Last update 5/27/25

Investar Holding Corporation (ISTR), a regional bank headquartered in Baton Rouge, Louisiana, continues to execute a focused strategy grounded in sound credit practices, disciplined capital allocation, and consistent shareholder returns. With a presence concentrated in the Gulf South, the bank has steadily expanded through a mix of organic growth and selective acquisitions. Recent financials reflect a business that’s operating with efficiency and control, posting strong earnings and maintaining a robust capital position.

Backed by an experienced leadership team, ISTR has managed to grow its net interest margin, reduce nonperforming loans, and maintain steady deposits. Trading at a modest valuation with a forward P/E under 10, the stock offers a 2.24% dividend yield and ample room for future increases, thanks to a low payout ratio. Analysts see upside in the current price, and while the company remains mindful of economic and regulatory challenges, its balance sheet and credit quality provide a firm foundation moving forward.

Recent Events

Investar came into 2025 with some momentum behind it. In the first quarter, the company posted $88.89 million in trailing twelve-month revenue, up 12% year-over-year. But the bigger story was on the earnings side, where net income grew by nearly 34%. In a time when many regional banks are still finding their footing, that kind of bottom-line growth stands out.

The bank’s profit margin hit an impressive 24.6%, while operating margin came in at 33%. These aren’t numbers you often see from a bank of this size. Even better, the return on equity reached 9.1%—a sign that management is putting shareholder capital to good use.

ISTR also stands out for its valuation. With a trailing P/E of 8.55 and forward P/E under 10, the stock isn’t expensive. And with a price-to-book ratio of 0.73, it’s trading well below its book value. For long-term investors who like their stocks cheap and their dividends steady, that’s a setup worth noting.

Key Dividend Metrics

💰 Forward Dividend Yield: 2.24%

📆 Payout Ratio: 18.95%

📈 Five-Year Average Yield: 2.00%

🏦 Trailing Dividend Yield: 2.23%

🔄 Most Recent Dividend Date: April 30, 2025

📉 Ex-Dividend Date: March 31, 2025

These numbers are telling. Not flashy, but they speak to stability.

Dividend Overview

Let’s talk about the dividend. At 2.24%, the current yield won’t make your jaw drop, but it’s higher than the company’s five-year average. That small uptick signals quiet strength. The story here isn’t about high yield—it’s about reliability.

What really jumps out is the payout ratio, sitting just under 19%. That’s a lot of breathing room. It means that Investar is only using a small slice of its profits to fund the dividend, leaving plenty of cash on hand to reinvest in the business, buy back shares, or—if earnings keep trending up—raise that dividend over time.

The latest dividend payout landed on April 30, and the annualized dividend rate sits at $0.42. It’s the kind of consistent payout that appeals to investors looking for a solid base of income that can grow, slowly but surely, with the business.

ISTR’s low beta of 0.60 also adds to its appeal. The stock tends to move less than the broader market, which is exactly what a lot of dividend investors want—predictable returns, less drama.

Dividend Growth and Safety

Here’s where things start to look even more promising. The company reported earnings per share of $2.19 over the past year. With just $0.42 of that going out in dividends, there’s a wide margin for safety. That kind of cushion makes it easier for the company to increase payouts in the future or stay the course even during tougher quarters.

Investar has been growing earnings at a good clip, with a 33.7% year-over-year gain in net income. For dividend investors, earnings growth is what ultimately drives dividend growth. When profits rise and payout ratios stay low, it’s a clear sign that future dividends are on solid ground.

There’s also a reassuring amount of cash on the balance sheet—just under $59 million, or $5.95 per share. That kind of liquidity adds another layer of safety to the dividend, especially when economic conditions get bumpy. Investors can feel confident that the company has the financial strength to maintain its payouts without stretching.

Short interest in the stock remains low at just 1.3% of the float, a quiet nod from the market that there’s not much skepticism about where this company is headed in the near term.

When you put it all together—low payout ratio, rising earnings, cash on hand, low volatility—you get a picture of a bank that understands the value of keeping its dividend policy grounded. It’s not trying to wow anyone with oversized payouts. Instead, it’s doing what long-term investors value most: staying the course, keeping things sustainable, and letting time do the heavy lifting.

