Last Update 5/27/25

Kinsale Capital Group, Inc. (KNSL) operates with focus and efficiency in the specialty insurance space, offering coverage in the excess and surplus lines market. The company’s disciplined underwriting, strong leadership, and consistent profitability have helped it post impressive financial metrics, including a return on equity close to 30% and profit margins above 24%. With a solid 22% stock price gain over the past year, Kinsale continues to attract institutional interest and long-term investor confidence.

Though its dividend yield is modest at 0.15%, it’s backed by a payout ratio under 4% and substantial free cash flow, giving Kinsale room for future increases. Recent earnings showed resilience despite weather-related losses, and leadership remains committed to strategic growth through underwriting precision and technology investment.

Recent Events

Kinsale has been consistent in sticking to its formula: write profitable business, avoid unnecessary complexity, and let the numbers do the talking. In the first quarter of 2025, earnings dipped year-over-year, falling just under 10%. That sounds worse than it is. Even with the drop, the company still posted a profit margin of 24.7%—a strong result by any standard. Their return on equity? A remarkable 29.4%. That’s not just good, that’s elite.

Revenues have kept moving in the right direction, climbing nearly 14% over the past year. The demand for E&S insurance remains solid, and Kinsale is picking its spots carefully. Investors seem to like the story. Over the past 12 months, KNSL stock has gained more than 22%, easily beating the broader market.

Digging into the ownership structure, more than 91% of shares are held by institutions. That’s a pretty clear sign that the big money trusts what management is doing. Short interest has stayed relatively tame, suggesting most traders aren’t betting against the stock in any significant way.

Key Dividend Metrics

📈 Dividend Yield: 0.15% (Forward)

💸 Annual Dividend Rate: $0.68

🧮 Payout Ratio: 3.57%

📅 Next Dividend Date: June 12, 2025

⏰ Ex-Dividend Date: May 29, 2025

📊 5-Year Average Yield: 0.18%

Dividend Overview

If you’re screening for high-yield income plays, Kinsale won’t jump off the page. The forward yield sits at just 0.15%, a level that’s not going to meaningfully pad your cash flow. But that’s only part of the picture. This is a business that pays a dividend not out of obligation, but because it can. That’s worth more than it seems.

With a tiny payout ratio below 4%, Kinsale is only setting aside a small sliver of its earnings for dividends. The bulk of its profits are being reinvested back into the business or reserved for future growth. That’s a smart play for a company with this kind of return on capital.

Also worth noting: its current ratio is just 0.21, which might look like a red flag in other sectors, but it’s not unusual for insurers. The nature of their business model and the structure of their balance sheets mean you have to read those numbers differently than you would for, say, a manufacturer.

For dividend investors who appreciate sustainable, well-managed companies—even if the checks are small—KNSL offers a compelling setup. You’re not getting a lot now, but you’re getting it from a company that could afford to do a lot more later.

Dividend Growth and Safety

Here’s where things start to get more interesting. Even though Kinsale’s dividend is small, it’s been growing steadily. Over the past year, the annual payout has crept up from $0.62 to $0.68. That might not sound dramatic, but it’s nearly a 10% increase—well ahead of inflation and far better than many larger payers in the market.

And let’s talk about safety. With nearly $938 million in free cash flow and only about $16 million needed to cover the dividend, there’s almost no risk of a cut. That’s less than 2% of its free cash flow going toward dividends. In other words, Kinsale could triple or quadruple its payout and still be in great shape financially.

The quality of the earnings behind that cash flow is just as strong. High profit margins, solid cash generation, and strong underwriting discipline keep the business humming. There’s also very little debt—just $184 million on the books—and a debt-to-equity ratio under 12%. This isn’t a company that’s leveraged up to pay shareholders.

If Kinsale ever decides to make its dividend a bigger part of the story, it has all the tools to do so. For now, the small payout acts as a signal. It’s a company that’s focused, flush with cash, and in complete control of its destiny. And that makes it one to keep watching.

