Updated 5/29/25

Lithia Motors (LAD) is one of the largest automotive retailers in North America, operating hundreds of dealerships across the U.S. and Canada. Known for its rapid expansion through strategic acquisitions, the company also continues to invest heavily in digital innovation and its financing arm, Driveway Finance Corporation. Backed by consistent revenue growth, strong operational execution, and a disciplined management team, Lithia has carved out a significant presence in a changing retail landscape.

Recent Events

Lithia hasn’t slowed down in the slightest. In fact, its latest numbers tell a story of continued momentum. The company brought in $36.8 billion in revenue over the past twelve months, a 7.2% increase compared to the year before. That topline strength has been matched by solid earnings performance, with net income climbing to nearly $849 million and earnings per share hitting $31.70. That’s a 28.8% jump year over year.

Debt has crept higher, now sitting at $13.9 billion. With a debt-to-equity ratio above 200%, that might raise an eyebrow. But it’s worth noting that Lithia is generating healthy cash flows—about $455 million from operations and over $636 million in levered free cash flow. So far, they’ve managed the leverage with care, investing heavily in their dealership network without compromising liquidity.

Most recently, shareholders received a dividend of $0.55 per share on May 23. The company continues to make consistent, quarterly payments—a reassuring signal for income-focused investors.

Key Dividend Metrics

💰 Forward Annual Dividend Rate: $2.20

📈 Trailing Dividend Yield: 0.68%

🌱 5-Year Average Yield: 0.58%

🔒 Payout Ratio: 6.69%

🎯 Dividend Growth: Consistent and under control

💼 Cash Flow Coverage: $636M levered free cash flow

🧾 Dividend Date: May 23, 2025

📆 Ex-Dividend Date: May 9, 2025

Dividend Overview

The yield here isn’t going to catch your eye—it’s currently just under 0.7%. But sometimes what matters isn’t how big the check is today, but how sustainable and reliable it will be over time. That’s where Lithia starts to stand out.

The company is only paying out about 7% of its earnings in dividends. That’s an extremely conservative figure, and it gives them a lot of flexibility. Rather than stretching to keep up with high-yield competitors, Lithia is doing what responsible dividend payers do: they’re building from a solid foundation.

With more than $636 million in free cash flow and relatively light dividend obligations, the coverage here is excellent. This means that even during rough patches in the cycle—or if interest rates stay elevated—Lithia should have no trouble maintaining its payout.

Dividend Growth and Safety

Lithia doesn’t yet have the decades-long dividend history that some investors chase, but the early signs are encouraging. They’ve been gradually increasing their payout over the years, staying within their means while continuing to reinvest in the business.

What’s especially appealing is how much room they have to grow the dividend if they decide to shift focus. With a payout ratio this low and strong cash generation in place, the company could easily ramp up dividend growth when the time is right.

The safety profile also looks solid. Despite a higher-than-average debt load, the company has been able to service its obligations while still returning capital to shareholders. Margins remain stable, with a 4.43% operating margin and return on equity north of 13%, showing that the business is managing its assets effectively.

Even though the dividend yield might seem small, it’s the reliability and potential for future growth that make LAD worth watching. It’s not about chasing short-term income—it’s about owning a business that treats shareholders like long-term partners.

Lithia is still in growth mode, and they’re making deliberate decisions with capital. For dividend investors who value consistency, free cash flow, and long-term potential, this is a company quietly doing the right things.

