Updated 6/2/25

Mercantile Bank Corporation (NASDAQ: MBWM), headquartered in Michigan, has built its reputation on disciplined growth, community banking, and a consistent approach to shareholder returns. With a market cap around $717 million, a price-to-earnings ratio of 9.2, and a dividend yield of 3.35%, it offers a stable presence in the regional banking space. Recent earnings highlighted steady loan growth and strong capital levels, while management continues to navigate rate pressures with a clear focus on core banking fundamentals.

Recent Events

Mercantile Bank Corporation has kept its footing steady in a landscape that’s been anything but predictable. In its most recent quarter, the bank saw earnings per share ease down 9.4% from a year ago, with revenue slipping by 3.1%. It’s not the kind of shift that shakes confidence, though. With a profit margin of nearly 35% and return on equity at 13.55%, the bank still shows it’s running a tight ship.

Its balance sheet tells a reassuring story too. With over $410 million in cash on hand and $777 million in debt, it may seem like a heavy load at first glance—but this isn’t a balance sheet out of balance. The liquidity position is strong, and the bank’s operations are clearly designed for endurance. A book value per share of $37.47 and a price-to-book ratio around 1.18 keeps valuation in a realistic, almost conservative range.

Investors have noticed the steady hand at the wheel. The stock has climbed more than 17% in the past year, quietly building value without a lot of noise. It hasn’t needed fanfare to prove itself—just consistent, careful management and an eye for sustainability.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.35%

💵 Annual Dividend Rate: $1.48

📆 Ex-Dividend Date: June 6, 2025

🧮 Payout Ratio: 30%

📊 5-Year Average Dividend Yield: 3.76%

⏳ Next Dividend Pay Date: June 18, 2025

Dividend Overview

Mercantile’s dividend profile isn’t flashy, but it’s exactly what many long-term investors are looking for—reliable, steady, and built on actual earnings strength. With a forward dividend yield sitting at 3.35%, it offers income at a pace that balances well with the company’s risk profile.

Even though the current yield is just a shade under the five-year average, that’s mostly due to the stock’s solid price movement rather than any retreat in payouts. The dividend has grown modestly but consistently, with the latest increase bringing the annual payout to $1.48, up from $1.44. This kind of slow, steady rise is a quiet signal of strength from management—it says they’re confident, but not careless.

Right now, earnings cover the dividend nearly 3.25 times. That kind of cushion isn’t just comfortable—it’s a major reason income investors can rest easy. It also means the company has the flexibility to continue rewarding shareholders while keeping plenty of earnings in reserve for reinvestment or downturn protection.

This isn’t the kind of dividend built on borrowed time or borrowed money. It’s based on solid banking fundamentals and a leadership team that values reliability over drama.

Dividend Growth and Safety

If you’re looking for a dividend payer that throws around big double-digit hikes every year, Mercantile probably isn’t your speed. But if your portfolio is built for the long haul, with a focus on dependability and low-risk yield, this name deserves your attention.

The bank’s payout ratio—just 30%—tells us there’s a wide margin of safety. It also tells us that future increases don’t depend on booming earnings; they can come even if profits hold steady. That’s the hallmark of a sustainable dividend strategy.

From a return standpoint, Mercantile is using its capital wisely. A return on assets of 1.34% and return on equity above 13% means the bank is squeezing real value out of its resources. It’s making money the old-fashioned way—through operational strength, not financial tricks.

And for those planning around regular income, the bank’s payout rhythm stays intact. The next dividend is scheduled for June 18, with the ex-dividend date just a few days earlier on June 6. There’s a predictability here that dividend-focused investors will appreciate.

Another point worth noting: the stock’s beta is only 0.90, which suggests it tends to move less than the broader market. For income investors, that can translate to a smoother ride during volatile stretches—a trait not every bank stock can offer.

