Updated 5/30/25

Marsh & McLennan (NYSE: MMC) is a global leader in risk management, insurance brokerage, and consulting, delivering stable results through diverse business segments including Marsh, Mercer, Guy Carpenter, and Oliver Wyman. The company posted $7.1 billion in revenue in the most recent quarter, driven by 9% year-over-year growth, and maintains strong operating margins, steady earnings, and disciplined leadership under CEO John Doyle.

Recent Events

In its most recent quarter ending March 31, the company posted solid revenue growth—up more than 9% year over year, bringing the total to $25.05 billion over the trailing twelve months. That’s no small feat in a world where economic uncertainty seems to linger. Even with that revenue growth, earnings came in slightly lower than a year ago, down about 1.4%. But this isn’t a red flag—it’s more a sign of the times than a sign of weakness.

Margins remain healthy, with operating margins at a strong 30.4%. That level of profitability shows MMC knows how to manage its costs and deliver consistent performance, even if the bottom line occasionally fluctuates.

The company’s return on equity stands out at 30.5%. That’s the kind of number that tells you a management team is doing something right—putting shareholder capital to work and getting a strong return. Return on assets is more modest at just under 8%, but that’s typical for a business in this space with a capital-light model.

The stock itself has been holding up well. Over the past 12 months, it’s gained about 11.5%, just a shade below the broader market. And with shares sitting above both their 50-day and 200-day moving averages, there’s been a slow, steady climb—nothing dramatic, but certainly solid.

There has been a small rise in short interest recently, from just under 5 million shares to just below 6 million. Still, that’s only about 1.2% of the float, not enough to raise any serious concerns.

Key Dividend Metrics

📈 Forward Annual Dividend Rate: $3.26

💰 Forward Dividend Yield: 1.41%

📆 Last Dividend Paid: May 15, 2025

🧾 Payout Ratio: 48.7%

📊 5-Year Average Yield: 1.39%

🔄 Dividend Growth Streak: 14 years

🪙 Free Cash Flow Coverage: Strong – $4.12B FCF vs. ~$1.6B in dividends

🔒 Dividend Safety: High – backed by reliable earnings and consistent cash flow

Dividend Overview

Marsh & McLennan’s dividend yield isn’t going to jump off the page. At 1.41%, it’s below what some income-focused investors may aim for. But looking at yield alone misses the point here. The real value lies in reliability, and that’s something MMC delivers in spades.

The company generates significant free cash flow—more than $4 billion over the past year—and only a portion of that is needed to cover the dividend. That leaves room to reinvest, reduce debt, and buy back shares. It also means the dividend has room to grow.

With a payout ratio of just under 49%, MMC isn’t overextending itself. It’s in that sweet spot where shareholders are rewarded while the business retains enough earnings to stay flexible and strategic. This is especially important during economic slowdowns, when some firms are forced to slash payouts. MMC isn’t one of them.

Dividends are paid quarterly, and the most recent one landed in investor accounts in mid-May. Each payment has been consistent, and that predictability helps income investors plan their cash flows—whether for reinvestment or retirement income.

Dividend Growth and Safety

Where MMC really earns its stripes is in its dividend growth track record. The company has now raised its payout for 14 straight years. That includes periods of market stress, rising rates, and global uncertainty. The increases aren’t flashy, but they are steady—right in that mid-single digit range that long-term holders appreciate.

That kind of growth compounds well over time, especially when paired with a business that doesn’t get shaken easily. With a beta of just 0.85, MMC’s stock tends to move less than the broader market, which adds another layer of stability for investors looking to reduce volatility in their portfolios.

The balance sheet tells a similar story. Yes, debt is elevated with a debt-to-equity ratio of around 157%, but that needs context. MMC’s model doesn’t require a lot of capital investment, and its cash flows are highly predictable. That makes it easier to carry and service debt without putting the dividend at risk.

Institutions clearly have confidence in the business—over 91% of shares are held by big money players. Insider ownership is small, but that’s not unusual for a mature company of this size.

Altogether, Marsh & McLennan offers something that’s becoming harder to find: a well-run business that consistently grows its dividend, doesn’t overreach, and keeps its focus on delivering long-term value to shareholders. It won’t be the highest yielder in your portfolio, but it might end up being one of the most dependable.