Cash Flow Statement

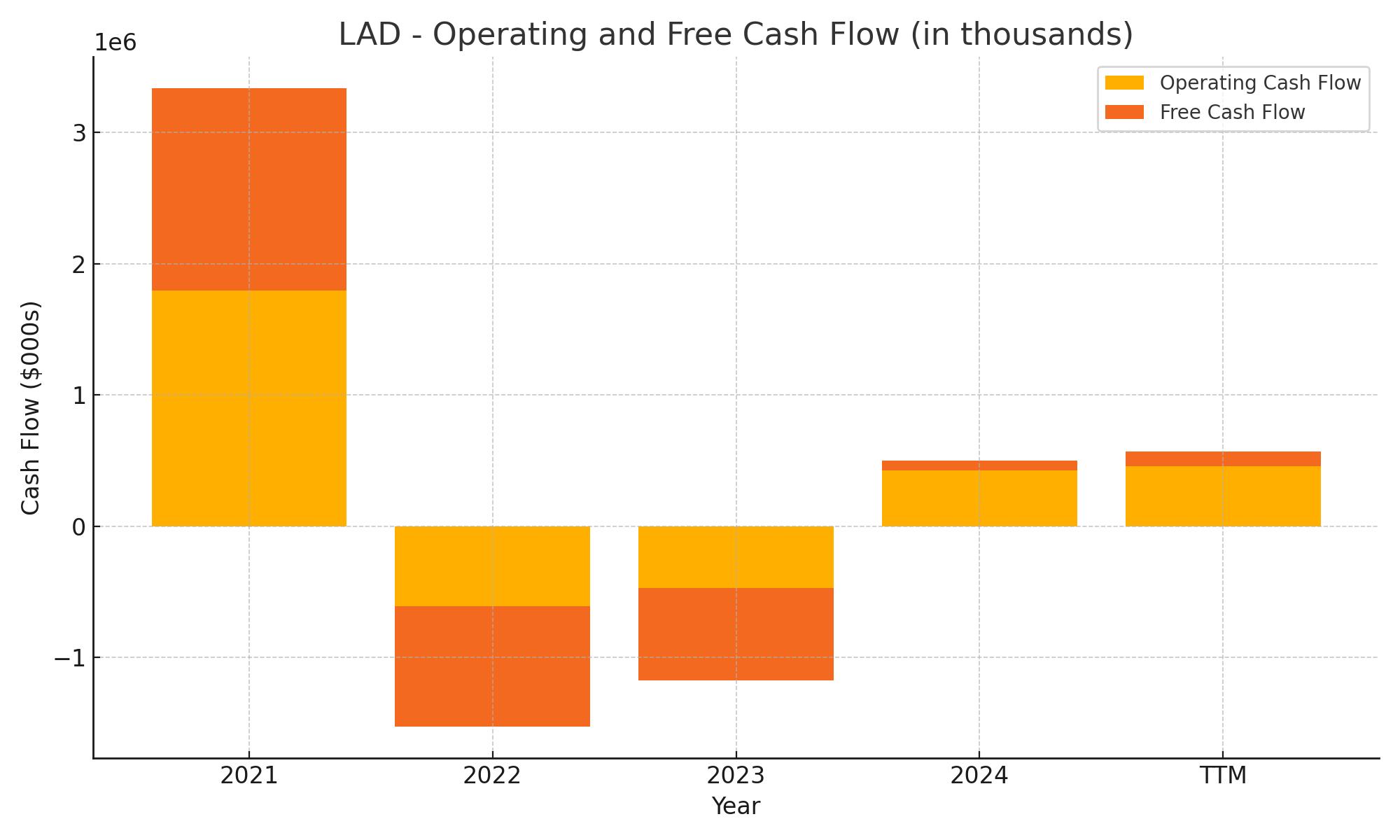

Lithia Motors’ trailing 12-month cash flow profile shows a business generating positive operating cash flow of $454.8 million, a solid rebound from two years of negative flows. Free cash flow, sitting at $114.3 million, has returned to positive territory after two tough years, reflecting improved operational performance and tighter control on capital spending, which came in at $340.5 million. This shift back to consistent cash generation signals stronger fundamentals beneath the surface.

On the investing side, outflows remain heavy at $705.6 million, largely driven by continued acquisitions and expansion efforts—typical for Lithia’s aggressive growth strategy. Financing cash flow is positive at $289.6 million, with a substantial amount of new debt issuance ($15.7 billion) largely offset by repayments ($14.8 billion). The company’s end cash position has modestly increased to $479.3 million, reflecting prudent liquidity management despite its high capital demands.

Analyst Ratings

📈 Lithia Motors (LAD) has recently seen a mix of analyst sentiment, reflecting both confidence in its aggressive growth model and caution around industry dynamics. In April 2025, Citigroup shifted its rating from neutral to buy, pairing that with a new price target of $375. That move came as analysts responded to Lithia’s steady earnings performance and the momentum behind its dealership acquisition strategy, which continues to drive top-line expansion.

⚖️ On the other hand, Goldman Sachs opted to stick with a neutral stance while trimming its price target from $385 to $328. The concern there centered around broader macroeconomic pressures and potential slowdowns in consumer auto spending. Wells Fargo echoed that tone, dropping its target from $397 to $308, reflecting a slightly more cautious view of near-term demand trends despite the company’s strong execution.

💡 Even with some pullback in price targets, overall sentiment remains cautiously optimistic. The consensus 12-month price target sits around $361.20, suggesting that analysts still see upside from current levels. For now, most are balancing Lithia’s robust expansion efforts with external headwinds, keeping their outlook steady while watching how the auto retail landscape evolves.

Earning Report Summary

Strong Start to 2025

Lithia Motors opened the year with a solid first-quarter performance, bringing in $9.2 billion in revenue—a 7% improvement over the same quarter last year. Net income came in at $211 million, and earnings per share jumped to $7.94, marking a 35% increase. These numbers weren’t driven by one-time events or unusual gains. Instead, the company saw growth across its core segments: new vehicles, used vehicles, financing, and service operations.