In a space where many institutions are still trying to find their footing, Mercantile is quietly moving forward. It’s not aiming for headlines—it’s focused on the fundamentals. And in the world of dividends, that’s exactly the kind of mindset that holds up year after year.

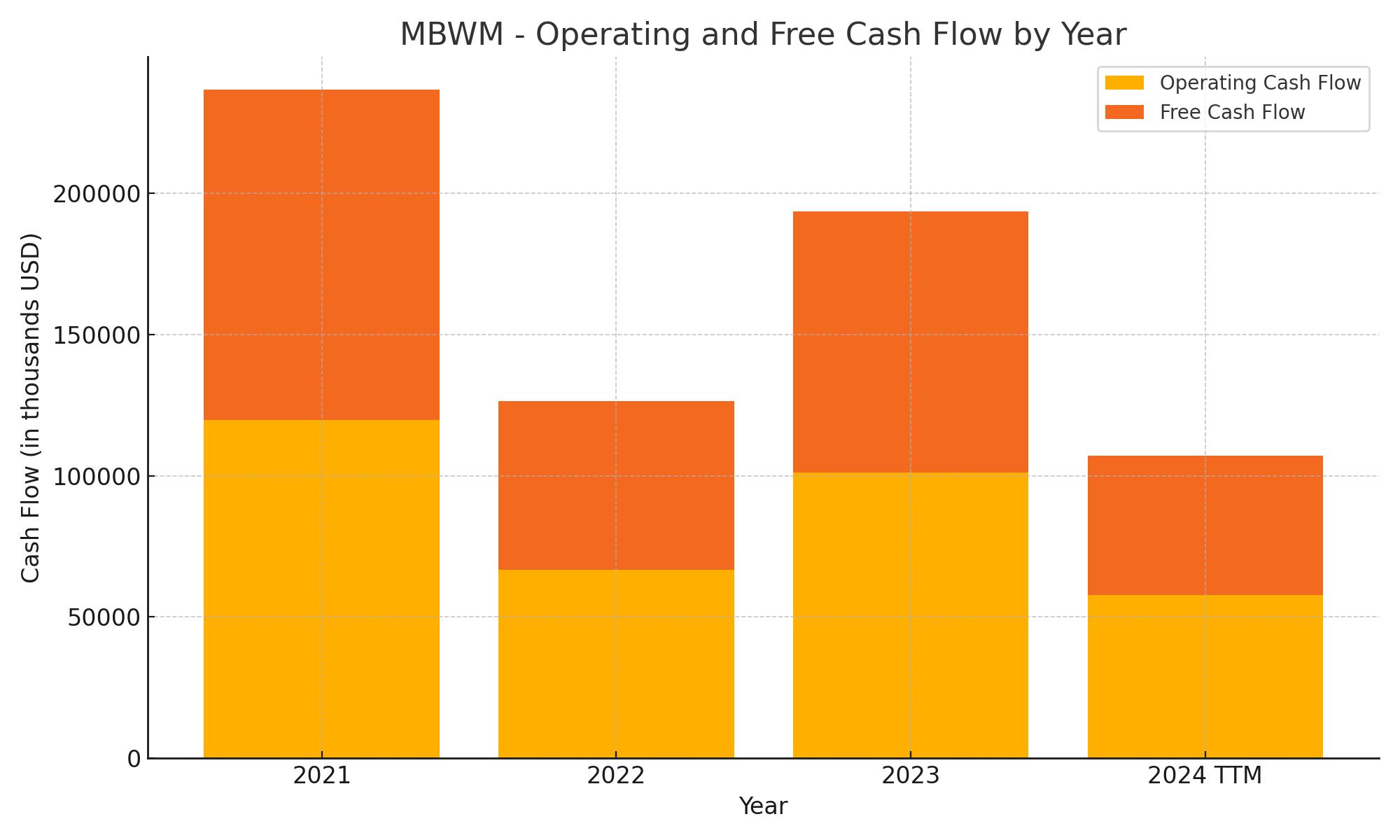

Cash Flow Statement

Mercantile Bank’s trailing twelve months (TTM) cash flow shows a noticeable cooling in operating cash flow, landing at $57.9 million compared to $101.1 million the prior year. While lower, it’s still positive and sufficient to support dividends and core operations. Free cash flow follows a similar path, totaling $49.3 million for the period—down from the previous year, but reflective of more normalized activity after a particularly strong prior period.

