Key Takeaways

💸 Logitech offers a forward dividend yield of 1.63% with a five-year average of 1.34%, supported by a low 33% payout ratio and consistent annual increases.

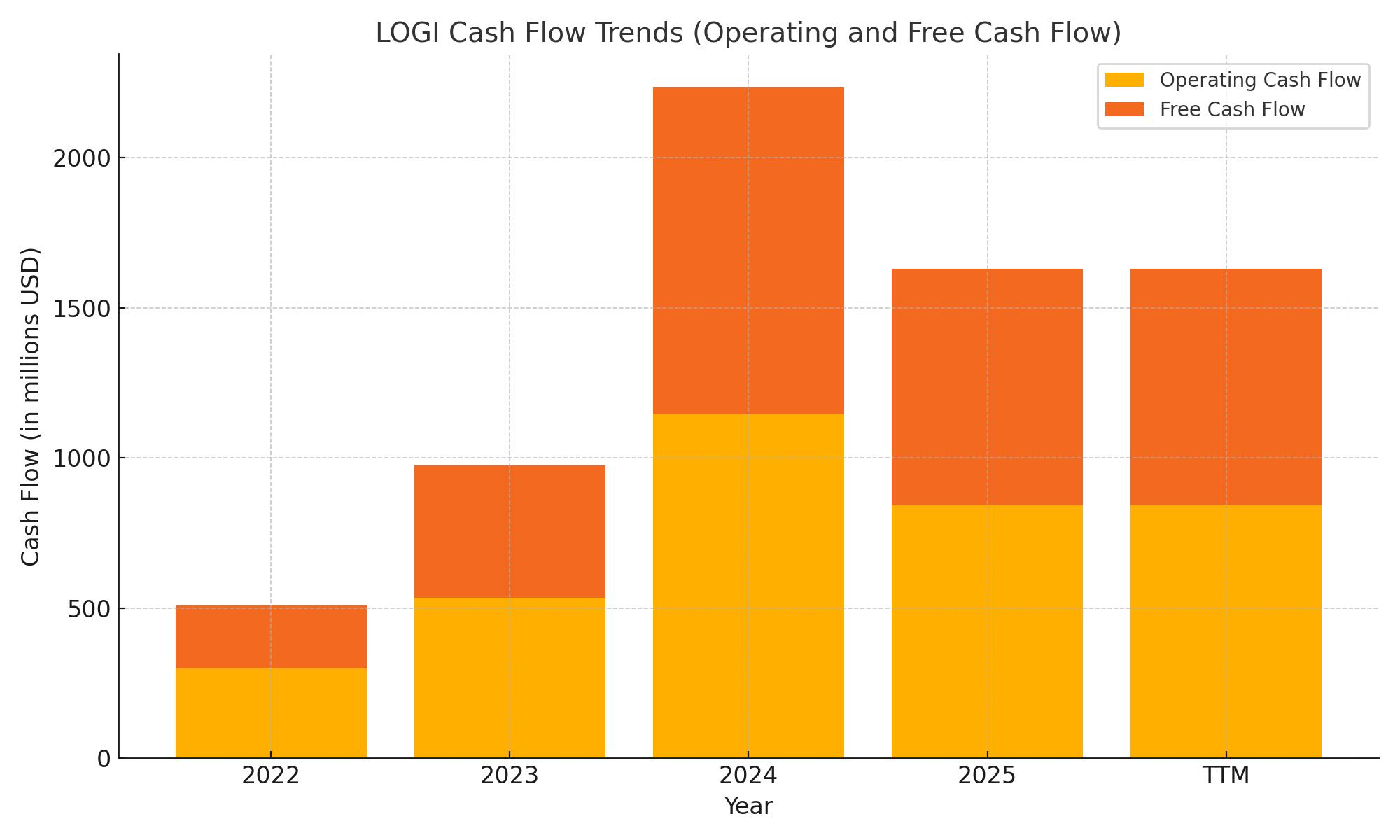

💰 The company generated $843 million in operating cash flow and $786 million in free cash flow over the trailing twelve months, ending the year with $1.5 billion in cash and no debt.

