Updated 6/13/25

The Mosaic Company (MOS) is a key global producer of potash and phosphate fertilizers, essential components in agriculture and food production. With a broad footprint across North and South America and a focus on integrated operations, Mosaic supports critical crop nutrition supply chains while maintaining a steady approach to cost and capital management.

Recent performance shows a company regaining its footing. Earnings have improved meaningfully, free cash flow remains positive, and dividend coverage is strong. Backed by a disciplined management team and measured capital allocation, Mosaic is positioning itself as a consistent performer in a historically cyclical industry.

Recent Events

Lately, Mosaic has been riding a solid rebound. Its stock price is up more than 27% over the past year, clearly outperforming the S&P 500. As of mid-June, the share price sits just shy of $36, after jumping nearly 4% in a single day. What’s driving that momentum? Fertilizer prices are showing signs of life again, and global demand—especially from major buyers like Brazil and India—is recovering.

Mosaic’s most recent quarter backed up that market optimism. Net income surged over 400% year-over-year, landing at $367.8 million. That sounds dramatic, but it’s a rebound from a soft stretch last year. Revenues were slightly down, but margins held firm, and EBITDA for the trailing twelve months came in at a solid $1.93 billion.

The balance sheet also looks relatively healthy. Mosaic carries about $4.8 billion in total debt, but it’s supported by $1.4 billion in operating cash flow and just over $500 million in free cash flow. That’s more than enough to cover dividends and maintain flexibility through the commodity cycle.

Key Dividend Metrics

🪙 Forward Yield: 2.54%

📈 5-Year Average Yield: 1.61%

🔁 Dividend Growth: Slow, steady, upward trend

🛡️ Payout Ratio: 73.28%

📅 Ex-Dividend Date: June 5, 2025

💵 Next Dividend Payment: June 19, 2025

📉 Trailing Dividend Rate: $0.86

💰 Forward Dividend Rate: $0.88

Dividend Overview

At a 2.54% forward dividend yield, Mosaic offers a decent income stream—especially when you compare it to its own 5-year average yield of just 1.61%. The current yield reflects both a slightly richer payout and a still-reasonable stock price, making it attractive for those seeking stable cash flows in a cyclical sector.

The payout ratio, around 73%, might seem a bit high. But keep in mind that this figure comes during a period when earnings are still normalizing after a downturn. Looking under the hood, the dividend looks well covered by free cash flow. With about 317 million shares outstanding, Mosaic is spending roughly $279 million annually on dividends—easily funded by the company’s $502 million in levered free cash flow.

That gives investors some breathing room. There’s no indication of a dividend cut on the horizon. If anything, Mosaic seems to be keeping its payout at a sustainable level that doesn’t overstretch its financial resources.

Dividend Growth and Safety

Mosaic isn’t known for explosive dividend growth, but there’s been a clear, steady effort to raise the payout. That restraint may not thrill those chasing high-yield fireworks, but for long-term investors, it shows a company managing capital with discipline.

They’re not overcommitting during good times, and they’re maintaining consistency during rougher stretches. That kind of pattern builds trust. In a space where dividend cuts happen quickly when commodity prices tank, Mosaic’s measured approach is worth noting.

On the safety side, debt is something to monitor, but it isn’t excessive. The company’s debt-to-equity ratio sits just above 40%, and liquidity metrics like the current ratio (1.12) suggest no immediate concerns. Mosaic is generating enough cash to keep operations humming while still rewarding shareholders.

One thing to remember: this isn’t a low-volatility stock. With a beta of 1.15, Mosaic tends to swing a bit more than the market. But that’s part of the tradeoff. For income investors willing to accept some bumps in exchange for exposure to a necessary industry, the combination of stable payouts and room for capital appreciation makes Mosaic an intriguing player in the dividend space.

