Key Takeaways

💰 Johnson & Johnson offers a forward dividend yield of 3.40% with 61 consecutive years of increases, supported by a 55% payout ratio and strong free cash flow.

💵 The company generated $24.8 billion in operating cash flow and $18.6 billion in free cash flow over the trailing twelve months, ending the period with $38.6 billion in cash.

📈 Analysts have a consensus price target of $170.88, with recent adjustments reflecting caution on near-term growth but continued long-term confidence.

Last Update 5/27/25

Johnson & Johnson remains a pillar of reliability for income-focused investors. With a forward dividend yield of 3.40%, a 61-year streak of annual dividend increases, and a healthy payout ratio of 55%, it continues to offer dependable cash returns backed by strong fundamentals. The company recently posted solid earnings with adjusted EPS of $2.77 and raised its full-year revenue guidance, signaling ongoing strength across its pharmaceutical and medtech segments.

Led by CEO Joaquin Duato, J&J is now centered on high-growth areas following the spin-off of its consumer health division. The company holds over $38 billion in cash, maintains a forward P/E of 14.5, and operates with low volatility, making it a consistent performer in both stable and uncertain markets. While legal and regulatory risks exist, J&J’s robust pipeline, financial discipline, and experienced leadership provide the foundation for long-term confidence.

Recent Events

The first part of 2025 has been anything but slow for Johnson & Johnson. The company posted quarterly earnings showing a dramatic 237.9% increase from the same period last year. That kind of jump doesn’t come out of thin air—it reflects a mix of strategic execution and the strength of its core business lines.

Revenues over the trailing twelve months came in at $89.33 billion, and profitability remains strong, with a 24.42% net margin. Operating margins are even stronger at 29.41%, which tells us they’re managing costs efficiently while maintaining pricing power in their markets. The balance sheet looks sturdy as ever, with over $38 billion in cash. Add in a levered free cash flow of $16.8 billion, and there’s plenty of financial muscle to keep the dividend machine running smoothly.

Mark your calendar if you’re tracking income dates: JNJ’s next ex-dividend date is May 27th, and the upcoming dividend payout hits on June 10th.

Key Dividend Metrics

🟢 Forward Dividend Yield: 3.40%

🟢 Annual Dividend Rate: $5.20

🟢 5-Year Average Dividend Yield: 2.76%

🟢 Payout Ratio: 55.17%

🟢 Dividend Streak: 61 consecutive years

🟢 Ex-Dividend Date: May 27, 2025

🟢 Next Payment Date: June 10, 2025

These figures don’t just reflect another quarterly distribution. They tell a story of long-term commitment to income-focused shareholders.

Dividend Overview

With a yield of 3.40%, JNJ is currently offering income that’s comfortably above its 5-year average. That’s a notable signal for dividend investors looking for both yield and safety. When a company like this trades with a yield premium, it often suggests that the market is offering a better-than-usual opportunity to lock in consistent income.

And the foundation is solid. With a payout ratio just above 55%, there’s no red flag here. That level keeps plenty of room for reinvestment while still rewarding shareholders. Backed by strong free cash flow and a massive cash cushion, this isn’t a case of a company stretching to maintain appearances. The dividend is well within reach—and likely has room to keep climbing.

It’s easy to take consistency for granted, but JNJ’s record of uninterrupted dividend payments stretches back more than six decades. That’s through wars, recessions, inflation spikes, and the occasional crisis. You don’t find many companies that can say the same.

Dividend Growth and Safety

Safety is the bedrock here. JNJ maintains a debt-to-equity ratio of about 67%, which is entirely manageable given the strength of its earnings and cash flows. Cash on the books totals nearly $39 billion, more than enough to handle obligations while still growing the business and paying dividends.

As for growth, the company hasn’t just kept the dividend flat. Over the last 10 years, JNJ has averaged around 6% annual growth in its payout. It’s not flashy, but it’s reliable—and that’s exactly the appeal. Even in uncertain times, the dividend checks keep showing up.

