Key Takeaways

📈 Smucker offers a forward dividend yield of 3.84% with over 20 consecutive years of dividend growth, supported by a consistent payout strategy and a five-year average yield of 3.14%.

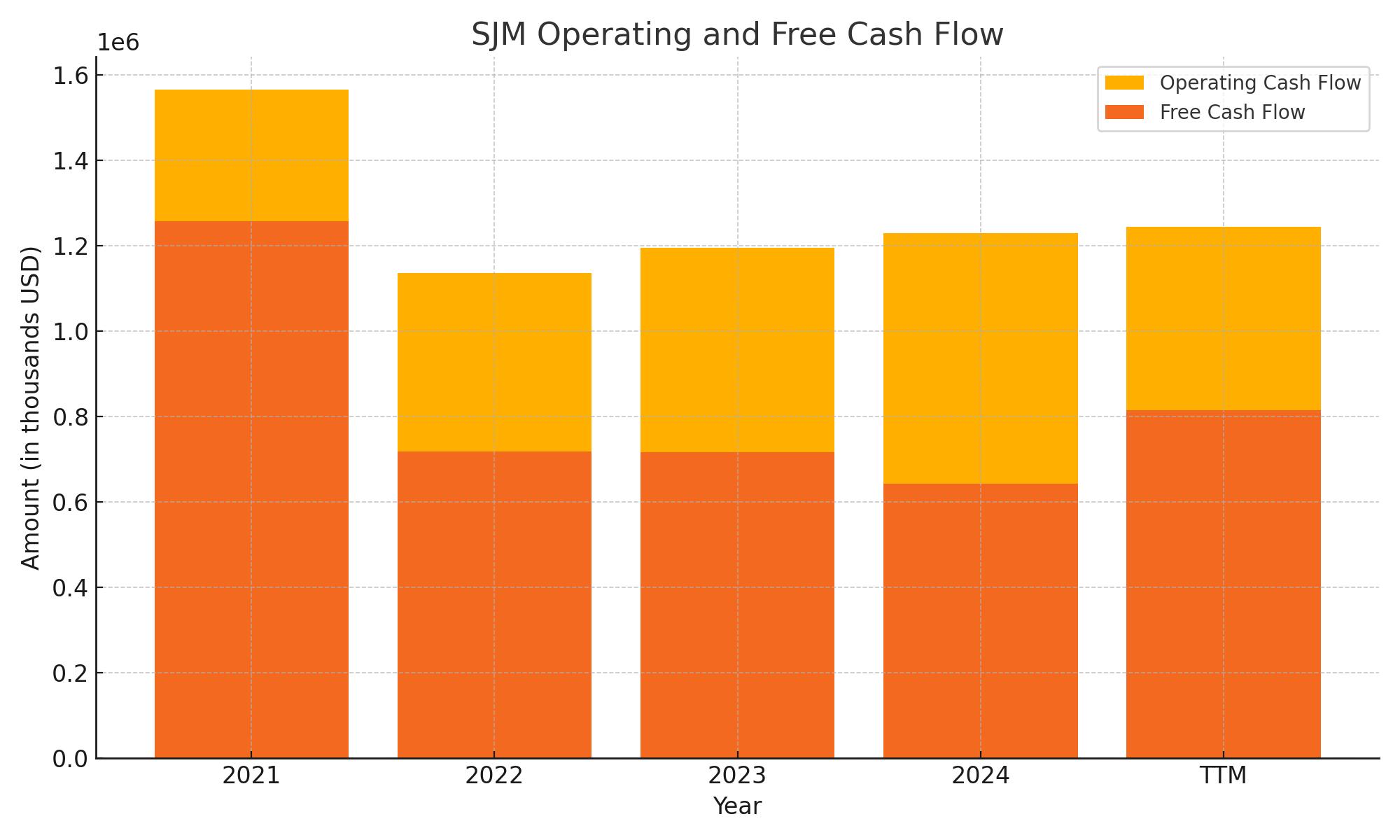

💵 The company generated $1.24 billion in operating cash flow and $815 million in free cash flow over the trailing twelve months, highlighting its ability to fund dividends and manage debt responsibly.

📊 Analysts have a consensus price target of $125.70 and a Hold rating overall, with some firms maintaining Buy positions based on brand strength and expected synergies from the Hostess acquisition.

Last Update 5/27/25

J.M. Smucker is a household name built on enduring brands like Folgers, Jif, and Milk-Bone, and now includes Hostess snacks following a major acquisition. With over 20 years of consecutive dividend increases, steady cash flow generation, and a forward dividend yield of 3.84%, the company has remained a reliable income-generating stock in the consumer staples sector.

Despite modest revenue softness and supply chain pressures, Smucker has maintained solid earnings and raised its full-year guidance. Backed by a focused leadership team, disciplined capital management, and a long-term strategy emphasizing brand strength and operational efficiency, the company continues to draw interest from dividend-minded investors.