📊 Analyst sentiment is cautiously optimistic with a consensus 12-month price target of $85.71, reflecting confidence in Logitech’s fundamentals despite recent revenue headwinds.

Updated 5/29/25

Logitech International S.A. (LOGI) has steadily built a reputation for disciplined execution, strong cash generation, and consistent capital returns. With fiscal 2025 revenue reaching $4.55 billion and a GAAP operating income of $655 million, the company has shown it can maintain profitability while navigating shifting tech demand. A pristine balance sheet—with over $1.5 billion in cash and virtually no debt—adds another layer of confidence for long-term investors.

Leadership under CEO Hanneke Faber has focused on aligning innovation with sustainability and long-term growth. The stock is currently trading around $85, with a forward P/E of 15.60 and a consensus analyst price target near $85.71. Logitech continues to prioritize returning value through dividends and buybacks, supported by free cash flow of $786 million and a modest 33% payout ratio.

Recent Events

As of the end of its most recent fiscal year on March 31, 2025, Logitech reported revenue of $4.55 billion. That’s a slight dip from the previous year, and quarterly earnings also softened, down more than 14% year over year. Not exactly thrilling on the surface, but in the context of post-pandemic normalization across tech hardware, it’s more of a return to baseline than a warning sign.

The bigger picture tells a more reassuring story. Logitech carries just $92 million in total debt, against a cash pile of $1.5 billion. That’s a rare position of strength in this sector. Even as revenue plateaus, the company is operating from a position of financial stability, giving it plenty of options for shareholder returns.

This includes dividends—something Logitech has steadily nurtured, even if it doesn’t dominate headlines.

Key Dividend Metrics

🧾 Dividend Yield: 1.63% (Forward)

📈 5-Year Average Yield: 1.34%

🧮 Payout Ratio: 33.39%

💰 Forward Annual Dividend Rate: $1.38

📆 Next Dividend Date: September 25, 2024 (ex-date: September 23)

📊 Dividend Growth Trend: Gradual and steady

🔐 Debt/Equity Ratio: 4.34%

🏦 Free Cash Flow (ttm): $566.6 million

Dividend Overview

Logitech’s dividend isn’t about grabbing attention—it’s about delivering consistently. At a forward yield of 1.63%, it won’t blow the doors off your income portfolio, but it’s quietly crept up from its 5-year average of 1.34%. That’s a subtle shift, but it reflects a commitment from management to share more of the company’s success with shareholders, even during a softer earnings period.

What makes Logitech stand out here is the discipline. The company’s payout ratio sits just above 33%, which leaves plenty of headroom. Even if earnings don’t grow in the near term, the dividend doesn’t look remotely at risk. It’s comfortably funded by operating cash flows and supported by an exceptionally strong balance sheet.

Speaking of that balance sheet—Logitech’s net cash position means it has virtually no reliance on debt to fund its business or its dividend. For income-focused investors, that’s as reassuring as it gets. There’s no financial engineering here. Just solid fundamentals.

Cash flow is strong, too. With more than half a billion in free cash flow over the trailing twelve months, Logitech has enough flexibility to maintain its dividend, invest in growth, and even pursue share repurchases if management sees fit. It’s a rare combination, especially in this sector.

Dividend Growth and Safety

When you track Logitech’s dividend over time, there’s a clear pattern—methodical, well-paced growth. It hasn’t made splashy increases or erratic jumps. Instead, management has taken a measured approach, letting the dividend rise in sync with cash flow.

That’s the kind of behavior dividend investors appreciate. It’s not about short-term sizzle—it’s about long-term sustainability.

Logitech’s extremely low payout ratio and high cash reserves translate into one of the more secure dividends in the tech hardware space. The risk of a cut is minimal, and there’s room to grow even in a flat earnings environment.

