Updated 6/3/25

Middlesex Water Company, trading under the symbol MSEX, has been around since the late 1800s and remains a steady presence in the world of regulated utilities. Serving parts of New Jersey and Delaware, the company delivers water and wastewater services to homes, businesses, and industries. It might not grab headlines, but that’s not why investors look at it. This is a name you consider when you’re after consistency, reliability, and a commitment to shareholders.

Middlesex isn’t in a rush to grow wildly or reinvent the wheel. Instead, it quietly operates its regulated business, adjusts rates with the help of local regulators, and shares a good chunk of earnings with shareholders. It’s a story of steady income—not fireworks.

Recent Events

MSEX has had a relatively stable run over the past year. The stock is currently trading just under $58, modestly higher for the day, and showing a 12-month gain of a little over 6%. Not a market-beater, but for income-focused investors, that’s just fine. It’s not meant to be volatile, and its 0.80 beta underscores that stability.

Revenue has ticked up, with the latest quarter showing a 9% increase compared to the same time last year. That brought total revenue over the trailing twelve months to just shy of $196 million. But while the top line moved in the right direction, earnings slipped a bit—net income dropped about 11% year-over-year. That dip might catch your eye, but for a regulated utility like Middlesex, it doesn’t spell danger.

The company does carry a fair bit of debt—nearly $396 million—and only a modest cash cushion of around $2.7 million. Its current ratio is below 0.5, which isn’t unusual in this sector but does leave less room to maneuver. Still, with steady rate-based income, the business model remains intact.

Key Dividend Metrics

💰 Forward Dividend Yield: 2.38%

📈 5-Year Average Yield: 1.66%

🔁 Dividend Growth Streak: Over 50 years

🧮 Payout Ratio: 55.2%

📆 Next Dividend Date: June 2, 2025

⛲ Dividend Rate: $1.36 per share annually

📉 Trailing Yield: 2.33%

Dividend Overview

What sets Middlesex apart is its incredible consistency. This company has been raising its dividend for over half a century—one of the few in the market to boast that kind of track record. It’s part of a very select group of companies that can call themselves Dividend Kings.

Today’s yield stands at 2.38%, which is comfortably above its five-year average. That reflects both a rising dividend and some recent stock softness. For investors who focus on income, that’s a positive combination.

The payout ratio is sitting at just over 55%, a healthy zone that suggests Middlesex isn’t stretching itself too thin to support the dividend. With a stable business and predictable earnings, there’s nothing here that suggests the company will pull back on its payout anytime soon.

Dividend Growth and Safety

Middlesex doesn’t just pay—it raises. Year after year, it finds room in its budget to bump the dividend up a notch, even through tough economic times. That’s a reassuring signal for long-term investors who want to rely on growing income streams.