Cash Flow Statement

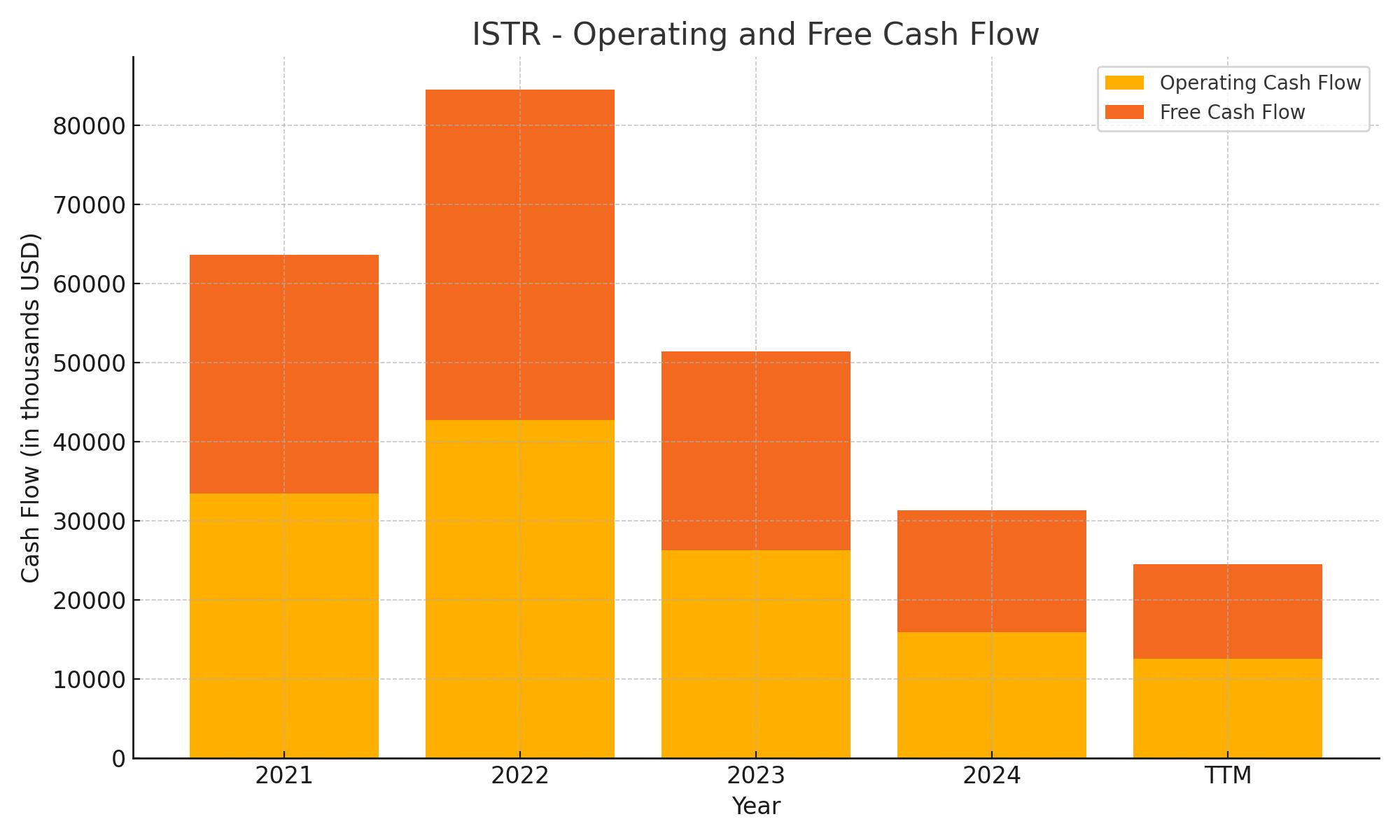

Investar Holding Corporation’s trailing twelve-month cash flow shows a shift toward tighter operations and more focused financial management. Operating cash flow came in at $12.58 million, a notable drop from prior years where the bank posted over $26 million in 2023 and more than $42 million in 2022. Despite this decline, the company still managed to generate positive free cash flow of nearly $12 million, reflecting a business that, while less cash-generative than before, remains solidly in the black after capital expenditures.

The standout movement comes from the financing and investing sections. Financing cash flow was deeply negative at -$80.74 million, reflecting aggressive debt repayments and modest share repurchases. This continues a trend from 2023, where the company used more than $110 million in cash for financing activities. In contrast, investing cash flow flipped positive to $69.85 million, signaling a pullback in prior periods’ heavy investment activity. That swing likely contributed to the improved cash position, which ended at $43.52 million—up from $27.92 million a year earlier. It’s clear the bank is prioritizing liquidity and balance sheet strength while dialing back on external obligations.

Analyst Ratings

📈 Investar Holding Corporation (ISTR) recently received an upgrade from analysts, signaling renewed confidence in the bank’s trajectory. On April 22, 2025, Piper Sandler bumped its rating from “Neutral” to “Overweight” and nudged the price target from $21 to $22. The move followed a strong earnings report, where ISTR posted $0.64 in earnings per share—well ahead of expectations. The upgrade reflects improving financial metrics and momentum in the company’s core banking operations, especially its growing net interest income and solid loan performance.

⚖️ On the flip side, a more cautious tone came just a few weeks later. On May 17, 2025, another firm revised its stance from “Buy” to “Hold,” citing valuation concerns. While the fundamentals remain intact, there’s a sense that the stock may be fairly priced for now after a solid run. This divergence in opinion highlights the nuanced outlook for ISTR—still financially strong but facing the usual scrutiny that comes with a potential plateau in share price.

🎯 Despite the mixed reviews, analysts currently have a consensus price target ranging between $22 and $24.94. With shares last trading around $18.72, the projected upside remains attractive, even as opinions diverge on the short-term path forward.

