Last update 5/27/25

Invitation Homes (NYSE: INVH) owns and operates over 80,000 single-family rental homes across the U.S., with a focus on high-demand markets where homeownership is increasingly out of reach. With consistent occupancy around 97% and solid rent growth, the company offers a dependable income stream backed by real assets and stable operating performance.

Recent Events

Over the last year, shares of Invitation Homes have dipped slightly, down around 3%. That’s a minor pullback, especially when you consider how stable the business remains underneath. In fact, the company has continued to show growth where it counts.

In the most recent quarter, reported in March, revenue climbed 4.4% year-over-year. More importantly, earnings jumped by more than 16%. That kind of bottom-line strength in today’s environment—rising costs, higher interest rates—is no small feat. It speaks to the staying power of the rental model and the operational efficiency the company has built up over time.

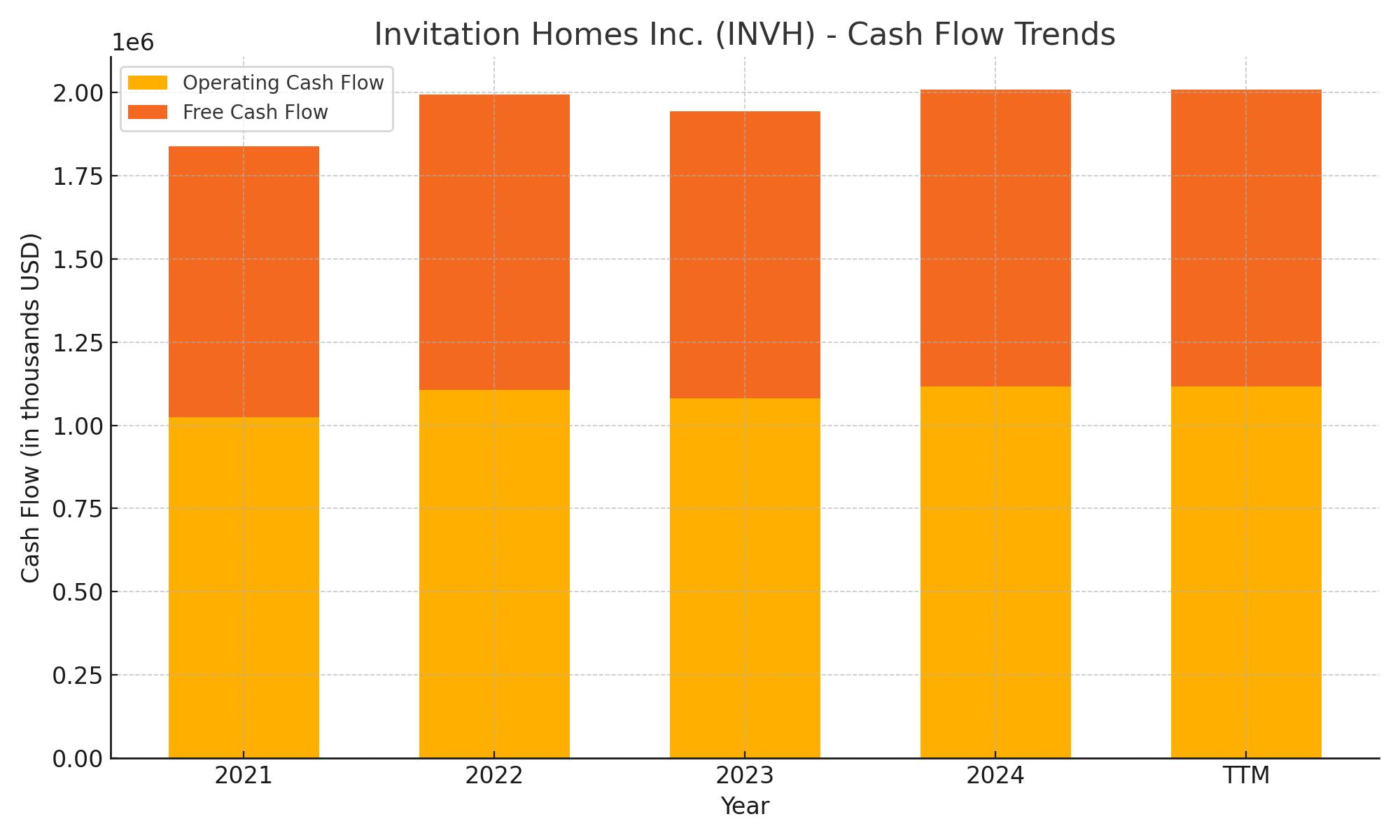

Operating cash flow remains strong at over $1.1 billion for the past 12 months. And levered free cash flow—what’s left after taking care of interest and other obligations—sits just under $978 million. That’s money that can be used to pay dividends, reinvest in properties, or pay down debt.

And while the share price hasn’t done much lately, the business itself has continued to hum along, quietly but effectively.

Key Dividend Metrics

🔁 Dividend Yield: 3.51%

💸 Annual Dividend: $1.16 per share (forward)

🧮 Payout Ratio: 146.15% (based on EPS)

📈 5-Year Average Yield: 2.52%

📅 Dividend Date: April 17, 2025

📉 Ex-Dividend Date: March 27, 2025

Dividend Overview

Right now, Invitation Homes is offering a forward dividend yield of 3.51%. That’s not only higher than the broader market, it’s well above the company’s own five-year average of 2.52%. For investors who rely on steady income, that kind of yield can be a meaningful part of a portfolio’s cash flow.

The high payout ratio—146% of earnings—might look worrisome at first glance. But that number is based on GAAP earnings, which isn’t the right lens for evaluating a real estate investment trust (REIT) like this one. REITs often show inflated payout ratios when looking at net income because of non-cash depreciation expenses.

