Updated 6/3/25

Midland States Bancorp, Inc. might not be the most talked-about name in banking, but for those who care about income and yield, it’s worth paying attention to. Based out of Effingham, Illinois, this regional bank has been quietly running its operations across the Midwest, offering a mix of traditional banking services, commercial lending, and wealth management. Over time, it’s carved out a solid niche, staying focused on community relationships and regional growth rather than chasing headlines.

The stock has taken a hit over the past year, sliding nearly 25% and now trading around $17. That decline has pushed the dividend yield well into attractive territory for income investors. With a forward yield north of 7%, it’s the kind of situation that tends to draw in those hunting for dependable cash flow.

Recent Events

There’s been a bit of activity around Midland in recent months, and the dividend headline is front and center. Earlier this year, the company bumped up its annual payout to $1.24 per share — a sharp move up from the previous $0.93. That’s a significant increase, especially considering the bank reported a net loss over the trailing twelve months. Earnings came in at a negative $1.05 per share, with a total net loss of about $21 million.

Despite that, Midland went ahead with its dividend on May 23rd after going ex-dividend on May 16th. Trading volume ticked up around those dates, but the broader trend has been a slow and steady climb off the 52-week low of $14.79.

One area that could raise some eyebrows is debt. Total debt now stands at over $667 million, which is quite a bit relative to a market cap just shy of $356 million. That leverage means the company needs to stay on its toes — but for regional banks, this level of debt isn’t out of the ordinary. It just adds a layer of complexity when assessing long-term sustainability, especially with a dividend yield that’s this high.

Key Dividend Metrics

💰 Forward Yield: 7.50%

📈 Trailing Yield: 5.62%

🧮 Payout Ratio: 53.5%

🕰️ 5-Year Average Yield: 5.22%

💵 Forward Dividend Rate: $1.24

📆 Most Recent Dividend Paid: May 23, 2025

📉 Stock Price (as of June 3): $16.96

🔻 52-Week Price Range: $14.79 – $28.08

Dividend Overview

That 7.5% forward yield is tough to ignore. For dividend-focused investors, it’s the kind of number that jumps off the page — well above both the broader market average and the company’s own five-year yield. But let’s not lose sight of what’s driving that yield higher: the stock price. With shares down considerably from their highs, the dividend yield has naturally climbed.

What’s interesting is that this yield boost isn’t just coming from the price drop — the dividend itself has grown. That increase signals confidence from management, even in the face of recent losses. While the payout ratio sits at 53.5%, it’s important to keep in mind that this figure is being calculated from negative earnings. So, it’s not the most useful metric in this scenario.

More relevant is how much cash the company has on hand and what kind of cushion it has in terms of assets. Midland currently holds just over $102 million in cash, and the book value per share is a healthy $29.48. That gives the dividend some breathing room, even in a challenging environment.

Still, the margin for error isn’t huge. A prolonged period of underperformance or unexpected credit losses could change the picture. For now, though, the bank seems set on maintaining its payout, and income investors will likely see that as a positive.

Dividend Growth and Safety

Midland doesn’t get flashy with its dividend hikes, but it does have a record of steadily increasing its payout over time. That consistency is something income-focused investors tend to appreciate. The most recent jump in the dividend was a notable one, especially against the backdrop of less-than-stellar earnings.

From a safety standpoint, there are a few flags, but nothing immediately alarming. Yes, the company is currently reporting a net loss. Return on equity is slightly negative at -1.63%, and return on assets is also in the red. But the operating margin is holding up nicely, above 31%, and the company is still generating cash at the core banking level.

The stock’s price-to-book ratio has dropped to just 0.48, which suggests that the market is pricing in a fair amount of risk. That said, sometimes these discounted valuations can work in favor of long-term investors — especially those focused on income.

Debt remains something to keep in mind. With leverage on the high side and interest rates still elevated, the bank needs to maintain discipline with its capital management. But Midland’s leadership appears to be confident enough to continue rewarding shareholders, even as they work through a tougher environment.

So, while this isn’t a clean, textbook story, it is one that may appeal to investors who don’t mind a little complexity in exchange for a high yield and a management team that’s standing by its dividend.

