Key Takeaways

📈 LHX offers a forward dividend yield of 2.02% with a 24-year track record of increases and a conservative 55% payout ratio, signaling consistent income with room for future growth.

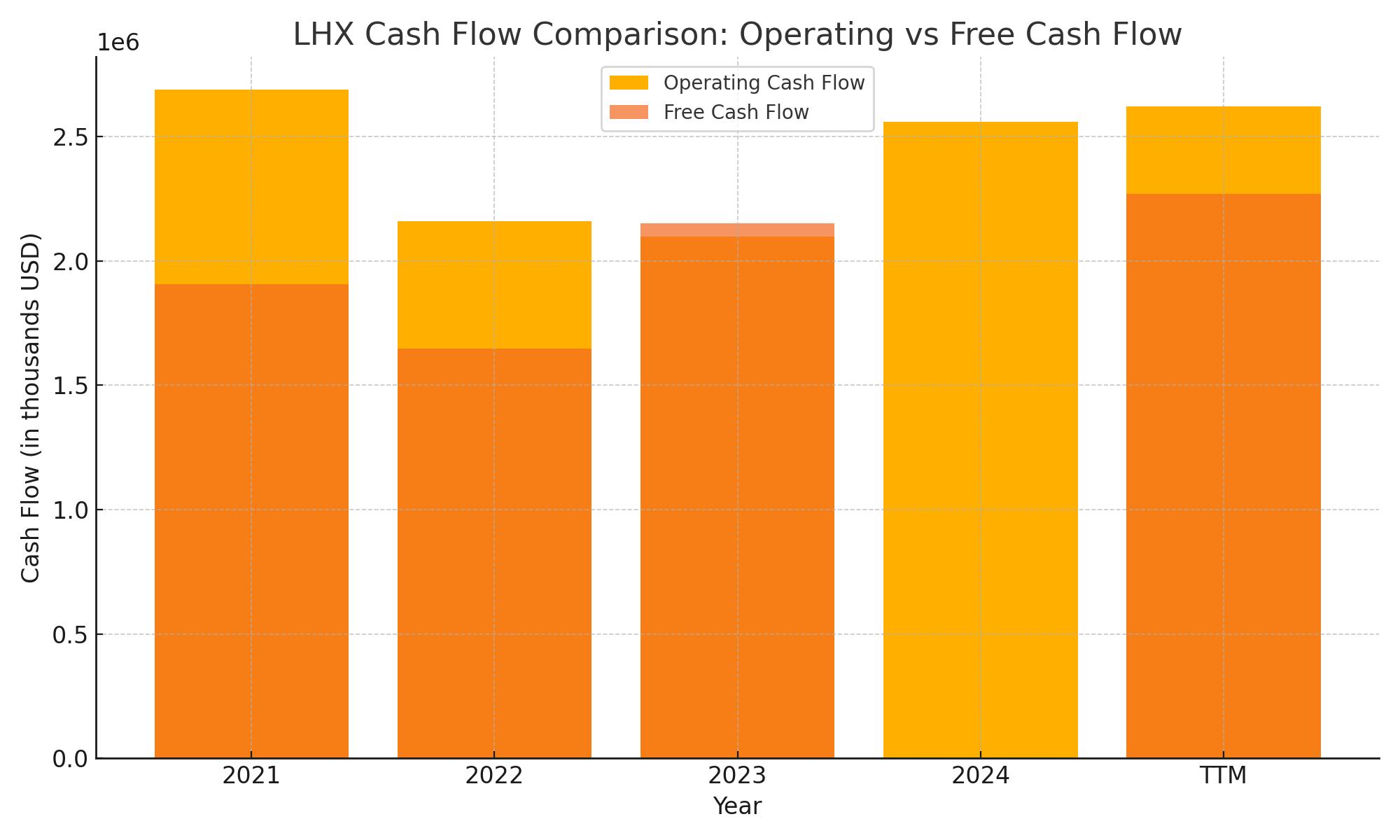

💵 Strong operating cash flow of $2.62 billion and free cash flow of $2.27 billion over the trailing twelve months support dividend sustainability and strategic flexibility.

📊 Analysts maintain a moderate buy rating with a consensus price target of $256.56, reflecting cautious optimism backed by solid earnings growth and improving margins.

Last Update 5/27/25

L3Harris Technologies, a major player in defense and aerospace, blends decades of technical expertise with a forward-looking approach to modern warfare and communications. Formed from the merger of L3 Technologies and Harris Corporation, the company delivers secure communication systems, advanced sensors, and missile technologies while maintaining steady earnings and a long-standing commitment to dividends.

With strong leadership, growing free cash flow, and a reliable dividend that’s been increased for 24 consecutive years, LHX offers income investors a disciplined, shareholder-focused story. Its performance reflects thoughtful capital allocation, resilience in a complex market, and strategic clarity amid evolving defense priorities.