Cash Flow Statement

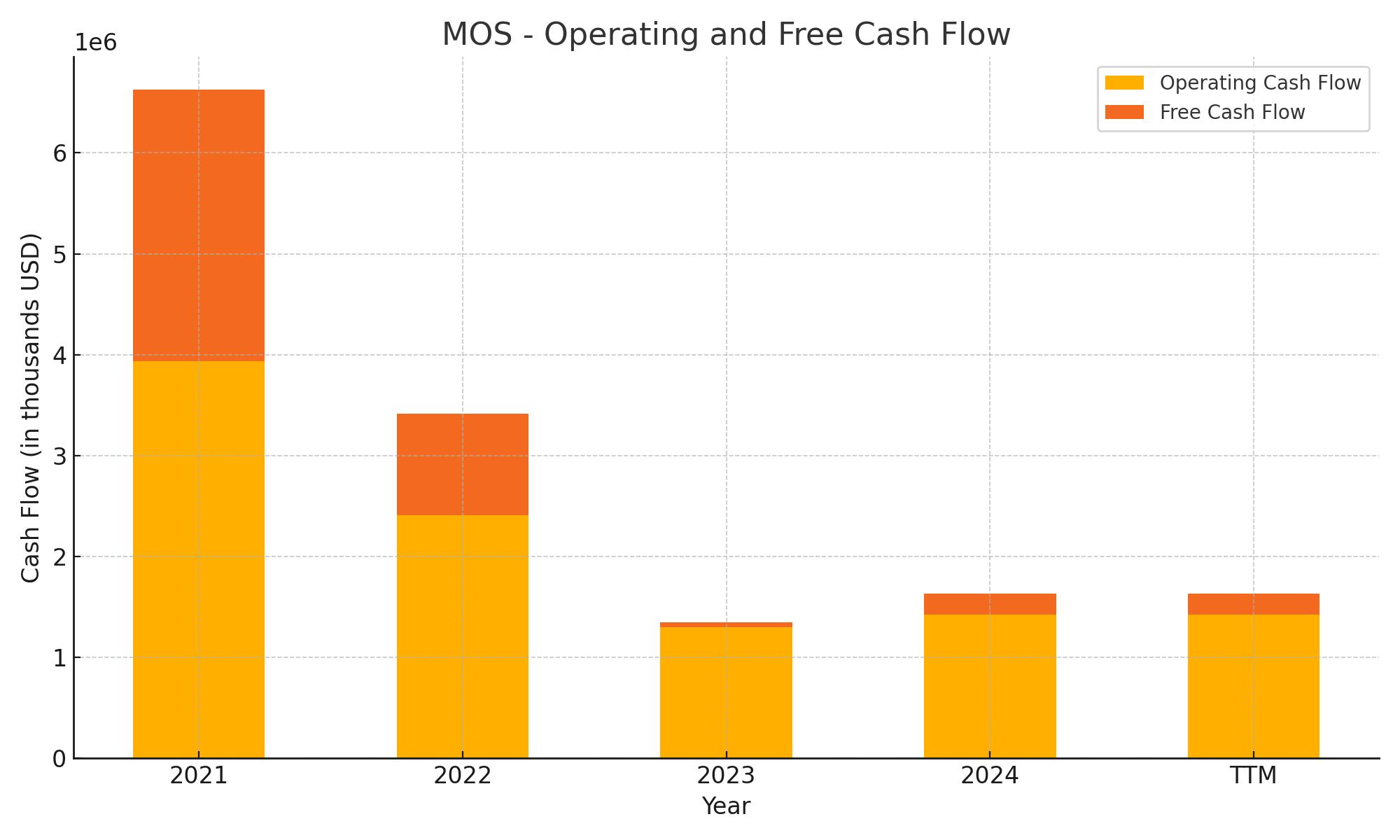

Mosaic’s cash flow over the trailing twelve months shows a company stabilizing after a volatile stretch. Operating cash flow came in at $1.42 billion, recovering modestly from $1.3 billion in the prior year, but still well off the highs seen in 2021 and 2022. This reflects the normalization of fertilizer prices and demand following an unusually strong upcycle. Despite the decline in peak cash generation, Mosaic remains fundamentally sound in its ability to generate operating income.

On the investing side, the company continues to reinvest heavily, with $1.21 billion in capital expenditures—consistent with previous years and focused on sustaining operations. Financing cash flow was negative $317.8 million, reflecting a combination of debt repayments, share repurchases, and dividend payouts. While Mosaic has taken on and repaid significant debt, it’s managed to keep its end cash position at $237.4 million. Free cash flow, a critical metric for dividend investors, stands at $212.5 million for the TTM—down significantly from the boom years, but still positive and sufficient to cover current dividend obligations.

