Updated 7/17/2025

National Bank Holdings Corporation (NBHC), a regional bank headquartered in Denver, operates through NBH Bank across six states. Known for its disciplined lending and strong liquidity position, the company focuses on serving small to mid-sized businesses with a steady hand. The leadership team brings years of experience in community banking, maintaining a measured approach to growth and shareholder returns.

With a forward dividend yield of 3.2% and a payout ratio under 40%, NBHC offers income investors a well-covered and consistently growing dividend. Recent earnings showed modest declines in revenue and net income, but the bank remains well-capitalized with over $280 million in cash and low debt, signaling ongoing financial strength.

Recent Events

The first quarter of 2025 brought mixed results for NBHC. Revenue and earnings saw a dip year-over-year, with revenue falling by nearly 10% and earnings down over 22%. Not exactly encouraging at first glance, but there’s nuance here. The bank still delivered $111 million in net income over the last twelve months and generated $2.89 in diluted earnings per share. These numbers show that despite the earnings contraction, the company remains solidly profitable.

Key performance indicators like return on assets (1.11%) and return on equity (8.72%) point to a steady, well-managed business. These aren’t eye-popping returns, but they’re consistent with NBHC’s conservative playbook. With over $280 million in cash and only $166 million in debt, the balance sheet gives off a vibe of calm control rather than risk-taking.

Even with the recent earnings dip, NBHC hasn’t lost its footing. Institutional investors seem to agree—over 99% of the stock is held by institutions. That level of confidence from large players adds a layer of reassurance.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.19%

💸 Forward Annual Dividend: $1.20 per share

📉 Trailing Dividend Yield: 2.94%

📆 Ex-Dividend Date: May 30, 2025

💰 Payout Ratio: 39.45%

📊 5-Year Average Dividend Yield: 2.58%

Dividend Overview

NBHC is paying out an annual dividend of $1.20 per share, which gives it a forward yield of 3.19%. That’s a healthy number, especially compared to many peers and the broader market. It’s the kind of yield that grabs the attention of income-focused investors—not too high to be risky, but generous enough to make a difference.

The trailing yield sits just under 3%, and the company’s payout ratio is comfortably below 40%. That’s important. It means the dividend isn’t being forced or strained—there’s room for error, and even room for growth. In today’s uncertain rate environment, you want a company that doesn’t need everything to go right to keep paying shareholders.

One of the strengths here is NBHC’s measured approach. Unlike some regional banks that stretch themselves to deliver high yields, this bank stays well within its earnings power. That kind of restraint is exactly what keeps dividends stable when things get tough.

Also, the fact that NBHC’s institutions hold nearly all of the outstanding shares tells you something: this stock is in the hands of long-term, strategic investors. That kind of shareholder base often aligns well with dividend-focused thinking.

Dividend Growth and Safety

There’s been a steady upward trend in dividends over the past several years. The five-year average yield of 2.58% has gradually given way to the current 3.19%, which tells us NBHC has been increasing its payout in line with its earnings strength. The pace is moderate—no leaps or surprises—but it’s consistent.

This is a business with solid fundamentals backing that growth. Profit margins are strong, with a 28.64% net margin and 36.09% operating margin. Those numbers suggest operational efficiency and a well-run shop, both of which are good signs for dividend sustainability.

