Key Takeaways

💸 IIPR offers a forward dividend yield of 13.71% with a history of consistent growth, though recent tenant issues have introduced some risk to future increases.

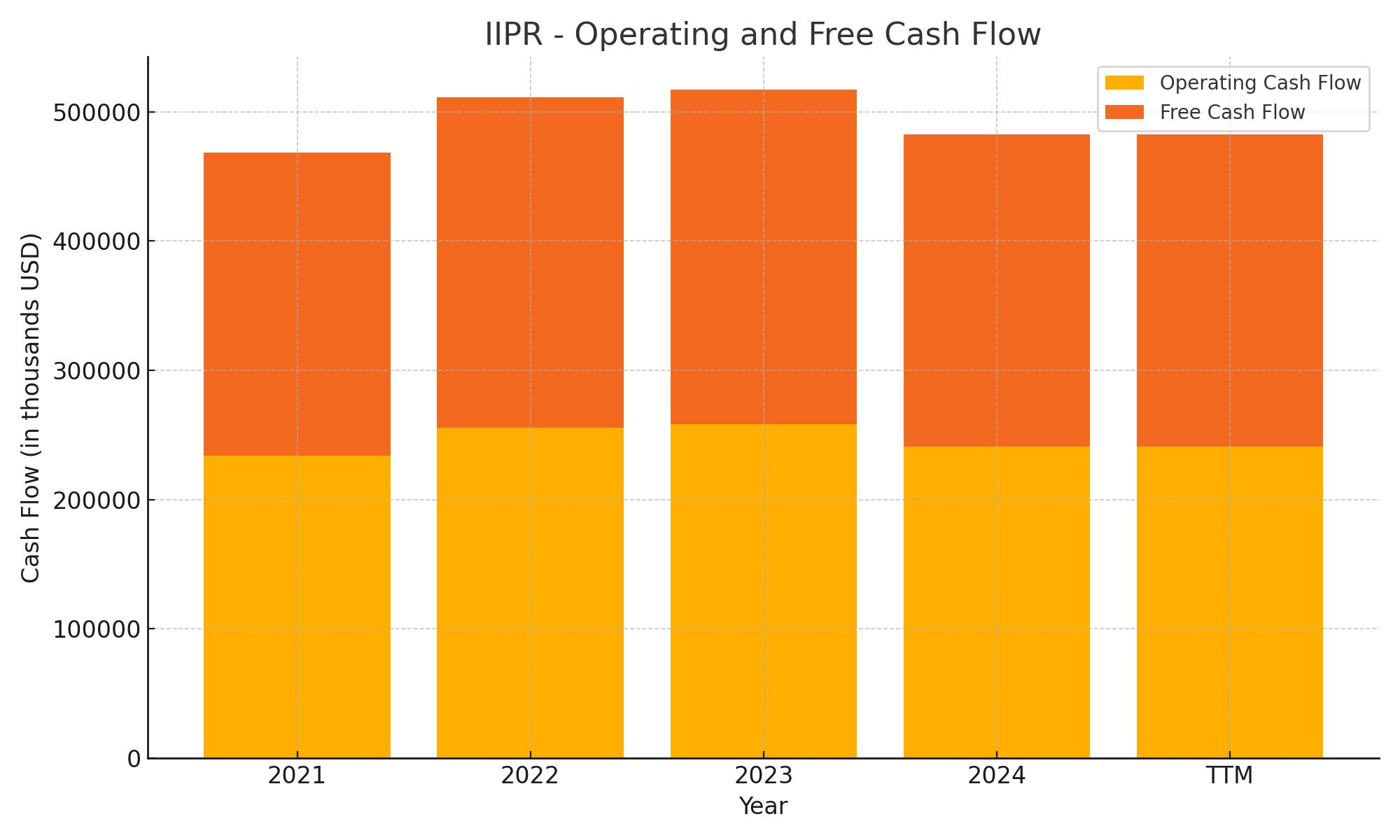

💼 Operating and free cash flow remain strong at $241 million TTM, supporting dividend coverage despite earnings pressure and tenant defaults.

📊 Analysts are split, with a consensus price target around $91 and recent downgrades due to tenant instability, while some maintain a bullish long-term view.

Updated 5/16/25

Innovative Industrial Properties (IIPR) is a real estate investment trust focused on owning and leasing specialized facilities to licensed operators in the regulated cannabis industry. With a portfolio spanning 110 properties across 19 states and nearly 9 million rentable square feet, IIPR offers investors exposure to a high-yielding REIT with a distinct operational niche. Despite recent tenant defaults, the company maintains strong cash flow and continues to support its substantial dividend.

Trading at a steep discount from its previous highs, IIPR is attracting attention for its current yield, disciplined balance sheet, and ongoing property development. Management has taken proactive steps to reinforce tenant quality and preserve long-term value, even amid sector volatility.

Recent Events

The company’s latest quarterly numbers were mixed. Revenue came in slightly lower, down nearly 5% year-over-year, and earnings saw a more noticeable dip, falling over 21%. These aren’t ideal figures, but context matters here.