Recent Events

Smucker’s most headline-worthy move in recent memory was the acquisition of Hostess Brands. That’s right—Twinkies, CupCakes, and HoHos are now part of the Smucker family. It’s a strategic step that expands their presence into indulgent snacking, a category with plenty of growth potential if managed well.

Of course, deals like this don’t come cheap. There’s new debt on the books, and revenue growth hasn’t exactly turned heads lately. Over the past year, the stock’s been hovering between $98 and $125, reflecting some investor caution as the integration process unfolds.

What hasn’t changed is Smucker’s ability to generate consistent cash flow. That’s the real foundation of their dividend strength. Despite some softness in the top line and macro uncertainty, the company’s core operations remain sound. The low beta of 0.34 also underscores its appeal as a defensive holding—something to consider when the broader market starts to wobble.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.84%

💸 Forward Annual Dividend: $4.32 per share

🧾 5-Year Average Yield: 3.14%

📊 Payout Ratio: 86.06%

📅 Next Dividend Date: June 2, 2025

🔁 Ex-Dividend Date: May 16, 2025

📆 Dividend Growth Streak: 22 consecutive years

Dividend Overview

Smucker offers one of the most attractive yields in the consumer staples space right now. With a forward yield pushing 3.84%, it stands well above many of its peers. And it’s not just the number—it’s the consistency behind it that matters. This company hasn’t missed a beat in over two decades of dividend growth.

That payout ratio at 86% might raise some eyebrows at first glance, but context is everything. Earnings have taken a temporary hit due to integration costs from the Hostess acquisition and other short-term items. The real story lies in the cash flows, where operating cash is still coming in at a healthy clip—over $1.2 billion in the trailing twelve months. That gives management the flexibility to continue rewarding shareholders without putting the balance sheet under undue pressure.

There’s also no indication Smucker’s leadership intends to shift course. Dividends are a core part of their capital allocation strategy, and so far, they’ve shown no willingness to compromise on that.

Dividend Growth and Safety

Steady as she goes—that’s been Smucker’s approach to dividend growth. Over the past five years, they’ve averaged around 6% annual increases. Not aggressive, but not token either. Just a deliberate, methodical climb that matches the company’s overall operating rhythm.

Looking ahead, there are a few pressure points worth keeping an eye on. The debt load has grown to just under $8 billion, and the current ratio sits at a lean 0.60. That doesn’t give them a ton of wiggle room in the short term, but consumer staples companies often run with tight liquidity and rely on steady cash conversion cycles to fund operations and returns.

What makes Smucker’s dividend feel safer than the raw numbers might suggest is the durability of its brands. These are pantry staples, snack-time favorites, and pet treats that maintain relevance even when the economy slows. That’s a built-in resilience that supports cash flow, even in leaner times.

From a performance standpoint, return on assets is still respectable at 5.5%. The negative return on equity is more of a short-term accounting artifact tied to acquisition adjustments than a deeper operational concern. Short interest remains modest at 5.7% of the float, and with over 88% institutional ownership, there’s a lot of long-term money betting on Smucker’s stability.

In short, this is the kind of name dividend investors often gravitate toward. It’s not flashy. It doesn’t move in big, sudden bursts. But it keeps delivering—in cash, in discipline, and in a way that lets investors sleep a little easier at night.

Cash Flow Statement

The J. M. Smucker Company continues to show reliable cash generation through its core operations. For the trailing twelve months (TTM), it produced $1.24 billion in operating cash flow—slightly higher than the previous year and maintaining a steady trend since 2021. Even with heavier capital expenditures at $429 million, free cash flow held strong at $815 million, signaling a healthy margin between what the company brings in and what it spends to maintain and grow its business.

On the investing side, the latest figure reflects a manageable outflow of $122 million, a sharp reversal from the prior year’s $3.96 billion, which included the Hostess acquisition. Financing activities also returned to more normalized levels after that one-time spike, showing an outflow of $1.1 billion largely driven by debt repayments and dividend commitments. The end cash position sits at $50 million, a lean figure but consistent with how Smucker typically runs its liquidity. The free cash flow numbers reinforce its ability to cover dividends and manage debt without tapping capital markets frequently.

Analyst Ratings

📊 In recent months, J.M. Smucker (SJM) has experienced a mix of analyst sentiment, reflecting both cautious optimism and concerns over near-term challenges. 🎯 The consensus 12-month price target stands at $125.70, suggesting an approximate 11% upside from current levels.

🟢 Citi analysts recently adjusted their price target slightly downward from $129 to $128 while maintaining a Buy rating. This revision anticipates strong performance in the company’s Coffee segment, despite potential cost pressures from rising coffee prices and tariffs.

🟢 UBS initiated coverage with a Buy rating and a $134 price target, highlighting Smucker’s stable market share and potential for low single-digit organic revenue growth over the next 12 to 18 months. 🟢 Morgan Stanley also began coverage with an Overweight rating and a $123 price target, citing the company’s strong brand portfolio and resilience to inflationary pressures, particularly in its coffee segment.

