Last update 5/27/25

J&J Snack Foods, the maker behind well-loved names like SuperPretzel and Icee, operates across theaters, amusement parks, schools, and retail shelves. With a strong presence in frozen and handheld snacks, the company has built a resilient business that caters to everyday impulse and convenience-based food consumption. Its consistent dividend history, stable balance sheet, and solid operating cash flow have long made it appealing to income-focused investors.

Recent Events

It’s been a bumpy ride for JJSF shareholders lately. The stock has slid more than 30% from its 52-week high of $180.80, now resting around $111.46. That’s a meaningful drop, driven largely by underwhelming earnings and softer top-line growth. Their most recent quarter showed a small dip in revenue—down 1% year-over-year—but the bigger concern was the earnings slide, which came in more than 60% lower than last year.

Valuation-wise, the trailing P/E has climbed to around 28.6, but without clear forward earnings guidance, it’s hard to know if that multiple really reflects the company’s near-term potential. For income investors, though, what matters most is whether the dividend can weather the earnings dip.

There are some encouraging signs on the balance sheet. The company’s current ratio is 2.38, showing decent liquidity. And debt levels are very manageable, with a debt-to-equity ratio under 18%. That kind of financial profile usually supports dividend stability, even if earnings hit a rough patch.

Key Dividend Metrics

🪙 Forward Dividend Yield: 2.80%

📅 Dividend Growth Streak: 15+ years

💵 Annual Dividend Rate: $3.12 per share

📉 Payout Ratio: 78.85%

📈 5-Year Average Yield: 1.75%

📆 Next Ex-Dividend Date: June 17, 2025

💰 Next Payment Date: July 8, 2025

🏛️ Dividend Type: Regular Quarterly

Dividend Overview

Looking under the hood, J&J Snack Foods is still producing solid cash flows—about $158.8 million from operations over the trailing twelve months, with $65.6 million in free cash flow left over after capital expenditures. The dividend, which costs the company around $60 million annually, is still covered, but the margin for error is starting to thin.

That 2.80% yield looks attractive at current levels, particularly compared to the company’s 5-year average yield of just 1.75%. But it’s important to recognize that this increase isn’t due to some major bump in the dividend—it’s the result of the falling stock price. For investors chasing yield, that might present a timely opportunity, although it’s coming with more risk than usual.

The company’s dividend payout ratio, currently hovering close to 79%, tells us that most of the net income is being returned to shareholders. It’s not an immediate concern, but if earnings continue to weaken, the room for future dividend hikes becomes limited. This isn’t a company in distress, but one in a tightening position when it comes to maintaining its generous payout track.

Dividend Growth and Safety

JJSF has a reputation for being dependable when it comes to the dividend. The company has increased its payout every year for well over a decade, rewarding shareholders with a growing stream of income that hasn’t skipped a beat—even in tough environments.

But looking forward, dividend growth might slow down a bit. With earnings under pressure and the payout ratio already elevated, future raises could be more modest unless profitability rebounds. Still, there’s no clear sign that a cut is on the table. Cash flow remains solid, and the company has shown in past downturns that it values its dividend enough to protect it.

Insider ownership sits north of 21%, which can be reassuring. It suggests that management has skin in the game and is likely to be aligned with shareholder interests. Meanwhile, institutional holders make up nearly 83% of ownership—an indication that this stock still holds respect among professional investors, many of whom rely on consistent dividend payers.

All in all, J&J Snack Foods is showing the marks of a business in transition. The dividend remains intact, but the pressure on earnings could shape the pace of growth in the years ahead. For dividend investors seeking stability and yield from a consumer staple, it’s a name worth keeping on the radar—especially with a yield that’s gotten a little juicier lately.

