Updated 6/3/25

MGIC Investment Corporation, ticker symbol MTG, isn’t the kind of name that draws a lot of mainstream attention. But for dividend investors with an eye for consistency and value, it’s the type of company that might deserve a closer look. Based in Milwaukee, MGIC has been around since 1957, specializing in private mortgage insurance. This essentially means it helps lenders manage risk when borrowers put down less than 20% on a home—an important part of the real estate financing puzzle.

Over the years, MGIC has proven it can navigate both boom times and market stress. The company came through the 2008 housing crisis, rebuilt its balance sheet, and re-emerged as a steady performer. It now finds itself in a stronger, more shareholder-friendly position, one where dividends have become part of the regular conversation.

Recent Events

In its most recent earnings report for Q1 2025, MGIC posted solid results. Net income over the last twelve months hit $774 million, which breaks down to $3.00 per share. That’s not just good—it’s comfortably profitable. Their profit margin sits at an impressive 63.5%, and the return on equity is just over 15%, which speaks to efficient use of shareholder capital.

The business is moving forward slowly but surely. Year-over-year earnings rose by 6.5%, and revenue ticked up 4%. This isn’t aggressive growth, but it’s stable, which can be exactly what dividend-focused investors are after. You’re not looking for fireworks here—you want predictability and staying power. And so far, MGIC seems to be delivering that.

Stock-wise, the past year has been kind. MTG has gained over 24% in the last 52 weeks, more than doubling the return of the broader S&P 500. That price action isn’t random; it’s tied to growing investor confidence in the business, and yes, in the dividend too.

One more important point: MGIC isn’t buried under debt. It carries about $645 million in debt, which is manageable, especially considering its low debt-to-equity ratio of 12.6%. The company also has over $200 million in cash on hand. Taken together, those numbers paint a picture of financial stability—a key foundation for any company committed to returning cash to shareholders.

Key Dividend Metrics

🟢 Forward Dividend Yield: 1.98%

💸 Annual Dividend Rate: $0.52

🔁 5-Year Average Dividend Yield: 2.20%

🧱 Payout Ratio: 16.8%

📅 Ex-Dividend Date: May 8, 2025

💼 Last Dividend Paid: May 21, 2025

Dividend Overview

Looking at the current dividend setup, MGIC might not turn heads with its yield. At just under 2%, it doesn’t fall into the high-yield camp. But that’s only part of the story. The key is how secure the dividend is and what it says about management’s intentions.

That 16.8% payout ratio tells us something meaningful: MGIC is only using a small slice of its earnings to pay out the dividend. There’s plenty of room left over for reinvestment, share buybacks, or just letting the cash build. That’s a sign of both confidence and caution—two traits dividend investors should appreciate.

MGIC has also shown it’s thinking about shareholders. In addition to regular dividends, the company has been actively buying back stock. This helps reduce share count and can quietly enhance shareholder value over time. Free cash flow over the last twelve months came in at about $632 million, which is more than enough to support its dividend and still leave breathing room.

In short, this is a company not trying to impress with a high dividend yield. It’s focused instead on building a pattern of reliability and sustainable growth.

Dividend Growth and Safety

MGIC’s dividend journey over the past few years tells a story of quiet progress. After halting its dividend in the wake of the financial crisis, the company reintroduced payouts in 2019. Since then, it’s been increasing them slowly but consistently. Most recently, the annual dividend was bumped up from $0.50 to $0.52. Not a huge jump, but a steady step forward.

That kind of conservative approach often signals strength. It shows the company is not stretching or overpromising. Instead, it’s laying a foundation. And based on the business fundamentals—strong profit margins, solid returns, and ample free cash flow—there’s room for more growth down the line.

What also stands out is MGIC’s focus on risk management. As a mortgage insurer, the company has to stay disciplined. And it shows in the numbers. Operating margin is pushing 80%, and return on assets is close to 10%. These aren’t the stats of a company flying blind—they suggest tight control over operations and a clear sense of purpose.

