Last Update 5/27/25

KKR & Co. Inc. has steadily evolved from its roots in private equity into a diversified global investment firm managing over $660 billion in assets. With strong leadership under Co-CEOs Joseph Bae and Scott Nuttall, the firm now spans infrastructure, credit, real estate, and growth equity. Its disciplined capital deployment, consistent fee-related earnings, and robust fundraising – $31 billion in the most recent quarter—highlight a platform built for resilience and scale.

The company recently posted $1.15 in adjusted earnings per share and generated $7.67 billion in operating cash flow over the trailing twelve months. Despite short-term mark-to-market losses in its insurance segment, KKR remains well-capitalized with $116 billion in dry powder and a forward-looking approach to investment.

Recent Events

The start of 2025 has been solid for KKR. With a market cap that’s now over $100 billion and shares up more than 11% in the past year, it’s clear the market continues to value the company’s strategy. Not only has KKR outpaced the broader S&P 500 in terms of performance, but it’s doing so while sitting on a massive $40 billion in cash.

However, the headline revenue number for the most recent quarter wasn’t flattering—down nearly 58% year-over-year. That kind of drop will naturally catch your eye. But this isn’t a traditional business with smooth quarter-to-quarter sales trends. A lot of what drives KKR’s financial results—like performance fees and investment exits—can be lumpy by nature. The more important takeaway here is that the company remains strongly profitable, with over $7.6 billion in operating cash flow over the past year.

Insiders seem to like what they see, too. Nearly a quarter of shares are held by those inside the company. That’s not just window dressing. It shows real alignment, and it gives dividend investors added confidence that the leadership is riding alongside them through the ups and downs.

Key Dividend Metrics

💵 Forward Dividend Yield: 0.63%

🔁 5-Year Average Yield: 0.99%

📈 Dividend Growth (TTM): 4.2%

📊 Payout Ratio: 30.17%

📆 Next Ex-Dividend Date: June 18, 2025

💳 Dividend Date: May 27, 2025

Dividend Overview

Let’s not sugarcoat it—KKR’s dividend yield isn’t going to make income investors jump out of their chairs. It sits at just over half a percent, well below the broader market average and its own historical pace. But a deeper look shows this isn’t because the dividend has been cut or flatlined. The stock’s strong performance has simply pushed the yield lower.

Right now, the annual dividend stands at $0.74. It’s a modest payout, but it’s backed by strong fundamentals. Earnings per share sit at $2.32, which means the dividend only uses about 30% of profits. That leaves plenty of cushion. For a firm like KKR, where results can swing based on market activity, that cushion is exactly what you want. It helps ensure the dividend keeps flowing even if things get choppy.

KKR isn’t a company that exists to churn out high dividends. It’s a long-game kind of stock. You’re not investing here just for a yield. You’re betting that over time, earnings will keep expanding, and that payout will keep stepping up along with it.

Dividend Growth and Safety

The pace of dividend growth isn’t going to win any awards, but it’s steady. The latest bump, from $0.71 to $0.74, isn’t dramatic—but it’s deliberate. Management seems committed to sustainability over showmanship. And that’s something dividend investors should appreciate. You don’t want a company straining to impress with flashy hikes that can’t be maintained.

As far as safety goes, the numbers speak clearly. With $7.67 billion in operating cash flow and a payout ratio just above 30%, the dividend is in a very comfortable spot. KKR does carry debt—about $51 billion—but it’s backed by $40 billion in cash. That’s a level of liquidity most companies would envy.

The firm’s current ratio is a bit under 1, but that’s typical for asset-light financial businesses like KKR. They’re not holding inventory or receivables in the same way a traditional company does. What matters is their ability to generate and deploy capital effectively—and on that front, they continue to deliver.

In terms of volatility, the stock isn’t shy. A beta of 1.91 means you’ll see swings. But those swings are less concerning when the underlying business is solid and the dividend is well-covered. KKR isn’t here to offer a high yield today. It’s building a track record of reliability and optionality—so when the time comes, it has room to return more to shareholders.