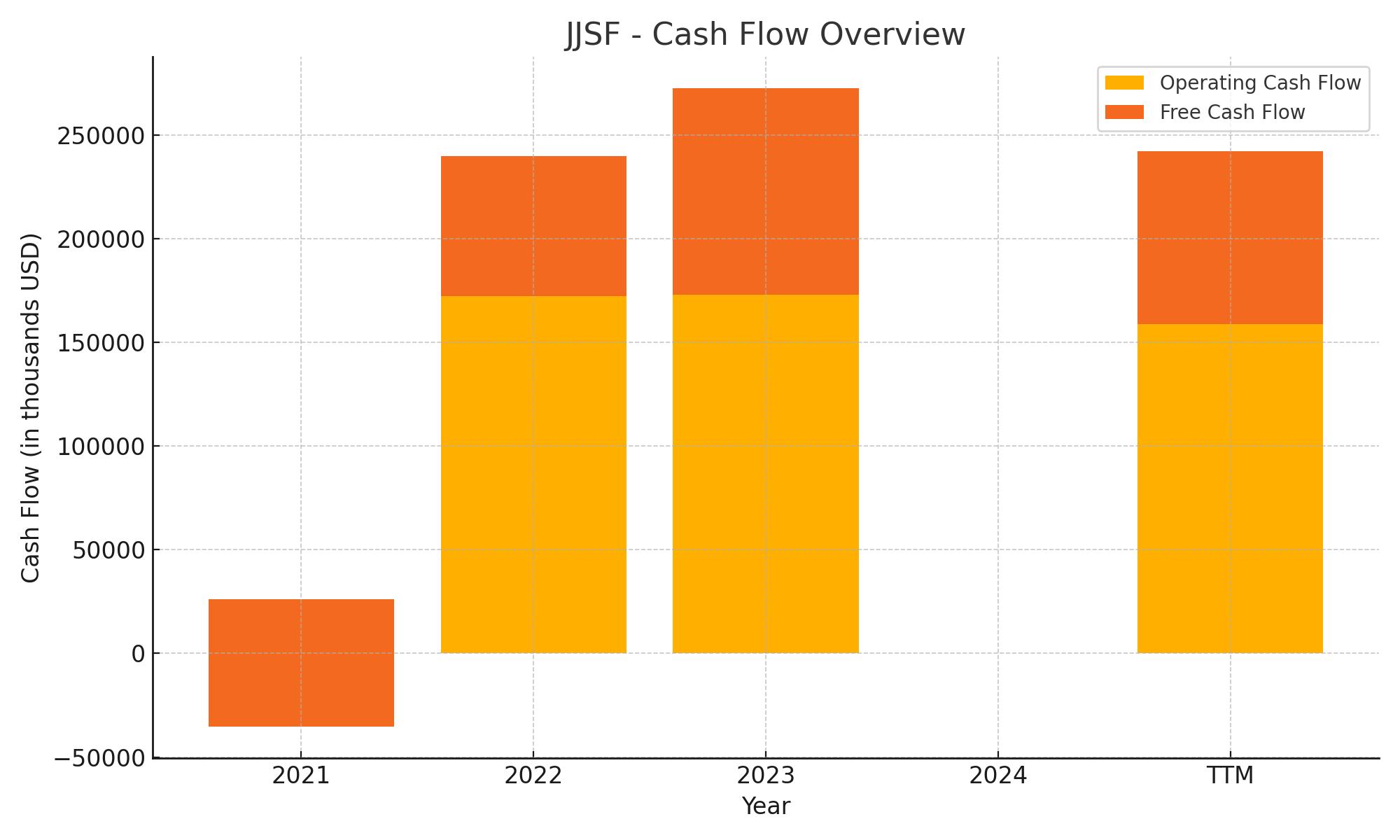

Cash Flow Statement

J&J Snack Foods generated $158.8 million in operating cash flow over the trailing twelve months, a slight decline from the $173.1 million reported in the prior fiscal year. Despite the dip, cash generation remains strong and well above the levels seen in 2021, when operating cash flow hit a low of $26 million. Capital expenditures came in at $75.5 million, which is fairly consistent with recent years and leaves the company with $83.4 million in free cash flow—healthy enough to support its dividend payout and provide financial flexibility.

On the investing side, the company reported a cash outflow of $79.1 million, primarily related to maintenance and growth-related capex. Financing activities showed a net cash outflow of $68.9 million, mostly due to debt repayments and a modest amount of share repurchases. The company ended the period with $54.4 million in cash, down from $73.4 million the previous year. While the cash balance has declined, the overall cash flow profile remains stable, with consistent free cash flow generation and disciplined capital management, reinforcing the company’s ability to continue funding its dividend and core operations.