Cash Flow Statement

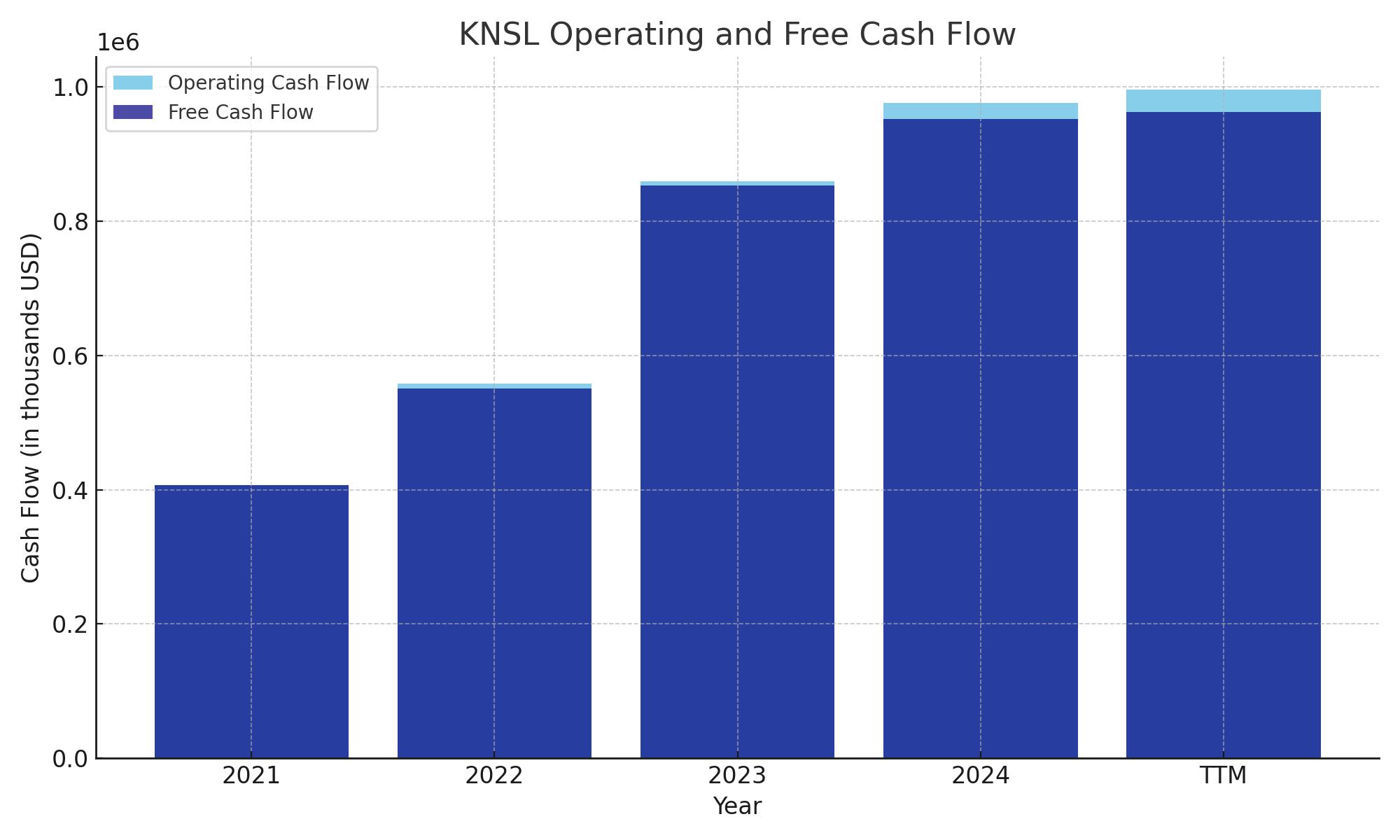

Kinsale Capital Group’s cash flow statement over the trailing twelve months reflects a robust operational engine, with $995.7 million in operating cash flow—its highest on record. That’s a continuation of steady annual growth in this area, driven by consistent underwriting profitability and disciplined expense management. Free cash flow came in at $963.2 million, maintaining a very high conversion rate from operations and demonstrating the company’s strong efficiency in turning earnings into real, deployable cash.

On the investment side, outflows totaled $948.6 million, reflecting an ongoing commitment to reinvesting in the business, particularly through the purchase of fixed-income securities that insurers typically hold. Financing activities saw a relatively modest outflow of $41.3 million, primarily due to share repurchases and minor dividend payments, with no new debt issued in the most recent period. The company ended the TTM with $142 million in cash, a slight increase from the previous year, signaling a stable liquidity position even after significant reinvestment.

Analyst Ratings

📈 Kinsale Capital Group has recently seen a mix of analyst activity, with some firms adjusting their price targets while maintaining existing ratings. 🏦 Morgan Stanley reaffirmed its Overweight rating on May 19, 2025, and raised its price target from $490 to $525, citing confidence in Kinsale’s underwriting discipline and consistent profitability. 💡 Similarly, Truist Securities maintained its Buy rating but lowered its price target from $525 to $500 on April 28, 2025, reflecting a more cautious outlook on valuation amid broader market conditions. 📉 On the same day, JPMorgan Chase & Co. reiterated its Neutral stance and slightly reduced its target from $402 to $400, indicating a wait-and-see approach given current market dynamics.

💬 The consensus among analysts places the average 12-month price target for KNSL at $484.57, with estimates ranging from a low of $400 to a high of $535. 🔍 This suggests a modest upside potential from current levels, reflecting a balanced view of the company’s strong fundamentals and the challenges posed by market volatility.

