Updated 6/3/25

MGE Energy might not be a household name outside the Midwest, but this Madison-based utility company has built an impressive track record for steady performance and shareholder rewards. With a long history rooted in electric and gas service through its primary subsidiary, Madison Gas and Electric, MGEE has quietly proven itself to be a solid pick for investors who value reliability over flash.

This is the kind of company that tends to fly under the radar, but for dividend-focused investors, that’s often a good thing. It’s about consistency, and MGEE has delivered that for decades. What makes it stand out isn’t explosive growth, but rather a slow and steady approach that continues to pay off—especially for those who value regular income and a low-risk profile.

Recent Events

So far in 2025, MGEE has had a strong start. Revenue in the first quarter grew 14.4% compared to last year, which is impressive for a utility company where growth tends to be measured in single digits. Even more encouraging, earnings grew by 23% over the same period. That’s not just top-line inflation—it’s profitable growth, which speaks volumes about how the company is managing its operations.

Operating margins held steady at a healthy 25.5%, a sign that they’re controlling costs while expanding the business. MGEE’s regulated utility model seems to be benefiting from a favorable rate environment and solid customer demand, and they appear to be managing regulatory relationships effectively.

The balance sheet remains in decent shape. Total debt is just under $768 million, which is a typical figure for a capital-intensive business like this. The current ratio stands at 2.07, suggesting they have more than enough liquidity to handle short-term obligations. With a debt-to-equity ratio just under 61%, there’s no immediate concern about leverage spiraling out of control.

Trading around $89.94, the stock sits comfortably above its 52-week low of $72.27, although it’s still off its high of $109.22. That recent dip may not worry long-term holders, but it’s worth keeping an eye on as broader market conditions evolve.

Key Dividend Metrics 📊

💸 Dividend Yield: 1.99%

🧾 Annual Dividend: $1.80 per share

📈 5-Year Average Yield: 2.10%

📅 Next Dividend Date: June 15, 2025

📉 Payout Ratio: 50.21%

📊 Dividend Growth Streak: 48 consecutive years

🔄 Last Split: 3-for-2 in 2014

📉 Recent Ex-Dividend Date: May 30, 2025

Dividend Overview

MGEE has quietly become one of the most consistent dividend-payers in the market. With 48 consecutive years of dividend increases under its belt, it’s only two years away from reaching Dividend King status—a milestone reserved for the most reliable payers out there.

At just under 2%, the current dividend yield might not jump off the page. But it’s steady, and that’s what matters here. The company has kept its payout ratio right around 50%, which is a sweet spot for long-term sustainability. It’s high enough to provide meaningful income while still giving the company room to reinvest in operations and grow earnings.

Investors should also take note of MGEE’s low beta of 0.77. That means the stock tends to be less volatile than the broader market—an important trait for income investors who want to avoid big swings in portfolio value.

The dividend is well-supported by the company’s operating cash flow, which totaled $289.83 million over the past 12 months. Despite showing slightly negative levered free cash flow, MGEE’s consistent income from operations gives them plenty of flexibility to maintain and even grow the dividend over time.

Dividend Growth and Safety

One of the most attractive things about MGEE’s dividend isn’t the current yield—it’s the reliability. This is a company that’s increased its payout every single year for nearly five decades. The growth rate has been modest, but that’s to be expected from a utility. What matters more is that it’s consistent and supported by real earnings.

Their payout ratio just above 50% suggests there’s still room for modest increases going forward. And given the company’s solid return on equity of 10.62% and stable margins, there’s no immediate reason to think that streak will end anytime soon.

The safety of the dividend also comes down to the company’s financial position. With strong operating cash flow and manageable debt, MGEE is well-positioned to continue rewarding shareholders, even if the broader economy hits a rough patch.

What really separates MGEE is the mindset of its management. They’ve shown a long-term commitment to returning capital to shareholders in a measured, responsible way. That kind of corporate culture doesn’t just appear overnight—it’s built over decades and becomes a defining part of the company’s identity.

For investors who want dependable income without having to worry about the next headline or market move, MGEE offers a lot to like. It’s a quiet performer, but one that’s shown time and again it knows how to deliver for its shareholders.

