Updated 5/28/25

LeMaitre Vascular (LMAT) specializes in medical devices for vascular surgery and has steadily grown its presence across global markets. With strong operational execution, a clean balance sheet, and a disciplined leadership team, the company continues to deliver consistent earnings growth. Its niche focus in vascular health, along with a history of double-digit revenue gains and expanding product lines, gives it a dependable foundation for long-term investors.

Recent Events

In the quarter ending March 31, 2025, LeMaitre reported revenue of $226 million over the trailing twelve months, a 12% increase compared to a year earlier. It wasn’t an explosive result, but that’s not really what this story is about. What matters more is how consistently the company continues to grow, and how that translates into real value for shareholders.

Profit margins came in near 20%, and the company maintained an operating margin above 21%. That level of operational efficiency speaks volumes, especially for a mid-cap firm working in such a specific segment of healthcare. There’s a clear discipline in how the company operates, and it shows in its bottom line.

Another highlight was the company’s balance sheet. As of the latest quarter, LeMaitre had over $300 million in cash and only $185 million in total debt. That means plenty of flexibility—not just to fund ongoing operations and R&D, but also to continue rewarding shareholders. The current ratio of 16.49 is more than enough to suggest strong short-term financial health.

The company’s dividend policy continues to reflect this underlying strength. LeMaitre paid its latest dividend on May 29, 2025, following an ex-dividend date of May 15. For investors keeping track, the company hasn’t missed a beat in delivering those payouts.

Key Dividend Metrics 📊

💵 Forward Dividend Yield: 0.97%

📈 5-Year Average Yield: 0.91%

📊 Payout Ratio: 34.52%

📆 Dividend Growth Streak: Over a decade

🧾 Latest Dividend Date: May 29, 2025

🧮 Ex-Dividend Date: May 15, 2025

💰 Cash per Share: $13.39

🔁 Debt-to-Equity Ratio: 53.33%

Dividend Overview

Let’s be honest—LMAT isn’t going to attract income investors who are just chasing high yields. The current forward yield of 0.97% is modest. But what it lacks in size, it makes up for in quality.

The company pays its dividend from a position of strength. The payout ratio of just under 35% suggests there’s plenty of room to grow the dividend in the years ahead. It also means management is being smart—keeping enough cash inside the business to fund expansion and weather any rough patches, without short-changing shareholders.

What’s really appealing here is the upward trajectory of the dividend. Over the past year, the annual payout jumped from $0.68 to $0.80 per share—a bump of more than 17%. That’s not just a one-off either. LeMaitre has been steadily raising its dividend year after year, a pattern that builds trust with long-term investors.

At the same time, 95% of the company’s float is held by institutions. That’s a significant endorsement. It shows that big money sees long-term value here and is willing to hold through the ups and downs.

Dividend Growth and Safety

When it comes to dividend safety, a lot of investors focus on just one number: the payout ratio. But real safety is about the full picture. And in LMAT’s case, the picture looks solid.

Start with earnings. LeMaitre delivered $1.97 in earnings per share over the past year, and those earnings grew more than 11% year-over-year. That kind of growth gives the company room to raise its dividend without stretching the balance sheet.

Then there’s the cushion: more than $13 per share in cash sitting on the books. Compare that to the $0.80 per share being paid out annually, and it’s clear the company has the firepower to maintain—and likely increase—its dividend even if profits took a temporary hit.

Debt levels are reasonable too. A debt-to-equity ratio of 53% is manageable, especially with that kind of cash buffer. It means the company isn’t overly reliant on borrowed money, which gives them more control over their future.

One interesting note is the short interest. Around 7.7% of the float is currently sold short. That might suggest some investors believe the stock is overvalued at current levels, especially with a trailing P/E around 42. But for dividend investors focused on stability and growth, short-term pricing noise is far less relevant than the strength of the business.

And make no mistake—LeMaitre runs a strong business. Revenues are growing, earnings are expanding, and cash flows are solid. Operating cash flow hit $48 million over the last twelve months, with $29 million in free cash flow left after paying for capital investments. That kind of performance is exactly what supports a reliable, rising dividend over time.

This is a company that seems to understand its role. It’s not swinging for the fences—it’s getting on base, playing good defense, and delivering for its shareholders quarter after quarter. And in the world of dividend investing, that kind of consistency can be worth its weight in gold.