Its beta is another reason to feel comfortable. At just 0.67, the stock tends to move less dramatically than the broader market. That kind of lower volatility can be valuable for dividend-focused portfolios looking for a smoother ride.

Looking ahead, the next dividend date is set for September 25, with the ex-dividend date on September 23. For investors planning their calendar around income, it’s worth keeping that on the radar.

Cash Flow Statement

Logitech’s cash flow profile over the trailing twelve months tells a story of strength, discipline, and shareholder focus. Operating cash flow came in at $842.6 million, a healthy figure that reflects stable core operations despite recent softness in top-line growth. Free cash flow followed suit at $786.4 million, indicating Logitech continues to convert the majority of its operating income into usable cash even after accounting for capital expenditures.

The company maintained modest investment outflows at just $57.3 million, keeping capital expenditures in check. On the financing side, Logitech returned a significant amount to shareholders—over $797 million—primarily through stock buybacks, which made up $588.8 million of that total. Notably, there was no new debt issued or repaid, reinforcing the company’s debt-free approach. With an ending cash position of $1.5 billion, Logitech enters its next fiscal period with more than enough flexibility to support its dividend and strategic initiatives.

Analyst Ratings

🟢 Logitech International S.A. (LOGI) has recently caught the attention of analysts, with a mix of upgrades and price target revisions reflecting a more nuanced sentiment. UBS moved the stock from Neutral to Buy, showing growing confidence in the company’s strategic positioning and ability to maintain strong fundamentals despite a challenging tech environment.

🟠 On the flip side, Loop Capital held its Hold rating but trimmed its price target from $97 down to $78. The adjustment was largely driven by concerns around short-term revenue softness and weaker-than-expected earnings momentum. While the long-term view remains intact for some, there’s a sense that the next few quarters could remain bumpy.

📊 The consensus 12-month price target now sits around $84.29. Within that, analyst estimates span from a conservative $73 up to a more optimistic $100. This spread reflects a cautious yet balanced outlook—analysts are keeping one foot on the brake and the other near the gas, watching closely how Logitech performs amid shifting industry demand.

🔍 Overall, the tone around LOGI has shifted slightly more positive, but with eyes still on execution and recovery in key product categories like video collaboration and gaming accessories.

Earnings Report Summary

Solid Full-Year Growth with a Strong Cash Position

Logitech wrapped up its fiscal year 2025 on a solid note, posting net sales of $4.55 billion. That’s a healthy 6% bump in US dollar terms, and slightly stronger—7%—when adjusted for currency. The company also improved its profitability, with GAAP operating income climbing 11% to hit $655 million. Non-GAAP operating income matched that growth rate, ending the year at $775 million.

Earnings per share came in strong too. GAAP EPS was $4.13, up 7% from the prior year, while non-GAAP EPS rose 14% to $4.84. The business continues to generate impressive cash, logging $843 million in operating cash flow. By year-end, Logitech was sitting on a hefty $1.5 billion cash balance. On top of that, it returned nearly $800 million to shareholders through a mix of dividends and buybacks, reinforcing its commitment to capital returns.

A Mixed Finish to the Quarter

The fourth quarter was a bit more mixed. Sales came in at $1.01 billion, holding steady year over year in USD and up 2% in constant currency. That’s solid, but profits took a hit. GAAP operating income fell 19% to $106 million, and the non-GAAP number was down 16% to $133 million. There were a couple of culprits here—some bad debt expenses and increased strategic investments.

EPS followed the same path. GAAP EPS dropped 10% to $0.96, and non-GAAP EPS slipped 6% to $0.93. Still, operating cash flow for the quarter landed at $130 million, showing the business continued to generate meaningful cash despite those headwinds.

Leadership’s Take and the Road Ahead

CEO Hanneke Faber called out strong performance across key segments and praised the company’s ability to grow broadly across categories. Her message was clear: Logitech is focused on staying aggressive, controlling costs, and moving quickly in response to market shifts. CFO Matteo Anversa emphasized strong momentum across all geographies and customer segments, and highlighted healthy gross margins at 43.5%.