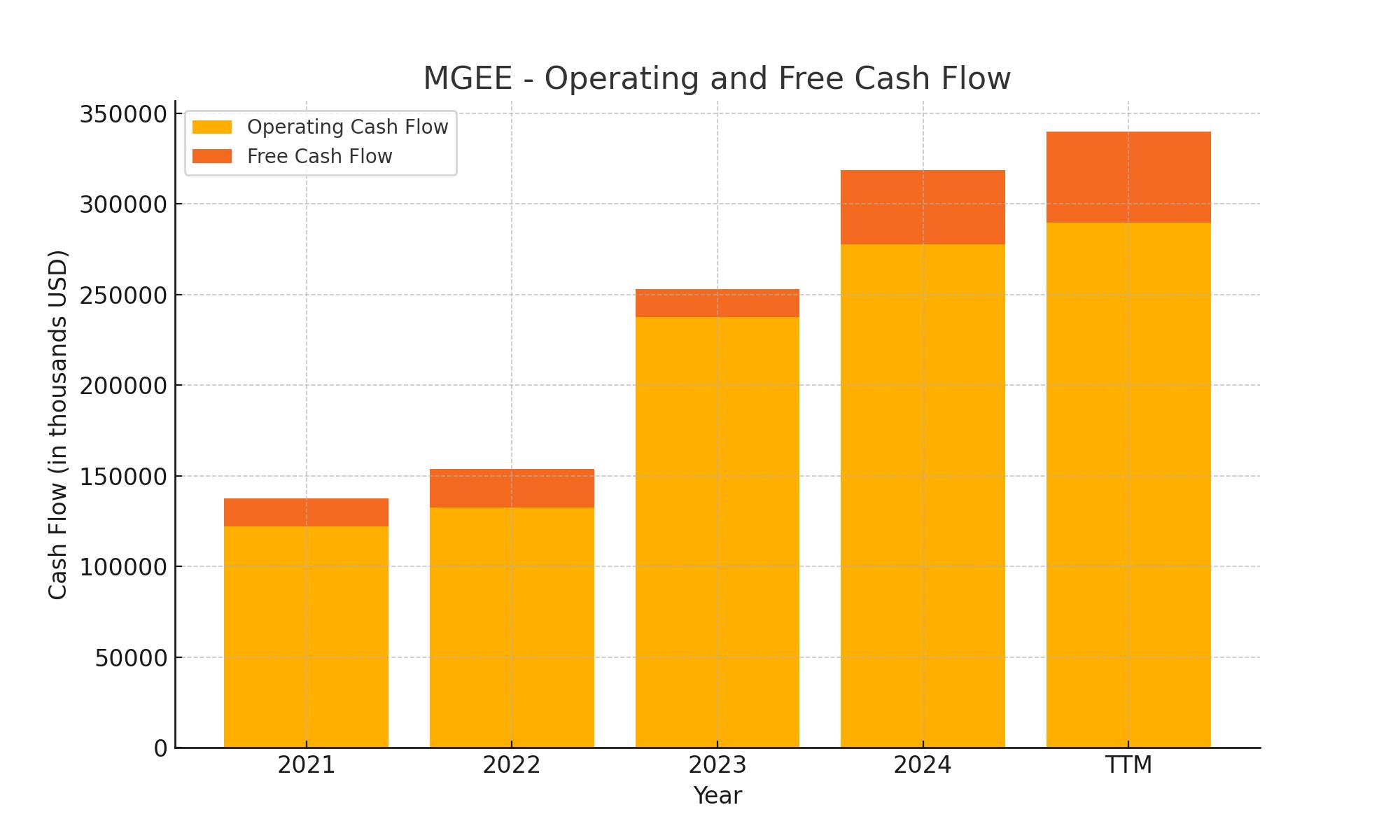

Cash Flow Statement

MGE Energy’s cash flow performance over the trailing twelve months shows a steady and disciplined financial approach. Operating cash flow climbed to $289.8 million, continuing a clear upward trend from prior years. This growth reflects improved profitability and efficient cash generation from the company’s core utility operations. Free cash flow followed suit, reaching $50 million, a notable improvement from 2022’s $15.5 million and a significant reversal from negative levels in 2021. This positive free cash flow supports dividend sustainability and gives MGEE room for modest reinvestments or debt management.

On the investing side, the company maintained a consistent pattern of capital expenditures, totaling nearly $240 million. These investments, while sizeable, are typical for a utility focused on infrastructure and system upgrades. Financing cash flow turned slightly negative at $27.6 million, influenced by modest debt repayments and limited new borrowings ($47 million issued, $5.2 million repaid). Despite high capital spending, MGEE’s cash position improved to $36.7 million, more than doubling from the prior year. This balance between investment and liquidity reflects a company maintaining its operational priorities while carefully managing its financial position.

Analyst Ratings

MGE Energy has recently seen a shift in how analysts view the stock. One notable change came from a firm that lowered its price target from $75 to $74 while maintaining an underweight rating. This kind of move usually signals that analysts see the stock as trading above its justified value, especially when weighed against its future growth potential. The downgrade was based on valuation concerns and slower-than-expected earnings growth compared to its utility-sector peers.

📉 The average 12-month price target now sits at $74, which is about 17% below where the stock is currently trading near $90. This suggests that analysts broadly believe MGEE may be fully valued or slightly overextended. Much of this cautious tone stems from the company’s modest growth outlook and its current price-to-earnings ratio, which stands higher than industry averages.

📊 Despite this, MGEE’s Relative Strength Rating recently ticked up from 68 to 72. That means the stock has been outperforming 72% of all publicly traded companies over the past 12 months. While that’s a positive sign, it’s still below the preferred threshold of 80 that typically signals strong momentum and leadership in the market.

The current consensus rating leans bearish, with analysts urging caution on the back of valuation and market positioning, even as operational performance remains steady.

