Updated 6/3/25

Mid-America Apartment Communities, or MAA, is a name that quietly stands out in the real estate investment trust (REIT) space. It’s not the most talked-about stock at the water cooler, but it doesn’t need to be. With a laser focus on owning and managing apartment communities across the Sunbelt, MAA has built its strategy around population shifts and growing demand for rental housing in cities where people are putting down roots.

Think of places like Atlanta, Tampa, Dallas, and Charlotte—booming metros where jobs are growing, and people are constantly on the move. That’s where MAA plants its flag, and that’s how it’s built a portfolio that’s both stable and forward-looking.

Let’s take a closer look at how things have been shaping up lately and what dividend investors should have on their radar.

Recent Events

MAA’s share price recently dipped to $152.48, down just over 2% on the day. While that drop may catch some attention, the bigger picture is a bit more comforting—MAA is still up more than 14% over the last year, showing strength even in a challenging market for REITs.

The company’s first quarter of 2025 delivered solid results. Revenue climbed a modest 1% compared to the same time last year, but the real story was on the bottom line. Net earnings rose by more than 26% year-over-year, thanks to tighter expense control and improved operating efficiency. These are the kinds of moves that quietly fuel long-term success.

Looking at the balance sheet, MAA appears steady. With a total debt-to-equity ratio around 83%, the company has room to maneuver. Operating cash flow came in at a strong $1.09 billion over the past 12 months, and levered free cash flow wasn’t far behind at $990 million. That’s real financial strength, especially in a space where cash flow is king.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.89%

💵 Forward Annual Dividend: $6.06 per share

🔁 5-Year Average Yield: 3.23%

🧮 Payout Ratio: 123.18%

📆 Ex-Dividend Date: July 15, 2025

🎯 Dividend Payment Date: July 31, 2025

Dividend Overview

If there’s one thing MAA does consistently, it’s deliver a reliable dividend. With a forward yield of 3.89%, the stock offers more income than a typical S&P 500 name. And when you compare that yield to the current backdrop of interest rates, it’s even more attractive for those looking to supplement their portfolio with income.

Now, a payout ratio over 120% might seem high on paper—but in the REIT world, it’s a very different game. These businesses are required to return most of their earnings to shareholders in the form of dividends, which means traditional payout metrics don’t tell the full story. What matters more is whether cash flow is healthy enough to support those payouts. For MAA, that’s a solid yes.

The company is throwing off over $1 billion in operating cash flow and nearly that much in levered free cash flow. That’s more than enough to cover the dividend and still leave room to reinvest or strengthen the balance sheet. In other words, the dividend doesn’t just look good—it looks sustainable.

Dividend Growth and Safety

Steady growth in the dividend has been a consistent part of MAA’s strategy. Over the past five years, the payout has increased at a comfortable pace—usually in the ballpark of 5 to 6 percent annually. It’s not flashy, but it’s dependable, and it helps investors keep up with inflation while building a more resilient income stream.

The latest dividend bump came in early 2024, raising the quarterly payout from $1.13 to $1.215 per share. It wasn’t a massive jump, but it reinforced the company’s commitment to rewarding shareholders without overextending.

Operationally, MAA continues to run a tight ship. Profit margins are strong, with operating margins sitting above 29% and net profit margins around 26%. The return on equity—at just over 9%—reflects thoughtful capital management, especially for a company in a capital-intensive industry like real estate.

On the debt side, MAA holds just over $5 billion, a number that’s manageable given its $18 billion market cap and the $23 billion enterprise value. As long as the company can maintain favorable borrowing terms and avoid major shocks to the rental market, the dividend remains well-covered.

Another reassuring factor is MAA’s relatively low beta of 0.78. That suggests the stock tends to move less than the broader market, which is appealing to dividend investors looking for a smoother ride.

Institutional investors clearly like what they see. With over 100% of the float held by institutions (due to lending and short interest dynamics), there’s a lot of conviction behind this name. Insider ownership is low, at under 1%, which is common for large REITs, though it always helps to see more alignment from leadership.