The valuation also deserves a quick mention. With a forward P/E around 14.5 and a PEG ratio just above 1.0, there’s an argument that JNJ is fairly priced relative to its growth. It’s not bargain-bin cheap, but you’re paying for quality and stability here.

Another point that stands out is the low beta—just 0.41. For investors building a portfolio around dividend income, that’s more than just a stat. It means less volatility when markets get rough. JNJ tends to hold up, making it a buffer during broader market stress.

There are always risks, and legal liabilities still hang around the edges. But the company has been proactive in addressing them and seems to be putting that chapter behind it. The fundamentals show no signs of strain, and the dividend remains one of the most reliable in the entire market.

At the end of the day, Johnson & Johnson isn’t aiming to dazzle. It’s aiming to endure. And for investors looking for a steady stream of income with a foundation that’s stood the test of time, that quiet strength is exactly the point.

Cash Flow Statement

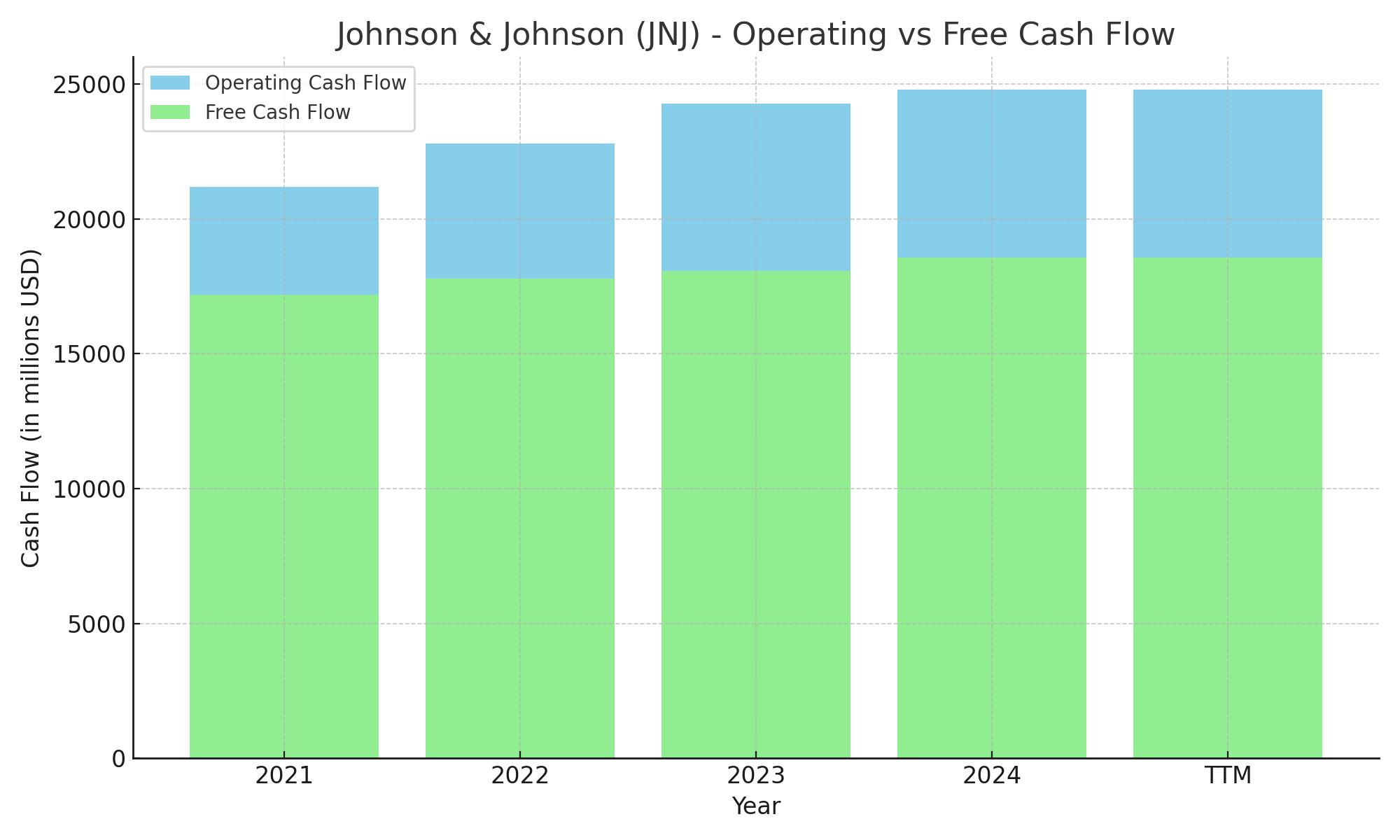

Johnson & Johnson generated $24.8 billion in operating cash flow over the trailing twelve months, marking a continued climb from the previous years. This sustained strength underscores the efficiency and stability of its core operations, especially in the post-spin-off structure. Free cash flow followed suit, rising to $18.6 billion, reflecting the company’s consistent ability to convert sales into actual cash after capital expenditures, which held steady at just over $6.2 billion.

On the investing side, JNJ reported a cash outflow of $18.4 billion, largely due to acquisitions and internal investment—a sign it remains committed to fueling long-term growth. Financing cash flow flipped positive at $6.7 billion, a notable reversal from previous years. This change was driven by a significant $34.6 billion in new debt issuance, offset by $13.9 billion in debt repayments and a lighter touch on stock buybacks. Altogether, the company ended the period with $38.6 billion in cash, a healthy jump from last year and a strong cushion for dividends, debt service, and future investment.

Analyst Ratings

🔻 Johnson & Johnson was recently downgraded by Leerink Partners from “Outperform” to “Market Perform” with the price target trimmed from $169 to $153. This shift came on the back of tempered near-term growth expectations and lingering concerns surrounding the company’s legal overhang. While not a bearish call, it reflects a move toward neutrality as analysts reassess how litigation risk and slower momentum in certain drug pipelines could affect valuation.