Earning Report Summary

A Strong Start to 2025

MGE Energy rolled into the new year with momentum. For the first quarter of 2025, the company posted earnings per share of $1.14, up from $0.93 a year ago. That’s a solid jump, showing the kind of steady progress investors like to see. Revenue also saw a healthy bump, climbing more than 14% year-over-year to reach just under $219 million. A big part of that lift came from increased energy demand, helped along by weather that pushed usage up across the board.

Electric revenue hit $125.5 million, and natural gas wasn’t far behind at $93.5 million. Both segments showed solid volume growth, with gas retail sales rising 19% and electric retail sales ticking up 3%. These are the kind of gains that reflect both a stable customer base and some helpful seasonal tailwinds.

Leadership’s Take

During the earnings call, CEO Jeff Keebler pointed to the company’s long-term strategy as the real engine behind the performance. He emphasized that ongoing investments in renewable energy—like the newly operational Darien Solar Project—are starting to show results. Not only are these projects expanding MGEE’s clean energy footprint, but they’re also delivering power at lower costs, something that benefits both customers and the bottom line.

Keebler was also clear about the company’s direction going forward. The focus remains on sustainability, smart capital spending, and keeping customer service front and center. With more renewable capacity coming online and a steady rate base backing operations, leadership sounded confident about keeping the earnings growth on track.

Looking Ahead

The message from management was pretty straightforward: stick to the plan. MGEE intends to keep building out renewable assets and invest in the kind of infrastructure that supports long-term, stable returns. At the same time, the company is positioning itself to meet the changing needs of customers—whether that’s cleaner energy, better reliability, or more flexibility.

All signs point to a company that’s doing exactly what it set out to do: grow gradually, improve efficiency, and stay focused on delivering value to shareholders and customers alike. It wasn’t a flashy quarter, but it was a good one. And for a utility like MGEE, that’s usually a sign of things going right.

Management Team

MGE Energy’s leadership is grounded in long-term strategy and operational consistency. Jeff Keebler, serving as Chairman, President, and CEO, has over 25 years of experience with the company and has led the utility through a period of steady expansion and growing renewable investment. His leadership style emphasizes financial discipline, community-focused service, and a strong commitment to sustainability.

The broader management team mirrors this sense of stability. Many of the senior executives have deep roots within MGEE, and that continuity has helped maintain a disciplined capital allocation strategy while adapting to the evolving energy landscape. The team’s approach isn’t about chasing headlines—it’s about making smart, incremental progress that compounds over time.

Their reputation with regulators, customers, and investors has remained strong. This is the kind of leadership that prioritizes clear communication, smooth operations, and consistent delivery. That kind of trust is built slowly, but it’s part of what keeps MGEE running reliably and profitably, even in shifting market conditions.

Valuation and Stock Performance

MGEE has long commanded a premium valuation compared to most other utilities. The stock trades near $90, with a trailing P/E ratio above 25, which reflects confidence in its dependable business model. For context, most utilities tend to trade at lower earnings multiples, but MGEE’s history of dividend growth and operational resilience has kept investors willing to pay more.

Over the last 12 months, the stock has climbed roughly 14%, outperforming broader indexes and some peers in the sector. It’s held up well through market volatility, supported by low beta and the stability of utility revenues. With a 52-week range between $72 and $109, the price movement has been noticeable, but the overall trend has remained constructive.

While some analysts have reduced their price targets, pointing to the stock’s valuation, that hasn’t changed the fundamental appeal. MGEE continues to deliver steady returns and operate with conservative financial management. It’s not the cheapest stock on the market, but it’s priced for quality, and investors looking for consistency have historically rewarded that.

Risks and Considerations

As with any utility investment, there are risks that come with owning MGEE. One of the more immediate considerations is the current valuation. A higher-than-average price-to-earnings ratio suggests limited upside unless earnings growth can keep pace. Any disappointments—whether in regulation, capital projects, or macro conditions—could prompt a pullback.

Interest rates are another pressure point. Utilities like MGEE typically carry substantial capital investment, and when borrowing costs rise, so do financial burdens. While MGEE has managed its debt well, the potential for prolonged high-rate environments could impact future project economics or shareholder returns.

Regulatory environments also matter. MGEE operates in a tightly regulated space, and while that brings some predictability, it also leaves them vulnerable to policy shifts. Whether it’s rate changes or evolving standards for clean energy, the company needs to stay agile and proactive to remain on course.

Lastly, the transition to renewables, though positive in the long run, isn’t without its challenges. Delays, permitting issues, or cost overruns in clean energy projects could introduce execution risks, even with the best planning.

Final Thoughts

MGE Energy has built a business that runs on discipline, not drama. It doesn’t chase fads or overextend itself. Instead, it focuses on doing the essentials well—delivering power, investing in infrastructure, and rewarding shareholders with a growing dividend stream. That simplicity, paired with a strong balance sheet and a forward-looking energy strategy, gives the company staying power.

The leadership team has stayed consistent in both its messaging and execution. The renewable transition is real, but it’s being handled at a measured pace. And while MGEE’s stock may not look cheap at first glance, it reflects confidence in future reliability.

For income investors, that combination of steady returns, experienced leadership, and a clear sense of direction continues to make MGEE a solid presence in any long-term dividend-focused portfolio.