Key Takeaways

📈 Lakeland Financial offers a 3.41% forward dividend yield with a consistent pattern of annual increases and a sustainable 55% payout ratio, making it attractive for income-focused investors.

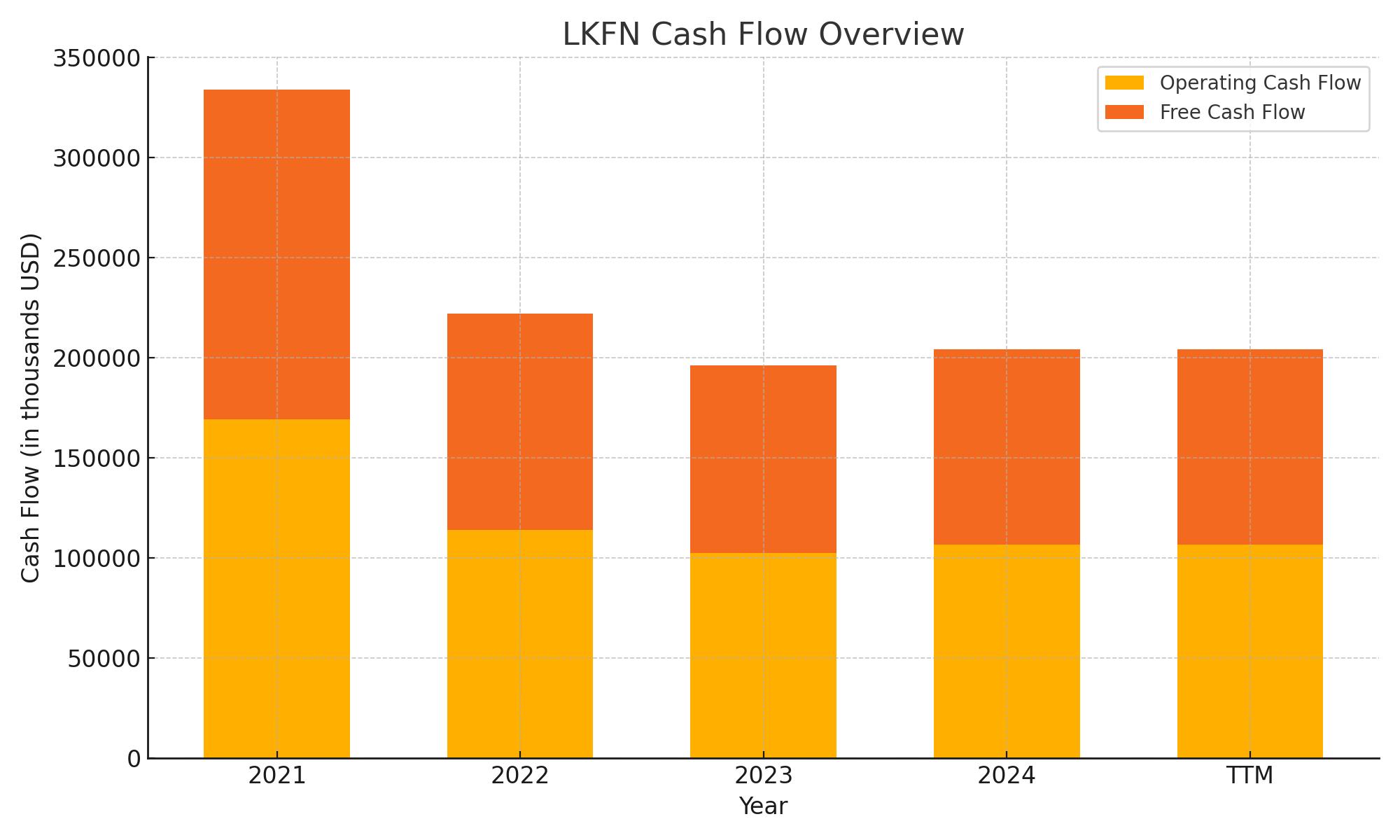

💵 The bank maintains strong free cash flow of $97.7 million, with stable operating cash generation and a growing cash position despite increased investment activity.

🔍 Analysts have turned more optimistic on LKFN, with a recent upgrade and a consensus price target of $68.50, reflecting confidence in its loan growth and margin expansion.

Last Update 5/27/25

Lakeland Financial Corporation (NASDAQ: LKFN), the parent of Lake City Bank, is a well-capitalized regional bank based in Indiana with over 150 years of history. The company has shown solid fundamentals through a challenging economic environment, with strong loan growth, expanding net interest margins, and a disciplined approach to capital allocation. Leadership remains focused on long-term shareholder value through consistent dividend increases and steady performance.

With a current dividend yield of 3.41% and a payout ratio of 55%, LKFN has continued to return capital to investors while maintaining financial flexibility. Despite a recent dip in earnings due to an isolated nonperforming loan, the bank’s balance sheet, leadership stability, and operational efficiency support a positive long-term outlook.

