

📉 5-Year Average Dividend Yield: 3.37%

📈 1-Year Stock Price Return: +47.05%

Dividend Overview

At 2.53%, NFG’s dividend yield isn’t the juiciest you’ll find in the energy sector. But that doesn’t mean it’s lacking appeal. The reason the yield appears lower than its five-year average of 3.37% has little to do with the dividend itself. It’s the price that’s moved up significantly, outpacing the dividend’s steady climb. That’s a good problem to have—it means investors are placing a premium on NFG’s predictable income stream.

Some might raise an eyebrow at the payout ratio, which sits at a staggering 447.8%. But that’s largely a function of how net income was reported over the past year. There were significant non-cash charges that weighed on reported earnings, making the payout look far higher than it actually is. The real story is in the cash flow. With nearly $954 million in operating cash flow last year, NFG has more than enough to keep its dividend moving forward.

As with many utilities and energy firms, the dividend policy here is clearly a priority. The regularity of payments and consistency of increases suggest a management team deeply committed to returning capital to shareholders—even when headline numbers might suggest short-term pressure.

Dividend Growth and Safety

This is where NFG truly sets itself apart. The company has increased its dividend for 53 straight years. That puts it in rare territory—a true veteran of income reliability. These aren’t just token increases either. They’ve come through recessions, oil crashes, interest rate hikes, and just about every type of market turbulence you can imagine.

The most recent bump was modest, but even a small hike sends a clear message: management isn’t backing away from its long-term commitment. It’s also worth pointing out that even after all these years, the dividend still fits well within the company’s free cash flow budget. After funding capital expenditures and servicing debt, there was still over $50 million in free cash flow left—more than enough to support the next round of increases.

Now, the balance sheet does show a healthy dose of leverage. Total debt is just shy of $3 billion, with a debt-to-equity ratio north of 106%. But for a company with stable cash-generating assets like regulated utilities and long-term gas contracts, that’s not as alarming as it might be elsewhere. These are manageable levels in a capital-heavy business model, and interest coverage remains within a comfortable range.

While the current yield may not offer a high initial income, for long-term investors, the appeal lies in its steady trajectory. You’re not just buying today’s yield—you’re buying a growing stream of income that’s backed by a company with a multi-decade history of delivering. And in a market full of uncertainty, there’s a lot to be said for that kind of track record.