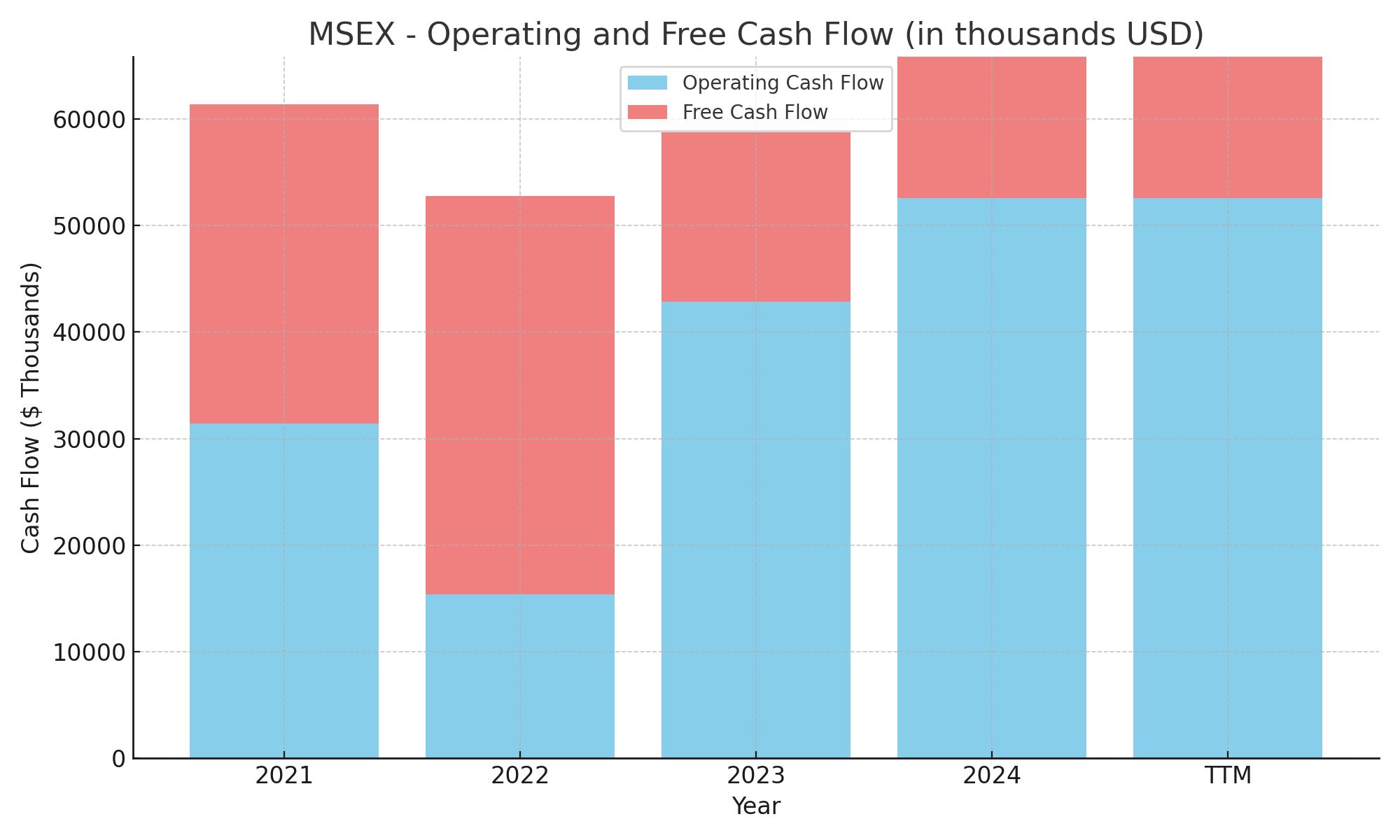

There are a few things to watch, though. The balance sheet leans heavily on debt, and short-term liquidity is tight. That said, free cash flow has held up well—about $55 million on a levered basis—and operating cash flow is solid too.

These cash flows give the company room to maintain and slowly grow its dividend, even in an environment with rising costs or regulatory delays. Middlesex has shown over decades that it can manage through different cycles, and that’s not something to take lightly.

This isn’t the kind of stock you buy expecting surprises. And that’s exactly why some investors keep coming back to it. For those who care more about their income than day-to-day share price movement, MSEX continues to offer a stable option with a rare track record of consistent dividend increases.

Cash Flow Statement

Middlesex Water’s trailing twelve-month cash flow tells a story of consistent operating strength paired with heavy capital investment. The company generated $65.86 million in operating cash flow, a noticeable increase from the previous year’s $58.73 million. That improvement underscores the dependable nature of its regulated utility business, where revenues and margins remain relatively stable. Still, those healthy cash flows have been outpaced by aggressive infrastructure spending, as reflected in capital expenditures of $79.14 million over the same period.

