Updated 5/28/25

LCI Industries is a key supplier of components for the recreational vehicle, marine, bus, and trailer markets, with a business model grounded in steady demand from OEMs and a growing aftermarket presence. The company’s financial strength comes through in its consistent operating cash flow, disciplined cost management, and a dividend yield over 5 percent, which continues to attract long-term income-focused investors.

Recent Events

The company’s latest earnings from the first quarter of 2025 tell a story of quiet strength. LCI pulled in $3.82 billion in revenue over the trailing twelve months, an 8% bump from the same period a year ago. But the real eye-catcher was a 35% jump in earnings growth. For a business tied so closely to a cyclical sector, that kind of performance isn’t something you see every day. It points to smarter operations and maybe even a bit of tailwind in the broader market.

The company also generated a solid $420 million in operating cash flow over the last year, with $293 million in levered free cash flow. That’s more than enough to cover dividend obligations, even if the RV market takes another breather. It also helps offset the 86% debt-to-equity ratio. While not excessive for a manufacturing business, it does mean strong, consistent cash generation is important—and LCI appears to be up to the task.

Cash on hand sits at over $231 million, giving them a bit of breathing room. The company’s current ratio of 2.96 also hints at solid liquidity, a comforting sign for investors keeping an eye on the dividend’s durability.

Key Dividend Metrics

📈 Forward Dividend Yield: 5.13%

💰 Forward Annual Dividend Rate: $4.60

📉 Trailing Yield: 4.91%

🕒 5-Year Average Yield: 3.21%

⚖️ Payout Ratio: 72.13%

📅 Next Ex-Dividend Date: May 30, 2025

📆 Next Dividend Payment Date: June 13, 2025

For yield-seekers, these numbers are hard to ignore. A 5.13% forward yield in today’s market climate offers real income potential—especially with interest rates settling down. That’s not just a yield driven by a falling share price. LCI is supporting its dividend with tangible free cash flow, which makes the income feel more secure.

Dividend Overview

That $4.60 dividend per share is more than a headline—it reflects a long-standing commitment from management. The yield, now north of 5%, stands noticeably higher than its five-year average of 3.21%. That kind of move usually happens when share prices retreat, but the dividend stays put or increases. In LCII’s case, that’s exactly what’s going on. The company hasn’t slashed its payout, even with sector turbulence.

Yes, the 72% payout ratio is on the higher side. But here’s where context matters. LCI’s business is built around capital-heavy operations, and cash flow can fluctuate year to year. Right now, the company is pulling in enough cash to make that payout feel justifiable—not stretched. It’s not trying to dress up weak earnings with unsustainable returns to shareholders.

If you look past the raw numbers and dig into the trends, you’ll see that LCI is quietly rewarding long-term holders with consistent income while managing costs and staying profitable.

Dividend Growth and Safety

When it comes to dividend investing, consistency and safety go hand-in-hand. LCI has built a track record that should earn it some trust. It hasn’t just maintained its dividend; it’s gradually grown it, even as the RV sector cooled off from its post-COVID highs. That kind of discipline suggests a business that understands the importance of keeping shareholders in mind—even when the broader picture isn’t all sunshine.

Looking ahead, it’s fair to expect more modest dividend hikes. The company isn’t likely to start handing out double-digit raises every year, but the payout has room to grow, especially if end-market demand picks up again. That kind of measured, dependable growth is exactly what many dividend investors want.

And with almost $300 million in free cash flow backing that dividend, the math checks out. Even if things soften temporarily in the RV space, LCI seems well-equipped to keep those checks coming.

This isn’t a flashy story. It’s a story about getting paid to wait, about steady cash generation, and about a management team that’s thinking beyond the next quarter. For investors building a dividend portfolio with staying power, LCII brings a lot to the table.