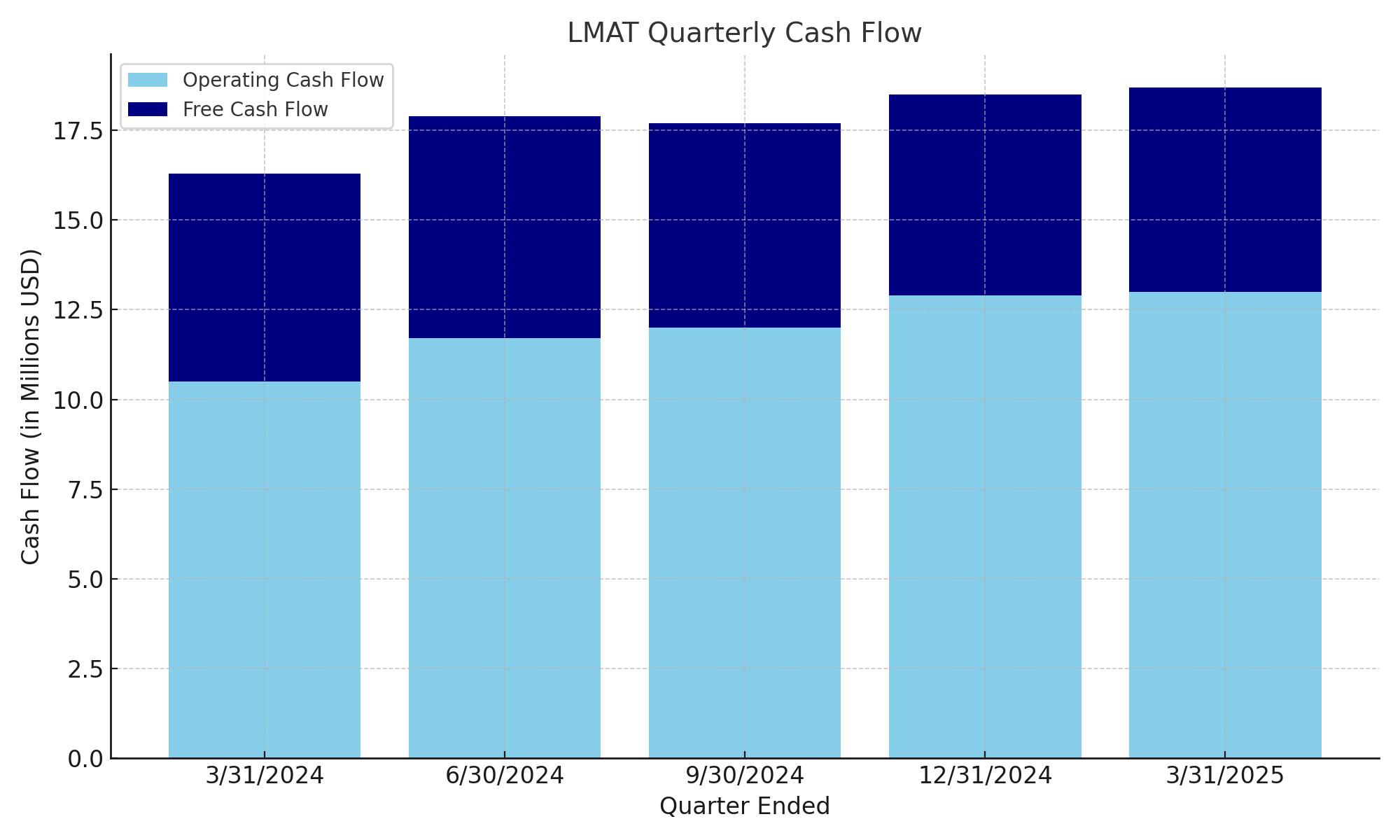

Cash Flow Statement

LeMaitre Vascular’s cash flow performance over the trailing twelve months reflects solid operational execution. Operating cash flow came in at $48.09 million, showing that the company is effectively converting earnings into actual cash—a key sign of financial health, especially for dividend-paying firms. This cash generation supports its ongoing dividend growth and gives it room to maneuver for future investments or acquisitions without needing to rely heavily on debt markets.