All things considered, MAA presents a solid case for dividend-focused investors—offering not just a healthy yield, but one backed by strong fundamentals, thoughtful management, and exposure to growing markets across the U.S. Sunbelt.

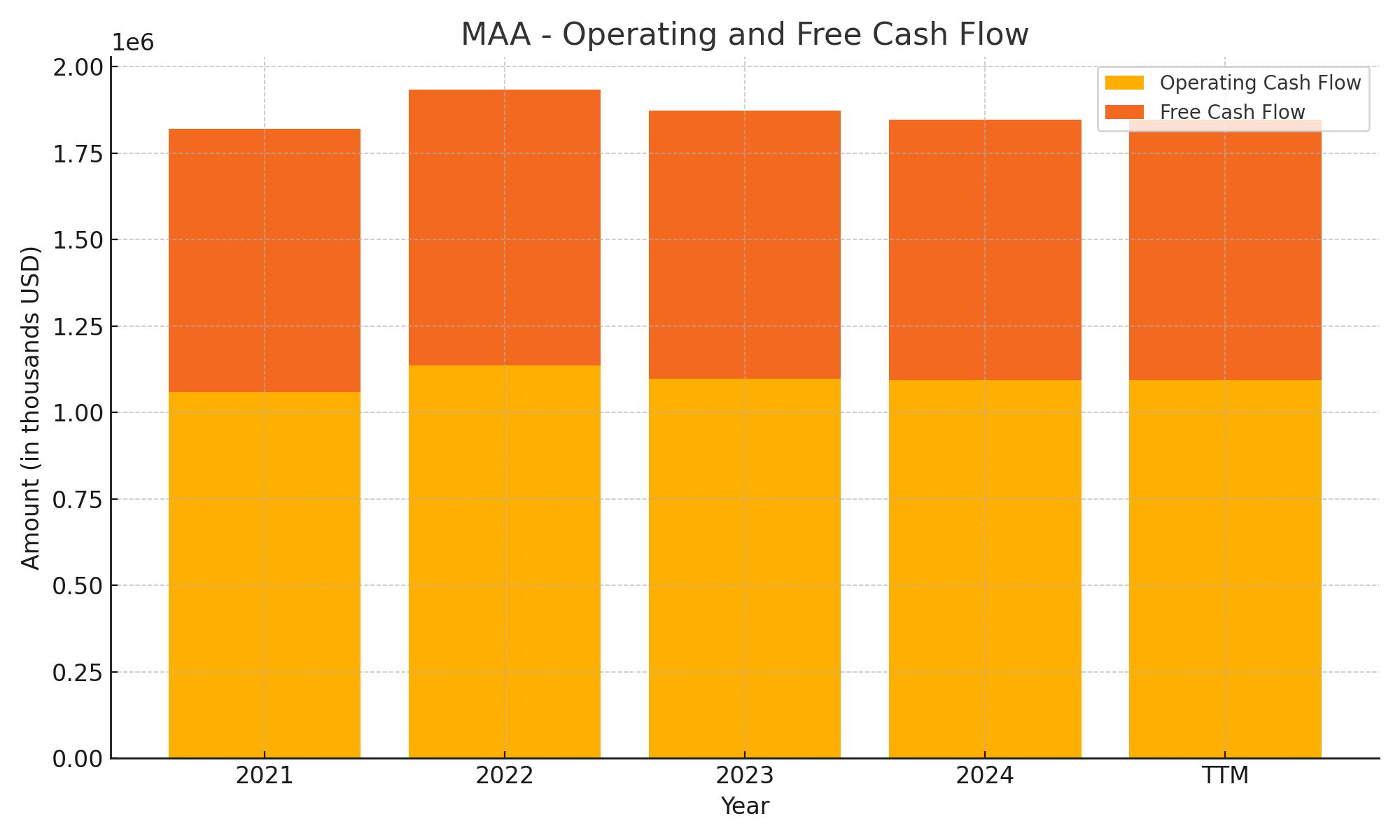

Cash Flow Statement

Mid-America Apartment Communities generated $1.09 billion in operating cash flow over the trailing twelve months, maintaining a solid and consistent trend when compared to the past few years. Despite a slight dip from the peak in 2023, this figure reflects continued operational strength and a stable rental income base. Free cash flow came in at $751.7 million, slightly lower than the previous year but still healthy, giving MAA ample room to support its dividend and ongoing property investments.