Cash Flow Statement

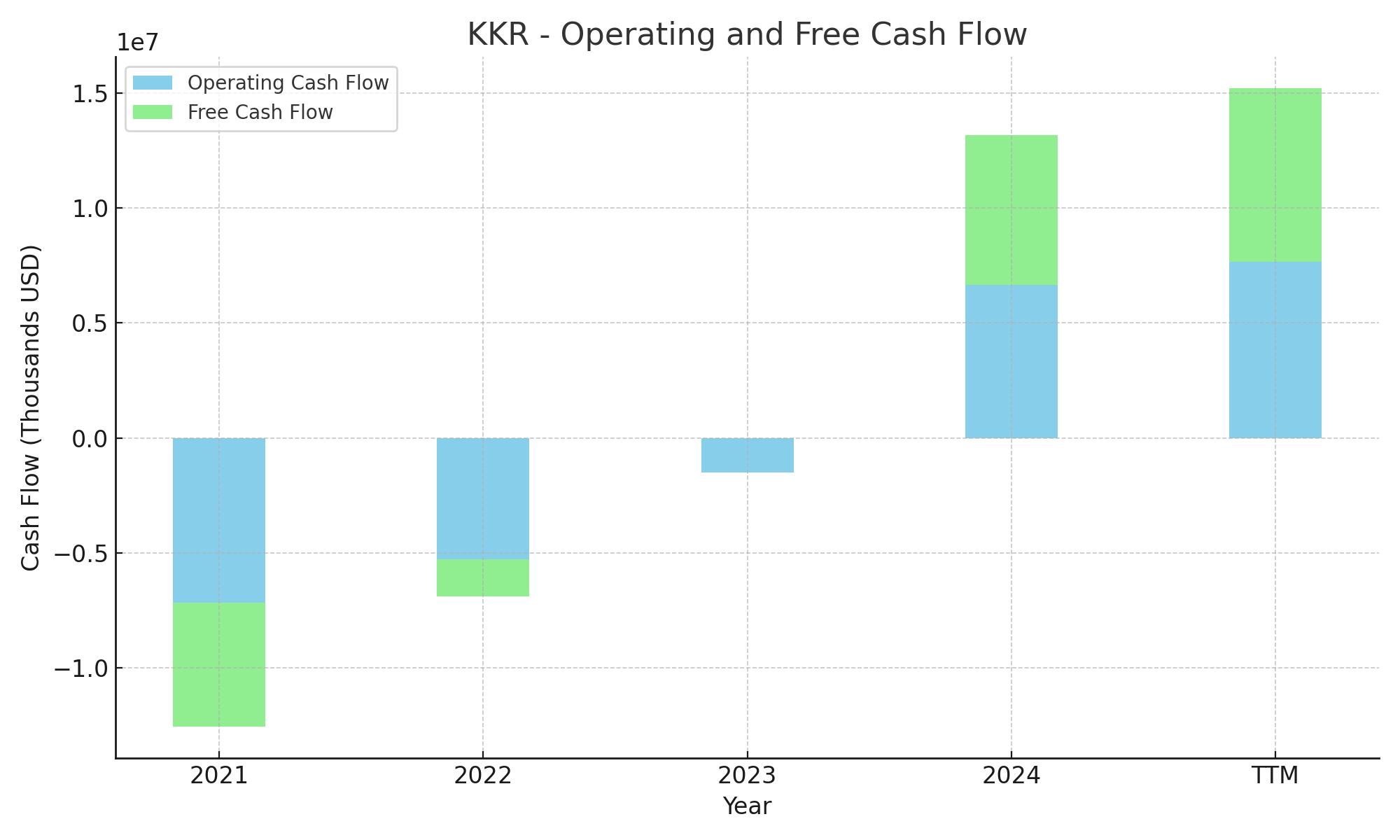

KKR’s trailing 12-month cash flow story highlights a clear shift in momentum. Operating cash flow came in strong at $7.67 billion, a sharp turnaround from negative flows seen in 2022 and 2021. This rebound underscores improved earnings consistency and tighter control over operating outflows. Free cash flow mirrored that strength at $7.53 billion, confirming that the company is not just generating earnings on paper—it’s translating those into real, usable capital.

On the investing side, cash outflows remain steep, totaling nearly $16 billion over the past year. That’s consistent with KKR’s strategy of deploying capital across a wide range of asset classes. Meanwhile, financing activities added $10.63 billion to the coffers, driven heavily by new debt issuance, which slightly outpaced repayments. Despite aggressive investing and steady capital returns, the company’s cash position still climbed to $18.48 billion by period-end. This balance between deployment and liquidity reflects a disciplined approach to growth and financial flexibility.

Analyst Ratings

📈 KKR has recently caught the attention of analysts, with several firms adjusting their outlooks and price targets. Morgan Stanley upgraded the stock from Equal-Weight to Overweight, citing expectations of a capital markets rebound and increased deal activity. They also raised their price target from $120 to $150, reflecting a more optimistic view of KKR’s earnings potential in the coming years.

💼 Wells Fargo maintained its Overweight rating but increased its price target from $136 to $140, pointing to KKR’s strong asset growth and consistent fee generation. Barclays also kept an Overweight stance, lifting its target from $129 to $141, highlighting the firm’s diversified investment portfolio and robust fundraising capabilities.

📊 The consensus among analysts is a “Strong Buy,” with an average 12-month price target of $149.43. This suggests a potential upside of approximately 24% from the current share price. The high estimate stands at $194, while the low is $119, indicating a broad range of expectations based on varying assumptions about market conditions and KKR’s performance.

🔍 These adjustments reflect growing confidence in KKR’s ability to navigate the evolving financial landscape and capitalize on emerging opportunities. Analysts appear to be responding to the firm’s strategic positioning and its track record of delivering value across different market cycles.