📊 Still, the general tone among analysts leans cautiously optimistic. The average 12-month price target currently sits at $170.88, which represents an estimated upside of nearly 12% from where the stock trades now. Projections vary widely—ranging from a high of $215 to a more conservative low of $150—showing a fairly broad range of sentiment depending on how much weight is given to future growth versus ongoing risks.

🔄 Barclays continues to rate the stock as “Equal Weight,” slightly adjusting their price target from $166 to $165. Morgan Stanley has echoed a similar stance, reaffirming an “Equal Weight” rating while lifting their target modestly from $164 to $169. These moves suggest that while JNJ may not be a short-term outperformer in analysts’ eyes, it still holds value as a long-term, stable performer.

Earning Report Summary

A Solid Start to the Year

Johnson & Johnson kicked off 2025 with a steady quarter, posting sales of $21.9 billion. That’s a 2.4% bump from the same period last year, and more importantly, it reflects organic growth of 4.2% when you strip out currency impacts and divestitures. Adjusted earnings landed at $2.77 per share, just a touch ahead of what Wall Street had penciled in.

Leadership came through with a confidence boost as well. The full-year sales forecast got a lift, now expected to land between $91.0 and $91.8 billion, up from the earlier range of $89.2 to $90.0 billion. They left the earnings per share guidance unchanged at $10.50 to $10.70, but the tone was optimistic about the rest of the year.

Strong Segments and Promising Pipeline

The pharmaceutical division continues to be the anchor for JNJ. One standout was the approval of TREMFYA for treating Crohn’s disease—a major win for expanding its immunology franchise. There was also encouraging news for RYBREVANT and LAZCLUZE in non-small cell lung cancer, which could support further momentum if approved in broader indications.

MedTech, another important piece of the puzzle, made strides too. JNJ kicked off clinical trials for its surgical robotic system, OTTAVA, which has been quietly in development. It’s early days, but the company clearly sees this as a long-term bet in an increasingly tech-forward healthcare space.

