Updated 5/29/25

LyondellBasell (LYB) is a global leader in chemicals and plastics, with a well-established track record of returning capital to shareholders through dividends and buybacks. Despite operating in a cyclical and capital-intensive industry, the company has maintained a clear focus on financial discipline, operational efficiency, and long-term planning. With a forward dividend yield near 10%, it stands out as a high-yield opportunity in the large-cap space.

Recent performance has been weighed down by softer demand, rising input costs, and global economic uncertainty, leading to a significant decline in both earnings and share price. Still, management remains committed to sustaining shareholder returns, managing cash carefully, and positioning the company for recovery as market conditions stabilize.

Recent Events

This past year has tested that commitment. The stock is down more than 40% from its highs, dragged down by weaker demand, rising costs, and broader concerns across the industrial sector. At the same time, the S&P 500 has been climbing, leaving LYB behind in the dust.

The latest quarterly results reflect the pressure. Earnings plunged by nearly 63% year-over-year, and revenue fell 7.6%. Margins are thinner than they’ve been in years—operating margin is just 1.43%, and net margin is barely above 2.5%. Simply put, the business is feeling the squeeze.

Despite all that, the dividend is still standing. And not just standing—yielding nearly 10%, which is enough to make any income investor take a closer look.

Key Dividend Metrics 📊

📈 Dividend Yield: 9.60% (Forward)

💸 Annual Dividend: $5.48

📅 Next Dividend Date: June 9, 2025

🚫 Ex-Dividend Date: June 2, 2025

📊 Payout Ratio: 185.47%

📉 5-Year Average Yield: 5.32%

🏗️ Dividend Coverage (Free Cash Flow): Under Pressure

⚠️ Debt-to-Equity: 103.88%

Dividend Overview

At nearly 10%, LYB’s dividend yield is among the most attractive out there for large-cap stocks. It’s not just high—it’s historically high for this company. The five-year average sits closer to 5%, which means the market clearly sees some risk in the current payout.

The company is paying out significantly more than it’s earning right now. That 185% payout ratio is a red flag on the surface, but the full picture is a bit more nuanced. LYB is still generating solid operating cash flow—about $3.35 billion over the past 12 months—and has $1.9 billion in cash on hand. But with levered free cash flow at $1.45 billion, it’s running close to the line in terms of dividend sustainability.

It’s worth noting that LYB hasn’t shown any signs of backing off from the current payout. That speaks to the management’s focus on delivering value to shareholders, even in a tough environment. It’s not uncommon for companies in cyclical industries to maintain dividends through down cycles, counting on a rebound to restore coverage. That appears to be the play here.

Dividend Growth and Safety

Over the past five years, LYB has grown its dividend slowly but steadily. From $4.20 in 2020 to $5.48 expected this year, it’s not rapid growth, but it’s consistent. What’s changed lately is the risk side of the equation.

With earnings under pressure and cash flow tight, there’s limited room for further dividend increases unless business picks up. The company’s high payout ratio and current debt load—over $12.8 billion—leave little wiggle room. The balance sheet still looks manageable, thanks in part to a current ratio of 1.83, but it’s not what you’d call fortress-like.

Return metrics paint a similar picture. Return on equity is sitting at 7.44%, and return on assets at 3.85%. Those are decent but not outstanding figures, especially given the capital intensity of the business. It’s another sign that LYB needs stronger operating results before investors can expect more dividend growth.

Still, the existing payout is backed by a long-standing commitment and enough liquidity to keep things going in the near term. If margins stabilize and revenue picks back up, the company will likely have room to revisit growth again.

For now, the dividend is doing the heavy lifting. With the stock beaten down and yield elevated, LYB offers an intriguing proposition for those willing to weather the storm.