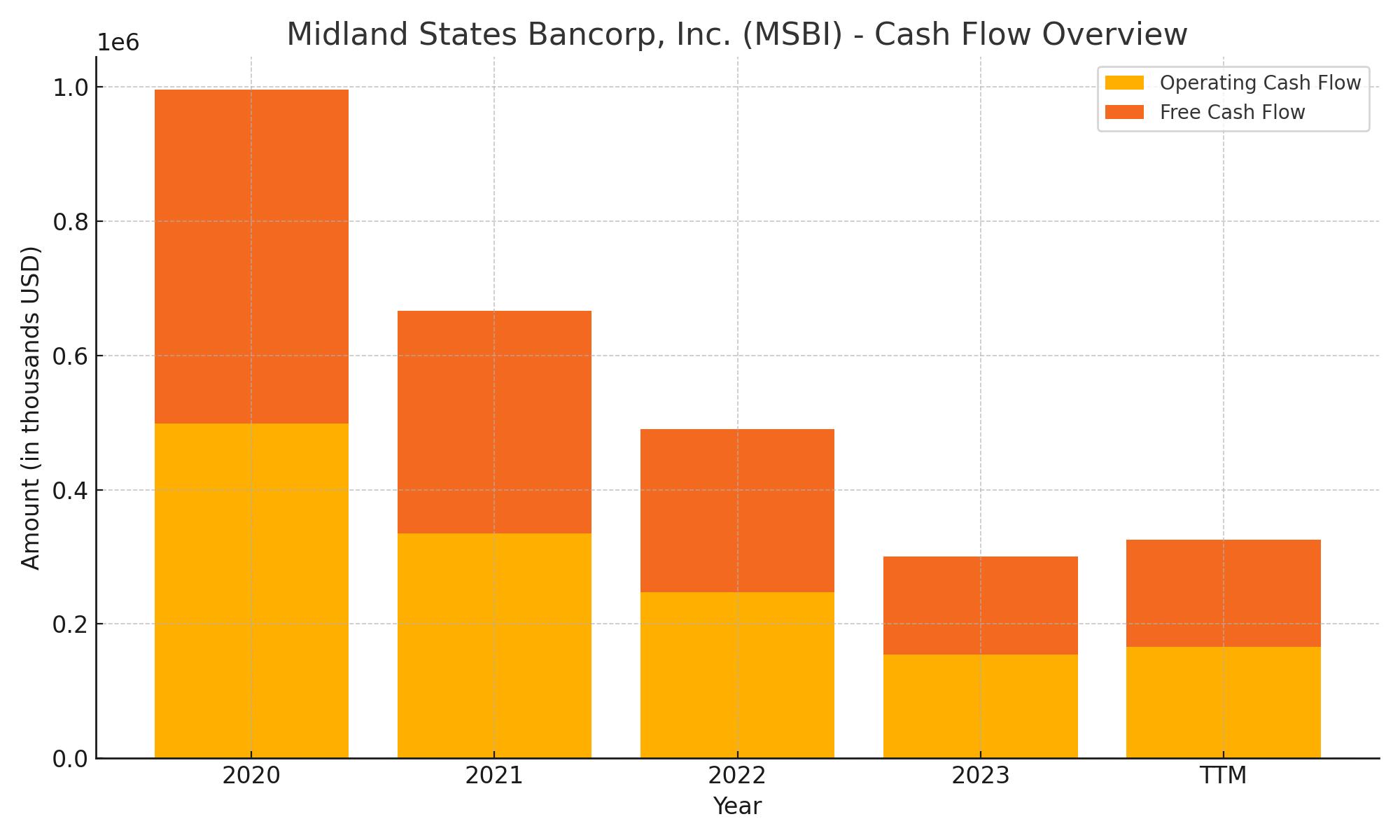

Cash Flow Statement

Midland States Bancorp’s trailing twelve-month (TTM) cash flow reflects a business that remains operationally sound but has been navigating major shifts in capital strategy. Operating cash flow came in at $165.6 million, a healthy figure that shows the bank’s core operations are still generating solid cash despite earnings volatility. Free cash flow is nearly identical at $159.7 million, indicating minimal capital expenditure pressure—just under $6 million—highlighting a lean approach to reinvestment.

The more dynamic movement comes from financing and investing activities. Financing cash flow was a steep negative at -$318.6 million, largely driven by significant debt repayments totaling $23.5 billion, which slightly exceeded new debt issuances. The company also continued its trend of share repurchases, albeit modestly. On the investing side, the positive cash flow of $142.8 million marks a stark contrast to heavy outflows in prior years, signaling a pause or reversal in major investment activities. This combination of strong operating inflows and scaled-back investment and financing suggests a shift toward liquidity preservation. The result is a stable end cash position of $121.9 million, giving the company a decent buffer as it maneuvers through a more conservative financial stance.

Analyst Ratings

📉 Midland States Bancorp (MSBI) has experienced mixed analyst sentiment recently. In early May, one research firm lowered their price target from $21.00 to $20.00 while maintaining a “market perform” rating. This slight downward revision seems to reflect cautiousness around the bank’s near-term profitability, especially as earnings have remained under pressure and debt levels are being closely watched by the market.

📈 On the brighter side, MSBI received an upgrade to a “Buy” rating from another analyst group, driven by improved earnings projections. Analysts noted that forward EPS expectations for the fiscal year ending in December 2025 have been trending upward, which helped support a more optimistic outlook. The upgrade points to confidence in the bank’s ability to stabilize its operations and generate steady cash flow, particularly through its core regional banking and wealth management segments.

💬 The broader consensus remains a “Hold,” with the average 12-month price target currently sitting at $19.50. That suggests a modest upside from current levels near $17. The divided opinion reflects the balance between MSBI’s appealing dividend and book value metrics against the backdrop of tighter margins and market skepticism toward regional lenders in this environment.