Another point worth noting: institutions own more than 99% of the float. That kind of support doesn’t happen by accident. Institutional investors value stability and consistency, particularly when it comes to dividends. MGIC is starting to build that kind of profile.

With a modest valuation—forward P/E under 9 and a price-to-book around 1.22—MGIC doesn’t look overbought. It’s a company that still trades at reasonable levels, even after a strong year in the market.

Taken together, the picture is clear. MGIC isn’t a flashy name in the dividend world, but it’s shaping up to be a solid one. The company’s dividend is well-covered, has room to grow, and is backed by strong business fundamentals. For income-focused investors looking for reliability, that’s a story worth following.

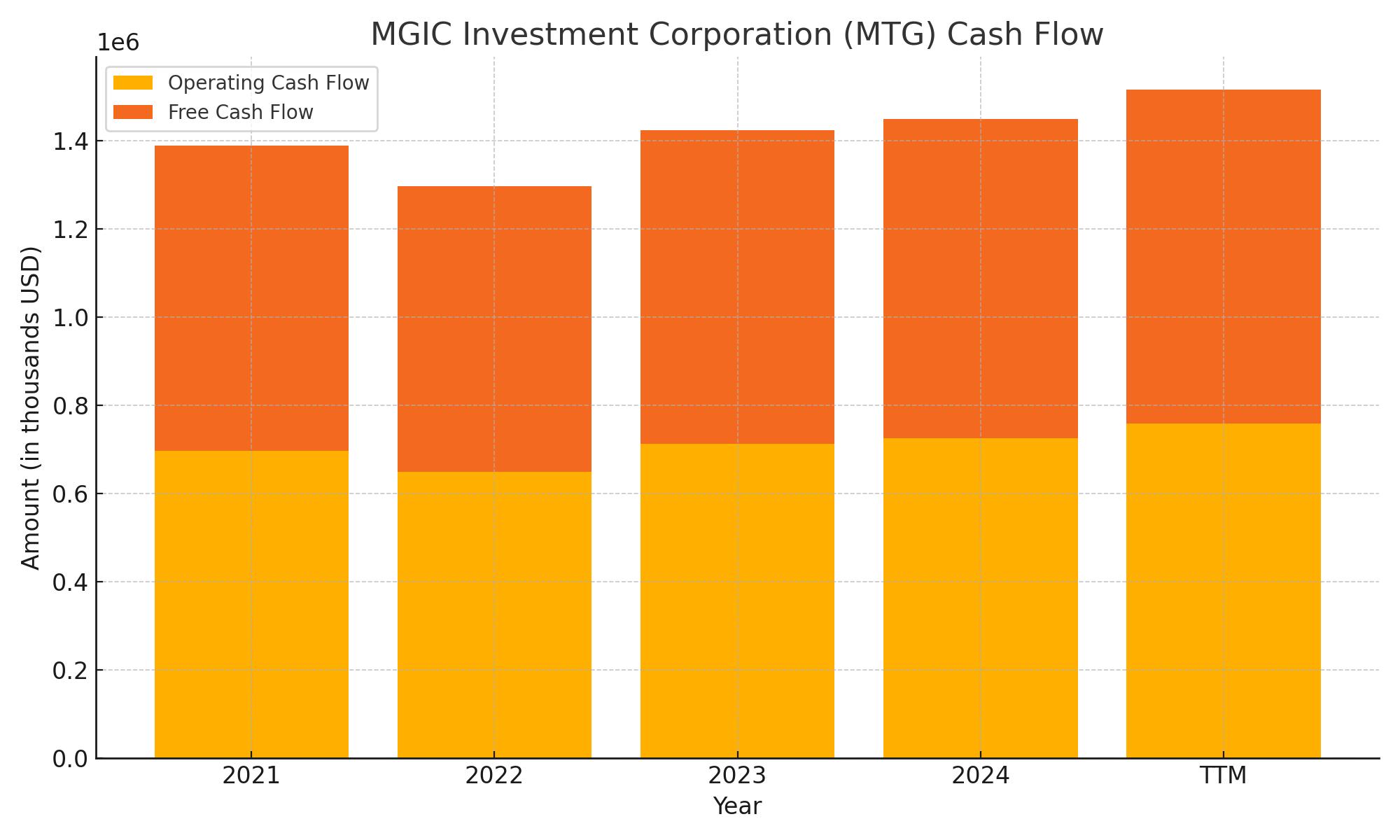

Cash Flow Statement

MGIC Investment Corporation’s cash flow statement for the trailing twelve months highlights the financial discipline behind its operations. Operating cash flow came in at $758 million, continuing a multi-year trend of stable and growing inflows from the core business. Free cash flow closely matched this at $756 million, indicating low capital expenditure requirements and efficient cash conversion. These figures underscore a business model that consistently generates cash without significant reinvestment needs.

On the other side, financing cash flow was a notable outflow at -$849 million. This was primarily driven by aggressive share repurchases, which totaled $699 million—reflecting a strong commitment to returning capital to shareholders. While there was no new debt issued, the lack of material repayments also indicates a stable debt structure. Investing cash flow showed a relatively modest outflow at -$135 million, suggesting a conservative approach to capital deployment. The company ended the period with $213 million in cash, maintaining solid liquidity while actively managing its capital base.

Analyst Ratings

🟡 MGIC Investment Corporation (MTG) has recently seen a mix of analyst activity that leans toward cautious optimism. 🟡 Compass Point nudged its price target up slightly from $27 to $28, keeping its rating at neutral. 🟡 Keefe, Bruyette & Woods trimmed their target to $26 from a previous $28, while also maintaining a hold stance. 🟡 UBS made a modest move upward, lifting their target from $25 to $26, continuing with a neutral outlook.