Analyst Ratings

📈 Analysts have been revisiting their stance on Mosaic recently, and the tone is turning more constructive. RBC Capital upgraded the stock from sector perform to outperform and lifted its price target from $30 to $40. That shift followed Mosaic’s stronger earnings performance and signs of stabilization in potash prices. With operational costs under control and fertilizer demand picking back up, RBC saw room for the company to outperform its previous outlook.

📊 Piper Sandler also moved its target higher, bumping it from $30 to $38. Their rationale focused on improving visibility into 2025 earnings, as well as steady demand from major agricultural markets. Barclays wasn’t far behind, adjusting its price target upward from $33 to $40 while maintaining a positive stance on the stock. Their upgrade highlighted Mosaic’s reliable cash flow and consistent capital discipline, especially in a commodity environment that’s beginning to turn.

💡 Oppenheimer joined in as well, raising its price target from $33 to $40 and reaffirming its outperform rating. The firm pointed to better-than-expected cost management and a more stable outlook for both phosphate and potash segments.

⚠️ A few analysts remained cautious. Morgan Stanley nudged its target up only slightly from $30 to $33, signaling a more tempered view on near-term pricing. Mizuho trimmed its target from $32 to $31, reflecting concerns about phosphate supply dynamics.

🎯 Overall, the consensus price target sits around $38.50 to $39.00, suggesting about 11–12% upside from current levels. The average rating leans between a moderate buy and a hold, reflecting a mix of upbeat forecasts and measured skepticism.

Earning Report Summary

A Quietly Strong Quarter

Mosaic’s most recent earnings came in better than many expected—not flashy, but steady and solid. Revenue was down just a touch, about 2% year-over-year, but profits told a different story. Net income climbed to $367 million, a big jump from the same time last year when margins were getting squeezed. The company’s ability to protect earnings, even with softer pricing in some fertilizer segments, speaks to how much ground it’s gained since the last commodity downturn.

What stood out this time was the strength in margins. Costs have been a challenge across the industry, but Mosaic seems to be getting a better handle on them. Executives pointed out improvements in how their phosphate and potash businesses are working together—basically smoothing out the ups and downs that usually come with global agriculture pricing.

Focus on Free Cash Flow and Dividend Stability

Cash flow remains a strong suit. Mosaic generated about $1.4 billion in operating cash flow and over $200 million in free cash flow over the last twelve months. Leadership stressed that they’re being careful with how that cash is used. The dividend is clearly a priority—they want to keep it reliable, not something that jumps around based on quarterly numbers.

They also talked a lot about balance. The goal is to invest in the business without putting too much pressure on the balance sheet. So far, they’re walking that line. The payout ratio is just over 70%, which is high but not alarmingly so, especially considering how volatile earnings can be in the fertilizer space. Management suggested that if conditions improve, they might increase the dividend slightly, but only if it’s sustainable.

A Measured View of What’s Next

Looking forward, Mosaic’s leadership is cautiously optimistic. Brazil and India were highlighted as key growth markets, while other regions are still a bit uneven. They’re not betting on a huge surge in demand, but they’re seeing enough strength in pricing and order flow to stay confident about the back half of the year.

One interesting point was the way Mosaic is controlling costs at a local level. While global inflation is still a reality, the company has been shifting more of its sourcing and logistics in-house. That’s helped them keep some cost pressure at bay, and executives say it’s starting to show up in the bottom line.

Overall, this quarter wasn’t about big surprises—it was about steady progress. Mosaic looks like it’s moved past the worst of the cycle and is settling into a more predictable, well-managed phase. For shareholders, that’s not just good news for today—it sets the stage for more consistency ahead.

Management Team

Mosaic’s leadership team brings together industry veterans with a clear understanding of the fertilizer market’s ups and downs. The CEO has navigated multiple cycles and brings a calm, steady approach to growth and profitability. He’s emphasized balance—between cost control, shareholder returns, and responsible long-term strategy. There’s no rush to overexpand, but a clear commitment to executing well in the current environment.

