Last Update 5/27/25

KLA Corporation (KLAC) plays a crucial role in the semiconductor industry, providing the inspection and metrology tools that chipmakers rely on to maintain precision and efficiency. With growing demand tied to AI, high-performance computing, and advanced chip packaging, the company is positioned at the center of a major technology expansion cycle. Its financial strength, disciplined capital allocation, and consistent dividend growth make it a compelling name for income-focused investors.

Recent earnings reflect strong operating performance, with record-level cash flows, an expanding services segment, and confident shareholder returns. Leadership has reinforced its focus on strategic growth areas, while maintaining a steady hand through industry cycles and external risks.

Recent Events

Shares of KLAC have seen a sharp rebound, gaining around 30% year to date. That’s been driven largely by a recovery in semiconductor capital spending. Top chipmakers are putting serious dollars into the next wave of fabrication technology, and KLA stands to benefit from every phase of that process.

Financially, the company is firing on all cylinders. Revenue growth is sitting at nearly 30% year-over-year, and earnings surged by over 80% in the most recent quarter. Those numbers aren’t just impressive—they’re signaling that demand is picking up faster than even the bulls expected.

From a dividend perspective, things are looking even more solid. KLA announced its next payout with an ex-dividend date of May 19 and a dividend date of June 3. The new forward annual dividend sits at $7.60 per share, a healthy step up that reflects both confidence and consistent cash generation.

Key Dividend Metrics 📈

💰 Forward Dividend Yield: 1.00%

📅 Next Payment Date: June 3, 2025

🔄 5-Year Average Yield: 1.13%

📊 Payout Ratio: 22.92%

📈 Dividend Growth Trend: Strong and Steady

📉 Free Cash Flow Coverage: Ample

💼 Institutional Ownership: 90.39%

📆 Ex-Dividend Date: May 19, 2025

Dividend Overview

At face value, a 1.00% yield may not raise eyebrows for those used to higher-yielding names. But for dividend investors focused on total return and steady compounding, KLA offers something more durable—reliability. What stands out is not just the payout, but how responsibly it’s managed.

With $7.60 paid annually per share and less than a quarter of earnings allocated to dividends, the runway for future increases remains wide open. The company’s gross and operating margins, hovering above 60% and 42% respectively, give it plenty of room to navigate ups and downs without touching the dividend.

Cash generation is another strong point. KLA produced $2.57 billion in free cash flow over the past year. That comfortably covers its dividend obligations and leaves room for share repurchases, debt management, and reinvestment into R&D.

There’s also a consistency to how KLA approaches its dividends. It’s not flashy or erratic—it’s methodical. That’s the kind of approach that builds confidence for long-term holders.

Dividend Growth and Safety

This is where things really get interesting. KLA has built a pattern of reliable, aggressive dividend growth. For more than a decade, they’ve increased the payout each year—often at double-digit clips. For investors looking to grow their income steadily over time, that’s exactly the kind of trend to seek out.

Even with those annual hikes, the payout ratio stays comfortably low. That speaks to a company that’s growing earnings fast enough to support rising payouts without stretching financially. It also helps that KLA runs one of the most efficient operations in tech. Its return on equity? An eye-catching 104%. That’s not a typo—it reflects just how effectively the company uses shareholder capital.

Now, the debt side does warrant a glance. At $6.09 billion in total debt and a debt-to-equity ratio above 150%, it might seem aggressive. But KLA also holds $4 billion in cash and generates strong recurring cash flow. The net debt situation isn’t alarming, and their balance sheet is more than capable of supporting dividend growth.

Another encouraging sign? Management’s dividend rhythm. Increases have come early each year like clockwork. It’s a subtle detail, but it shows intention and commitment. That matters for anyone building a portfolio of dividend payers meant to grow with time.