📊 Across the board, the overall analyst sentiment remains steady with a consensus rating of “Hold.” Of the eight analysts covering the stock, two have issued buy ratings, five have hold ratings, and just one has a sell rating on file.

🎯 The average 12-month price target comes in at $26.63, with a range that stretches from $25.00 on the low end to $30.00 on the high. This shows that while there’s some variation in expectations, most analysts see MTG hovering around its current trading level with limited upside or downside risk in the short term.

💬 The general tone from analysts indicates confidence in MGIC’s operating performance and capital returns but a wait-and-see attitude when it comes to aggressive growth or valuation expansion.

Earning Report Summary

Solid Start to the Year

MGIC Investment Corporation kicked off 2025 with a strong performance, showing that steady execution and careful management are still very much part of the company’s playbook. Net income came in at $186 million, or $0.75 per share. That’s a meaningful improvement over the $0.64 per share posted in the same period last year. It also reflects a healthy 14.3% return on equity—something investors like to see when judging how effectively a company is putting its capital to work.

What stood out this quarter was the consistency. MGIC’s insurance in force reached $293.8 billion, and it wrote $10.2 billion in new insurance during the period. Persistency—the rate at which existing policies remain on the books—was strong at 84.7%. That suggests their customers are sticking around, which keeps revenue predictable and helps with long-term planning.

Keeping Costs in Check

On the expense side, MGIC did a solid job keeping things lean. Operating expenses were trimmed down to $53 million, compared to $61 million a year ago. That kind of discipline goes a long way in supporting bottom-line growth, especially in a business that can be sensitive to interest rate and housing market swings.

MGIC continued its trend of rewarding shareholders. The company bought back 9.2 million shares during the quarter, spending $224 million in the process. It also paid out a quarterly dividend of $0.13 per share. On top of that, management approved a fresh $750 million repurchase program, which gives them flexibility to keep returning capital to investors going forward.