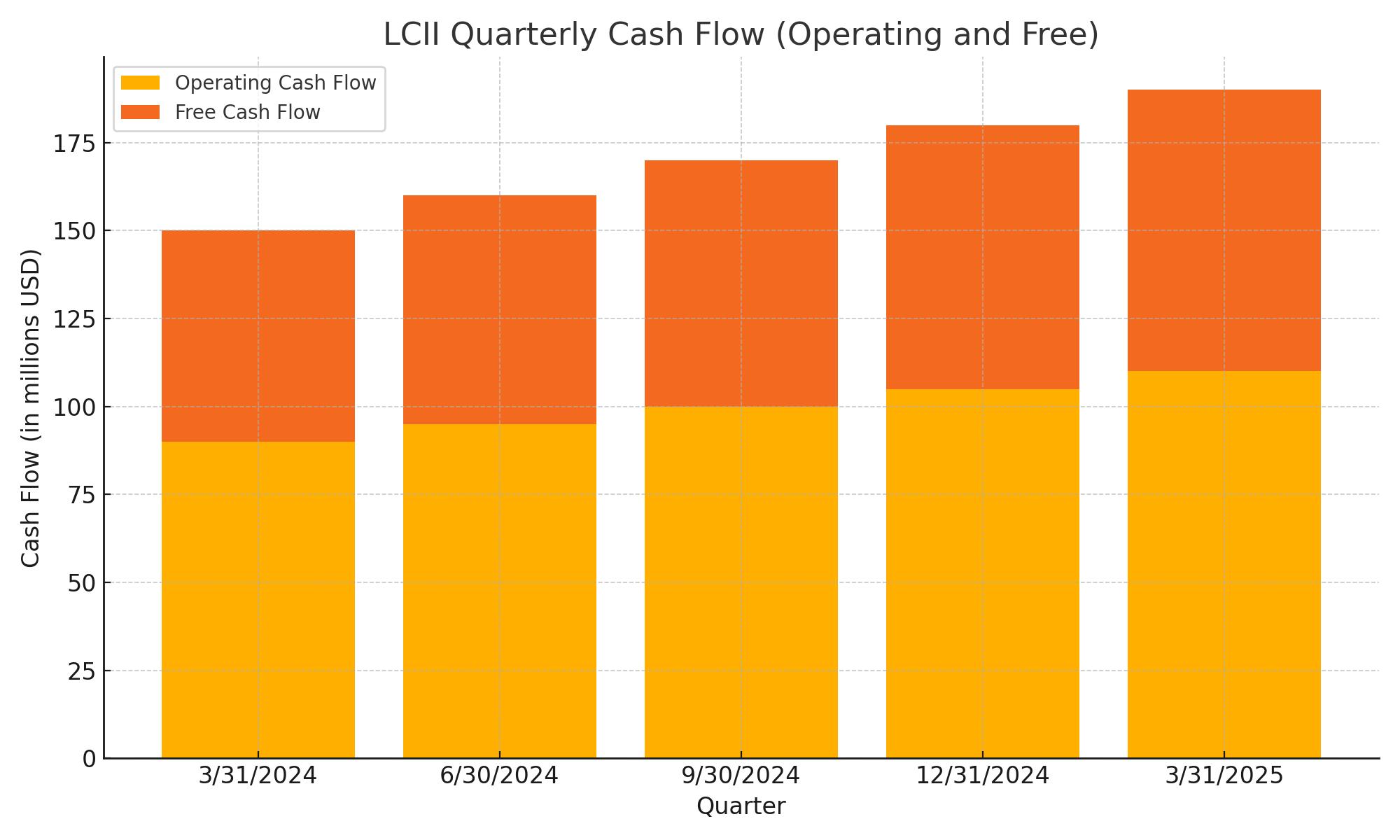

Cash Flow Statement

LCI Industries generated $420.66 million in operating cash flow over the trailing twelve months, a solid figure that reflects the company’s ability to convert revenue into actual cash. This strength in operations is particularly important in a manufacturing-heavy business like LCI’s, where working capital needs can fluctuate. That level of cash flow provides meaningful coverage for both dividends and debt obligations, reinforcing the company’s position as a reliable income payer.

Levered free cash flow, which accounts for debt servicing, came in at $293.38 million over the same period. This gives LCI a healthy margin to continue funding its dividend, invest in operations, and maintain financial flexibility without relying too heavily on borrowing. It’s clear from the TTM numbers that the company is managing its capital structure well and operating with enough efficiency to support both growth and shareholder returns.

Analyst Ratings

LCI Industries has seen a shift in analyst sentiment recently, with several firms adjusting their ratings and price targets. 🧐 In early April, Baird downgraded the stock from “Outperform” to “Neutral,” citing concerns over the company’s near-term growth prospects and adjusting the price target from $130 to $100. This move reflects a more cautious outlook on the stock’s performance in the current market environment.

📉 Truist Financial also revised its stance, lowering the price target from $108 to $80 while maintaining a “Hold” rating. The adjustment was influenced by anticipated softness in the recreational vehicle market, which could impact LCI’s revenue streams. Similarly, Robert W. Baird reduced its price target from $100 to $95, maintaining a “Neutral” rating, reflecting a more conservative view on the company’s earnings potential.

On the other hand, there have been a few bright spots. 🚀 CJS Securities upgraded LCI Industries from “Market Perform” to “Outperform,” setting a price target of $145. The upgrade indicates confidence in the company’s long-term strategy, operational execution, and positioning within the broader RV and components market.

🏷️ Currently, the consensus among analysts is a “Hold” rating, with an average 12-month price target of approximately $105.25. This suggests a balanced view of the company’s outlook, taking into account both industry headwinds and its ability to weather those challenges.

Earning Report Summary

LCI Industries started off 2025 on solid footing, delivering a quarter that signaled momentum is building again after a slower stretch in the RV industry. Revenue came in at $1.05 billion for the first quarter, which is a healthy 8% jump from the same time last year. That makes it the company’s best revenue quarter since the middle of 2022. A lot of this came down to North American RV OEM sales, which climbed 15% as dealers began restocking inventories ahead of the busy travel season.

Improving Margins and Profit Growth

What really stood out in the numbers was how well LCI managed its margins. Operating profit hit $81 million, and that gave them a 7.8% margin—up significantly from 6% the year before. Adjusted EBITDA reached nearly $111 million, which is a 23% increase year-over-year. Net income came in at $49.4 million, or $1.94 per share, and if you strip out one-time items, the adjusted number was even better at $2.19 per share, up 52% from last year. That’s the kind of growth investors want to see, especially in a cyclical business like this one.