The result is negative free cash flow of $13.28 million, continuing a multiyear trend of cash burn driven by investment. Financing activities helped bridge the gap, with $13.09 million flowing in—mostly from new debt issuance, which offset regular repayments. Middlesex ended the period with just $2.66 million in cash on hand, a tight cushion that keeps it reliant on steady operating performance and capital markets access. This pattern isn’t unusual for a water utility that’s expanding or upgrading its system, but it does mean careful balancing is required to keep dividend commitments intact while navigating ongoing infrastructure needs.

Analyst Ratings

Middlesex Water Company (MSEX) has been on analysts’ radar lately with a mix of rating changes, reflecting a split sentiment on its near-term valuation and long-term stability.

📈 In May 2025, Janney Montgomery Scott upgraded MSEX from “Neutral” to “Buy” with a target price of $66. This move followed steady operational results and a visible push toward infrastructure improvements that aim to solidify its long-term cash flow reliability. The firm pointed to consistent revenue growth and a dependable regulatory framework that continues to support earnings stability.

🔄 Interestingly, just a month earlier in April 2025, the same firm had downgraded the stock from “Buy” to “Neutral.” That shift was driven by valuation concerns after a solid rally in the stock. While the fundamentals remained strong, the price at the time had pushed past what they viewed as fair value based on projected earnings.

🚀 Back in March 2025, Baird took a more optimistic stance, upgrading MSEX from “Neutral” to “Outperform” and issuing a price target of $61. Their rationale centered on Middlesex’s regulated model, which offers consistent returns and reduced volatility—a setup they believed was undervalued by the market.

🔻 On the more cautious side, BofA Securities initiated coverage in December 2024 with an “Underperform” rating and a $56 price target. Their concerns revolved around rising capital expenditure needs and potential regulatory friction, which could weigh on margins and pressure the balance sheet.

🎯 As of now, the analyst consensus sits at a “Hold” with an average price target near $61. That consensus captures both the dependable nature of the business and some of the financial constraints it faces, particularly around free cash flow and capital spending.

Earning Report Summary

Solid Revenue Growth, But Profit Slips

Middlesex Water Company got off to a steady start in 2025 with first-quarter revenue coming in at $44.3 million, up from $40.5 million this time last year. That increase was mostly thanks to rate adjustments, stronger customer usage, and a growing customer base. It’s the kind of slow, stable growth you’d expect from a utility that knows its lane and sticks to it.

But on the earnings side, things were a little softer. Net income dipped to $9.5 million from $10.7 million a year ago. Earnings per share followed suit, landing at $0.53 compared to $0.59 last year. The drop wasn’t due to any major red flag—more of a one-off situation. Last year’s first quarter included a sizable cost recovery tied to the Park Avenue treatment plant, which wasn’t repeated this time around.

Infrastructure Focus and New Customers

Expenses rose a bit too, coming in at $32.7 million versus $30.7 million the year before. Much of that was tied to production costs and weather-driven maintenance, which is par for the course in this line of work. Middlesex also poured about $19 million into system upgrades and infrastructure improvements during the quarter—consistent with its long-term focus.

One notable move was the acquisition of the Ocean View water utility assets in Delaware, finalized in April. That deal brought around 900 new customers into the fold and cost the company $4.6 million. It’s a small but strategic addition that fits into Middlesex’s approach of expanding deliberately where it makes sense.

Regulatory Updates and Dividends

On the regulatory front, the company submitted another request for a Distribution System Improvement Charge (DSIC). If approved, the new charge would bring in about $1.9 million in additional annual revenue starting this June. That’s on top of the $1.1 million already flowing in from previous DSIC approvals. It’s a reminder of how essential rate mechanisms are to keeping infrastructure upgrades funded without overextending.

And for dividend-focused investors, the story continues to be positive. The board declared a $0.34 per share dividend for the second quarter, payable on June 2 to shareholders of record as of May 15. That marks 52 consecutive years of dividend growth—something that’s getting harder to find, especially with that kind of consistency.

All in all, Middlesex Water is sticking to its formula—modest growth, responsible spending, and a continued focus on delivering value to its shareholders through both infrastructure improvements and reliable dividends.

