Last update 5/27/25

Intuit is a financial technology company best known for products like TurboTax, QuickBooks, and Credit Karma. With consistent revenue growth, expanding profit margins, and a strong commitment to innovation, it has carved out a dominant position in the software landscape. Its recent push into AI-powered financial tools has deepened customer engagement and broadened its ecosystem across individuals, small businesses, and professional users.

While its dividend yield remains modest, Intuit offers steady free cash flow, disciplined capital returns, and an upward earnings trajectory. Supported by a confident management team and a loyal user base, the company continues to perform well, both in the market and across analyst expectations.

Recent Events

Shares of Intuit recently jumped over 8% in a single day, closing at $720.13 on May 23. That kind of pop isn’t random—it’s a reflection of investor confidence following a solid earnings report and strong underlying fundamentals. While the company did report a drop in earnings per share year-over-year (down 14.6%), revenue surged by 41%, signaling continued top-line strength.

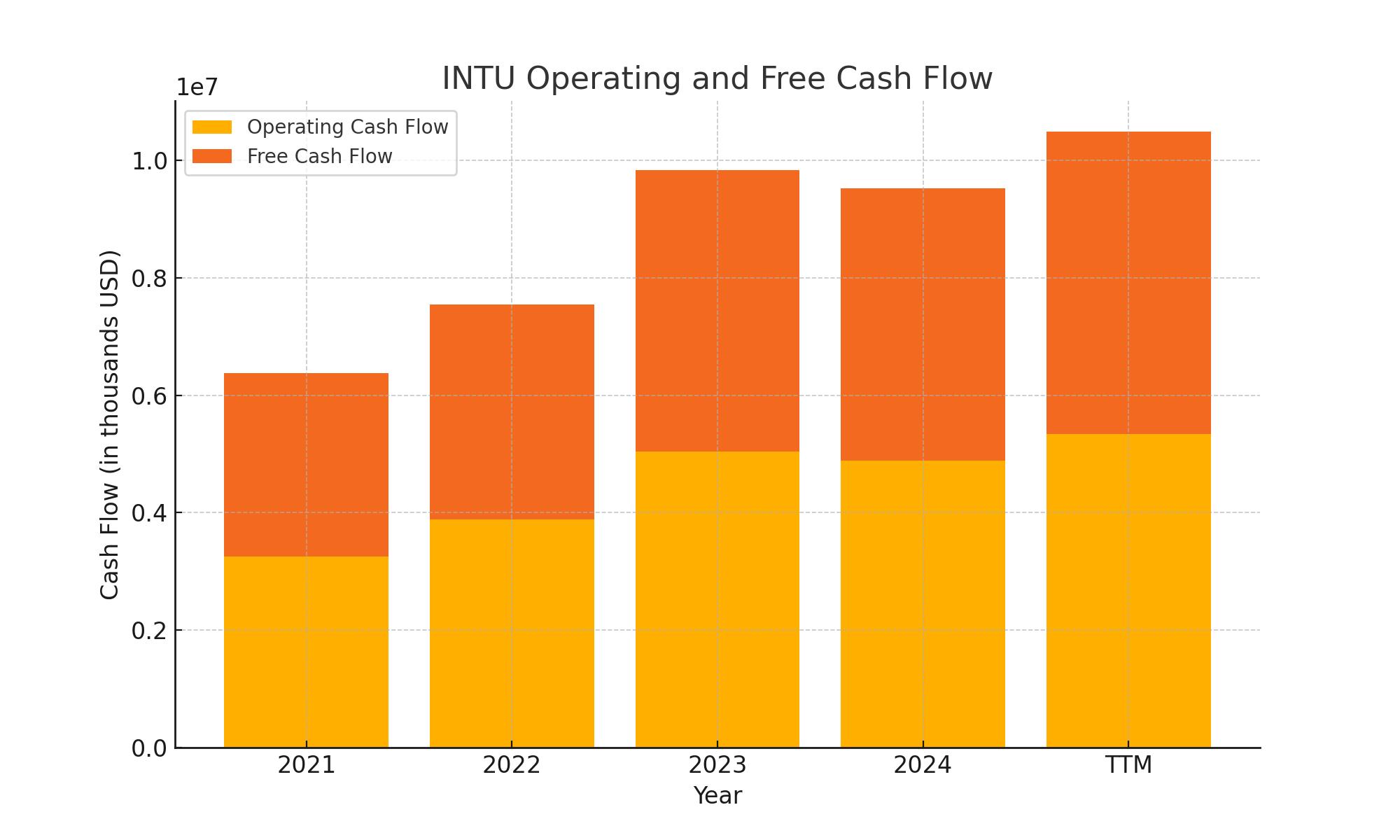

That revenue growth speaks to Intuit’s expanding role in digital finance, from tax prep to full-scale business management tools. Meanwhile, the company continues to produce significant cash. Over the past year, operating cash flow came in at $6.24 billion, with $5.2 billion of that turning into free cash flow. That’s a powerful foundation for dividends, and more importantly, for growing them.