Earning Report Summary

Solid Start to 2025

KKR kicked off the year with a performance that sent a clear message: they’re navigating this uncertain market with both caution and confidence. Adjusted earnings came in at $1.15 per share, up 19% compared to the same time last year. Revenue also beat expectations, landing at $3.11 billion. That kind of growth tells you their business model—spanning private equity, credit, and infrastructure—is still firing on all cylinders, even in a tricky macro environment.

What really stood out was fundraising. KKR brought in $31 billion in fresh capital this quarter, pushing assets under management up 15% year-over-year to $664 billion. That’s not a small feat. They’re continuing to attract long-term capital, and it shows in the numbers. Fee-related earnings were up too, hitting $823 million—a 23% jump, and a healthy sign that their recurring income base is growing.

A Few Bumps in the Road

That said, it wasn’t a flawless quarter. KKR reported a net loss of $185 million, which mainly came from their insurance business, Global Atlantic. A $1.1 billion hit from mark-to-market losses on a large fixed-income portfolio weighed things down. Rising and shifting interest rates made a big impact, especially on long-dated assets. But it’s worth noting—when you strip out those unrealized losses, the business still turned a $258 million pre-tax operating profit.

Leadership Looks Ahead

Co-CEO Scott Nuttall struck a confident tone during the call. He acknowledged the current market volatility but emphasized that these are the types of environments where KKR tends to find its best opportunities. As he put it, these uncertain stretches often turn out to be the moments you wish you had invested more. That tells you where their mindset is—playing the long game, staying opportunistic.

CFO Rob Lewin echoed that sentiment, pointing out that the firm has already deployed $10 billion into new investments since the latest bout of market shakiness. That’s not just talk—they’re actively putting capital to work.

Ready for What’s Next

With a war chest of $116 billion in dry powder, KKR is clearly setting up for continued expansion. Recent moves like the $3.1 billion acquisition of OSTTRA and the investment in Assura plc signal they’re not sitting still. They’re leaning into areas they see as growth engines over the next few years.

All in all, the quarter had its ups and downs, but the bigger picture looks solid. KKR isn’t just reacting to the current environment—they’re positioning themselves to come out stronger on the other side.

Management Team

KKR’s leadership is anchored by Co-Chief Executive Officers Joseph Bae and Scott Nuttall, who took the reins in 2021 after the transition of founding partners Henry Kravis and George Roberts to the roles of Co-Executive Chairmen. Bae has been a key figure in expanding KKR’s footprint in Asia, bringing a global lens to the company’s strategies. Nuttall, known for his work in building out the capital markets and public equities arms, brings deep expertise in structuring and growth initiatives. Together, they represent a blend of international experience and financial acumen that’s helped KKR evolve beyond its private equity roots.

The broader leadership team includes experienced professionals from across asset management, finance, legal, and operational functions. That depth allows KKR to move decisively across investment classes, whether in infrastructure, credit, or growth equity. Their approach emphasizes discipline, long-term thinking, and adaptability—key traits for a firm managing hundreds of billions in assets across shifting market cycles.

Valuation and Stock Performance

As of late May 2025, KKR stock is hovering around $120.88, reflecting a modest daily gain. While that number marks a rebound from recent lows, the stock is still down about 29% from its 52-week high of $170.40. The movement mirrors the volatility seen across asset managers as interest rates, market sentiment, and deal flow continue to fluctuate. Even with that pullback, the long-term trajectory remains positive in the eyes of most market watchers.

Analysts currently place the consensus 12-month price target at $149.43, which suggests a meaningful upside from where the stock is trading. This target reflects growing confidence in KKR’s recurring revenue streams and its capacity to raise and deploy capital at scale. Valuation models, both on a relative basis and using discounted cash flow, indicate that the stock is reasonably priced given its future cash flow prospects and the resilience of its business model.

Risks and Considerations

There are some important caveats to keep in mind. KKR’s structure and size mean it faces a wide array of risks, ranging from regulatory and compliance issues to market-dependent performance variability. With 74 risk disclosures in its latest earnings report, many tied to corporate governance and financial controls, it’s clear the company is navigating complex terrain.

Legal and jurisdictional issues come with the territory when operating globally, and any disruptions in capital markets could affect both fundraising and returns. Interest rate movements are another wildcard, particularly for an investment manager with substantial exposure to credit and fixed-income assets. Additionally, performance-based earnings can swing sharply depending on how well portfolio companies perform, adding another layer of unpredictability.

There’s also growing attention on environmental, social, and governance factors. As investor expectations evolve, KKR must continue demonstrating leadership in ESG or risk falling behind peers who align more closely with shifting societal priorities.

Final Thoughts

KKR has undergone a significant transformation over the past decade. From its roots in private equity to its current role as a global investment firm, it’s adapted to meet the needs of a more diversified and demanding investor base. Leadership has been thoughtful in expanding the firm’s capabilities and maintaining a balance between innovation and risk management.

The company is not without its challenges. Market volatility, regulatory scrutiny, and investment timing all add pressure. Still, its foundation appears strong, with a diversified portfolio, ample capital reserves, and a seasoned executive team at the helm. For investors looking beyond just the next quarter, KKR represents a business that is clearly planning for the long term.