Cash Flow Statement

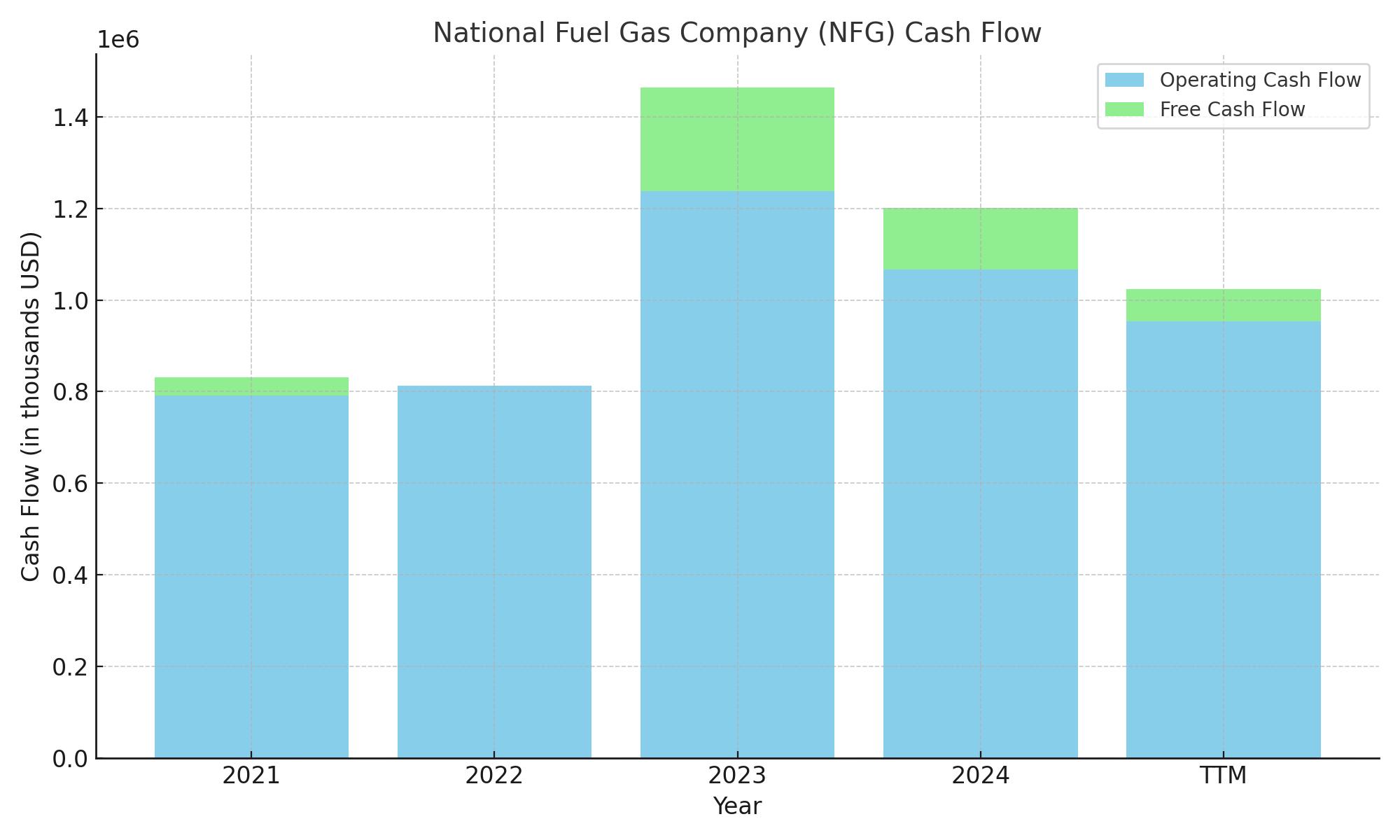

National Fuel Gas Company generated $953.6 million in operating cash flow over the trailing twelve months, reflecting solid contributions from its natural gas and utility segments. While this figure is down from the $1.24 billion peak in 2022, it remains strong by historical standards and more than sufficient to support dividend payments. The dip suggests a normalization in gas pricing and production volume, yet the core operations continue to deliver consistent cash generation.

On the investment side, capital expenditures reached $883.5 million, leading to negative investing cash flow of $876.1 million. Free cash flow came in at $70 million—lower than the prior two years but still positive. Financing activity shows a net outflow, primarily from repaying over $1.15 billion in debt while issuing $1.29 billion. There was also a notable uptick in stock repurchases, totaling $114.4 million. Despite these moves, the company ended the period with $91.3 million in cash, a healthy cushion that reinforces its commitment to capital discipline and shareholder returns.

Analyst Ratings

Bank of America recently upgraded National Fuel Gas Company (NFG) from underperform to buy, raising the price target from $85 to $107. 📈 The upgrade came on the back of stronger-than-expected production results in the company’s Eastern Development Area in Pennsylvania. Since the acquisition of Shell’s assets in 2020, this area has been outperforming, now producing about 16% more natural gas than previously forecast. Coupled with a more favorable regulatory climate for pipeline development, this set the stage for a more optimistic outlook.

The broader analyst community, however, remains somewhat mixed. 🧐 While a few firms are leaning bullish, the average consensus price target hovers in the $96 to $98 range. Some are holding back, preferring to wait and see how NFG navigates debt repayment, capital allocation, and sustained production growth. Ratings are largely centered around hold, with price projections ranging from a conservative $87 up to a high-end view of $112. 🏷️ That spread reflects both the recent operational momentum and the need for continued execution in a volatile commodity environment. Still, NFG’s consistent dividend and stable cash flow profile keep it firmly on the radar for income-oriented investors.

Earning Report Summary

Solid Results Across the Board

National Fuel Gas delivered a strong quarter, showing that it’s still firing on all cylinders across its key business segments. Revenue climbed nearly 16% compared to the same time last year, with solid contributions from both its exploration and production side and its regulated utility and pipeline units. The company seems to be finding a rhythm, especially in the Eastern Development Area of Pennsylvania, which is outperforming expectations. Production there came in about 16% higher than originally forecast, adding a welcome boost to overall performance.

Management was clear in their confidence during the earnings call. They pointed to this area as a major bright spot, helping to drive future development without throwing off their disciplined approach to capital. They also emphasized their commitment to keeping the dividend growing, something they’ve now done for over 50 years. That streak remains a cornerstone of their strategy.

Managing Cash and Capital

Cash flow held up well, even with some pressures from increased spending. Operating cash flow landed around $953 million for the trailing twelve months. That’s a slight dip from last year, but still comfortably strong. After capital expenditures of roughly $884 million, free cash flow came in just above $70 million. Not huge, but enough to keep the balance sheet moving in the right direction and support shareholder payouts.

The CFO pointed out that the company’s cash discipline is allowing them to do a little bit of everything—invest in future growth, keep the dividend flowing, and manage debt. It’s a balancing act, but one they seem to have under control.

Lean Operations and Growing Profits

Inflation and cost pressures haven’t derailed the story here. NFG has done a good job keeping its production costs stable and controlling overhead, especially in its midstream operations. Margins stayed healthy, and the focus on operational efficiency is clearly paying off.