What matters more here is cash flow. And on that front, Invitation Homes has consistently generated more than enough to support its dividend. The company’s operating income, EBITDA, and free cash flows are all in strong shape.

So while the raw payout number might seem high, the underlying cash production tells a much more reassuring story.

Dividend Growth and Safety

One of the more overlooked strengths of Invitation Homes is its consistency. Since going public, it has steadily increased its dividend over time—not in dramatic jumps, but with a measured, reliable cadence. That’s exactly the kind of approach many dividend investors prefer. No surprises. No flashy declarations. Just a quiet, steady climb.

Looking under the hood, the business fundamentals are sound. The operating margin sits at nearly 28%, and EBITDA over the trailing year came in at $1.44 billion. These numbers reflect how efficiently the company runs, even with the ongoing costs of managing a large portfolio of properties.

Debt is worth paying attention to. Total liabilities are around $8.1 billion, with a debt-to-equity ratio of 83.4%. That’s high, but not unusual in the REIT space. What’s more important is how manageable that debt is—and here, the company’s liquidity position looks solid. With over $100 million in cash and a current ratio above 2.4, there’s flexibility to navigate any bumps in the road.

Institutional investors seem to agree. Over 101% of shares are held by institutions—an indication of both confidence in the business model and belief in the dividend’s staying power.

The yield might not scream excitement, but it offers something arguably better: peace of mind. For investors looking to collect steady income without having to micromanage their holdings, Invitation Homes fits the bill. It’s a business rooted in long-term demand, run with discipline, and built around delivering recurring cash to shareholders.

Cash Flow Statement

Invitation Homes continues to show strong operating cash flow, with $1.12 billion generated over the trailing twelve months (TTM). This marks an increase from the previous year’s $1.08 billion and reflects the company’s stable rental income base and disciplined cost management. Even as the company expands and manages a vast portfolio of single-family homes, it consistently converts a high portion of its revenue into cash from operations.