Management Team

Middlesex Water Company is currently led by President and CEO Nadine Leslie, who stepped into the role in March 2024. With more than two decades of experience in the water utility sector, including senior leadership roles at SUEZ North America, she brings a practical and focused approach to utility management. Her early months have emphasized system reliability, regulatory alignment, and operational efficiency, all central to Middlesex’s long-term strategy.

Supporting Leslie is CFO Mohammed Zerhouni, who joined the company in June 2024. He previously held finance leadership roles with SJW Group and Veolia North America, bringing a deep understanding of regulated utility finances. Zerhouni has already played a key role in shaping Middlesex’s capital structure and long-range planning initiatives.

The operating side is headed by Gregory Sorensen, who became Chief Operating Officer in December 2024. With oversight of day-to-day utility operations, his experience in system performance and compliance has proven important, especially as the company continues to invest heavily in infrastructure upgrades and modernization.

Together, this leadership group combines operational discipline with strategic planning—a mix that aligns with Middlesex’s goal of delivering consistent service while navigating the regulatory landscape and capital requirements typical of the sector.

Valuation and Stock Performance

Middlesex Water shares are trading around $57.47, giving the company a market cap just over $1 billion. That places it firmly in the mid-cap category within the utility space. The stock has seen a 52-week range from $48.18 to $70.73, with current pricing sitting closer to the lower end. This makes valuation a point of interest, especially for investors looking at relative value compared to historical norms.

From a performance standpoint, the stock has delivered a modest gain of over 6% in the past year. That’s under the broader market’s performance but still reflects resilience, especially given the pressure utilities have faced from higher interest rates. The 5-year beta of 0.80 reflects relatively low volatility, which is part of its appeal to long-term, income-focused holders.

Financially, earnings per share rose 31% year-over-year in the most recent report, paired with a 9% increase in revenue. Despite softness in net income from one-off factors, the core earnings profile remains stable. Analysts see the stock forming a consolidation pattern with a technical breakout point near $67, which might draw attention if volume picks up in the weeks ahead.

For income investors, the dividend continues to be a core driver. The forward yield sits at 2.38%, supported by a consistent payout history and a solid track record of increases. While not a high-yield stock, Middlesex’s dividend growth and stability make it appealing in low-volatility portfolios.

Risks and Considerations

There are risks to weigh with Middlesex Water, even with its steady track record. The first is regulatory. As a regulated utility, the company’s ability to grow revenue and manage margins is closely tied to rate approvals. Changes in state-level policy, timing delays, or pushback from regulators could dampen returns.

Another concern is capital intensity. Maintaining and upgrading water infrastructure is expensive. Middlesex spends tens of millions each year in capital projects, and that puts pressure on cash flow. The company does cover its dividend, but free cash flow has been negative, which means funding often comes through debt issuance or equity.

There’s also the issue of environmental exposure. The company has launched testing and treatment programs for PFAS, also known as “forever chemicals,” in its systems. While proactive, the costs and timeline of full remediation remain unclear. That adds another layer of unpredictability to capital planning and long-term margins.

Lastly, in a high-rate environment, utilities face some relative performance headwinds. Investors often rotate away from income-generating utilities when bond yields rise, which can create valuation pressure even when business fundamentals remain sound.

Final Thoughts

Middlesex Water Company doesn’t try to be flashy, but it has built a reputation on consistency, stability, and commitment to shareholder returns. Its leadership team is experienced and engaged, and their operational discipline shows in the company’s steady financial results. The stock’s valuation isn’t stretched, and its dividend profile continues to be a strong feature for long-term investors who value dependability.

That said, the capital-intensive nature of the business, combined with environmental and regulatory uncertainties, means investors need to stay informed. Still, for those seeking a stable core holding in the utility space with a proven dividend history, Middlesex remains a name worth keeping on the radar.