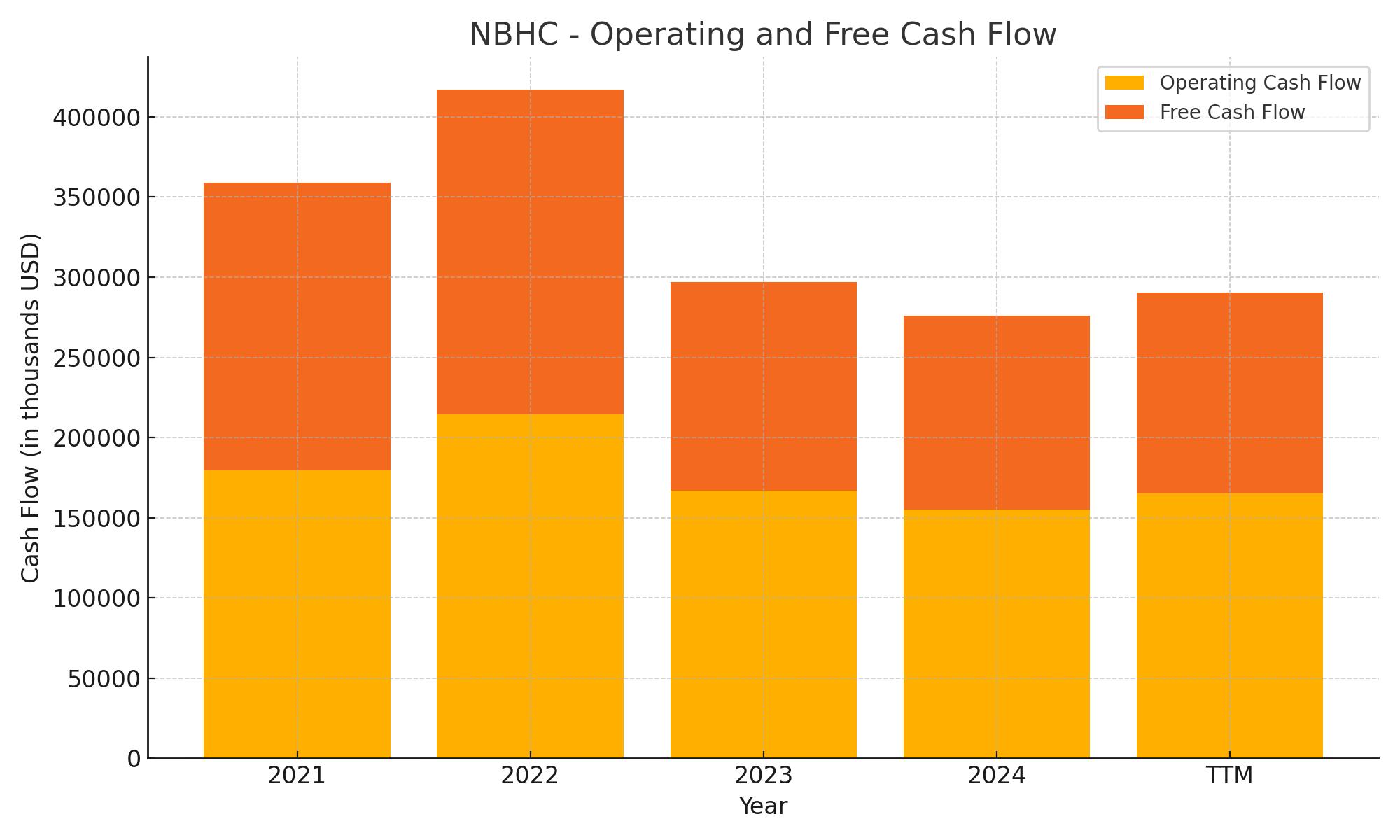

Beyond the income statement, the balance sheet deserves another mention. With $280 million in cash and a modest level of debt, there’s ample liquidity to support ongoing dividend payments. Operating cash flow came in at roughly $165 million over the past year, reinforcing the idea that this dividend is not just a priority, but fully supported by underlying cash generation.

The strategy here seems clear—keep payouts conservative, build reserves, and increase the dividend when it makes sense. There’s no sign of reaching or trying to impress. And that kind of patience and financial prudence is exactly what dividend investors tend to value most.

If you’re looking for a stock that won’t surprise you in either direction but will reward patience with steady cash flow, NBHC fits the mold.