Much of that drop is tied to tenant issues—missed rent, restructured leases, and some uncertainty that’s been brewing across the cannabis sector. That’s not surprising given how fragmented and complicated the legal landscape remains. Despite those challenges, IIPR has kept its profitability intact. Net income margins are still above 50%, and operating cash flow remains healthy.

Liquidity is another bright spot. The REIT has more than $128 million in cash and a current ratio north of 2.4. There’s no immediate pressure on the balance sheet. That’s not always the case in higher-yielding REITs, so it’s worth noting.

Market sentiment is still recovering. Shares have lifted off the 52-week low of $45.44 but remain far below last year’s highs near $138. That massive price compression has turned IIPR into one of the highest-yielding real estate investments on the market today.

Key Dividend Metrics

📈 Forward Dividend Yield: 13.71%

💰 Annual Dividend Rate: $7.60

📅 Ex-Dividend Date: March 31, 2025

✅ 5-Year Average Yield: 6.04%

📊 Payout Ratio: 146.44%

💼 Trailing P/E Ratio: 10.68

📉 Stock Price Decline (52-Week): -51.33%

It’s rare to see a yield above 13% without red flags waving everywhere. But here, there’s real property backing up those payments and a consistent history of rental income.

Dividend Overview

That payout ratio does raise eyebrows. At over 146%, it would normally be a flashing warning sign. But remember, this is a REIT—and REITs aren’t judged by earnings per share. They’re judged by their cash flow.

IIPR generated over $241 million in operating cash over the last year. That easily covers its dividend obligations, which total just over $212 million when you consider the 28 million shares outstanding. So while the payout ratio looks elevated, the cash says otherwise.

A key part of the business model is its lease structure. Nearly every property is under a triple-net lease—tenants pay the taxes, insurance, and maintenance. Add in annual rent escalators and you get a fairly predictable stream of income. That’s one of the reasons the dividend has held up even as some tenants have stumbled.

Still, the risks aren’t hidden. Several tenants have asked for restructured deals or missed payments entirely. And since most of these companies can’t access traditional banking, their liquidity is often stretched. That’s part of the package when you’re investing in this space.

Dividend Growth and Safety

Despite the sector’s issues, IIPR has grown its dividend like clockwork since its IPO in 2016. In fact, it’s one of the few REITs that’s delivered steady hikes almost every quarter since inception.

That said, the pace of increases has started to cool. Management is clearly being cautious, waiting to see how the next few quarters play out. But it’s notable that they haven’t cut the payout—not even once—through a period that’s seen more than a few growing pains.

Safety-wise, the company is sitting on a solid cash cushion and has kept its debt levels modest. With a debt-to-equity ratio just above 15%, there’s room to maneuver if things get tight. And because the leases are long-term—many run 10 to 20 years—it’s not as if income suddenly disappears even if a few tenants hit turbulence.

Another plus for dividend investors: the share count is stable. There hasn’t been dilution, and institutional ownership remains high at nearly 74%. That’s a sign that big money still believes in the income stream, even if price volatility makes the headlines.

Cash Flow Statement

Innovative Industrial Properties has remained a strong cash generator, reporting $241 million in operating cash flow over the trailing twelve months. That’s slightly lower than the $258 million reported in the previous year but still comfortably ahead of earlier periods. This steady inflow supports its generous dividend and provides a solid financial foundation even amid sector turbulence. Free cash flow mirrors operating cash flow precisely, showing that capital expenditures remain minimal or are structured in a way that doesn’t erode liquidity.

On the investment side, IIPR continues to deploy capital strategically, with $58 million in outflows tied to property acquisitions and improvements. That’s notably less aggressive than in earlier years, especially 2021, when investment spending topped $396 million. Financing activity tells a more cautious story now as well. The company reduced its financing cash flows by over $200 million in the past year, mainly through dividend payouts and modest debt repayments, offset slightly by just under $19 million in stock issuance. The result is a stable end-of-period cash position of $128 million, down modestly from the prior year but still showing strong financial flexibility.

Analyst Ratings

📉 Innovative Industrial Properties (IIPR) has seen a notable shift in analyst sentiment recently.

🔻 In late March 2025, Compass Point downgraded the stock from Neutral to Sell, trimming the price target from $60 to $50. This downgrade was largely driven by issues with tenant defaults and skepticism about the company’s ability to re-lease its properties quickly and without significant cost.

⚠️ Piper Sandler echoed the cautious stance, maintaining an Underweight rating while slightly lowering their price target from $60 to $55. Their concern centered around the financial health of key tenants and the ripple effects that could have on IIPR’s earnings stability.

💹 On the more optimistic end, Roth MKM kept a Buy rating in place, holding firm with a price target of $130. Their view points to longer-term confidence in the company’s strategy and the belief that the real estate portfolio remains solid despite current pressures.

🎯 The average consensus price target from analysts sits around $91. Estimates range broadly, from a low of $45 to a high of $130, reflecting the high degree of uncertainty—alongside potential opportunity—embedded in IIPR’s cannabis-linked property portfolio.