Recent Events

LHX recently caught a bit of a tailwind, with the stock jumping over 4.5% in a single session, bringing it up to $248.27. That’s the kind of movement that makes you look twice. It wasn’t a random pop either—the company posted impressive earnings growth of 36.4% year over year. That’s not something you see every day in this sector.

Now, revenue did tick down slightly, by 1.5% compared to the same period last year, so not everything is in full bloom. But management has shown they know how to protect margins, with operating performance still healthy and stable. Return on equity is sitting at 8.52%, and with a 13.33% operating margin, it’s clear the core business is humming even as the environment shifts.

If there’s one thing that comes through clearly, it’s that L3Harris is doing the quiet work well—managing costs, keeping the balance sheet in check, and rewarding shareholders along the way.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.02%

💰 Forward Annual Dividend Rate: $4.80 per share

🕰️ 5-Year Average Dividend Yield: 2.00%

🔁 Payout Ratio: 55.52%

📅 Next Ex-Dividend Date: June 3, 2025

📥 Next Dividend Payment Date: June 18, 2025

📊 Dividend Growth: Steady, with consistent increases over time

Dividend Overview

What stands out about L3Harris from a dividend perspective is its sense of consistency. This isn’t a stock trying to dazzle with high yields or erratic hikes. Instead, it’s about dependability—offering shareholders a steady payout quarter after quarter.

The current dividend clocks in at $1.20 per share each quarter, and with a forward annual yield of just over 2%, it fits squarely into that sweet spot many income investors target. It’s not flashy, but it is sustainable—and that matters more in the long run.

One thing that adds comfort is the payout ratio, which is just a hair over 55%. That leaves plenty of room for the company to reinvest in its operations, handle debt, or even boost the dividend in the future without straining its finances. In other words, you’re not getting yield at the expense of long-term stability.

The ex-dividend date is right around the corner on June 3, and the next payment hits accounts by June 18. For those looking to lock in a solid income stream before summer, that’s a timeline to keep in mind.

Dividend Growth and Safety

L3Harris doesn’t get the fanfare that some of the bigger dividend names attract, but it doesn’t need to. Its track record of raising the dividend over time is quietly impressive. You won’t see double-digit hikes, but what you do see is discipline—a steady hand on the wheel, keeping shareholder returns a top priority without overreaching.

Safety is another strength. Total debt sits at $12.25 billion, which sounds hefty, but it’s backed by a solid $3.56 billion in levered free cash flow and over $2.6 billion in operating cash flow. The current ratio is just over 1, giving it enough liquidity without letting cash sit idle. That balance shows up in how comfortably the company covers its dividend and still manages its long-term investments.

There’s also the bonus of low volatility. With a beta of 0.72, LHX tends to move less aggressively than the broader market—a nice trait when the waters get choppy. And with almost 90% of the float held by institutions, it’s clear that many big players see the same appeal in this slow-and-steady approach.

For investors who prefer their dividend checks on time and with minimal fuss, L3Harris is shaping up to be a solid name to keep on the radar. It won’t thrill you with surprises, but in the world of income investing, that predictability is exactly what you want.

Cash Flow Statement

L3Harris generated $2.62 billion in operating cash flow over the trailing twelve months, reflecting a steady upward trend from the previous two years. This uptick signals solid earnings quality and operational efficiency, which is further supported by consistently strong free cash flow—now sitting at $2.27 billion. The company has managed to grow cash generation even with fluctuating revenue, indicating disciplined cost control and a stable core business.

Investing cash flow showed a positive $597 million for the trailing period, largely due to reduced capital expenditures and a strategic shift following heavier investment periods like 2022. On the financing side, L3Harris spent more than $3.1 billion—mainly repaying debt and buying back stock. While this drained cash reserves to $522 million from previous highs, it also shows management’s confidence in maintaining shareholder value and balance sheet strength without overextending liquidity.

Analyst Ratings

L3Harris Technologies has seen a mix of analyst activity in recent months, reflecting both growing optimism in its long-term outlook and some caution regarding near-term execution. The consensus 12-month price target currently sits at 💵 $256.56, with individual estimates ranging from a low of $212 to a high of $324.

In April, one major Wall Street firm shifted its stance from a bearish to a bullish outlook, upgrading LHX from a “Sell” to a “Buy” and raising its target from $198 to $263. The catalyst? Confidence in L3Harris’s strong positioning in the defense tech landscape and expectations that increased government defense spending will continue to flow toward communications, surveillance, and space systems—areas where the company is particularly strong.

On the flip side, another firm maintained its “Buy” rating but trimmed its price target from $285 to $245. The reasoning there was based on concerns around slowing revenue momentum and the need for stronger top-line growth to justify a higher valuation, even though earnings and margins have shown resilience.

The overall tone among analysts remains constructive. The stock currently holds a consensus rating of ✅ “Moderate Buy,” with 12 analysts in the “Buy” camp and 5 recommending a “Hold.” The takeaway here is that while there are some mixed signals, sentiment continues to lean positive, supported by solid fundamentals and strategic positioning.