One change worth noting—Logitech decided to withdraw its full-year 2026 guidance due to uncertainty around potential tariffs. That said, it did provide guidance for the upcoming first quarter. Sales are expected to land between $1.1 and $1.15 billion, which would represent modest growth. Non-GAAP operating income for Q1 is projected in the $155 million to $185 million range, meaning we could see a slight dip or a bit of growth, depending on how things play out.

Even with some caution in the air, the tone from leadership was confident. Logitech looks well positioned to adapt and move forward, keeping a steady hand on costs while staying open to opportunity.

Management Team

Logitech’s leadership is a mix of global business veterans who bring together experience, strategic thinking, and a clear vision for the future. CEO Hanneke Faber stepped into the role in December 2023, bringing over thirty years of leadership experience across major international companies. Her focus is clear: blend product innovation with sustainability while staying responsive to evolving consumer trends and market dynamics.

She’s supported by a well-rounded executive team. Samantha Harnett serves as Chief Legal Officer, keeping the company aligned with global legal standards. CFO Matteo Anversa manages Logitech’s financial strategy and capital planning, keeping a close eye on both performance and long-term health. Prakash Arunkundrum, the Chief Operating Officer, leads global operations with an emphasis on execution efficiency. And Wendy Becker, as Chairperson of the board, adds strategic oversight, helping steer the company’s big-picture goals. Together, this team is steering Logitech with a measured, future-focused approach.

Valuation and Stock Performance

Logitech’s stock has seen its fair share of movement over the past year, shaped by broader market conditions and its own evolving fundamentals. As of late May 2025, shares are trading just below $85, a middle ground within the stock’s 52-week range between $64.73 and $105.65. It’s been a bumpy ride, but not without its signals of strength.

Analyst sentiment remains relatively steady, with a consensus 12-month price target hovering around $85.71. On a valuation basis, the stock doesn’t look stretched. It’s trading at a trailing P/E ratio of 20.49 and a forward P/E of 15.60, suggesting the market isn’t overly optimistic but does see potential for continued earnings delivery.

What adds confidence to the valuation picture is the company’s rock-solid balance sheet. With nearly no debt and over $1.5 billion in cash, Logitech has the flexibility to keep investing in innovation, returning capital to shareholders, or simply weathering unexpected challenges. Its consistent dividend and ongoing buybacks speak to that financial strength.

Risks and Considerations

Like any company in the tech sector, Logitech isn’t immune to risk. One of the primary challenges is the speed at which consumer preferences and technologies evolve. If Logitech falls behind the curve in terms of innovation or fails to catch emerging trends, it could feel the pressure on both sales and margins.

Supply chain vulnerabilities are another factor to keep in mind. Disruptions or rising component costs—whether driven by geopolitics, health crises, or logistics breakdowns—can dent profitability. The company operates globally, which means it also faces currency exchange risks. Fluctuations in foreign exchange can either help or hurt its results, depending on the macro environment.

Cybersecurity is becoming increasingly critical, especially for a company whose products connect consumers in digital ecosystems. A major security lapse could impact consumer trust and lead to financial or regulatory fallout. Alongside this, regulatory challenges, especially in areas like environmental compliance and data privacy, remain ongoing variables.

And of course, the competitive landscape is always shifting. Both large tech giants and nimble upstarts are constantly pushing into Logitech’s space. To stay relevant, the company has to keep innovating and delivering value in ways that resonate with customers.

Final Thoughts

Logitech continues to show why it’s considered a reliable presence in the tech space. Its experienced leadership team, strong financial footing, and disciplined execution are all working in its favor. The company’s ability to navigate changing market dynamics while still focusing on long-term growth puts it in a position of strength.

There are certainly risks, and the road ahead will likely include challenges—from macroeconomic shifts to industry-specific pressures. But Logitech isn’t standing still. It’s investing, adapting, and thinking forward. For long-term investors looking for a company that mixes stability with ongoing evolution, it remains a name worth watching.