Earning Report Summary

Stronger-Than-Expected Earnings

Midland States Bancorp kicked off 2025 on a high note, reporting first-quarter net income of $12.6 million, or $0.57 per diluted share. That came in a few cents better than what most analysts were expecting. Total revenue landed at $76.2 million, which also edged out projections. One of the more impressive points in the report was the net interest margin, which came in at 3.48%. That’s a solid mark, especially in a rate environment that continues to challenge many regional lenders.

Strategic Shift in Lending

One of the major headlines from the quarter was the sale of a large chunk of the GreenSky loan portfolio—roughly $330 million in loans, or 89% of the total. It’s a move aimed at reducing exposure to higher-risk lending, and it aligns with management’s push to sharpen focus on core community banking. Net charge-offs totaled $16.9 million, but it’s worth noting that $11.1 million of that was reimbursed through third-party protections. At quarter-end, nonperforming loans stood at $140 million, and the allowance for credit losses was $90.5 million—roughly 1.8% of total loans.

Loan and Deposit Trends

Loan balances fell to $5.02 billion, down about $150 million from the prior quarter. Most of that drop came from cutting back on the specialty finance side. But on the flip side, the Community Bank side of the business saw growth, adding about $56.8 million in new loans—a sign that core lending remains healthy. Deposits also came down a bit, ending at $5.94 billion, but not all of that was negative. Noninterest-bearing deposits actually grew by $35 million, and retail deposits jumped by nearly $97 million.

Operating Costs and Capital Position

Expenses came in a little heavier this quarter, reaching $48.9 million. That included one-time items like severance costs and professional fees. Legal and collection-related costs also remained on the higher side. Despite that, Midland’s capital ratios held firm. The total capital to risk-weighted assets ratio was nearly 13.8%, and tangible common equity was at 6.3%—a decent cushion for a bank of this size.

Leadership’s View

CEO Jeffrey Ludwig struck a confident tone in his remarks. He pointed to strong profitability trends and highlighted the steady performance of the Community Bank as reasons for optimism. With capital ratios moving in the right direction and loan quality improving, he sees 2025 shaping up to be a much stronger year for the company. The strategy seems clear—tighten credit, focus on core banking, and keep pushing for more consistent earnings.

Management Team

Midland States Bancorp is led by an experienced executive group with a deep understanding of regional banking. At the top is Jeffrey G. Ludwig, who has served as President and CEO since 2019. With over 20 years in banking, Ludwig has guided the company through economic shifts while keeping a steady focus on shareholder value and disciplined lending practices.

Backing Ludwig is Eric T. Lemke, the Chief Financial Officer. Since joining the company in 2019, Lemke has played a key role in maintaining the bank’s financial health and guiding it through regulatory and economic changes. His approach to risk management and capital discipline has been instrumental in preserving the bank’s balance sheet strength.

Also on the leadership team is Jeffrey S. Mefford, Executive Vice President. His long tenure and experience in commercial lending and operations have made him a driving force behind the bank’s growth in its community-focused business lines. Altogether, the management team brings a combination of continuity, strategic clarity, and a grounded approach to navigating today’s banking challenges.

Valuation and Stock Performance

As of early June 2025, Midland States Bancorp’s shares are trading just under $17. While that’s well below its 52-week high of $28.08, the stock has managed to stabilize after touching lows around $14.79 earlier in the year. This range reflects investor uncertainty but also highlights potential room for upside if performance improves or sentiment shifts.

With a market cap around $362 million and a price-to-book ratio below 1, MSBI appears undervalued relative to its asset base. For value-focused investors, that discount might be compelling, particularly when paired with a strong dividend yield of 7.5%. Historically, the bank has traded at higher multiples, suggesting that current levels could represent a buying opportunity if risks are managed properly.

The average analyst price target is $19.50, which implies a modest upside from current levels. Market watchers are keeping an eye on net interest margins and loan performance, as these will likely dictate future earnings trends and investor sentiment. Despite challenges, the company has maintained a consistent dividend payout, which is a key draw for income-oriented investors.

Risks and Considerations

There are several risks investors should keep in mind with Midland States Bancorp. Most notably, the company received a notice from Nasdaq after delays in filing its financial reports. It has until late September to address the issue, but any prolonged delay could cause reputational damage and impact institutional confidence.

The bank also has exposure to higher-risk sectors, including commercial real estate and specialty finance. While it has taken steps to reduce this exposure—such as selling off a large portion of its GreenSky loan portfolio—any future instability in these segments could still pose challenges.

Operational issues have surfaced as well. A recent settlement of $3.1 million related to overdraft and nonsufficient funds fees highlights the potential cost of compliance and legal oversight. While these types of issues are not uncommon in the banking industry, they do create headline risk and potential pressure on future earnings.

Final Thoughts

Midland States Bancorp offers a unique blend of opportunity and caution for investors. The stock trades at a deep discount to book, and the dividend remains high and consistent—two elements that tend to attract attention from value and income-focused portfolios. Add to that a management team that has shown discipline in adjusting the bank’s strategy, and the setup becomes even more interesting.

However, the risks are not negligible. Compliance delays, sector exposure, and legal settlements suggest that investors should tread carefully and be prepared for some volatility. Still, for those willing to look beyond the near-term noise, there may be long-term value to uncover as the bank works through its transformation and continues strengthening its core operations.