Earning Report Summary

Strong Start to the Year

Investar Holding Corporation kicked off 2025 with a solid first quarter that showed the bank’s strategy is hitting its marks. Net income reached $6.3 million, which works out to $0.63 per diluted share. That’s a decent jump from the $4.7 million they brought in during the same period last year. Revenue also moved in the right direction, climbing 12% to $24 million. It’s clear that the company is managing to grow even in a pretty mixed economic environment.

Profit margins saw a lift too, now sitting at 26%, up from 22% the year before. A big piece of that improvement came from a $3.3 million recovery tied to a Hurricane Ida insurance settlement, giving the bottom line a welcome boost. On top of that, they saw better performance on the lending side. Net interest margin improved to 2.87%, up by 22 basis points, which reflects smarter asset and liability management.

Better Credit and Lower Costs

One of the standout points this quarter was the improvement in credit quality. Nonperforming loans dropped to just 0.27% of total loans, which is a healthy sign compared to 0.42% at the end of last year. The loan book did shrink slightly, down 0.9% to $2.11 billion, but deposits held steady around $2.35 billion. That kind of deposit stability is valuable right now with all the noise in the banking sector.

The company also took steps to manage its cost of funds, which fell to 3.22%. That was helped along by the decision to redeem $20 million in subordinated debt. Moves like that show management is paying attention to the small levers that can make a big impact on financial efficiency.

Book value per share climbed to $25.63, a 4.4% increase from the previous quarter. That’s a good sign for shareholders, showing the underlying value of the company is moving in the right direction. Capital levels also improved, with the common equity tier 1 ratio rising to 11.16%, which puts the bank on strong footing for whatever comes next.

They also continued to return capital to shareholders, buying back just under 35,000 shares during the quarter. It wasn’t a massive buyback, but it shows consistency and a steady hand in managing shareholder value.

Looking forward, leadership is keeping the strategy steady—focused on balance sheet strength, credit discipline, and long-term growth. They’re not trying to chase headlines, just building on a solid foundation. For a regional bank, that kind of approach can be a real asset.

Management Team

Investar Holding Corporation is led by John J. D’Angelo, who has been at the helm since the company’s founding in 2006. With a deep background in banking and lending, D’Angelo has been instrumental in shaping Investar’s conservative yet growth-focused approach. His leadership has guided the company through various market cycles, always with an emphasis on disciplined expansion and sound credit practices.

Supporting him is a tightly-knit executive team including John R. Campbell as Executive Vice President and Chief Financial Officer, and Christopher L. Hufft as Executive Vice President and Chief Operating Officer. Their financial and operational expertise ensures the company stays efficient and aligned with its strategic goals. The board of directors includes professionals from finance, medicine, and industry, providing a well-rounded perspective. People like Suzanne O. Middleton, with her financial acumen, and Dr. Andrew C. Nelson, who brings a unique outside-industry view, help ensure strong governance and forward-thinking oversight.

Valuation and Stock Performance

As of late May 2025, Investar’s stock is trading at $18.72 with a market cap around $184 million. The share price has moved between $14.60 and $24.81 over the past year, showing it has seen both pressure and recovery during this period. The company is trading at a trailing P/E ratio of 8.55 and a forward P/E just under 10, which suggests it’s relatively inexpensive compared to its earnings power.

What makes it appealing to income-focused investors is the 2.24% forward dividend yield, paired with a low 18.95% payout ratio. That kind of cushion provides a lot of safety and flexibility for future increases. The stock’s beta sits at 0.60, meaning it tends to be less volatile than the broader market, which adds an element of consistency for conservative portfolios. Analysts covering the stock have settled on a consensus price target around $22, pointing to moderate upside from current levels.

Risks and Considerations

Like any regional bank, Investar faces risks tied closely to the economic environment. Loan demand, credit quality, and deposit behavior all fluctuate based on local and national trends. Rising or falling interest rates also have a direct impact on margins, and in turn, on profitability. Regulations are another factor that can shift unexpectedly and increase compliance costs or limit strategic flexibility.

The bank’s geographic footprint is mostly concentrated in Louisiana and nearby markets, which means it’s more exposed to regional challenges, including natural disasters like hurricanes. A slow-down in the local economy could disproportionately affect performance compared to more diversified institutions. Also, while the company has carved out a strong position in its niche, competition from larger national banks and fast-moving fintech players remains a constant threat. These competitors can put pressure on pricing, customer acquisition, and digital service expectations.

Final Thoughts

Investar Holding Corporation presents a stable picture with measured growth and solid financial discipline. The leadership team is seasoned, the capital position is healthy, and the bank continues to operate with a clear strategy grounded in fundamentals. Its dividend program is modest but consistent, with room to grow given how conservatively it’s managed. The valuation appears reasonable, offering some upside while providing a decent yield for income-focused portfolios.

That said, it’s important to stay mindful of the risks inherent in banking and the regional exposure that comes with Investar’s market focus. Still, for investors who value stability, capital discipline, and gradual shareholder returns, Investar fits comfortably into that lane. It’s not a flashy stock, but that’s part of the appeal—it’s focused on doing the basics well, and that foundation has served it reliably.