Cash Flow Statement

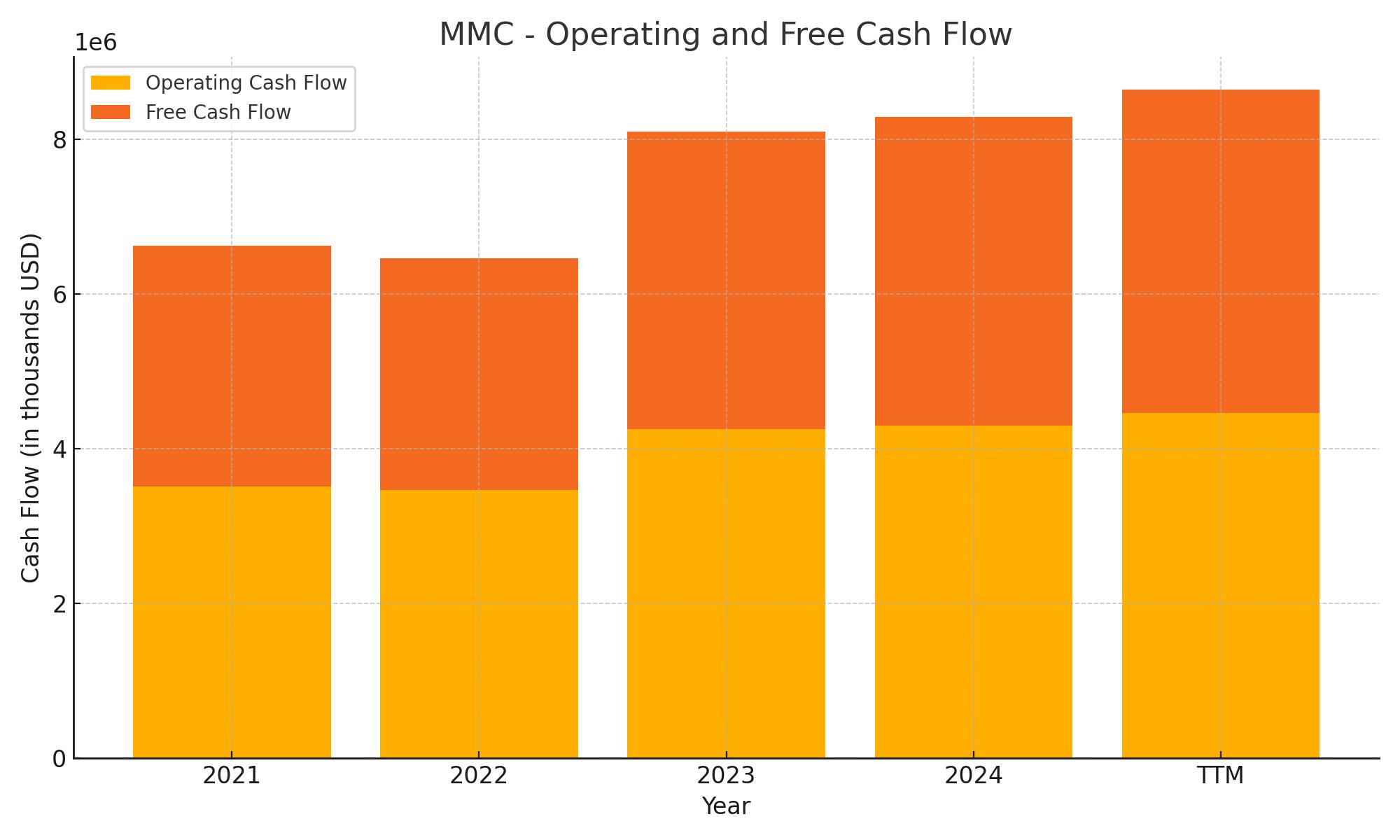

Marsh & McLennan’s cash flow performance over the trailing twelve months shows a business that continues to operate with strong internal efficiency. Operating cash flow came in at $4.46 billion, up slightly from the previous year, marking a continuation of a steady multi-year climb. That improvement reflects stable underlying earnings quality and careful working capital management. Free cash flow also ticked higher to $4.18 billion, underscoring the company’s ability to convert its operating results into real, usable cash—an important factor for dividend dependability and financial flexibility.