Cash Flow Statement

National Bank Holdings Corporation generated $164.9 million in operating cash flow over the trailing twelve months, slightly ahead of the prior year’s $155.3 million. This consistent cash generation points to a stable core business despite pressure on revenue and earnings. Free cash flow, which strips out capital expenditures, came in at $125.7 million—strong enough to comfortably support dividends and allow some room for reinvestment. These figures reflect efficient operations and disciplined expense management.

On the investing side, NBHC recorded a cash outflow of $156.4 million over the same period, following a return to more normalized activity after large swings in previous years. Financing cash flow was negative $55.1 million, driven primarily by debt repayments and possibly dividend payouts. Despite these outflows, the company’s cash balance remains solid at $246.3 million, well above recent years. This puts NBHC in a strong liquidity position, reinforcing its capacity to maintain shareholder returns even in a slower growth environment.

Analyst Ratings

📉 DA Davidson recently lowered their one-year price target for NBHC from $46 to $42 but kept a strong-buy rating in place. The adjustment was driven by softer net interest income projections and a slight earnings miss in the latest quarter, which led to a revision in their EPS expectations. Even with the target cut, they expressed continued confidence in the bank’s long-term positioning and overall fundamentals.

⚖️ Hovde Group also revised their outlook slightly, trimming their target from $48 to $43 while maintaining a neutral stance. Their decision reflects a cautious view on short-term earnings performance, especially in a challenging rate environment. Still, they see NBHC as fairly valued and stable.

📌 Keefe, Bruyette & Woods, on the other hand, left their price target unchanged in the mid-$40s, signaling no major concerns. Their view suggests that while the near-term outlook is pressured, the bank’s consistent execution and balance sheet strength provide enough support to justify current valuations.

📊 The average analyst consensus price target now sits around $46–$47, hinting at a moderate upside from current trading levels. Overall, analysts appear to be taking a measured approach—recognizing the near-term challenges while acknowledging the company’s steady fundamentals.

Earning Report Summary

A Solid but Uneventful Quarter

National Bank Holdings Corporation’s latest earnings results didn’t spark any major headlines, but they quietly reinforced what this bank tends to deliver—stability, even when the landscape gets bumpy. The company pulled in $111 million in net income over the last twelve months and posted $2.89 in diluted earnings per share. Not thrilling numbers, but still respectable considering the current backdrop.

Revenue took a hit, down close to 10% year-over-year, and net income dipped over 20%. It wasn’t a surprise, though. Management had already hinted that loan volumes would slow and margins would tighten as interest rates continued to adjust. It’s a story we’re seeing across the regional banking space. NBHC is feeling the same pressure, especially around deposit costs and slower lending activity, but it’s navigating with care.

Management’s Take and Liquidity Comfort

Leadership didn’t sound the alarm. In fact, they were pretty measured in their outlook. Return on assets came in at 1.1%, and return on equity held near 8.7%. These aren’t breakout numbers, but they signal a steady hand on the wheel. Management stressed their conservative loan book and kept coming back to one message—they’re sticking to their game plan and keeping risk in check.

One area they seemed especially confident in was liquidity. The bank ended the quarter with $280 million in cash and only $166 million in debt. That kind of balance gives them some real flexibility, whether they want to support the dividend, invest selectively, or just wait for more favorable conditions. The CFO emphasized that their payout ratio—sitting just under 40%—shows they’re not overreaching. It’s clear they’re prioritizing sustainability.

Looking Down the Road

As for what’s next, leadership kept things grounded. They acknowledged the current rate environment is tricky and that earnings might not bounce back right away. But they see opportunity later in the year as rates stabilize and lending normalizes. In the meantime, they’re focused on cost control and improving operational efficiency without cutting corners on customer service.

They also touched on tech and automation as key tools for driving better performance without growing headcount. It’s a familiar theme across the industry, but NBHC seems to be executing that strategy thoughtfully rather than just slashing expenses.