On the financing side, the company pulled in a hefty $584.6 million, primarily driven by strategic funding actions rather than recurring flows. That more than offset the $494.3 million used in investing activities, much of which likely went toward expanding the loan book or repositioning the securities portfolio. While capital expenditures remained modest at just over $8.6 million, Mercantile continues to show discipline in where and how it allocates capital, preserving a solid end cash position of $385.5 million.

Analyst Ratings

Mercantile Bank Corporation (MBWM) has recently drawn mixed attention from analysts, highlighting both strengths and some caution around future conditions.

📈 On January 22, 2025, Hovde Group upgraded MBWM from market perform to outperform and raised its price target to $54.00. The upgrade was driven by the bank’s solid balance sheet and consistent earnings performance. Analysts pointed to its strong capital levels and dependable dividend payout as key reasons for the positive shift. The bank’s ability to deliver steady returns while maintaining discipline in a fluctuating interest rate environment helped support the case for higher expectations.

⚖️ Then on April 23, 2025, Piper Sandler maintained a neutral rating but trimmed its target price from $50.00 to $47.50. The firm cited tighter net interest margins and the broader pressures of a high-rate environment as reasons to dial back expectations. While not a downgrade, the revision did reflect a more cautious tone around near-term earnings growth, particularly in loan activity and margin compression.

🎯 Overall, the consensus analyst price target sits around $52.83, suggesting an upside of roughly 18% from current levels. Target estimates range from $47.50 on the low end to as high as $57.00, reflecting varying outlooks depending on how market conditions evolve over the next few quarters.

Earning Report Summary

Solid Start to the Year with Some Pressure Points

Mercantile Bank kicked off 2025 with net income of $19.5 million, or $1.21 per diluted share. That’s down from $21.6 million, or $1.34 per share, a year ago. The drop was mostly tied to a few things happening at once—noninterest income slid, expenses inched higher, and there was a larger provision for credit losses this time around.

Even so, net interest income ticked up to $48.6 million from $47.4 million last year. That was driven by solid growth in earning assets, though the net interest margin did compress a bit to 3.47% from 3.74%. That margin pressure came as loan yields edged down and the mix of earning assets shifted slightly. On the fee side, treasury services, mortgage banking, and payroll services showed decent gains, but a slowdown in interest rate swap income and other segments held back the total, pulling noninterest income to $8.7 million from $10.9 million.

Managing Costs and Growing the Loan Book

Expenses came in at $31.1 million, compared to $29.9 million last year. That increase was mostly driven by higher payroll and benefit expenses, along with a bump in data processing costs. The provision for credit losses rose to $2.1 million from $1.3 million, a move that reflects updated assumptions in the bank’s economic forecast.

Despite those cost increases, the bank continues to grow. Total assets reached $6.14 billion, and the loan portfolio expanded by about $35.8 million—largely fueled by commercial lending activity. Deposits dipped slightly, down $16.6 million on a sequential basis, though they’re still up $674 million from this time last year. The loan-to-deposit ratio improved meaningfully to 99%, a strong improvement from 108% in the prior year.

Focused on Quality and Future Growth

Asset quality remains a highlight for Mercantile. Nonperforming assets totaled just $5.4 million, which is less than 0.1% of total assets. Capital levels are also in good shape. Shareholders’ equity climbed to $608 million, and the bank’s total risk-based capital ratio stands at 14.0%—well above regulatory minimums.