Cash Flow Statement

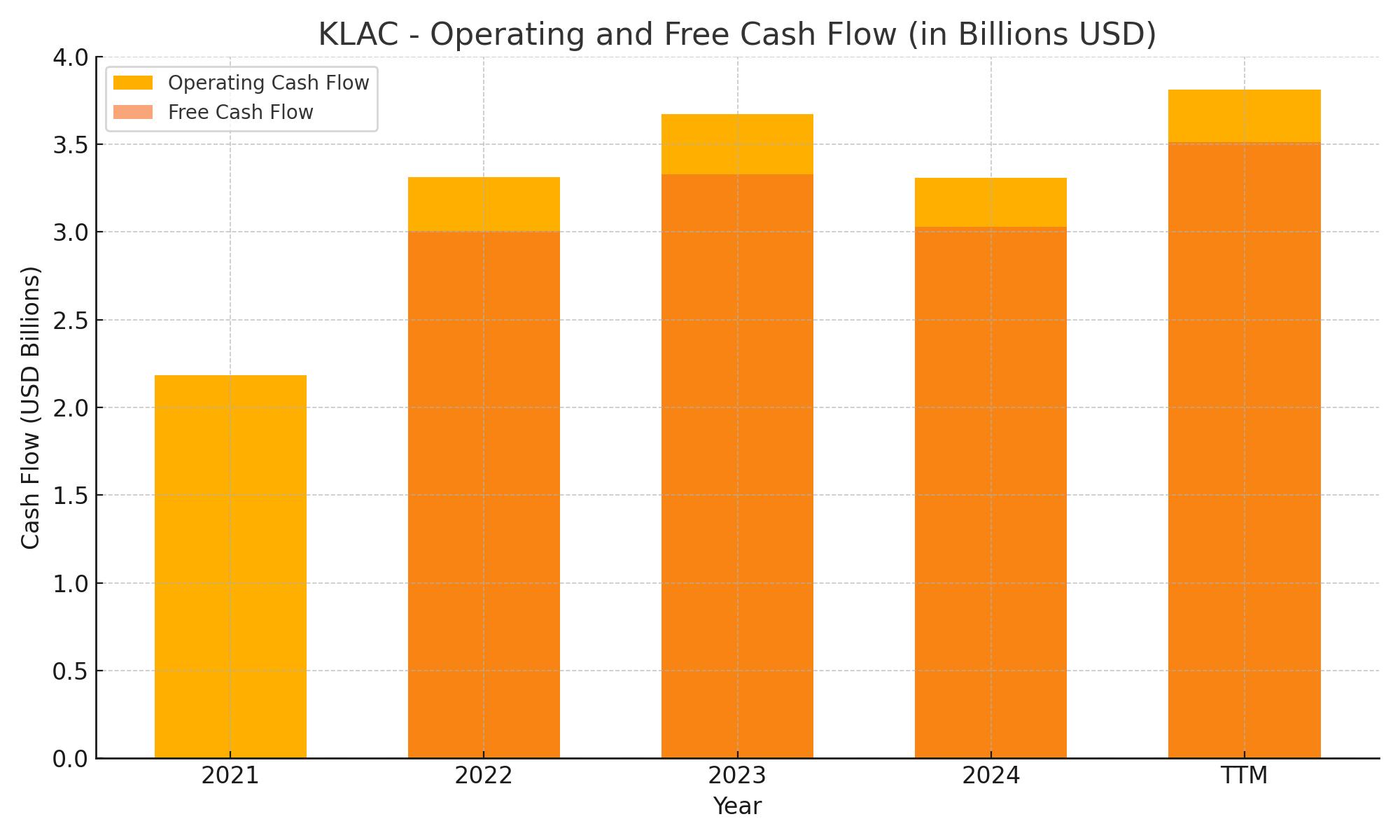

KLA Corporation continues to exhibit strong and consistent cash generation. Over the trailing twelve months (TTM), operating cash flow reached approximately $3.81 billion—its highest level in the past five years. This marks a notable uptick from $3.31 billion in the prior fiscal year and highlights the company’s ability to convert earnings into real cash. Capital expenditures remain modest relative to cash flow, at just under $300 million, allowing free cash flow to come in at a solid $3.51 billion.

On the financing side, KLA has been active in returning capital to shareholders. The company repurchased over $2.19 billion in stock during the TTM period and made a $750 million debt repayment. There was no new debt issuance, which, combined with strong free cash flow, helped maintain a healthy balance sheet. Despite significant capital returns, the company ended the period with nearly $1.87 billion in cash—underscoring its financial flexibility and disciplined capital allocation strategy.

Analyst Ratings

📉 KLA Corporation has recently seen mixed reactions from analysts. Deutsche Bank downgraded the stock from “Buy” to “Hold,” pointing to valuation concerns following a sharp rise in the stock price. They set a price target of $790, signaling limited short-term upside from its current trading range.

📈 On the other side of the aisle, several analysts remain confident in KLA’s long-term growth story. JP Morgan reiterated its “Overweight” rating, though they trimmed their price target slightly from $950 to $900. Their view is rooted in KLA’s strategic role in semiconductor manufacturing, particularly as demand for AI and advanced chips accelerates. Morgan Stanley echoed that sentiment, maintaining an “Overweight” rating while making a minor price target adjustment from $870 to $868.

📊 The consensus analyst rating stands at “Moderate Buy,” with an average 12-month price target of approximately $799.58. That represents a small upside from the current price but reflects a stable outlook based on solid fundamentals and a favorable position within the chip equipment space. For now, the market sees KLA as a quality name with room for growth—just not at the breakneck pace it’s recently experienced.

Earning Report Summary

KLA Corporation kicked off fiscal 2025 with a strong quarter, showing solid momentum across the board. For the quarter ending September 30, 2024, revenue came in at $2.84 billion, landing at the higher end of guidance and reflecting broad-based strength in customer demand. Profits followed suit, with GAAP earnings per share at $7.01 and non-GAAP at $7.33. The company continued its strong cash flow trend, generating $995 million in operating cash flow and turning out $935 million in free cash flow.