Leadership’s Outlook

Leadership sounded measured but optimistic about the path ahead. The focus remains on maintaining a strong capital base, keeping underwriting standards tight, and staying disciplined no matter how the economic winds shift. They made it clear that while growth is important, protecting the company’s long-term health takes priority. That kind of approach tends to resonate with long-term investors who value consistency over flash.

All in all, it was a clean, well-executed quarter—nothing flashy, just solid performance from a company that knows what it’s good at and continues to deliver.

Management Team

MGIC Investment Corporation is guided by CEO Tim Mattke, who took on the role in 2019 after serving as the company’s CFO. His deep background in financial strategy and risk oversight has helped MGIC maintain a steady course through both volatile and stable periods. He’s been with the company since 2006, giving him a long-term view on what drives sustainable performance in mortgage insurance.

Joining Mattke at the top is Sal Miosi, the company’s President and Chief Operating Officer. Miosi manages daily operations and has been central in carrying out MGIC’s business strategy. Nathan Colson, the current CFO, plays a key role in managing the financial health and planning processes, while Paula Maggio handles legal and governance responsibilities as General Counsel. Together, this team has struck a balance between discipline and growth, with a clear focus on risk management and capital efficiency.

Valuation and Stock Performance

MGIC’s stock has had a solid run, gaining around 23% over the past year. That kind of performance has helped it stand out, especially in a sector where growth tends to be measured. The strength in earnings, low payout ratio, and consistent buybacks have all played a part in pushing the stock higher.

Valuation-wise, MGIC trades at a forward P/E of about 8.1 times, which sits below the broader industry average. That could signal a potential discount for investors who believe in the company’s stability and long-term growth story. Its price-to-book ratio is about 1.2 times, reflecting investor trust in the quality of its balance sheet and ongoing profitability.

The current analyst consensus price target sits at roughly $27.00, with most estimates falling in the $26.00 to $30.00 range. While that doesn’t imply dramatic upside from current levels, it reflects a belief in the company’s ability to continue generating solid results, particularly in a housing market that remains active, if more balanced.

One thing that continues to support MGIC’s share price is its capital return program. The company bought back 9.2 million shares for $224 million in the first quarter of 2025 and followed that with authorization for a new $750 million buyback plan. Along with a $0.13 per share dividend, this shows a strong commitment to rewarding shareholders over time.

Risks and Considerations

As steady as MGIC appears, it’s not without risks. One issue that looms is the company’s reliance on dividends from its insurance subsidiaries to meet holding company obligations. If regulations tighten or those subsidiaries face challenges, it could limit the ability to fund dividends or buybacks.

There’s also the broader housing market to consider. High interest rates, shifting affordability, or a cooling real estate environment could lead to fewer mortgage originations. That would mean less new insurance business and potentially softer earnings.

Competition in private mortgage insurance remains intense. If pricing pressure picks up or new entrants gain traction, MGIC could see margin compression. While they’ve managed this well so far, it’s something to monitor.

Then there’s the regulatory landscape. Any changes in capital standards or underwriting guidelines could affect how the business operates. MGIC needs to stay nimble here, particularly in managing risk without compromising profitability.

And of course, a significant economic downturn would be a headwind. If default rates rise, claim activity could increase, putting stress on reserves. While MGIC has strong capital and loss management practices, extreme conditions could test that strength.

Final Thoughts

MGIC has carved out a strong, reliable position in the mortgage insurance space. With a steady hand at the top, a clean balance sheet, and a clear focus on capital discipline, the company has made a solid case for itself among investors looking for durable performance and consistent returns.

It isn’t trying to be the flashiest name in the sector. Instead, it’s sticking to what it does well—underwriting sensibly, managing risk carefully, and returning value to shareholders when it makes sense. The leadership team’s long tenure and focus on operational execution help reinforce that confidence.

For those watching the housing and credit cycle, MGIC remains a company that balances growth with caution. While risks do exist—from market competition to regulation and broader economic swings—the company has positioned itself to weather those uncertainties with a thoughtful and conservative approach.