Cash Flow Statement

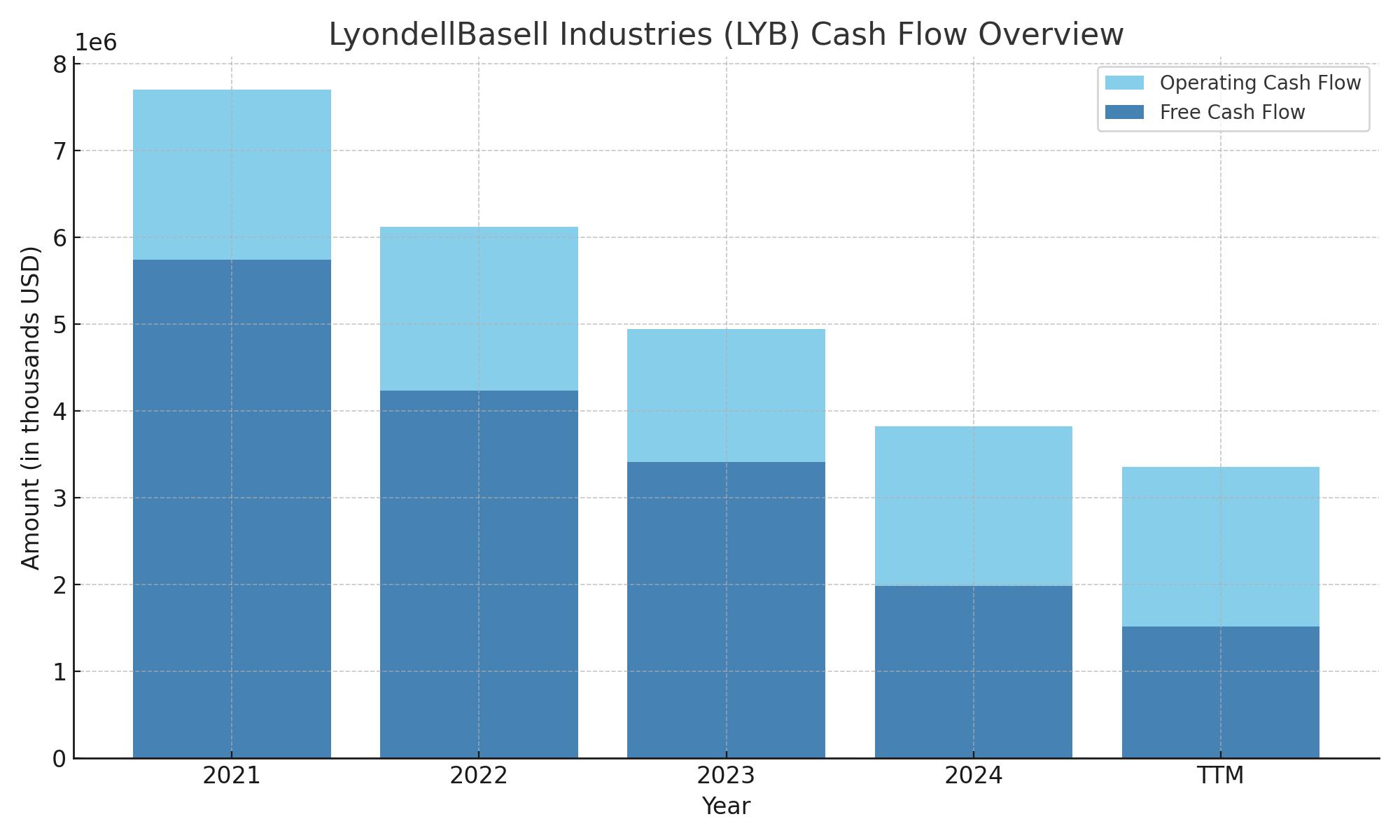

LyondellBasell’s cash flow profile over the trailing twelve months shows a clear shift toward tighter financial conditions. Operating cash flow came in at $3.35 billion, a notable decline from previous years, where it once surpassed $7.6 billion in 2021. This downward trend highlights how softer demand and compressed margins have begun to erode the company’s core cash generation. Capital expenditures held steady at $1.84 billion, resulting in free cash flow of $1.52 billion—a considerable drop from the more than $5.7 billion reported just a few years ago.

On the financing side, LYB has remained cautious. With no new debt issued and minimal repayments, the company focused instead on sustaining shareholder returns and managing its balance sheet. Share repurchases were modest at $305 million, and dividends continued to be paid from existing cash flows rather than borrowed funds. The net result was a drawdown in the company’s cash reserves, ending the period with $1.88 billion on hand—down from $3.39 billion a year earlier. While still comfortably liquid, the shrinking cash position underscores the importance of stabilizing operating performance to maintain its current dividend payout level.

Analyst Ratings

LyondellBasell Industries (LYB) has seen a shift in analyst sentiment lately, as the company grapples with rising input costs and global supply headwinds. 🧯 UBS recently downgraded the stock from Neutral to Sell, reflecting concern over the erosion of profitability in the current environment. Meanwhile, RBC Capital followed suit by lowering its rating to Sector Perform from Outperform, slashing the price target to $62 from $90 due to reduced earnings expectations and compressed valuation multiples.

🎯 Despite these more cautious views, not all analysts are bearish. Fermium Research took a contrarian stance, upgrading LYB to a Strong Buy. Their outlook suggests confidence in the company’s resilience and ability to navigate through the current downturn, possibly eyeing a recovery in chemical demand or better cost management going forward.

📊 The overall analyst consensus stands at Hold, signaling a split in conviction about LYB’s near-term direction. The average 12-month price target is $69.75, which implies moderate upside from current levels. This target reflects a balance between those expecting a cyclical rebound and others bracing for continued pressure on earnings and cash flow. As it stands, LYB finds itself in the middle of a divided Wall Street view, shaped by economic uncertainty and sector-specific challenges.

Earnings Report Summary

LyondellBasell’s most recent earnings update gave investors a mixed bag—some clear pressure on the business, but also signs the company is trying to stay focused and disciplined through a tougher cycle.

Slower Start to the Year

In the first quarter of 2025, LYB reported net income of $177 million, which works out to $0.54 per diluted share. After adjusting for certain items, the figure drops to $0.33 per share. That’s a noticeable step down from where they were a year ago, when earnings came in at $1.44 per share. Revenue also dipped, landing at $7.7 billion compared to $8.3 billion in the same period last year.