Analyst Ratings

J&J Snack Foods has recently seen a shift in analyst sentiment, with changes to price targets reflecting some pressure on earnings and consumer trends. One analyst lowered the price target from $165 to $150 while maintaining a buy rating. This move was driven by a more cautious view on sales and margin expectations for the remainder of fiscal 2025, particularly in light of soft first-quarter results and signs of fading consumer momentum. 📉

Another financial group adjusted its stance as well, cutting its target from $175 to $135 and keeping a hold rating. The downgrade came on the heels of disappointing earnings, where both top and bottom lines came in under analysts’ forecasts. The note cited concerns over execution and near-term demand softness, particularly in the company’s foodservice and entertainment channels. 🛑

Despite the pullback in targets, the overall analyst outlook still leans moderately constructive. The average 12-month price target now sits at $142.50, suggesting there’s room for upside from the current share price. 🎯 While not overwhelmingly bullish, the consensus reflects confidence that J&J’s brand strength and operational discipline could reassert themselves once near-term pressures ease.

Management Team

At the helm of J&J Snack Foods is Dan Fachner, who has been leading the company as President and CEO since 2020 and took on the role of Chairman in late 2023. Fachner has a long history with the organization, having previously served as the head of The ICEE Company, one of J&J’s most recognizable subsidiaries. His leadership style emphasizes operational discipline and a clear focus on nurturing the company’s well-established brands.

Joining him on the executive team is Shawn Munsell, who became Chief Financial Officer in December 2024. Munsell brings a background rich in financial stewardship from roles across various public companies, giving him a well-rounded perspective to guide J&J’s fiscal strategy. Rounding out the leadership are Lynwood Mallard as Chief Marketing Officer, Michael Pollner serving as General Counsel, and Steve Every leading operations. Collectively, this group blends experience, strategic thinking, and a hands-on understanding of the foodservice and retail industries.

Valuation and Stock Performance

J&J Snack Foods’ stock has seen some notable fluctuations, currently trading around $113 per share. This puts the company’s market cap at roughly $2.17 billion. From a peak of $180.80 over the past year, the share price has pulled back significantly, reflecting both sector-wide pressures and specific challenges in profitability and cost control.

Looking at the valuation picture, the company trades at a trailing price-to-earnings ratio of 28.6, which suggests investors are still valuing the stock based on expectations for a recovery in earnings. The price-to-sales ratio is sitting around 1.4, and the price-to-book is at 2.32. These figures position the stock in a middle ground—neither especially cheap nor overly expensive—indicating it’s priced more for stability than rapid growth. For investors focused on long-term income and capital preservation, these levels may still look reasonable, particularly within a defensive sector like consumer staples.

Risks and Considerations

There are a few key risks that could impact J&J Snack Foods going forward. One of the most immediate concerns is the rising cost of ingredients. Inputs such as chocolate, eggs, and various proteins have seen price increases, which squeeze margins and may require further price adjustments to maintain profitability. If these cost pressures persist or worsen, they could have a material impact on earnings.

Operational risks also linger. The company previously experienced some hiccups during the rollout of new systems and processes, and while those appear to be mostly behind them, any further disruptions could affect production or distribution. Dependence on channels like theaters, stadiums, and amusement venues can also create volatility, especially if consumer behavior shifts due to economic uncertainty or evolving entertainment habits.

Another area to watch is the broader shift in consumer preferences. As more people seek healthier snack alternatives, J&J will need to continue innovating and adapting its product lines to stay relevant. While they have made progress, staying ahead of trends is an ongoing challenge that requires continual investment in research and development.

Final Thoughts

J&J Snack Foods remains a dependable player in the snack food landscape, backed by recognizable brands and a leadership team that knows the industry inside and out. While recent performance has highlighted some of the headwinds facing the business—particularly in terms of costs and earnings—the company still maintains strong operational fundamentals and a solid balance sheet.

For long-term investors, especially those focused on dividends and defensive sectors, J&J offers consistency with potential for recovery. The dividend is well-supported, and management appears committed to long-term shareholder value. As the company works through current challenges, including cost pressures and shifting consumer trends, it remains well positioned to adapt and maintain its role in everyday snacking routines.