Recent Events

Lakeland Financial Corporation (LKFN) has been quietly navigating through some uneven terrain lately. The first quarter of 2025 came with a few soft spots—most notably, a slight dip in revenue, down just under 1% from a year ago. That’s not a red flag, but it does show a modest cooling in momentum. Earnings saw a bigger pullback, falling over 14% year-over-year, which is something to watch.

Despite the softer performance, the market’s response has been relatively optimistic. LKFN shares recently climbed 3%, bringing the price to $60.41. That’s still shy of the stock’s 52-week high near $79, but a comfortable step above the $50 low seen earlier in the year. Notably, institutional investors own over 86% of shares outstanding, showing strong backing from the kind of long-term holders who value reliability over flash.

So while the headlines may not be shouting, there’s something to be said for how this bank handles itself. For those who are focused on consistent income, that kind of steadiness matters.

Key Dividend Metrics

📅 Dividend Date: May 5, 2025

🔔 Ex-Dividend Date: April 25, 2025

📈 Forward Dividend Yield: 3.41%

💰 Annual Dividend Rate: $2.00

🔢 Payout Ratio: 55.43%

📊 5-Year Average Yield: 2.55%

🕰 Dividend Growth Streak: Steady history of increases

📉 Trailing 12-Month Yield: 3.34%

📆 Last Dividend Increase: Consistent annual hikes

🔄 Last Stock Split: 3-for-2 on August 8, 2016

Dividend Overview

Lakeland Financial doesn’t try to wow with sky-high yields, but what it does offer is consistency—and that’s exactly what many income investors are looking for. Right now, the forward yield stands at 3.41%, which is comfortably ahead of its five-year average. That tells us the stock might be trading at a relative discount from a yield standpoint, which always catches the eye of income-focused portfolios.

What really makes the dividend stand out, though, is the cushion behind it. With a payout ratio sitting at about 55%, there’s plenty of breathing room. It’s not scraping the ceiling like some higher-yield names do. This is a bank that isn’t paying out everything it earns just to keep shareholders happy. That signals confidence and a longer-term approach.

The fundamentals back that up. Lakeland runs a lean operation with a profit margin over 38% and return on equity above 13%. These are solid numbers, especially for a regional player. What that means for dividend investors is simple: those quarterly checks aren’t coming from a shaky operation—they’re being supported by real, repeatable earnings power.

This also isn’t a company that’s ever been reckless with shareholder returns. Even during stretches where earnings dipped, the dividend stayed steady. There’s something reassuring about that, especially when you’re looking to build reliable income over time.

Dividend Growth and Safety

Here’s where Lakeland really begins to show its long-term value. The company hasn’t just been paying dividends—it’s been raising them with consistency. In fact, it’s done so in most years over the last decade. The hikes might not be eye-popping, but they’ve been dependable—often in that nice middle ground where you’re getting a raise every year without overextending the business.

That 55% payout ratio we mentioned earlier? It leaves room for more growth. Many banks stretch that closer to 70% or even higher when they run out of better uses for cash. Lakeland, on the other hand, keeps things tight, giving itself room to maneuver if interest rates shift or loan demand slows.

And then there’s the balance sheet. The company holds over $235 million in cash versus just $115 million in total debt. That’s a rare setup in the financial sector and gives an extra layer of security. If anything unexpected comes up—regulatory changes, economic swings, or just a bad quarter—the dividend still looks secure.

One last piece of the puzzle: the stock’s beta is just 0.59. That means it moves less than the broader market, which might not excite growth chasers, but for dividend investors? It’s gold. It means less volatility and fewer swings in portfolio value. When you’re relying on steady income, that stability can be just as valuable as the checks themselves.

Cash Flow Statement

Lakeland Financial’s trailing 12-month cash flow paints a picture of operational resilience paired with active balance sheet management. Operating cash flow stood at $106.6 million, a modest increase from the prior year, showing that core business activities remain healthy even amid shifting market conditions. Free cash flow came in at $97.7 million, providing ample flexibility to support dividends, fund capital expenditures, and maintain liquidity. Capital spending has been conservative, with just $8.9 million allocated, aligning with the company’s disciplined approach to growth and infrastructure.

The more dramatic shifts appear in investing and financing activities. On the investing side, outflows accelerated to $217.5 million over the past year, largely driven by securities purchases, a common move among regional banks adjusting to rate changes and asset allocations. Financing activity surged with $198.5 million in inflows, rebounding from last year’s $78 million. This included debt adjustments and capital maneuvering, helping boost Lakeland’s end cash position to $235.2 million. Despite aggressive investment moves, the company managed to grow its cash reserves, highlighting solid financial stewardship and flexibility to weather future challenges without compromising shareholder returns.

Analyst Ratings

📈 Lakeland Financial Corporation (LKFN) recently received an upgrade from Hovde Group, shifting its rating from “Market Perform” to “Outperform.” This change reflects a more optimistic stance on the stock’s future, with analysts setting a fresh price target of $72.00. That’s a confident nod toward the bank’s stability and earnings potential, suggesting some solid runway for growth ahead.

💹 The decision to upgrade came on the back of strong profitability metrics. With a net margin over 21% and return on equity sitting north of 13%, Lakeland is demonstrating the kind of efficiency and earnings quality that analysts favor, especially in an uncertain rate environment. It’s a signal that the fundamentals are doing the heavy lifting, and not just short-term sentiment.