On the financing side, there was a notable jump in activity, with $8.18 billion in new debt issued over the past year. This is a sizable increase from previous years and appears to be part of a strategic funding approach, potentially for refinancing or capital allocation purposes. Repayments of debt were more modest at just over $1.1 billion. The end cash position decreased slightly to $13.13 billion, down from $13.67 billion, indicating continued capital deployment while maintaining a robust liquidity cushion. MMC’s ability to fund dividends, manage debt, and preserve cash speaks to the resilience and predictability of its financial engine.

Analyst Ratings

📊 Marsh & McLennan Companies (NYSE: MMC) has seen a mix of analyst calls recently, reflecting its steady performance but also a fair amount of debate on its current valuation. The consensus rating sits at a “Hold,” with an average 12-month price target of around $233.06. That price target suggests a limited upside from where shares are currently trading, which likely explains the cautious tone.

📉 Some firms have downgraded their expectations slightly. One major research house dropped its target from $220 to $215 while maintaining an “Underperform” rating. The reasoning centered around concerns that margins might come under pressure, particularly if expense growth doesn’t stay in check. There was also a hint of skepticism about how much further operating leverage can be extracted in the near term.

📈 On the flip side, other analysts remain more upbeat. A notable upgrade came with a price target boost to $261. That call pointed to the company’s stable, recurring revenue base and its ability to consistently generate free cash flow. The firm also noted MMC’s diversified model, which includes both risk advisory and consulting services, giving it multiple paths to keep earnings growth moving forward.

💬 Overall, sentiment is split between those who see MMC as fairly valued and others who believe its steady execution deserves a premium.

Earning Report Summary

Strong Start to the Year

Marsh & McLennan kicked off 2025 with a solid quarter, showing they’re not slowing down anytime soon. Revenue for the first quarter hit $7.1 billion, up 9% from the same period last year. That kind of growth doesn’t just happen—it’s a result of steady organic gains along with smart acquisitions paying off. Adjusted earnings per share came in at $3.06, a 5% increase, even with some bumps in the road like currency swings and a tougher tax picture.

Risk & Insurance Services Drives Momentum

The real engine this quarter was the Risk & Insurance Services segment, pulling in $4.8 billion in revenue. That’s an 11% increase year over year. Within that, Marsh stood out with $3.5 billion in revenue, growing 15% overall. They saw especially strong activity in Latin America, and good momentum in EMEA, Asia Pacific, and North America. Reinsurance business under the Guy Carpenter name also had a solid showing, bringing in $1.2 billion—up 5% across the board.

Consulting Keeps Its Footing

The consulting side of the business brought in $2.3 billion, up 5% from a year ago. Mercer continues to be the bigger player in this division with $1.5 billion in revenue. Health consulting led the way there, growing by 7%, while the wealth business added 3%. The career side of Mercer dipped slightly. Oliver Wyman, their management consulting arm, came in with $818 million, posting a 4% gain.

Leadership Commentary and Financial Moves

Operating income for the quarter totaled $2 billion, up 4%, while adjusted operating income came in a bit stronger at $2.2 billion, rising 8%. The company also used some of its financial strength to buy back 1.3 million shares, spending $300 million in the process. On top of that, they repaid $500 million in senior notes that matured this quarter, which helps keep the balance sheet in check.

CEO John Doyle had a clear message—this quarter showed the kind of momentum Marsh & McLennan can deliver in any environment. He emphasized how the company’s advice and services continue to matter to clients, especially when things get uncertain. That’s a recurring theme for MMC: delivering consistency when the world doesn’t. And judging by this quarter, they’re doing just that.

Management Team

Marsh & McLennan’s leadership team has shown a steady hand in guiding the company through multiple economic cycles. At the helm is President and CEO John Doyle, who stepped into the top role with deep operational experience and a strong understanding of both the risk and consulting sides of the business. His approach emphasizes long-term consistency over short-term reactions, and that mindset is echoed throughout the organization.