It’s clear that margins are feeling the squeeze. The company pointed to higher feedstock costs and planned maintenance work as key reasons for the drop in profitability, particularly in the Olefins & Polyolefins – Americas segment. That part of the business saw earnings slide from $521 million to $251 million. The Intermediates & Derivatives segment also had a tough quarter, with earnings down nearly 70 percent.

Staying Focused on Cash

Even with the softer results, LyondellBasell didn’t pull back on shareholder returns. They returned $543 million to investors through dividends and buybacks, signaling confidence in the long-term picture. Leadership is leaning into a more conservative financial strategy for now, launching a $500 million cash improvement plan to help tighten things up operationally.

CEO Peter Vanacker acknowledged the rough start but emphasized that the company is committed to keeping things steady. The focus is squarely on building up cash, managing costs, and preparing for better demand as the year goes on. There’s no sugarcoating the headwinds, but there’s also no panic in the tone from leadership.

Looking Ahead

As for what’s next, LyondellBasell expects things to look a bit better in the second quarter. They’re forecasting more typical seasonal demand trends to kick in, which should help bring some volume back. Operating rates are projected at 85% for North America olefins and polyolefins, 75% in Europe, and 85% for the Intermediates & Derivatives business.

The broader economic picture is still murky, and the company knows it. But they’re staying disciplined—keeping capital allocation tight and watching operating efficiency closely. It’s a cautious but steady approach, the kind of strategy that often appeals to long-term, income-focused investors during slower periods.

Management Team

LyondellBasell’s leadership team is led by CEO Peter Vanacker, who stepped into the role with a strong background in the specialty chemicals industry and a clear focus on financial discipline. His approach has emphasized improving operational efficiency, driving stronger cash generation, and preparing the company for longer-term shifts in the chemicals and plastics markets.

Vanacker has been steering the company toward more sustainable production methods, while also maintaining attention on core financials. His pragmatic tone has been consistent—acknowledging the headwinds without losing sight of long-term goals. Alongside him, CFO Michael McMurray has helped maintain a conservative balance sheet approach and prioritize shareholder value. Together, the leadership team seems grounded, calm under pressure, and focused on managing capital allocation wisely during a slower stretch for the business.

Valuation and Stock Performance

LyondellBasell shares are currently trading at a discount relative to historical averages. With a forward price-to-earnings ratio around 12.3 and a price-to-sales ratio under 0.5, the valuation suggests a good portion of bad news is already priced in. Price-to-book stands at roughly 1.5, which still reflects some confidence in the underlying asset base.

The stock has struggled over the past year, down over 40% from its 52-week high. From topping out around $100, it now trades closer to $57. That kind of drop often raises questions, and in this case, it’s a mix of shrinking margins, global demand softness, and increased caution among institutional investors.

Yet, despite the drawdown, the dividend yield now hovers near 10%, making it one of the higher-paying large-cap stocks in the market. The market is clearly signaling concern, but for income investors who think the company can weather the downturn, LYB might offer rare value at today’s levels.

Risks and Considerations

The most immediate concern for investors is the dividend. A payout ratio north of 180% means earnings aren’t covering distributions under traditional metrics. So far, free cash flow has kept things afloat, but it’s not a wide margin. If profitability weakens further or capital needs increase, pressure could mount to revisit the current payout.

There’s also the macro picture. LYB’s performance is tied closely to industrial production, consumer activity, and energy markets. If global growth slows more than expected, or if inflation continues to push feedstock costs higher, the company could face further margin erosion.

Debt is another factor. With over $12.8 billion in total debt, LYB is in a position where rising rates and tighter credit could limit its financial agility. While current ratios and liquidity are acceptable, the company doesn’t have a lot of flexibility to take on major new initiatives without affecting its capital structure.

Environmental expectations are shifting, too. As regulations tighten and customers demand cleaner materials, LYB is having to evolve quickly. That’s going to require smart capital deployment and a long-term vision, and the transition won’t happen overnight.

Final Thoughts

LyondellBasell sits at a crossroads. The business is clearly under earnings pressure, and the stock has been hit hard. But rather than cutting back, the company is pushing forward with steady shareholder returns and a strategy built on discipline, cost control, and long-term adaptation.

The high dividend yield is a double-edged sword—it draws in income-seekers, but also signals that the market is skeptical about sustainability. And that skepticism isn’t unfounded, considering the payout ratio and the broader economic outlook. Still, LYB has continued to return capital through both dividends and share repurchases, which suggests leadership has confidence in its ability to stabilize and recover.

For investors focused on income, LYB offers a mix of high current yield and potential upside if earnings rebound. The risk is real, but so is the reward if the company executes its plan. It’s not a flashy stock, but for those willing to be patient and ride out some volatility, LyondellBasell brings a sense of strategic clarity and commitment to shareholder value that’s hard to ignore.