Levered free cash flow over the same period stood at $29 million, highlighting that even after interest and capital expenditures, LeMaitre still has a meaningful surplus. This level of free cash flow provides a dependable foundation not only for dividend payouts but also for reinvestment in product development or geographic expansion. For a company with a relatively conservative payout ratio and significant cash reserves, these cash flow metrics suggest stability and resilience in both up and down markets.

Analyst Ratings

LeMaitre Vascular has seen a mix of analyst sentiment recently, reflecting both optimism about the company’s fundamentals and caution about its valuation. 🎯 As of late May 2025, the average 12-month price target sits at $107.29, with estimates ranging from $92 on the low end to $120 on the high. 🧭

🔼 Roth MKM recently upgraded the stock to a “Buy” with a price target of $100. The reasoning was pretty straightforward: solid margins, strong cash flow, and a management team that continues to execute. The firm pointed out that LeMaitre’s steady revenue growth and expanding global footprint are fueling long-term potential, and the balance sheet strength adds to the appeal.

🔽 On the other side of the fence, Oppenheimer moved its rating down to “Market Perform” from “Overweight” and issued a lower price target of $45. Their concern centered on valuation—they acknowledged the company’s consistent performance but felt the stock had run ahead of itself given current multiples.

🟡 Meanwhile, Wells Fargo began covering the stock with an “Equalweight” rating and a price target of $95. Their view was more balanced: while recognizing LeMaitre’s attractive fundamentals, they noted the current share price reflects much of the near-term growth already.

The range of opinions highlights an important dynamic. LeMaitre’s strong financial footing and history of delivering results are clear positives. But analysts are watching closely to see if the stock can justify its premium trading levels going forward.

Earnings Report Summary

Solid Start to 2025

LeMaitre Vascular kicked off 2025 with a strong first quarter. The company brought in $59.9 million in revenue, which was up 12% from the same time last year. Most of that growth came from a 13% boost in organic sales—something management was quick to highlight as a positive signal. Graft sales were particularly strong, jumping 17%, while carotid shunt sales climbed 14%. From a geographic standpoint, EMEA sales grew 18%, the Americas were up 11%, and the Asia-Pacific region saw a modest 3% increase.

Margins were another highlight. The gross margin came in at 69.2%, a slight improvement over last year thanks to stronger pricing and improved efficiency in manufacturing. Operating income rose to $12.6 million, and earnings per share landed at $0.48—up 10%. Cash on hand also improved, with the total hitting $302.5 million by the end of the quarter.

Product Momentum and Strategic Moves

One of the big developments this quarter was the MDR CE Mark approval for Artegraft in Europe. That opens the door for new international sales of one of their top-performing products. In 2024 alone, Artegraft brought in $37 million in the U.S. market. Alongside that, the company ended its distribution agreement for the Elutia porcine patch, which had accounted for $5 million in hospital sales last year. Leadership made it clear this was part of a broader strategy to sharpen their product lineup and focus on higher-performing assets.

CEO George LeMaitre summed things up confidently. He pointed to the strong start in Q1 as the reason for bumping up full-year guidance. The company is now expecting $245 million in reported revenue for 2025, up from the earlier $239 million. Organic sales are now projected to grow 13% for the year instead of the previous 10%. With over $300 million in cash, the company feels it has plenty of flexibility to invest in growth or return value to shareholders.

Looking Ahead

For the second quarter, LeMaitre is guiding revenue to land between $61.5 million and $63.5 million, which would continue the double-digit growth trend. Full-year expectations were also raised, not just for revenue but for margins as well. Gross margins are expected to hold around 69.6%, while operating margins could reach 24%, showing strong control over costs and efficiency.

On top of that, the board approved a new share repurchase plan worth up to $75 million, running through early 2026. They also declared a quarterly dividend of $0.20 per share, payable at the end of May. Altogether, the report showed a company that’s not only growing but doing so with discipline—and with a clear eye on shareholder returns.

Management Team

At the helm of LeMaitre Vascular is a leadership team that blends long-term stability with a clear strategic vision. George LeMaitre, the company’s Chairman and CEO, has led the business since 1992. His deep involvement in the company, both operationally and as a significant shareholder, brings a founder’s mindset to corporate decision-making. That alignment with shareholders isn’t just symbolic—under his watch, the company has expanded its product line, built a global footprint, and delivered consistent profitability.