🔴 Conversely, TD Cowen downgraded the stock from Buy to Hold, adjusting the price target from $130 to $121. The downgrade reflects concerns over the company’s ability to navigate cost pressures and integrate recent acquisitions effectively.

⚖️ Overall, the analyst community presents a balanced view of J.M. Smucker, with a consensus rating of Hold. The company’s strong brand portfolio and consistent dividend payments are seen as positives, while integration challenges and cost pressures remain areas of concern.

Earning Report Summary

Steady Performance Despite Some Headwinds

J.M. Smucker’s latest quarterly report showed the company is staying steady, even with a few bumps along the way. Sales came in at $2.19 billion, down about 2% from the same time last year. That dip mostly came from recent divestitures and some lingering supply chain hiccups. Still, earnings per share actually moved higher, climbing 5% to $2.61 on an adjusted basis. That improvement points to solid cost control and a continued focus on running a lean operation.

Leadership acknowledged the challenges in getting products out the door efficiently, but they didn’t shy away from talking about the progress that’s been made. CEO Mark Smucker spoke confidently about where the business is heading. He noted the integration of Hostess Brands is going well and sees it as a major step toward building out their growth strategy.

Looking Toward Growth and Stability

The company also raised its outlook for the full year, which is always a good sign. They’re now expecting net sales to grow by 7.3%, and adjusted earnings per share to land between $9.85 and $10.15. That kind of guidance reflects a level of confidence in both their ability to deliver in the short term and their long-term strategy.

Smucker’s team is clearly focused on execution. They’re streamlining operations, leaning into core brands, and working hard to make the most out of recent acquisitions. With consistent dividend payouts and a plan that prioritizes profitability, the direction from here looks measured and intentional—not flashy, but solid.

Management Team

At the helm of J.M. Smucker is Mark Smucker, serving as Chair of the Board, President, and CEO. As the sixth CEO in the company’s history, he brings a deep understanding of the business and a commitment to its long-term vision. Supporting him is John Brase, the Chief Operating Officer, who oversees day-to-day operations and ensures the company’s strategic initiatives are executed effectively.

The financial health of the company is managed by Tucker Marshall, the Chief Financial Officer, who plays a crucial role in guiding the company’s fiscal strategies. Gail Hollander, as Chief Marketing Officer, leads the branding and marketing efforts, ensuring the company’s products resonate with consumers. Jeannette Knudsen, the Chief Legal Officer and Secretary, oversees legal affairs and corporate governance. Jill Penrose, the Chief People and Company Services Officer, focuses on human resources and company culture, fostering an environment that supports employee growth and satisfaction.

This leadership team combines experience and innovation, steering J.M. Smucker through the evolving landscape of the food and beverage industry.

Valuation and Stock Performance

J.M. Smucker’s stock is currently trading at $113.50, reflecting the market’s cautious optimism. The company’s market capitalization stands at $11.99 billion, with an enterprise value of $19.93 billion. The price-to-earnings (P/E) ratio is 16.85, and the price-to-book (P/B) ratio is 1.74, indicating a valuation that aligns with industry standards.

Over the past year, the stock has experienced fluctuations, reaching a 52-week high of $125.42 and a low of $98.77. Despite these variations, the company’s consistent dividend payouts and stable earnings have provided a buffer against market volatility. The stock’s beta of 0.34 suggests lower volatility compared to the broader market, making it an attractive option for conservative investors seeking steady returns.

Analysts have set a consensus price target of $123.58, with a range between $105.04 and $141.75, reflecting a balanced outlook on the company’s future performance.

Risks and Considerations

While J.M. Smucker has a strong market presence, it faces several risks that investors should consider. The company’s exposure to low-income consumers means that changes in government assistance programs, such as potential cuts to SNAP benefits, could impact sales. Additionally, the competitive landscape of the food and beverage industry requires continuous innovation and marketing efforts to maintain market share.

Supply chain disruptions and fluctuations in commodity prices, such as coffee and peanuts, can affect production costs and profit margins. Regulatory changes, including potential restrictions on food additives and labeling requirements, may also pose challenges. Furthermore, the integration of recent acquisitions, like Hostess Brands, requires careful management to realize anticipated synergies and avoid operational disruptions.

Investors should also be aware of the company’s debt levels, which have increased due to recent acquisitions. Effective debt management will be crucial to maintaining financial stability and supporting ongoing dividend payments.

Final Thoughts

J.M. Smucker stands as a resilient player in the consumer staples sector, offering a blend of traditional products and strategic innovation. The company’s commitment to dividend growth, coupled with its diversified brand portfolio, provides a solid foundation for long-term investors. While challenges exist, the experienced management team and strategic initiatives position the company to navigate the evolving market landscape effectively.