The CFO complements that with disciplined financial management. She has focused on keeping leverage in check while funding the dividend and reinvesting wisely. It’s not about taking big swings—it’s about smart decisions that support the business during downturns and capitalize during upswings. Together, they’ve brought Mosaic a more measured tone, with transparency that investors can actually follow.

Operational improvements have been a clear priority. The team has restructured logistics, renegotiated supply contracts, and pushed hard on internal efficiencies. That’s led to cost savings that aren’t just on paper—they’re showing up in earnings. It’s a group that seems far more interested in substance than flash, and the results speak to that.

Valuation and Stock Performance

Mosaic’s stock has enjoyed a strong recovery over the past year. From trading near $22, it has climbed to just under $36—a gain of roughly 70%. This rise isn’t just about hope; it’s been backed by better cash flow, stronger earnings, and improved visibility in global demand. As fertilizer markets stabilize, the market is rewarding Mosaic’s progress.

On valuation, Mosaic now trades at levels that reflect a healthier earnings profile. It doesn’t look cheap by past trough standards, but it doesn’t look overvalued either. The forward P/E sits in the low double digits, which feels reasonable given the earnings rebound. The dividend yield around 2.5% isn’t high for a cyclical, but it reflects the company’s growing confidence in maintaining returns across cycles.

Compared to peers, Mosaic’s valuation is fairly aligned. But where it stands out is in free cash flow coverage and dividend discipline. It doesn’t try to keep up with high-growth promises—instead, it focuses on sustainable operations and reward predictability. That kind of profile appeals to dividend investors looking for names that don’t chase every market move.

Global dynamics support the story too. As the world continues to demand more food and better crop yields, fertilizers aren’t going anywhere. Mosaic benefits from this demand tailwind while also keeping costs under control. The market has noticed—and the stock’s move reflects that.

Risks and Considerations

Despite the improvements, Mosaic still faces real risks. Fertilizer pricing remains volatile, and a sharp downturn in global agriculture spending could quickly hit margins. That kind of volatility is always part of the equation in this sector, and while Mosaic is better prepared, it’s not immune.

Debt is manageable but still present. A debt-to-equity ratio in the low 40s isn’t extreme, but higher interest rates could impact cash flow if refinancing becomes more expensive. Free cash flow covers the dividend now, but a squeeze could force tougher decisions if market conditions weaken.

There’s also the geopolitical angle. Mosaic operates in multiple regions, and export rules, trade tensions, or regulatory changes can shift the landscape quickly. Add in the weather variability that affects crop cycles, and there’s always a chance of unexpected disruption.

Competition is another factor. Mosaic holds a strong position in potash and phosphate, but emerging players in developing markets could introduce price pressures. Technological changes or shifts toward alternative fertilizers could also reshape demand patterns.

And with ESG issues becoming more prominent, Mosaic’s mining operations will continue to face scrutiny. The company has made efforts on sustainability, but environmental and regulatory expectations are rising. Missteps or compliance failures could impact both reputation and cost structures.

Final Thoughts

Mosaic looks like a company that’s found its stride. It’s not trying to chase the highs of past cycles or promise the moon. Instead, it’s building on what it has—steady cash flow, operational improvements, and a dividend policy that reflects financial discipline.

The management team is focused and practical. Their approach to balance sheet health, shareholder returns, and capital allocation seems rooted in lessons learned over years of volatility. That kind of stability matters in a business where pricing and demand can shift quickly.

Valuation-wise, the recent run-up reflects Mosaic’s progress but still leaves room for reasonable upside, especially if fertilizer prices firm up further. The stock isn’t a deep value play anymore, but it offers a mix of yield and operating strength that many income investors find appealing.

Risks remain. Market swings, debt levels, and regulatory changes all matter. But Mosaic has shown it can adjust. The company is no longer just reacting to the cycle—it’s trying to shape its response ahead of time.

In a sector often defined by swings and surprises, Mosaic’s grounded approach is starting to stand out. For investors looking for consistency, income, and measured execution, it’s a name that’s earned a closer look.