📊 The broader analyst consensus leans toward a “Moderate Buy” with an average price target of $68.50. That leaves room for about 15% upside from where shares currently sit. It’s not explosive, but it’s a respectable expectation in the current market for a well-run regional bank.

🔍 Altogether, the shift in sentiment highlights a growing confidence that Lakeland Financial is positioned to deliver steady returns, supported by operational strength and disciplined capital management.

Earnings Report Summary

Solid Loan and Margin Growth

Lakeland Financial kicked off 2025 with a mixed bag, but there were definitely some positives to pull from their first-quarter earnings. Net income landed at $20.1 million, which is down about 14% from the same time last year. Earnings per share also dipped to $0.78 from $0.91. While that kind of drop always gets attention, the underlying performance tells a deeper story.

Net interest income actually rose 12% compared to the prior year, climbing to $52.9 million. That kind of growth doesn’t happen by accident. It came down to a combination of higher loan balances and expanding net interest margins, which grew by 25 basis points to hit 3.40%. Loan balances rose by 4% as well, pushing the total average loan portfolio to just over $5.19 billion. This was all backed by steady deposit growth, which helped fuel that lending activity.

Capital Position Stays Strong

Lakeland’s capital strength remained one of the highlights of the quarter. Tangible book value per share increased to $26.85, up 7% from a year earlier. On the regulatory side, their common equity tier 1 capital ratio improved to 14.51%, and the tangible capital ratio edged up to 10.09%. These numbers reflect a bank that’s still managing its capital with discipline and a focus on long-term stability.

Managing Through Credit Headwinds

Not everything was smooth sailing, though. The bank did take a noticeable hit from increased credit provisions. They set aside $6.8 million for potential loan losses, up sharply from $1.5 million in the same quarter last year. That jump was largely tied to a specific $43.3 million credit that’s now classified as nonperforming. While it’s never good news to see a big increase in provisions, the transparency and proactive approach to managing it are worth noting.

Even with a few earnings pressures, Lakeland stayed committed to rewarding shareholders. The board bumped the quarterly dividend up by 4%, bringing it to $0.50 per share. They also extended their stock repurchase program through April 2027, leaving $30 million in authorization on the table. That signals confidence from leadership that they can continue to generate value and return capital at the same time.

CEO David Findlay called out the strong margin expansion and healthy loan growth as highlights, while President Kristin Pruitt emphasized the flexibility the bank has to keep supporting lending and returning capital. Together, their tone reflected a steady hand at the wheel, even if the road ahead has a few bumps.

Management Team

Lakeland Financial Corporation is led by an experienced executive team with a steady hand on the wheel. David M. Findlay serves as Chairman and Chief Executive Officer, guiding the company’s strategic direction with deep industry experience. Kristin L. Pruitt holds the role of President, bringing both legal expertise and operational leadership to the table. Lisa M. O’Neill, as Executive Vice President and Chief Financial Officer, ensures the company maintains fiscal discipline and financial clarity. Rounding out the leadership is a diverse and engaged board of directors, including newer members like Dan Starr and Mindy Creighton Truex, who bring fresh perspectives and governance experience to support the bank’s long-term goals.

Valuation and Stock Performance

As of late May 2025, shares of Lakeland Financial (NASDAQ: LKFN) are trading around $60.46, reflecting a modest uptick of just over 3% on the day. The company’s market cap sits at approximately $1.5 billion. Valuation-wise, the stock appears fairly priced in comparison to industry peers, with a trailing P/E of 16.75 and a forward P/E of 20.08. The price-to-book ratio at 2.16 suggests a premium, but one that aligns with the company’s consistent performance and strong return metrics. Over the last 52 weeks, the stock has moved between a low of $50 and a high of $78.61, indicating some volatility but also opportunity. Meanwhile, the dividend yield stands at a healthy 3.41% with a payout ratio just over 55%, reinforcing the stock’s appeal to income-focused investors.

Risks and Considerations

No investment is without its risks, and Lakeland Financial is no exception. The bank’s exposure to commercial real estate and commercial and industrial loans introduces some potential vulnerabilities, especially in times of economic slowdown. The most pressing issue from recent quarters was a $43.3 million nonperforming loan that led to a notable increase in the provision for credit losses. Events like this serve as a reminder that even well-managed banks must stay vigilant in credit quality. In a broader context, the regional banking sector continues to navigate a shifting regulatory environment and competitive pressures from fintech disruptors. Interest rate swings also remain a key consideration, as they directly impact net interest margins and the bank’s earnings trajectory.

Final Thoughts

Lakeland Financial continues to offer a dependable story for investors focused on consistency and long-term growth. The management team’s measured approach, combined with a robust balance sheet and solid dividend track record, positions the bank as a stable presence in a competitive landscape. While there are pockets of risk—especially in the lending portfolio—the company’s proactive oversight and strong capital reserves offer a solid buffer. For those seeking a blend of income, quality, and disciplined execution, Lakeland Financial checks many of the right boxes.