CEO Ray Reitsma noted that the quarter reflected stable financial performance despite some pressure points. He pointed to the continued growth in treasury and payroll services as a win, and emphasized that the bank is focused on disciplined underwriting and maintaining strong asset quality. Reitsma also said Mercantile remains committed to growing its deposit base locally, aiming to lower reliance on wholesale funding.

Looking ahead, the bank expects loan growth to land somewhere between 3% and 5% for the year, with the net interest margin projected to hover in the 3.45% to 3.55% range. It’s clear the focus remains on stable, efficient growth and strong fundamentals.

Management Team

Mercantile Bank Corporation is led by a team with deep institutional knowledge and a strong foundation in relationship-driven banking. At the forefront is Raymond Reitsma, who took over as President and CEO in mid-2024. He’s no stranger to the bank, having been part of Mercantile’s leadership for over two decades. His path through various roles, including Chief Operating Officer and regional president, has given him hands-on insight into how the bank operates across its core markets.

Supporting him is Charles Christmas, the long-standing CFO and Treasurer. His role goes beyond the numbers—he helps steer strategy with a focus on capital strength and long-term sustainability. Other members of the executive bench include Mark Augustyn in commercial banking, Doug Holtrop overseeing regional lending efforts, and Sonali Allen guiding compliance. Together, they bring a balanced mix of operational focus, risk oversight, and customer-oriented strategy. This team has helped keep Mercantile stable and steadily growing, even when the broader banking landscape has been a bit shaky.

Valuation and Stock Performance

Mercantile’s stock has been trading in a steady range, most recently around $43.70 per share. The stock’s 52-week low was $35.61, and it peaked near $53. That’s a fairly typical range for a regional bank stock that isn’t overly volatile and tends to move with the pace of fundamentals rather than market hype.

From a valuation standpoint, the bank sits at a price-to-earnings ratio of around 9.2, which puts it in line with peers in the regional banking space. It’s not expensive, and it’s not stretched—just a fair reflection of steady earnings and a conservative balance sheet. At a market cap of about $717 million, this isn’t a small operation, but it’s still nimble enough to be responsive to changing economic conditions.

Analyst price targets hover around $52.25, which suggests room for upside if Mercantile continues executing well. That target reflects confidence in their disciplined credit underwriting, solid loan growth, and capital management. For dividend investors, the current yield of 3.35% is more than respectable, especially given the low payout ratio and the stability behind it. The stock is likely to appeal more to long-term income-focused investors than to short-term traders.

Risks and Considerations

Every bank has its list of risks, and Mercantile is no exception. One of the biggest is interest rate sensitivity. With the Fed still adjusting its stance on rates, the pressure on net interest margins isn’t going away anytime soon. If borrowing costs stay high while loan growth slows, that could squeeze earnings a bit.

There’s also the ever-present credit risk. While Mercantile has done a great job maintaining asset quality, it only takes a few bad loans to shift sentiment. Their commercial loan book is a core strength, but it also means exposure to businesses that can be more vulnerable in a downturn.

Add in regulatory risk—because rules can and do change—and you’ve got an environment that requires constant adaptation. There’s also the broader competitive landscape. Fintechs, large national banks, and digital-first platforms all represent competition for deposits and loans, especially among younger and tech-savvy customers. Keeping pace without overextending on technology spending is a constant balancing act.

Final Thoughts

Mercantile Bank Corporation continues to show that consistency and community focus still have a place in today’s banking environment. The management team is seasoned, steady, and clearly focused on creating long-term value without taking outsized risks. The stock trades at a valuation that gives investors a reasonable entry point, supported by a healthy dividend and a business model grounded in fundamentals.

There’s no denying that banking comes with its share of uncertainty. But Mercantile’s cautious approach to growth, clean balance sheet, and shareholder-focused capital allocation offer a sense of reliability that’s hard to ignore. For those looking to hold a stable, dividend-paying regional bank, Mercantile offers something that’s increasingly rare in financial markets—predictability with purpose.