On the investment front, capital expenditures remained significant at $342.9 million, reflecting ongoing development and maintenance efforts. Investing cash flow was negative $793.9 million, similar to prior years, which is typical for a REIT that continually reinvests in its portfolio. Financing activities showed a net outflow of $299.4 million, though the company raised $745 million in new debt during the period. That fresh capital was likely used to fund acquisitions and development, partially offsetting scheduled debt repayments. MAA ended the period with a cash balance of $69.5 million, showing modest growth from previous years and leaving the company with adequate liquidity for near-term needs.

Analyst Ratings

📉 Mid-America Apartment Communities (MAA) has recently seen a mix of analyst activity, reflecting nuanced views on its valuation and market positioning. Raymond James downgraded the stock from “Strong Buy” to “Outperform,” adjusting the price target from $185 to $175. This change was attributed to the stock’s valuation aligning more closely with its peers and a notable 30% decline in new multifamily supply deliveries since last fall.

📈 On the other side, several firms have lifted their price targets, signaling renewed confidence in MAA’s fundamentals. Scotiabank bumped its target from $182 to $194 while maintaining a “Sector Outperform” stance. Jefferies also upgraded the stock to “Buy” from “Hold,” with a new target of $190. JMP Securities followed suit, raising its price target to $170, citing strong operational efficiency and stable income flow.

🧭 The consensus among analysts sits at a “Moderate Buy,” with an average 12-month price target of around $172.69. That implies roughly 10% upside potential from current price levels, which is respectable given the stability of MAA’s cash flows and its positioning within the high-demand Sunbelt rental markets.

🔍 These rating changes suggest that while valuation may be catching up to fundamentals, many still see room for performance, especially as supply trends normalize and the company continues to execute.

Earning Report Summary

Solid Start to the Year

Mid-America Apartment Communities (MAA) opened 2025 with a steady hand. In the first quarter, the company delivered core funds from operations (FFO) of $2.20 per share, which came in slightly above the midpoint of its own guidance. That performance was helped along by better-than-expected same-store net operating income and the timing of a few expenses landing more favorably than expected.

Occupancy was one of the highlights. MAA’s same-store portfolio saw average occupancy of 95.6%, a modest but encouraging bump from last year. At the same time, resident turnover dropped to 41.5%. That’s a notable figure—it suggests fewer tenants are leaving, and fewer are making the leap to homeownership, which tends to slow down during uncertain economic periods.

Leasing Trends and Rent Growth

Leasing trends were a mixed bag. Effective blended lease rates were down by 0.5%, mainly because new lease pricing dropped 6.3%. Renewals helped soften that dip, with existing tenants accepting an average increase of 4.5%. So while it’s not a booming rent-growth environment, MAA is doing a good job holding onto residents and keeping revenue stable.

Development Pipeline and Property Moves

MAA is still actively developing its footprint. As of the end of Q1, the company had seven communities under construction, with expected total costs just north of $850 million. They’ve also got several recent developments and acquisitions moving through lease-up, totaling around $657 million in investment.

In terms of portfolio strategy, MAA exited the Columbia, South Carolina market by selling two properties for roughly $83 million. That move was part of a broader effort to sharpen focus on their highest-growth regions, and they walked away with a solid $72 million gain from the deal.

Balance Sheet and Financial Position

From a financial standpoint, MAA is keeping things clean. The company ended the quarter with nearly $56 million in cash and had access to a $1 billion credit facility. Their net debt to EBITDA ratio came in at 4.0x—well within a healthy range for a REIT of this size and stability.

Looking Ahead

Guidance for the rest of the year was reaffirmed. Management still expects full-year core FFO to fall between $8.61 and $8.93 per share. Same-store NOI growth is projected to range from slightly negative to flat, which reflects a cautious but measured outlook. There’s some softness expected due to supply trends, but nothing alarming.