Earnings per share jumped by about 30% compared to the same quarter a year ago. That’s not just from better gas prices—it’s also about volume gains and spreading fixed costs over more production. Leadership gave a lot of credit to the teams on the ground, saying their execution was a key factor in the earnings growth.

Looking Ahead

Management shared a fairly balanced outlook for the rest of the year. Capital spending will tick up a bit as they bring more wells online and expand pipeline capacity. Debt reduction is also on the radar, along with keeping free cash flow positive. They were careful not to overpromise, especially given the usual uncertainties with energy pricing, but the tone was steady and focused.

The next dividend is already lined up for mid-July, and there’s no wavering on the company’s commitment to long-term shareholder returns. This quarter’s results reinforced what investors have come to expect from NFG—dependable performance, disciplined growth, and a clear focus on rewarding income investors.

Management Team

National Fuel Gas is led by a team that brings a steady hand and deep experience across energy markets. CEO Andy Liponis has been with the company for decades and is known for his no-frills, results-first approach. He tends to let the operational teams lead on the ground while setting broad strategic direction. That’s part of why areas like the Eastern Development Area in Pennsylvania have outperformed—local leadership has room to make smart moves.

CFO Steve Brewton focuses heavily on financial health, and his influence shows in how the company manages debt and allocates capital. Even during years with elevated capital expenditures, NFG has avoided overstretching. Brewton’s strategy has consistently emphasized cash flow resilience and protecting the dividend.

On the operational side, Tom Scher manages exploration and production and is known for strong execution. His group has been the engine behind the recent production lift. Meanwhile, Kathy Najarian oversees midstream operations with an eye on system efficiency and cost control. Together, this team seems less interested in headlines and more focused on staying the course. There’s a clear focus on managing risk, staying cash flow positive, and continuing to deliver shareholder returns.

Valuation and Stock Performance

National Fuel Gas stock has gained nearly 50 percent over the last year, with shares trading around the $88 level. That performance reflects improving fundamentals, especially in the production business. On valuation, the stock currently trades at roughly 11 times forward earnings, which is neither aggressive nor cheap for a company with regulated operations and commodity exposure.

The company’s price-to-book ratio is around 2.9, which indicates strong investor confidence in the underlying asset base. It’s higher than historical levels, but not excessive considering how cash flows have improved. Enterprise value to EBITDA stands at 16.7, a bit above the company’s long-term average, suggesting the market is factoring in both the operational strength and dividend consistency.

From a dividend perspective, the forward yield is around 2.5 percent. While that’s lower than the five-year average of 3.4 percent, it’s a reflection of the stock price moving higher rather than the payout shrinking. If the yield were to normalize back to historical averages, the implied share price would fall, or the dividend would need to grow faster. With over 50 years of dividend growth, the market seems to believe the latter is more likely.

Risks and Considerations

Despite the steady hand at the wheel, National Fuel Gas does face real-world risks. First is exposure to natural gas pricing. The company’s production business has performed well recently, but sharp commodity price drops could pressure margins and free cash flow. That’s not a small consideration when capital needs are high.

The company also carries a sizable debt load, just under $3 billion. With interest rates staying high, refinancing could become more expensive, and that would put added pressure on cash generation. Although the balance sheet is manageable today, there’s limited margin for error if borrowing costs rise further.

There’s also the regulatory landscape. Changes in permitting, emissions rules, or tax structures can slow or derail projects. NFG operates both in upstream gas and regulated utility services, so it’s exposed to policy decisions at both state and federal levels.

Lastly, capital expenditures continue to run high, with management guiding for more spending ahead. While these investments are aimed at future production and infrastructure improvements, any delays or cost overruns could erode returns. With a relatively narrow buffer on free cash flow, execution has to remain tight.

Final Thoughts

National Fuel Gas has shown that a slow and steady approach still works. With a diversified model combining regulated utility stability and upstream growth, the company offers a hybrid opportunity that income investors can appreciate. Dividend consistency isn’t just a line in the investor deck—it’s backed by decades of follow-through.

The valuation today reflects a market that has started to reward that consistency, though shares aren’t in bargain territory. The lower yield, driven by recent price appreciation, doesn’t mean the story has weakened—it just means investors are pricing in more confidence about the future. Cash flows are solid, earnings are up, and the core operations are firing in sync.

That said, the path forward isn’t without potential pitfalls. Natural gas pricing, interest rate pressures, regulatory complexity, and high capital requirements are all worth monitoring. But for investors focused on steady income with a touch of growth upside, NFG’s profile remains compelling.

In the end, this is a company that understands its investor base. It’s not about explosive growth or flashy headlines. It’s about showing up, quarter after quarter, delivering the dividend, and sticking to a playbook that has worked for generations. And for many long-term investors, that’s exactly what they’re looking for.