CFO Joseph Pellegrino has been with the company since 2005 and brings a pragmatic approach to financial management. His guidance has played a key role in preserving a strong balance sheet, keeping debt levels modest while supporting a disciplined acquisition strategy. The team also includes experienced heads across operations, regulatory affairs, and international sales—many of whom have been in place for over a decade. This continuity helps create a culture of focus and execution.

The leadership team has been conservative in its growth targets, careful with capital, and measured in how it scales the business. Instead of making splashy moves, they’ve prioritized steady execution and long-term growth. That tone from the top has helped the company maintain credibility with investors and analysts alike.

Valuation and Stock Performance

From a valuation standpoint, LeMaitre isn’t cheap. The stock trades at a trailing price-to-earnings ratio near 42, and even on a forward basis, it sits close to 38. Compared to many in the medical device space, that’s a premium valuation. But investors have historically been willing to pay up for this kind of consistency and predictability. The company’s ability to grow earnings and dividends steadily, without taking on large amounts of risk, justifies that premium in the eyes of many.

Looking at broader trading trends, LMAT’s shares have seen a fair bit of movement over the past year. After peaking near $110, the stock has settled into a range closer to $80. It’s worth noting that this retreat in price hasn’t been due to any meaningful deterioration in fundamentals. Instead, the pullback seems driven more by valuation normalization as growth stocks broadly came under pressure.

Despite the decline from its highs, LeMaitre’s performance over the past five years remains impressive. Shares are still up substantially from pre-pandemic levels, and the business has been able to consistently grow both its top and bottom line. For long-term investors, that kind of sustained operational strength often matters more than short-term price swings.

The stock also benefits from relatively low volatility. With a beta under 1.0, it tends to move less sharply than the broader market, making it a steadier ride for investors who prioritize capital preservation and income growth.

Risks and Considerations

Like any company, LeMaitre faces its share of risks. One of the key issues is its relatively narrow product focus. While specializing in vascular surgery devices has allowed the company to carve out a niche, it also limits diversification. If reimbursement policies shift, or if a key competitor introduces a superior alternative, there’s limited buffer from other product lines to offset the impact.

Regulatory challenges also remain a reality. The recent MDR approval for Artegraft is a positive step, but the process for bringing products to market in the EU and other global regions continues to grow more complex. Delays or increased compliance costs could affect margins and product rollout timelines.

Another potential headwind comes from foreign exchange exposure. With a growing portion of revenue coming from international markets, currency swings can impact reported results. While management has done a good job managing through this historically, it’s still a variable outside their control.

There’s also the question of valuation risk. At current levels, the stock is priced for continued smooth execution. Any hiccup in quarterly results, even if temporary, could trigger outsized reactions from the market. This doesn’t mean the business is overvalued—just that expectations are high, and surprises could cut both ways.

Finally, while insider ownership is a positive in many ways, it can limit the company’s flexibility when it comes to governance changes or major strategic shifts. Investors looking for activist involvement or a potential buyout scenario may find this setup less appealing.

Final Thoughts

LeMaitre Vascular is a case study in what slow and steady execution can achieve. This isn’t a business chasing the latest tech trend or attempting to disrupt its industry. Instead, it focuses on doing one thing very well: serving the vascular surgery market with high-quality, reliable products. That singular focus, backed by a disciplined leadership team and a fortress-like balance sheet, has enabled it to steadily increase both earnings and shareholder returns.

For dividend investors, LMAT brings a unique blend of characteristics. While the yield is modest, the consistency and pace of dividend growth are impressive. The company has grown its payout steadily, supported by healthy free cash flow and a conservative payout ratio. With a balance sheet stacked with over $300 million in cash and minimal debt, that growth appears well-supported for the foreseeable future.

The leadership team has proven time and again that they’re capable of navigating regulatory environments, expanding internationally, and investing capital wisely. Their measured approach may not generate headlines, but it does generate results. For investors who value financial discipline, shareholder alignment, and long-term thinking, that’s a story worth considering.

In a market where so many companies chase growth at any cost, LeMaitre Vascular stands out for its clarity and commitment to doing the basics exceptionally well. Whether you’re watching it for its dividend track record or as a steady compounder with a niche moat, it’s a name that continues to earn attention the old-fashioned way—through performance.