On the investing side, cash outflows totaled $555 million TTM, primarily from property acquisitions and maintenance. This is a lighter investment load compared to prior years, suggesting a pause or shift in capital deployment strategy. Financing activities, however, show significant outflows at $1.19 billion, driven largely by aggressive debt repayments. This is a notable change from two years ago, when financing was a net positive. Despite these outflows, the company ended the period with $318 million in cash, and free cash flow remained strong at nearly $891 million—more than sufficient to support its dividend and reinvestment needs.

Analyst Ratings

📈 In recent months, analysts have adjusted their outlook on Invitation Homes (NYSE: INVH), reflecting evolving perspectives on the company’s performance and broader market conditions. The overall consensus remains a “Moderate Buy,” based on 14 analyst ratings: 6 Buys, 8 Holds, and no Sell recommendations.

🎯 The average 12-month price target sits at $37.62, which points to a potential upside of roughly 14% from the current share price of $33.01. Price estimates vary, with targets ranging from $34.00 on the lower end to $43.00 at the high end, showing a mix of cautious and optimistic views depending on the firm’s outlook.

🔼 Mizuho recently upgraded the stock from “Neutral” to “Outperform” and lifted its price target from $33.00 to $36.00. This shift was influenced by improving fundamentals and a stronger-than-expected performance in key rental markets.

📊 Scotiabank maintained its “Sector Perform” rating but nudged its price target upward from $36.00 to $38.00, citing operational consistency and resilient cash flow trends as key positives.

🧮 Barclays held onto its “Overweight” stance and bumped the target price from $37.00 to $39.00, reflecting growing confidence in long-term rent growth.

💼 Goldman Sachs reiterated a “Buy” rating and pushed its target even higher—from $39.00 to $43.00—underscoring strong demand in INVH’s core markets and a favorable outlook for single-family rental housing.

Overall, these updates reflect a generally supportive view of the company, with many analysts rewarding the stock for its stable earnings, strong occupancy rates, and cash flow reliability in an inflationary environment.

Earning Report Summary

Solid Start to the Year

Invitation Homes got off to a strong start in 2025, showing why it continues to be a steady player in the residential real estate space. Revenue for the first quarter hit $674 million, a healthy 4.4% bump from the same time last year. Net income also moved in the right direction, climbing to $166 million, or about 27 cents per share. That’s a solid jump of over 16% year-over-year.

Funds from operations, which are a better measure for REITs than regular earnings, looked good too. Core FFO came in at 48 cents per share, while AFFO grew to 42 cents. Both metrics showed improvement, with AFFO rising 4%—a sign that cash flow is keeping pace with the company’s growth.

Stable Operations and Rent Growth

Occupancy stayed high, holding steady at 97.2%. That’s a small dip from last year, but still a strong number. Rent trends are holding up as well. Renewals increased 5.2%, and new lease rents, after a slower patch, are beginning to pick up. In April, new leases saw a 2.7% increase, which helped lift blended rent growth for the quarter to 3.6%.

The leadership team, led by CEO Dallas Tanner, pointed to the company’s value proposition—offering families a more affordable alternative to homeownership in key U.S. markets. He also highlighted their strong resident satisfaction scores and the consistently high number of tenants choosing to renew their leases.

Managing the Portfolio and the Balance Sheet

During the quarter, Invitation Homes continued to fine-tune its portfolio. They bought 631 homes for around $213 million and sold 470 homes, bringing in roughly $179 million. That left them with a net gain of 161 homes, which signals a strategy that’s more focused on quality and fit than on aggressive expansion.

Financially, they’re in a comfortable spot. The company reported $1.36 billion in liquidity, made up of cash and untapped credit. Most of their $8.18 billion in debt is fixed or hedged, helping shield them from interest rate surprises. Their debt-to-EBITDA ratio sits at 5.3x, a level that suggests they’re managing leverage responsibly.

Outlook Still on Track

Looking ahead, Invitation Homes is sticking with its full-year forecast. They expect Core FFO to land somewhere between $1.88 and $1.94 per share, with AFFO projected in the $1.58 to $1.64 range. Same-store revenue and NOI are both expected to grow modestly, continuing the trend of steady, reliable progress.