New car sales hit about 92,000 units, up more than 7%, and the used car side followed suit with continued momentum. One of the more interesting parts of the story came from Driveway Finance Corporation, which originated $623 million in auto loans for the quarter. That shows Lithia’s success in building out its financial services as a steady, growing revenue stream.

Management’s Take and Where Things Go From Here

CEO Bryan DeBoer made it clear the team is staying focused on execution. He credited the quarter’s results to the company’s integrated approach and the benefits of scale from recent acquisitions. While there were some margin pressures—particularly a slight dip in gross profit per vehicle—leadership didn’t sound alarmed. Cost controls helped offset some of that compression, especially with SG&A expenses coming down.

Another move that stood out was the company’s buyback activity. Lithia repurchased 1.7% of its outstanding shares, signaling confidence in its long-term outlook and reinforcing a commitment to shareholder value.

Looking ahead, the roadmap is pretty straightforward. Lithia wants to stay aggressive on the acquisition front, with a goal of adding around $2 billion in annualized revenue through deals this year. At the same time, they’re aiming to bring operating expenses down further, specifically by getting SG&A to hover in the mid-50% range of gross profit. Increasing financing penetration through DFC also remains a priority, giving the company a wider profit base beyond car sales.

Management Team

Lithia Motors is led by a leadership group that combines deep auto retail experience with a clear vision for where the industry is heading. Bryan DeBoer, who has been with Lithia since the late 1980s and took over as CEO in 2012, is at the forefront of this evolution. Under his leadership, the company has grown from a regional dealership group into a national powerhouse, pursuing an aggressive but well-managed expansion strategy. His long tenure has brought a level of consistency and strategic clarity that’s rare in such a fast-moving industry.

Alongside DeBoer, Chief Operating Officer Chris Holzshu plays a key role in driving operational efficiency and integrating new acquisitions into the broader business. Tina Miller, serving as Chief Financial Officer, has been instrumental in maintaining financial discipline while fueling growth. And David Stork, the Chief Administrative Officer, manages real estate and legal operations while also contributing to long-term sustainability goals. Together, this team has built a company that’s not just keeping up with change but actively shaping how auto retail is evolving in both physical and digital spaces.

Valuation and Stock Performance

Lithia Motors’ stock recently closed at $313.87, giving the company a market cap of roughly $8.17 billion. Over the past 12 months, shares have gained just under 25 percent, comfortably outperforming the broader market. While the price has come down from its 52-week high near $405, the stock has rebounded from lows around $243 and is trading above its 50-day moving average, though slightly under its 200-day average.

With a trailing P/E ratio of 9.90 and a forward P/E of around 9.12, the valuation looks fairly reasonable, especially considering Lithia’s strong earnings growth and consistent revenue expansion. Analysts currently hold a consensus 12-month price target of about $361.20, reflecting continued optimism about the company’s growth trajectory. Much of that sentiment is anchored in Lithia’s continued success with acquisitions, its expanding finance business, and a disciplined approach to capital allocation.

Risks and Considerations

Lithia’s story is appealing, but it’s not without risks. The most glaring is the company’s elevated debt levels. With $13.9 billion in total debt and a debt-to-equity ratio north of 200 percent, any tightening in credit markets or shifts in interest rates could put pressure on their financial flexibility. While the company’s cash flow generation helps offset that risk, the size of the balance sheet still demands close attention.

Another consideration is Lithia’s heavy dependence on acquisitions to drive growth. The strategy has worked so far, but integrating new stores, aligning cultures, and achieving expected synergies isn’t guaranteed. Additionally, as the auto industry shifts toward electric vehicles and more direct-to-consumer models, traditional dealership operations could face longer-term structural challenges. Lithia has made moves toward digital transformation, but the pace of change in the industry could demand even faster adaptation.

There’s also exposure to cyclical trends in consumer spending. A slowdown in auto demand, whether from economic conditions or rising interest rates, could directly hit both sales and service revenue. These are manageable risks, but they’re important to understand when assessing the durability of the business model.

Final Thoughts

Lithia Motors has built a compelling growth engine through its mix of dealership acquisitions, operational execution, and expanding financial services. The management team has shown they know how to run a large, complex organization without losing focus. And while the dividend yield is modest, the financial foundation supporting it is solid, with plenty of room for future growth.

The road ahead does include challenges—from economic cycles to rising debt and an evolving auto industry—but Lithia seems well-equipped to handle them. It’s a business with real momentum and a clear strategy, offering investors exposure to a changing but still essential segment of the economy.