Earnings Report Summary

Solid Start to the Year

L3Harris Technologies kicked off 2025 with a steady performance that reflects a business staying the course amid a complex defense landscape. First-quarter revenue landed at $5.13 billion, which was just a bit lower than the same time last year. Even so, the company pulled off a 7% jump in non-GAAP earnings per share, reaching $2.41. That growth didn’t happen by accident—it came from tighter cost control and stronger margins in some of the company’s key business units.

Leadership was quick to point out the positive trends beneath the surface. Communication Systems, for instance, saw revenue climb 4%, driven by strong international demand for secure communications and satcom gear. On the flip side, there was a slight dip in Integrated Mission Systems and Space & Airborne Systems, largely tied to a planned wind-down in some areas and the sale of the antenna business last year. Still, those moves were strategic and already baked into expectations.

Margin Gains and Operational Discipline

Margins were a highlight this quarter. Communication Systems improved its margin by 150 basis points, hitting 25.5%, while Integrated Mission Systems nudged higher to 12.8%. These aren’t just numbers—they reflect a business that’s managing product mix and efficiency with precision. The LHX NeXt cost-cutting effort seems to be paying off, giving the company room to grow earnings even in a flat revenue environment.

Aerojet Rocketdyne also had a good showing with an 8% revenue lift, thanks to increased volume in missile and munitions programs. That acquisition continues to fit nicely into the broader portfolio, and the growth there is helping to offset some of the softer spots.

CEO Christopher Kubasik sounded upbeat about the quarter. He emphasized that the company continues to deliver in line with national defense priorities while maintaining operational focus. One thing that stood out was the commitment to shareholders—nearly $800 million returned through dividends and share buybacks. That included another bump in the dividend, extending the company’s 24-year streak of increases.

The updated guidance for the full year reflects some shifts, including the recent divestiture of the Commercial Aviation Solutions unit. Now, the company expects full-year revenue to come in between $21.4 billion and $21.7 billion, with EPS expected to fall between $10.30 and $10.50. Leadership isn’t backing away from their targets—they’re just sharpening the focus.

All in all, it was a quarter that didn’t try to overpromise, but still delivered where it counts. Operational discipline, margin strength, and a clear path forward remain the themes, and management seems comfortable navigating whatever comes next.

Management Team

L3Harris Technologies is led by Christopher E. Kubasik, who holds the dual role of Chair and Chief Executive Officer. Kubasik brings over thirty years of industry experience, including senior positions at Lockheed Martin and Ernst & Young. He became CEO in June 2021 after previously serving as Vice Chair, President, and Chief Operating Officer following the merger of L3 Technologies and Harris Corporation in 2019.

The executive leadership supporting Kubasik includes Kenneth L. Bedingfield, who serves as Chief Financial Officer, and Samir B. Mehta, President of the Communication Systems segment. The broader leadership team is made up of individuals with deep backgrounds in defense, aerospace, finance, and strategic operations. This group is instrumental in driving L3Harris’s innovation and executing its growth strategy across key technology segments.

Valuation and Stock Performance

As of late May 2025, L3Harris shares were trading around $247.90, representing a 4.4 percent gain for the day and outpacing many defense sector peers. While the stock has recovered from its lows, it’s still trading roughly 6.7 percent below its 52-week high of $265.74.

The average analyst price target currently sits at $256.56, with projections spanning from $212 on the low end to as high as $324. The company’s Relative Strength (RS) Rating recently improved to 82, reflecting stronger comparative performance over the past 12 months. Technically, the stock appears to be shaping a cup-without-handle chart formation, with a potential breakout zone around its previous high. That setup, paired with improved sentiment, may support further momentum if market conditions align.

Risks and Considerations

While L3Harris holds a strong position in the defense space, it does face several important risks. Chief among them is its dependence on U.S. government contracts, which leaves the company vulnerable to changes in federal budgets and defense spending priorities. Any shifts in political direction or funding delays could impact revenue streams across major programs.

Another challenge involves the integration of acquisitions like Aerojet Rocketdyne. While these deals expand capabilities, they also bring potential friction points in aligning operations, managing costs, and sustaining performance during the transition. Execution risk in these integrations remains a factor to watch closely.

Cybersecurity is an ongoing concern, particularly given the sensitive nature of the systems L3Harris develops. Despite strong protocols and infrastructure, the threat landscape evolves quickly, and no organization is entirely immune to disruption or data compromise. Global operations also introduce added complexity, with geopolitical tensions and shifting international regulations affecting procurement cycles and supply chains.

Final Thoughts

L3Harris Technologies stands out for its steady leadership, sound financial footing, and commitment to innovation in key national security areas. Management has shown discipline in capital allocation and shareholder returns while pursuing long-term strategic goals. Though risks remain—from defense funding to integration and cyber threats—the company’s focus and operational rigor provide a strong foundation.

For investors who value consistency and exposure to the defense technology space, L3Harris offers a balanced mix of growth potential and income reliability. Its strategic direction, while not without challenges, is aligned with sectors expected to see sustained demand in the years ahead.