All in all, the first quarter reflected a company that’s not just surviving the current environment—it’s quietly excelling. From rent growth to resident satisfaction and balance sheet discipline, Invitation Homes is making its case as a stable, income-generating business with room to grow.

Management Team

At the helm of Invitation Homes is Dallas B. Tanner, who has been serving as CEO since 2019 and was a founding force behind the company. With over twenty years of experience in real estate, Tanner has helped shape not just the company, but the broader single-family rental space. His focus on operational excellence and long-term vision continues to guide the company through various market cycles.

Supporting Tanner is a seasoned leadership team. Peter DiLello, Senior Vice President of the Investment Management Group, has played a central role in expanding the company’s West Coast presence and crafting its investment strategies from the early days. Scott G. Eisen, who stepped in as Executive Vice President and Chief Investment Officer in 2023, brings decades of real estate finance and investment banking experience. His addition adds strategic depth to an already capable executive suite.

The leadership team is known for its steady approach and alignment with shareholder interests. Employees have consistently rated the management highly, often placing them among the top tier of comparable companies. Their experience, combined with a disciplined growth mindset, has been a driving force behind Invitation Homes’ stability and continued success in a competitive real estate market.

Valuation and Stock Performance

As of late May 2025, Invitation Homes shares are trading around $33.01, placing them roughly 12 percent below the 52-week high of $37.80. While the stock has had its share of ups and downs over the past year, many of the broader pressures stem from macroeconomic shifts rather than company-specific weaknesses. The underlying fundamentals remain strong, with steady rental income and high occupancy.

Analyst sentiment has stayed positive. The consensus 12-month price target is around $37.62, suggesting room for upside. In terms of valuation, the company trades at a trailing price-to-earnings ratio of just over 42 and a forward P/E near 48. While those numbers might look stretched at first glance, they reflect investor confidence in Invitation Homes’ ability to generate consistent long-term cash flow.

The stock’s beta of 0.86 also suggests lower-than-average volatility, making it a potentially appealing option for investors looking for stability within the real estate sector. Institutional ownership remains notably high, with more than 96 percent of shares held by large firms. That level of backing implies a solid foundation of long-term belief in the company’s outlook and management.

Risks and Considerations

Despite its strengths, Invitation Homes does face several risks that investors should keep in mind. A major economic slowdown could impact tenants’ ability to pay rent, which would in turn affect cash flow and occupancy levels. Rising interest rates could also tighten financial conditions, increasing borrowing costs and limiting the company’s ability to finance new acquisitions.

Another important area is regulation. The company has faced scrutiny over its fee practices and disclosures. Regulatory changes at the federal or local level could add pressure in the form of compliance costs or operational constraints. Reputation and trust are important in a resident-facing business, so keeping these issues under control is essential.

Operationally, the company must maintain the quality and livability of its vast property portfolio. Maintenance lapses, poor communication, or delayed service can damage resident satisfaction and impact renewal rates. Competition is also heating up, with more institutional investors entering the single-family rental space. This could pressure rental growth or increase costs associated with property acquisition and upgrades.

Keeping a close eye on these evolving dynamics will be crucial as the company navigates the years ahead.

Final Thoughts

Invitation Homes has carved out a strong niche in the single-family rental sector, driven by a portfolio of well-located homes and a leadership team that knows how to manage through both growth and challenge. Its financial performance has been consistent, with high occupancy, solid rent growth, and reliable cash flow supporting a dividend that appeals to income-focused investors.

Still, it’s a business not without risks. Interest rate sensitivity, regulatory oversight, and competition all present ongoing challenges. But these are balanced by the company’s scale, its brand recognition in key housing markets, and its strong balance sheet.

What sets Invitation Homes apart is its disciplined approach. The leadership isn’t chasing aggressive growth at the expense of quality. Instead, the focus remains on optimizing the portfolio, keeping residents satisfied, and maintaining operational strength. That kind of mindset is likely to serve both the company and its investors well in a market that continues to evolve.