Strong Demand Across Key Markets

CEO Rick Wallace pointed to continued strength in advanced logic and memory markets, which helped fuel the quarter’s results. There’s growing traction in AI-driven and high-performance computing technologies, and KLA’s tools are right in the mix of that shift. Leadership highlighted particular strength in the advanced packaging segment, where demand is being driven by the increasing complexity of semiconductor designs.

Consistent Growth in Services

The services side of the business also posted another strong showing, with revenue reaching $644 million. That marked the 49th straight quarter of year-over-year growth in services—a streak that reflects both the quality of KLA’s products and the recurring nature of the support customers rely on.

During the quarter, KLA returned $765 million to shareholders through a mix of dividends and share repurchases. The company’s balance sheet remains in good shape, giving it the flexibility to keep rewarding shareholders while also investing in innovation and long-term growth.

Outlook Moving Forward

Looking ahead, leadership expressed cautious optimism. They’re seeing steady demand across core markets and are encouraged by the broader investment cycle in semiconductor manufacturing. The focus remains on execution—keeping operations tight, staying ahead of customer needs, and delivering consistent results in what’s still a dynamic industry landscape.

Management Team

KLA Corporation’s leadership team brings decades of experience and a clear strategic focus. Rick Wallace, the President and Chief Executive Officer, has been with the company since 1988. Over the years, he’s held a range of roles and has led the business with a steady hand, especially through key technology transitions. His leadership is marked by a commitment to innovation and long-term growth.

Bren Higgins, serving as Executive Vice President and Chief Financial Officer, is responsible for financial strategy and global operations. He plays a pivotal role in capital allocation and has helped maintain KLA’s strong financial footing. Ben Tsai, as Chief Technical Officer and Executive Vice President of Corporate Alliances, leads the charge on technological development and helps shape the future of KLA’s innovation roadmap. Bobby Bell, the company’s Executive Vice President and Chief Strategy Officer, helps guide long-term business strategy.

Supporting this team are MaryBeth Wilkinson, Executive Vice President, Chief Legal Officer, and Corporate Secretary, who oversees legal strategy and governance, and John Van Camp, Executive Vice President and Chief Human Resources Officer, who manages talent and culture. Ahmad Khan leads the Semiconductor Process Control division and is deeply involved in the company’s core technology platforms. Together, this leadership team has built a resilient, forward-looking organization focused on delivering for both customers and shareholders.

Valuation and Stock Performance

KLA Corporation shares recently traded around $789, showing strong momentum with a more than 4 percent daily gain. Over the past year, the stock has generally held its own against broader market pressures, though it currently trades about 12 percent below its 52-week high. Even with some short-term volatility, the longer-term trajectory remains upward, reflecting consistent execution and confidence in the company’s outlook.

The average analyst price target sits around $806, suggesting modest upside from current levels. While not dramatic, this figure signals stability and a belief in continued growth. KLA’s forward price-to-earnings ratio is in the mid-20s, a valuation that’s neither cheap nor stretched, especially for a business with consistent cash flow, high margins, and a leading role in its niche.

On performance metrics, KLA continues to impress. Its return on assets exceeds 26 percent, pointing to operational efficiency and smart use of capital. Add in a disciplined share buyback strategy and a growing dividend, and you get a total return profile that has appeal for investors with an eye on both income and capital growth.

Risks and Considerations

There are a few key risks that come with owning a company like KLA. One of the biggest is its exposure to China, which introduces a layer of geopolitical risk that can be difficult to predict. Trade policies and regulatory changes have the potential to disrupt sales and operations, depending on how things evolve internationally.

Beyond geopolitics, the semiconductor industry is known for its cycles. Capital spending from chip manufacturers can swing dramatically based on supply and demand. If we hit a downturn in the cycle, KLA’s revenue could take a temporary hit. The company also needs to stay ahead of rapid technology changes, which requires ongoing investment and can create execution risk if something slips.

There’s also growing awareness of supply chain fragility. Climate change, geopolitical tensions, or logistics challenges can all impact the flow of materials and components. While KLA has managed well so far, these are variables that investors should keep in mind when evaluating the long-term picture.

Final Thoughts

KLA Corporation stands out as a key player in the semiconductor space. It’s not just about selling machines—KLA is a mission-critical supplier for chipmakers who rely on its tools to keep production quality high and yields consistent. That positioning gives it staying power, even in a fast-moving industry.

Leadership remains a strength, and the financials back that up. The company continues to post strong results, generate real cash, and reward shareholders. Valuation looks balanced, with room for growth as long as the broader chip market holds up.

Of course, it’s not a risk-free story. The cyclical nature of the industry, combined with external uncertainties, means investors should be clear-eyed. But for those looking at the long-term, KLA presents a solid case with a blend of innovation, execution, and shareholder focus that’s hard to ignore.