Earning Report Summary

Solid Start to 2025 Despite Weather Headwinds

Kinsale Capital kicked off the year with a first quarter that showed both strength and a few bumps. The company posted net income of $89.2 million, or $3.83 per diluted share. That’s a bit lower than the $98.9 million, or $4.24 per share, from the same time last year. The difference? Catastrophe losses. They came in at $17.8 million after taxes this time around, a sharp jump from just half a million dollars a year ago.

But even with that hit, the core performance held up well. Net operating earnings actually rose to $86.4 million, or $3.71 per share, compared to $81.6 million and $3.50 a year ago. That’s a testament to the consistency in Kinsale’s underlying business, especially in how they manage underwriting and keep costs under control.

Premium Growth and Portfolio Gains

Gross written premiums climbed nearly 8% to $484.3 million, though not all segments shared in that growth. The Commercial Property division saw an 18% drop, largely due to falling rates and rising competition. Strip that out, and the rest of the business grew at an impressive 16.7% pace, showing that the engine is still running strong elsewhere.

Underwriting income also improved, coming in at $67.5 million for the quarter. The combined ratio ticked up a bit to 82.1% from 79.5% last year, mostly because of the higher catastrophe losses. The loss ratio rose too, from 58.8% to 62.1%. Still, these numbers reflect a company managing risks well, even when Mother Nature doesn’t cooperate.

One of the brighter spots this quarter was investment income. It jumped more than 33% to $43.8 million, thanks to both a growing portfolio and continued strong cash generation from operations.

Leadership’s Take and Looking Forward

CEO Michael Kehoe sounded confident as always. He credited the strong results to Kinsale’s steady underwriting discipline and their ongoing investment in technology to keep costs lean. His message was clear: the company isn’t just riding out the cycle—they’re staying profitable through it. That’s not something every insurer can claim in a competitive environment.

Looking ahead, Kinsale plans to stick with what’s worked: smart risk selection, efficiency, and not chasing volume at the expense of profitability. The tone from leadership suggests they’re not too concerned about short-term turbulence. Their focus remains on playing the long game, and the numbers show they’re positioned well to do just that.

Management Team

Kinsale Capital Group is led by a seasoned team with deep roots in the specialty insurance industry. Michael Kehoe, who founded the company in 2009, serves as Chairman and CEO. He brings decades of experience from prior leadership roles at James River Insurance and Colony Insurance Company. Kehoe’s strategic vision has been instrumental in positioning Kinsale as a leader in the excess and surplus lines market.

Supporting him is Brian Haney, President and Chief Operating Officer. Haney has been with Kinsale since its inception, previously serving as Chief Actuary. His expertise in risk assessment and operational efficiency complements Kehoe’s leadership. The executive team also includes Bryan Petrucelli as Chief Financial Officer, Diane Schnupp as Chief Information Officer, and Mark Beachy as Chief Claims Officer. Together, this team has fostered a culture of disciplined underwriting and technological innovation, driving consistent profitability.

Valuation and Stock Performance

As of late May 2025, Kinsale’s stock trades around $474, reflecting a market capitalization of approximately $10.8 billion. The stock has demonstrated strong performance, with a 22% increase over the past year, outpacing both the broader market and the insurance sector. This growth is underpinned by robust financial metrics, including a return on equity nearing 30% and a profit margin exceeding 24%.

Analyst sentiment remains positive, with a consensus 12-month price target of $484.57, ranging from $400 to $535. The company’s valuation metrics, such as a trailing P/E ratio of 26.69 and a price-to-book ratio of 6.83, indicate a premium valuation. However, these are justified by Kinsale’s consistent earnings growth and strong underwriting performance.

Risks and Considerations

While Kinsale’s business model has proven resilient, certain risks warrant attention. The company operates in the excess and surplus lines market, which, while offering higher margins, also entails underwriting more complex and higher-risk policies. This necessitates meticulous risk assessment and could expose Kinsale to significant losses in adverse scenarios.

Additionally, Kinsale’s investment portfolio, primarily composed of fixed-income securities, is subject to interest rate fluctuations. Rising rates could impact the market value of these investments, potentially affecting the company’s financial position. Moreover, the company’s relatively low dividend yield of 0.15% may not appeal to income-focused investors, although the low payout ratio suggests ample room for future increases.

Final Thoughts

Kinsale Capital Group stands out in the specialty insurance landscape due to its disciplined underwriting, experienced management, and consistent financial performance. The company’s focus on niche markets and efficient operations has translated into strong returns and a growing market presence. While certain risks are inherent in its business model, Kinsale’s track record suggests a capacity to navigate challenges effectively. For investors seeking exposure to a well-managed, growth-oriented insurance company, Kinsale presents a compelling case.