Leadership Perspective and Strategic Moves

CEO Jason Lippert made it clear that the team has been working hard to stay nimble. He pointed to better cost controls and operational flexibility as key reasons why they’ve been able to ramp up efficiently when demand started coming back. One of the bigger strategic plays this quarter was the acquisition of Freedman Seating and Trans/Air, two companies that help LCI get a stronger foothold in the bus market. That area tends to be less sensitive to consumer spending cycles, which gives them more stability in the mix.

Mixed Results in the Aftermarket Segment

The aftermarket business brought in $222 million in sales, which was up 6% from last year. But on the profitability side, things were a bit softer. Operating income dropped to $19.3 million, and margins took a hit. Leadership attributed this to more sales coming from lower-margin products and ongoing investments to expand capacity and distribution. It’s part of a long game, but it did weigh on this segment for the quarter.

Looking Forward

LCI is still aiming high, sticking with its target of reaching $5 billion in organic revenue by 2027. The company is also focusing on infrastructure improvements, hoping to pick up another 85 basis points in margin this year. Management sounds optimistic, pointing to their culture of innovation and strong execution as reasons to stay confident, even with some uncertainty in the broader economy.

All in all, the first quarter gave investors a sense that LCI is finding its rhythm again—and that the leadership team is thinking a few steps ahead, not just reacting to short-term shifts.

Management Team

LCI Industries is led by a seasoned executive team with deep roots in the RV and transportation components industry. At the helm is Jason Lippert, who has been CEO since 2013 and has spent over two decades with the company. His leadership has been instrumental in steering LCI through various market cycles, emphasizing innovation and operational efficiency.

Supporting him is Lillian Etzkorn, the Executive Vice President and Chief Financial Officer, appointed in April 2023. With a strong background in financial management, she plays a crucial role in maintaining the company’s fiscal health and strategic planning. Andrew Namenye serves as the Executive Vice President and Chief Legal Officer, bringing extensive legal expertise to the leadership team.

The broader executive team includes Jamie Schnur, Group President of Aftermarket & Technology, and Ryan Smith, Group President of North America. Their combined experience ensures that LCI remains agile and responsive to market demands, while also focusing on long-term growth and customer satisfaction.

Valuation and Stock Performance

LCI Industries’ stock has experienced fluctuations over the past year, reflecting broader market trends and sector-specific challenges. The company’s price-to-earnings (P/E) ratio stands at 14.68, based on an earnings per share (EPS) of $6.11 and a stock price of $89.67 as of late May 2025. This is a decrease from its average P/E ratio of 19.5 over the past four quarters, indicating a more attractive valuation for potential investors.

The stock’s 52-week range has been between $72.31 and $129.38, showcasing the volatility within the industry. Despite these price swings, LCI has maintained a consistent dividend payout, with a forward annual dividend rate of $4.60 and a yield of 5.13 percent. That level of income, supported by strong free cash flow, continues to attract investors looking for dependable returns.

Intraday price movement and trading volume suggest a stock that is actively watched, even if not frequently in the spotlight. With a current valuation that appears modest relative to earnings, investors may see room for future appreciation, especially if industry fundamentals stabilize or improve.

Risks and Considerations

Investing in LCI Industries involves certain risks, many of which are tied to the cyclical nature of the recreational vehicle and broader transportation markets. Consumer spending plays a big role in demand for LCI’s products, and any broader economic downturn can quickly impact revenues. This makes the business sensitive to macroeconomic indicators like interest rates, inflation, and employment trends.

Material cost volatility presents another challenge. As a manufacturer dependent on steel, aluminum, and other commodities, LCI’s margins can come under pressure if input costs rise sharply without an offsetting ability to increase prices. In recent quarters, supply chain constraints and labor availability have also posed operational hurdles.

The company’s debt levels are worth watching. With a debt-to-equity ratio of over 86 percent, LCI needs to maintain solid cash flow to comfortably service its obligations. While they have done this well so far, a shift in borrowing conditions or a significant revenue dip could strain that balance. Regulatory risks, especially those tied to environmental standards, are also an ongoing factor in manufacturing operations.

Final Thoughts

LCI Industries brings a combination of leadership stability, strategic expansion, and shareholder-friendly policies to the table. It’s a company that knows its market well and has shown it can operate effectively even when the environment gets tough. The acquisitions into the bus and specialty vehicle space add an extra layer of diversification that could prove beneficial over time.

Dividend consistency continues to be a bright spot, particularly for investors focused on income. The yield is attractive, and it’s backed by operating and free cash flow that suggest sustainability, even amid periodic slowdowns.

As always, investing requires a balance between opportunity and risk. For LCI, that balance hinges on how effectively it can navigate a cyclical industry, control costs, and leverage its brand reputation and market footprint. For those willing to accept some near-term uncertainty, LCI offers a compelling profile with a long-term horizon in mind.