Key Dividend Metrics

💵 Forward Dividend Yield: 0.58%

📈 5-Year Average Yield: 0.59%

💰 Forward Annual Dividend Rate: $4.16

📊 Payout Ratio: 32.82%

📅 Next Dividend Date: April 18, 2025

📆 Ex-Dividend Date: April 10, 2025

🔄 Dividend Growth Streak: Ongoing

🔧 Dividend Coverage: Strong via cash flow

These figures may not impress at first glance, especially for those used to hunting down 3% or higher yields. But there’s something to be said for quiet, steady reliability—especially when it’s paired with a company that’s continuing to grow.

Dividend Overview

Intuit’s dividend is understated, almost to the point of being missed by the average income-focused investor. At less than 1%, the current yield doesn’t scream “dividend play,” but the reality is more nuanced. That small payout is backed by a fortress-like balance sheet and a cash-generating engine that just keeps running.

The company initiated its dividend more than a decade ago, and it’s been quietly building on it ever since. The current payout ratio sits comfortably at about 33%, which gives plenty of breathing room for growth while allowing the business to keep investing in future expansion.

What makes the dividend especially compelling is the coverage. With $6.24 billion in operating cash flow and a dividend obligation of just over $1.1 billion annually (based on the $4.16 payout and share count), there’s plenty of cushion. Even during earnings hiccups, this level of free cash flow offers a clear signal: the dividend is not only sustainable, it’s got room to grow.

Dividend Growth and Safety

Safety is rarely in question with Intuit. The business model is sticky—tax software, accounting platforms, and financial services don’t get abandoned easily. Customers tend to stay, renew, and upgrade. That provides a stable revenue base, even in rocky economic environments.

Over the past several years, Intuit has built a consistent track record of dividend increases. They may not be huge, double-digit hikes each year, but they’re reliable. There’s a quiet discipline to the way Intuit approaches capital returns. They don’t chase yield. They don’t overextend the payout. And they don’t need to.

What’s encouraging is the free cash flow strength. Intuit’s dividend is solidly backed—not by debt or short-term cost-cutting, but by real, recurring cash flow. With a modest payout ratio and a management team that clearly values balance sheet strength, the dividend has room to grow, especially as the business scales further.

Intuit won’t be mistaken for a classic dividend stock, and that’s okay. For those building a portfolio focused on quality income over time, a name like INTU provides diversification, exposure to a high-margin business, and a payout that’s quietly becoming more meaningful.

Cash Flow Statement

Intuit’s cash flow generation remains a strength, with operating cash flow over the trailing twelve months hitting $5.34 billion. That’s up from $4.88 billion the prior year and reflects solid execution across its business units. Free cash flow over the same period landed at $5.14 billion, showing impressive efficiency, especially after accounting for just $199 million in capital expenditures. This indicates Intuit is converting a high percentage of its revenue into usable cash, supporting both operations and shareholder returns.

Investing cash flow came in at a manageable negative $625 million for the TTM, down from the large outflows seen in 2021 and 2022 during periods of heavy acquisition activity. Financing activities reflected the company’s ongoing commitment to returning capital, with $1.96 billion spent on share repurchases and $125 million in debt repayment. Despite this, the ending cash position rose to $8.03 billion, its highest in recent years. That kind of liquidity gives the company plenty of flexibility to weather short-term volatility while continuing to invest in growth and maintain its dividend.

Analyst Ratings

Intuit has recently drawn positive attention from analysts, with several adjusting their price targets upward in response to the company’s latest earnings. The general sentiment remains favorable, reflecting confidence in the long-term growth of Intuit’s business model and product expansion.

🔼 UBS kept a neutral stance but bumped its price target from $720 to $750, citing improved performance in consumer-focused segments.

🔼 Oppenheimer reiterated its outperform rating and raised its target from $642 to $742, noting TurboTax’s strong engagement even in a softer economic climate.

🔼 Jefferies continues to rate the stock a buy, pushing its target from $735 to $850, driven by confidence in the company’s earnings momentum.

🔼 Citi followed suit, moving its target from $726 to $789 based on optimism about future revenue and user growth across platforms.

🎯 The average 12-month price target now stands around $785, with a range spanning from $530 to $875. That puts the current market price well within a favorable zone for upside potential, based on analyst outlooks.

📈 Much of the positive momentum comes from Intuit’s strong revenue performance, careful cost controls, and strategic plays in automation and AI. Analysts are also encouraged by the recurring nature of its revenue streams and how effectively it retains users across its ecosystem.

Earning Report Summary

Intuit had a solid showing in its most recent quarter, with results that reflected strong demand across nearly all parts of the business. Total revenue came in at $7.75 billion, which is a 15% jump from where things stood a year ago. On the earnings front, adjusted EPS landed at $11.65, marking an 18% year-over-year increase. It was a clean, steady quarter that underscored the company’s momentum.

Strong Tax Season Performance

The Consumer Group, which includes TurboTax, had a particularly good run, bringing in $4 billion in revenue. That’s an 11% gain and a sign that the core tax prep business is still very much alive and thriving. Intuit saw solid volume and continued interest in its higher-tier offerings. Leadership pointed out that TurboTax benefited from both returning users and new customers choosing more premium options.