Leadership’s Take

CEO Joaquin Duato struck a confident tone in his remarks. He pointed to the strength and balance of JNJ’s portfolio as a key reason the company continues to grow through economic uncertainty. Duato also highlighted the pace of innovation, saying it’s foundational to JNJ’s future, especially as the company leans more heavily into pharmaceuticals and MedTech after spinning off its consumer health arm.

CFO Joseph Wolk emphasized the company’s strong cash generation and disciplined capital management. His comments reminded investors that JNJ’s financial base gives it plenty of flexibility—not just to invest in R&D, but also to reward shareholders. The 63rd consecutive dividend hike is just one example of how the company continues to deliver on that promise.

Management Team

Johnson & Johnson is led by Chairman and CEO Joaquin Duato, who has played a central role in the company’s ongoing transformation. His leadership has focused on streamlining operations and emphasizing higher-growth areas like pharmaceuticals and medical technology. Duato brings a strong background in global healthcare strategy, and his direction is firmly rooted in innovation and patient outcomes.

Supporting him is Chief Financial Officer Joseph Wolk, who manages the company’s capital structure and financial strategy. His steady approach has helped maintain a balance between investment and shareholder returns. Tim Schmid heads the MedTech division, working to expand the company’s footprint in surgical and digital health. Jennifer Taubert, who leads the Innovative Medicine segment, has been instrumental in guiding drug development and bringing new therapies to market. Together, the team brings a mix of strategic focus and operational discipline that keeps Johnson & Johnson moving forward.

Valuation and Stock Performance

Johnson & Johnson’s stock trades at around $152.67 as of late May 2025, placing its forward price-to-earnings ratio at roughly 14.5. This reflects a valuation that suggests the stock is neither undervalued nor overhyped, sitting at a point that many would consider reasonable for a business of its size and reliability. The stock’s beta is just 0.41, which confirms it tends to be less volatile than the broader market—something many income and conservative investors appreciate.

The analyst consensus price target sits at $170.88, implying about 12 percent upside from the current level. Price targets range from $150 on the low end to as high as $215, showing a wide range of opinion among analysts. There have been some recent changes in ratings. Leerink Partners downgraded the stock to a neutral stance with a price target cut to $153. They cited near-term growth headwinds and legal uncertainties. However, other firms, including Morgan Stanley, have held steady in their outlook while tweaking their targets slightly upward based on the latest earnings and strategic initiatives.

Risks and Considerations

While Johnson & Johnson carries a strong track record, it’s not without its challenges. The most prominent risk continues to be ongoing litigation related to its talc-based products. These lawsuits allege links to cancer, and although the company has taken steps to resolve them through bankruptcy proceedings and settlements, the legal landscape remains uncertain. Depending on the outcomes, these liabilities could affect both cash flow and investor sentiment.

The regulatory environment also brings potential hurdles. Any changes to drug pricing laws, or new tariffs on pharmaceutical imports, could disrupt operations or squeeze margins. Management has already flagged that such policy shifts might impact drug availability in the U.S., adding a layer of complexity to the company’s long-term planning. Beyond that, J&J faces the usual industry pressures—competition from generics and biosimilars, patent cliffs, and the high stakes involved in pharmaceutical development.

Final Thoughts

Johnson & Johnson continues to be one of the most recognizable and resilient names in global healthcare. The company’s shift toward a more focused model, centered on innovative medicine and medtech, marks a significant step forward. Its leadership team has shown an ability to adapt while staying grounded in core strengths. Financially, the company remains in a strong position, supported by consistent cash flow and disciplined capital management.

While risks tied to litigation and regulation remain, they are being actively addressed by management. The combination of steady execution, financial durability, and a renewed focus on growth sectors puts Johnson & Johnson in a solid spot. For long-term investors, especially those with an eye on dividend stability and moderate capital appreciation, J&J continues to hold a respected place in the portfolio conversation.