Doyle is supported by a seasoned group of executives, including CFO Mark McGivney, who brings a careful balance of fiscal discipline and capital allocation strategy. Under his watch, MMC has managed to maintain a healthy balance between shareholder returns and reinvestment. Their segment leaders—running operations at Marsh, Guy Carpenter, Mercer, and Oliver Wyman—have remained focused on scaling their respective platforms without sacrificing the firm’s high standard of client service. There’s a clear emphasis on building around talent, supporting innovation, and maintaining a deeply client-centric approach. The stability and clarity in leadership have been key in positioning MMC as one of the most dependable names in the professional services industry.

Valuation and Stock Performance

As of late May, shares of Marsh & McLennan were trading around $231, a level that’s modestly below its 52-week high of $248. The stock has gained over 11% in the past year, pacing just behind the broader S&P 500. It’s been a slow and steady climb rather than a surge, which mirrors the type of business MMC runs—measured, deliberate, and highly cash-generative.

In terms of valuation, MMC currently trades at a forward price-to-earnings ratio of around 24, slightly above the sector average but justifiable given the firm’s return profile. Its trailing P/E is a touch higher at 28.4, reflecting investors’ willingness to pay a premium for its predictability and low-beta performance. The PEG ratio of 2.49 suggests that while growth isn’t explosive, it is sustainable and well-supported by fundamentals.

Enterprise value to EBITDA stands at 19.25 on a trailing basis, which may look rich at first glance. However, when you consider the company’s return on equity of over 30%, and its strong free cash flow generation, the premium starts to make more sense. Investors have long paid up for MMC’s combination of durability and yield.

One additional point is that MMC rarely trades at a steep discount. The market has historically viewed it as a defensive play with a reliable payout and the ability to perform across various macro backdrops. That perception helps explain why institutional ownership is so high—over 91% of shares are held by institutions who likely value MMC’s blend of income and stability.

Risks and Considerations

While Marsh & McLennan has a lot working in its favor, there are still a few things investors should keep on their radar. For starters, the company operates in a space where regulatory shifts and geopolitical instability can create new challenges. Its insurance brokerage and reinsurance services are particularly sensitive to changes in the global risk landscape.

Currency exposure is another subtle but real issue. With operations spanning dozens of countries, swings in exchange rates can affect both top-line growth and margin performance. This isn’t unique to MMC, but it’s a consistent operational factor that can influence quarterly results even when the core business is strong.

MMC also carries a higher debt load than some of its peers, with a debt-to-equity ratio sitting at 157 percent. Now, the company is more than capable of servicing its obligations, and its cash flow more than covers interest and dividend payouts. But it does mean that any meaningful rise in interest rates or credit tightening could eventually squeeze flexibility.

Another consideration is its relatively low dividend yield. At just above 1.4 percent, MMC doesn’t offer the kind of high current income that some dividend investors prioritize. However, the trade-off comes in the form of consistent dividend growth and a strong balance sheet backing the payout.

There’s also the broader macroeconomic climate to think about. While MMC isn’t as cyclical as some sectors, a sustained global slowdown could still weigh on client budgets for consulting or risk advisory services. That could compress margins or slow down revenue growth in certain regions.

Final Thoughts

Marsh & McLennan offers a unique profile in today’s market—one that blends stable cash flows, modest but consistent dividend growth, and a leadership team that prioritizes long-term performance over short-term noise. It’s not the kind of stock that makes dramatic moves, but that’s precisely what makes it appealing for a certain kind of investor.

Its diversified business model ensures it’s not overly reliant on any one industry or geography. The firm’s ability to generate returns in both calm and chaotic environments speaks volumes about the resilience of its strategy. Whether it’s helping multinational corporations navigate risk or guiding employers through complex human capital challenges, MMC has carved out a role that’s both essential and deeply embedded.

For dividend-focused investors who value dependability over drama, and who appreciate management teams that stick to their playbook, Marsh & McLennan continues to offer a compelling case. The valuation reflects that consistency, and while it may not be a bargain bin find, the premium seems earned. With strong cash flows, a sustainable dividend, and clear leadership direction, MMC holds its ground as a cornerstone-type stock for conservative, long-term portfolios.