Small Business and Credit Karma Gain Ground

The business segment that covers QuickBooks and other tools for small companies also impressed. It brought in $2.8 billion in revenue, up 19%. The Online Ecosystem within that group was the standout, growing 20% to reach $2.1 billion. Credit Karma, which had gone through a slower period in the past, showed strong recovery. Revenue there jumped 31% to $579 million, with solid contributions from credit cards, personal loans, and insurance leads. Even the ProTax Group, which serves tax professionals, saw a 9% increase.

Earnings Climb with Higher Margins

On the profitability side, operating income climbed to $3.7 billion, a 20% increase from the same time last year. Net income came in at $2.82 billion, compared to $2.39 billion the year before. Diluted EPS rose to $10.02 from $8.42. These results reflected not just top-line growth but also improved margins and a disciplined approach to costs.

Optimistic Outlook Ahead

Management bumped up their guidance for the full year, now expecting total revenue to fall between $18.72 and $18.76 billion, representing 15% growth. Adjusted earnings per share are projected to land between $20.07 and $20.12, up 18% to 19% from last year’s numbers.

CEO Sasan Goodarzi mentioned that the company is leaning heavily into AI to enhance all parts of the platform. He described Intuit’s vision as becoming a full-service hub of smart tools and human help, especially for consumers and mid-sized businesses trying to stay ahead financially. CFO Sandeep Aujla echoed that view, noting how the strength across every part of the platform justified the raised outlook.

Intuit continues to show that it’s not just about taxes or accounting anymore. With steady execution, stronger digital adoption, and smart investments in AI, the company is positioning itself for even more consistent performance ahead.

Management Team

Intuit’s leadership has remained a steady hand through periods of growth and transformation. Sasan Goodarzi, the CEO, has been a driving force behind the company’s shift toward becoming an AI-first platform. His vision has shaped Intuit into more than just a tax software provider, pushing it into a broader space that includes credit, commerce, and smart business solutions. His leadership emphasizes innovation but not at the cost of customer trust, which remains central to Intuit’s approach.

Backing him is CFO Sandeep Aujla, who has brought operational clarity and a disciplined approach to capital allocation. With prior experience at Visa and several global finance roles, he’s helped streamline the company’s financial strategy to ensure that each dollar invested brings tangible growth or deepens platform strength. Other key leaders, including CTO Alex Balazs, have made major strides in integrating AI and automation across products. Collectively, the team has created a culture that balances ambition with execution, and that has paid off with consistent results.

Valuation and Stock Performance

Intuit’s stock has delivered solid gains over the past year, supported by consistently strong fundamentals and upbeat earnings. The stock has moved past previous highs and continues to trend upward, driven by market enthusiasm around its expanding role in fintech and AI. Momentum has remained positive following recent earnings and raised forward guidance.

From a valuation standpoint, the stock isn’t cheap by traditional metrics. Intuit trades at a forward price-to-earnings ratio in the low 30s, which puts it well above the average for many tech and financial names. But investors seem willing to pay that premium due to the reliability of its earnings, its cash generation, and the long runway for growth. Its PEG ratio sits in a range that suggests a healthy balance between price and expected earnings growth over the next few years.

The company’s consistent free cash flow and relatively modest debt also help justify its elevated valuation. With strategic investments in machine learning and new services showing results, the market appears confident that Intuit can continue expanding both revenue and margins.

Risks and Considerations

No company is without its challenges, and for Intuit, those risks start with the rapid pace of change in the software and financial services sectors. The pressure to continuously innovate is intense. If competitors offer better or more accessible products, customer loyalty can erode quickly, especially in the crowded small business software space.

Regulatory scrutiny is another area of concern. With Credit Karma and TurboTax under its wing, Intuit touches on a lot of sensitive areas, from credit scoring to tax filing. Any tightening in regulations could affect how it collects or uses data, or slow down new initiatives. And as the company continues pushing into fintech, compliance costs are likely to rise.

Economic slowdowns also pose a risk, particularly for the small and mid-sized business customers that make up a significant portion of Intuit’s base. In tough times, subscription-based services are often scrutinized or cut altogether, which could weigh on renewal rates or upsell opportunities.

Cybersecurity is a final, but serious, consideration. With so much customer financial information flowing through its systems, Intuit must continue making significant investments in infrastructure and defense. A breach wouldn’t just mean potential fines—it could deeply damage the company’s reputation, something that takes much longer to repair than a balance sheet.

Final Thoughts

Intuit remains one of the more intriguing tech names with an income-generating profile, even if the dividend yield itself is on the lighter side. What it offers instead is dependability, product stickiness, and a leadership team with a long-term view. With strong fundamentals, a robust cash position, and a clear focus on platform-wide integration of AI, it stands out as a company that’s managing to innovate while delivering consistent results.

For investors who want exposure to a tech-forward firm that also values shareholder returns and disciplined growth, Intuit checks a lot of boxes. Its past performance, paired with its strategic direction, suggests the story here is far from over.