Earning Report Summary

A Tough Quarter, but No Panic

Innovative Industrial Properties kicked off 2025 with some noticeable bumps in the road. Revenue for the first quarter landed at $71.7 million, a step down from $75.5 million a year ago. Net income came in at $30.3 million, or $1.03 per share, which was also lower than the $1.36 per share they posted this time last year. Adjusted funds from operations, often the best way to measure a REIT’s performance, slipped to $1.94 per share from $2.21.

The numbers reflect a few setbacks, particularly with tenants. Several cannabis operators missed rent payments in March, including PharmaCann and a few others, causing about $13 million in total missed rent. IIPR did apply some tenant security deposits to cover the shortfall, but those are one-time tools and won’t be available moving forward. That’s clearly something to watch in future quarters.

Staying Active, Even in Choppy Waters

Even with the revenue pressure, the company kept moving. It added a 22,000-square-foot facility in Maryland to its portfolio and locked in a long-term lease right away. Over in Michigan, it leased out a large property to Berry Green, and sold another location for $9 million while arranging financing for the buyer. Another property in California is also on the selling block, with a planned $2 million sale in the works.

Despite some challenges, IIPR is still in a solid financial position. It ended the quarter with over $220 million in liquidity, giving it flexibility to manage short-term turbulence and make opportunistic moves. It also recognized a $3.5 million impairment loss on one of its properties, which suggests management is being realistic about asset values rather than kicking the can down the road.

A Portfolio Built for Income

As of March 31, the portfolio included 110 properties across 19 states. That adds up to about 9 million rentable square feet, with nearly 670,000 of those under development or being redeveloped. So while the company’s facing some near-term noise, it’s not standing still. It’s reshaping and investing in its properties with a clear eye on long-term returns.

The dividend remains untouched, which is likely welcome news for income-focused investors. Management declared a first-quarter dividend of $1.90 per share, which was paid out in April. On an annualized basis, that comes out to $7.60 per share—one of the richer payouts in the REIT space.

Leadership acknowledged the ongoing tenant challenges but also made it clear they’re not sitting idle. They’re working to improve tenant quality and are focused on keeping the portfolio strong. It wasn’t a perfect quarter by any means, but they’re navigating the bumps with a steady hand and a long-term mindset.

Management Team

Innovative Industrial Properties (IIPR) is led by a seasoned team with deep roots in real estate and REIT operations. At the helm is Paul Smithers, who has served as President and CEO since the company’s inception. Smithers brings decades of experience in real estate law and investment, providing steady leadership through the company’s growth and the evolving cannabis industry landscape.

Supporting him is Executive Chairman Alan Gold, a veteran in the REIT sector known for his strategic vision and governance expertise. Chief Financial Officer David Smith, who joined in 2023, brings a strong background in financial management from his previous roles in both public and private REITs. Chief Operating Officer Catherine Hastings oversees day-to-day operations, ensuring the company’s assets are managed efficiently. Chief Investment Officer Ben Regin leads the acquisition strategy, focusing on identifying and securing high-quality properties. The team is rounded out by professionals like Andy Bui, Vice President and Chief Accounting Officer, and Tracie Hager, Senior Vice President of Asset Management, both of whom bring extensive experience in their respective fields.

Valuation and Stock Performance

As of mid-May 2025, IIPR’s stock trades around $56, reflecting a significant decline from its 52-week high of $138.35. This drop has been influenced by tenant defaults and broader challenges in the cannabis industry. Despite these headwinds, the company’s fundamentals suggest potential undervaluation. With a price-to-earnings ratio of approximately 10.4 and a price-to-book ratio of 0.83, the stock appears attractively priced compared to industry peers.

Analyst sentiment is mixed. Some maintain a hold rating, citing concerns over tenant stability and regulatory uncertainties. Others see value in the stock’s current price, especially given its strong dividend yield and the company’s proactive management strategies. The consensus price target hovers around $88.75, indicating potential upside if the company can navigate its current challenges effectively.

Risks and Considerations

Investing in IIPR comes with several risks. The company’s reliance on the cannabis industry means it’s exposed to regulatory changes, market volatility, and tenant financial health. Recent tenant defaults have highlighted the potential for income disruptions, which could impact dividend sustainability.

Additionally, the high dividend payout ratio, currently over 146 percent, raises questions about long-term sustainability, especially if cash flows are impacted by tenant issues. The company’s strategy of using security deposits to cover missed rent payments is a short-term solution and may not be viable in the long run.

On the financial side, while IIPR maintains a strong balance sheet with over $220 million in liquidity, any tightening in capital markets or increased borrowing costs could affect its ability to finance new acquisitions or support existing operations.

Final Thoughts

Innovative Industrial Properties operates in a niche market with unique opportunities and challenges. The company’s experienced management team, strategic asset acquisitions, and strong balance sheet position it well for long-term growth. However, investors should be mindful of the risks associated with the cannabis industry’s volatility and regulatory environment. While the current stock price and dividend yield may appear attractive, it’s essential to consider the potential for income disruptions and the sustainability of the dividend in the face of tenant defaults and market uncertainties.