Leadership emphasized confidence in their game plan. The focus remains on operational efficiency, targeted growth in high-demand markets, and tech-driven enhancements to improve tenant experience. In short, it’s a steady-as-she-goes strategy that continues to work in MAA’s favor.

Management Team

Mid-America Apartment Communities (MAA) recently completed a leadership transition aimed at supporting its long-term strategic vision. As of April 1, 2025, A. Bradley Hill has stepped into the role of President and Chief Executive Officer, taking over from H. Eric Bolton Jr., who now serves as Executive Chairman. Hill brings deep industry knowledge and a long tenure with the company, having held several leadership roles that helped shape MAA’s current market strategy.

The executive team includes A. Clay Holder as Executive Vice President and Chief Financial Officer, Robert J. DelPriore as Executive Vice President and General Counsel, and Joseph P. Fracchia as Executive Vice President and Chief Technology & Innovation Officer. These leaders collectively support the company’s priorities around financial strength, compliance, and innovation in resident experience. MAA’s board of directors includes a diverse mix of backgrounds, from real estate to financial oversight, and they provide guidance on both operational strategy and governance. This combination of experience and continuity creates a stable foundation for navigating a shifting real estate environment.

Valuation and Stock Performance

MAA’s stock recently traded at around $152.42, representing a 2% drop in the most recent session. Despite the daily volatility, the stock has held up well over the past year, bouncing between a low of $133.99 and a high of $173.38. That range reflects both macroeconomic uncertainty and investor appetite for reliable dividend payers in a higher-rate world. With a market cap of approximately $18.2 billion, MAA remains a heavyweight among residential REITs.

Analysts currently peg the stock’s consensus price target at $169.50, suggesting modest upside from current levels. The company trades at a price-to-earnings ratio of about 34.7, which may look elevated on the surface but reflects the market’s confidence in the company’s future cash flows. Importantly for income-focused investors, the dividend yield hovers around 3.90%, which offers an attractive income stream that compares favorably against many fixed-income alternatives.

Compared to peers in the multifamily REIT space, MAA’s valuation is balanced. It may not be the cheapest, but it’s priced in line with the premium the market places on management discipline, market positioning in high-demand Sunbelt regions, and consistent dividend growth. The stock’s relative stability and predictable income make it appealing for investors looking to anchor a dividend-heavy portfolio.

Risks and Considerations

Investing in MAA isn’t without its challenges. Real estate is a cyclical business, and while the long-term trends in population growth and urban migration favor MAA’s markets, short-term disruptions can weigh on performance. Rising interest rates, in particular, can increase borrowing costs and potentially slow down both development activity and investor enthusiasm for REITs.

Competition is another consideration. MAA operates in regions that are also attractive to other developers and landlords, which can put pressure on rent growth and occupancy if supply outpaces demand. Additionally, regulatory risks exist. Changes in housing policy, rent control measures, or tax laws could impact earnings and cash flow, even if fundamentals remain strong.

Operationally, there’s always the potential for hiccups—whether it’s construction delays, unexpected maintenance expenses, or fluctuations in tenant turnover. These factors can nibble at margins over time. Economic headwinds like inflation or rising unemployment could also dampen demand for rentals or reduce pricing power in some markets. While MAA has weathered past downturns well, no REIT is immune to shifts in the broader economy.

Final Thoughts

Mid-America Apartment Communities continues to execute on its strategy of delivering consistent income and measured growth. The leadership transition earlier this year was smooth and aligns with the company’s emphasis on continuity and vision. With its focus on high-growth Sunbelt markets, a track record of strong tenant retention, and a commitment to efficient operations, MAA stands on solid footing.

For investors focused on dividends and long-term stability, MAA remains a compelling option within the multifamily REIT space. Its reliable cash flow, attractive yield, and solid market positioning make it a stock worth watching. While the broader real estate market faces its share of risks, MAA’s approach reflects the kind of steady hand that many income investors appreciate.