All in, the tone was calm and calculated. This wasn’t a blowout quarter, and management didn’t pretend it was. But they delivered what long-term investors tend to value: clear priorities, disciplined execution, and a commitment to keeping the dividend secure. It’s not flashy, but it works—especially for those looking for income without drama.

Management Team

NBHC’s leadership team has the kind of experience you’d expect from a regional bank that plays it steady. The CEO has a long track record in community banking and stays focused on fundamentals—steady loan growth, risk management, and returning value to shareholders. His style is low-key but deliberate, always steering toward stability rather than taking unnecessary risks.

The CFO takes on the role of realist. He communicates clearly about how the bank handles capital, liquidity, and dividend sustainability. During earnings calls, he’s usually the one breaking down how the bank maintains a conservative payout ratio and preserves flexibility for shifting market conditions.

The broader leadership team includes senior figures in lending and risk management who’ve been through multiple rate cycles and understand the importance of sticking to tight underwriting standards. They tend to avoid the flashier parts of the loan market and instead lean on long-standing relationships with smaller businesses and mid-sized commercial clients.

Their approach reflects a strong internal culture. Most of the top team has worked together for several years, and that continuity shows in how they manage through change. It’s a steady group—experienced, methodical, and focused on long-term results over quarterly optics.

Valuation and Stock Performance

NBHC doesn’t trade at a deep discount, nor does it command a premium. With a P/E ratio in the mid-teens and a price-to-book just above 1, it’s in line with other well-capitalized regional banks. That kind of valuation tends to attract income investors who want consistency over volatility.

Its stock price over the past year has ranged from the low $30s to just under $52. It recently traded around $40, landing roughly in the middle of that spectrum. While it hasn’t made big moves, it also hasn’t shown signs of stress, which aligns with the stock’s lower beta. Investors looking for a smoother ride during broader market turbulence have likely found some comfort here.

Institutional ownership is high, close to the entire float, which tells you that larger investors are comfortable holding the name in income and balanced portfolios. The current yield near 3.2 percent adds to that appeal, especially since it’s supported by a conservative payout ratio and consistent free cash flow.

The company isn’t priced for aggressive growth, and that’s fine given the nature of the business. If margins improve later in the year and earnings pick up, the stock could see some upside. But most shareholders are likely more interested in preserving capital and collecting dividends than hoping for a sudden breakout.

Risks and Considerations

Interest rate sensitivity remains a central risk for NBHC. Margin compression has been a challenge, and if rates remain high or invert further, it could continue to weigh on net interest income. Even though the bank is conservative, it’s not immune to rate pressure.

Loan growth is another area to watch. With a cautious lending strategy, NBHC may miss out on growth opportunities when the economy picks up. That restraint helps with credit quality but can also mean earnings grow at a slower pace than some peers.

Credit risk is always a factor, particularly in commercial lending. While the bank’s portfolio has held up well, a sudden shift in regional economic activity or a downturn in key sectors could test even well-structured loan books.

Regulatory changes are a slower-moving risk but still worth noting. Any shift in capital requirements or supervision could impact how regional banks like NBHC deploy cash and manage shareholder returns. Those changes don’t happen overnight, but they shape long-term strategy.

Finally, there’s the matter of opportunity cost. The yield is competitive, but not extraordinary. If interest rates rise or other sectors begin offering better total returns, NBHC might lose some of its dividend appeal.

Final Thoughts

NBHC is the kind of bank that rewards patience. It won’t spike on a headline or tank on market noise. What it offers is a clear dividend strategy, a management team that stays grounded, and a balance sheet built for steadiness, not surprises.

This is a stock that fits well in income-focused portfolios where the goal is less about fast gains and more about preserving capital while collecting steady distributions. While risks remain, especially around interest rates and credit cycles, the company appears well-equipped to handle them.

NBHC won’t suit every investor, but for those looking for a stable regional bank with a reliable yield, it continues to earn its place on the list.