Key Takeaways

📈 Ingredion offers a forward dividend yield of 2.30% with a low 33.5% payout ratio, leaving room for continued dividend growth backed by strong free cash flow.

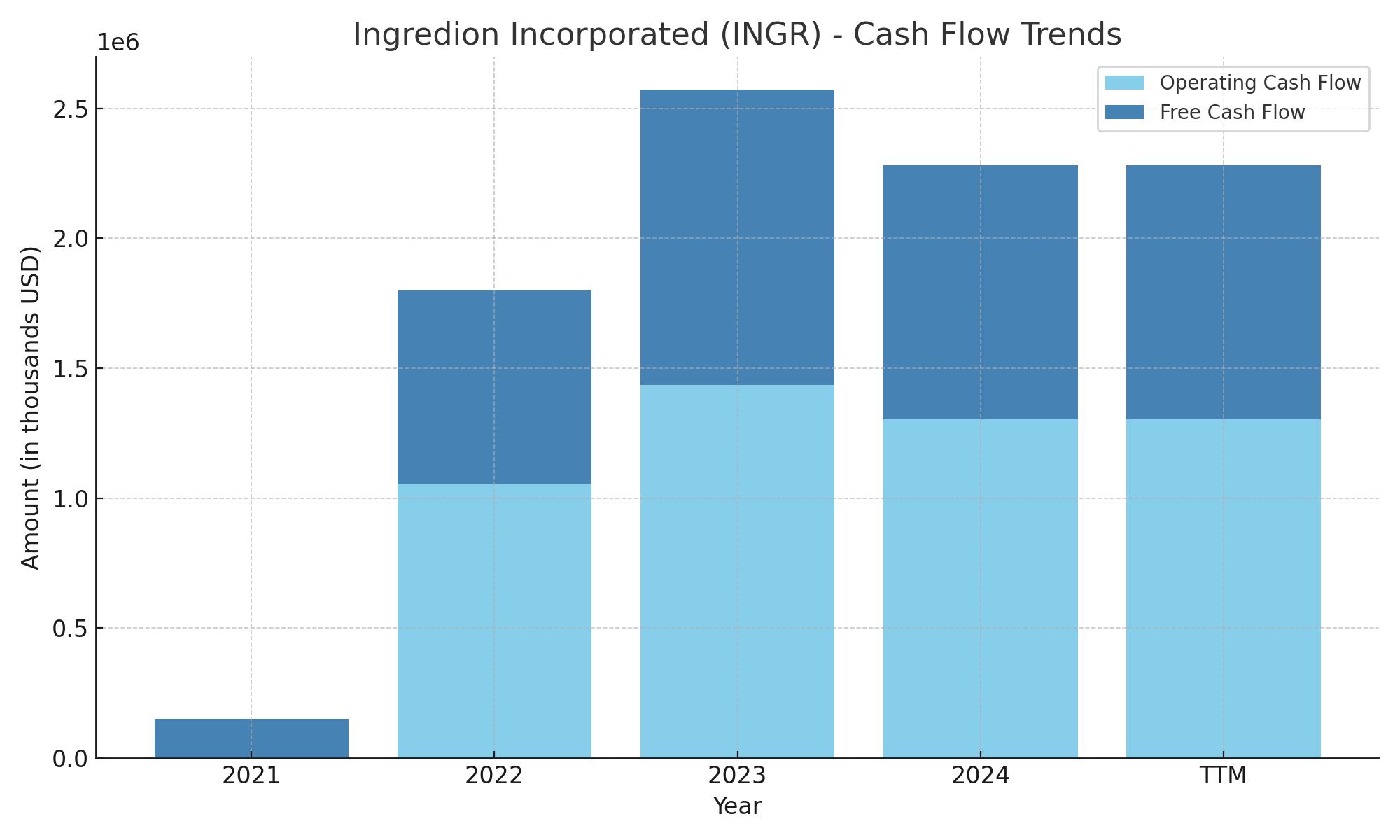

💵 The company generated $1.3 billion in operating cash flow and $976 million in free cash flow over the trailing twelve months, reflecting strong liquidity and efficient capital management.

🔍 Analyst sentiment is cautious but stable, with a consensus “Hold” rating and an average 12-month price target of $150.20, indicating moderate upside potential.

Updated 5/16/25

Ingredion Incorporated (NYSE: INGR) is a global producer of starches, sweeteners, and plant-based ingredients used across food, beverage, and industrial sectors. With operations rooted in efficiency and a diversified product mix, the company has built a reputation for consistent performance, steady cash generation, and shareholder-friendly capital allocation.

In recent quarters, Ingredion has shown resilience through margin improvement and disciplined cost control, even amid soft revenue trends. Backed by a strong management team and a healthy balance sheet, it continues to support a reliable dividend while reinvesting in innovation and sustainability-focused growth.

Recent Events

Ingredion, a company deeply woven into the fabric of food production and industrial ingredients, has been showing signs of steady execution even amid a slightly choppy environment. In the first quarter of 2025, they posted $7.36 billion in trailing twelve-month revenue, but it did come with a 3.7% decline from the year before. At first glance, that might raise eyebrows, but what’s encouraging is the strength behind the margins. Operating margin is holding firm at 15.6%, which tells us the company is managing its cost structure with care.

Earnings per share fell 8.8% over the same period. That’s a notable dip, but Ingredion’s underlying fundamentals remain intact. Their ability to generate consistent free cash flow and their clean balance sheet offer more than just comfort—they provide room for resilience. The company’s total debt is at $1.78 billion, paired with a solid cash reserve of $846 million. That makes for a healthy current ratio of 2.85, suggesting the company is well-equipped to meet any short-term obligations.

With the stock price recently touching $138.89 and up 16.1% over the past year, Ingredion is gaining attention. The market seems to be rewarding its steady hand. The 2.69% jump on May 15 indicates renewed confidence, perhaps from investors recognizing its defensive value.

Key Dividend Metrics

📈 Forward Yield: 2.30%

💰 Forward Dividend Rate: $3.20

🧮 Payout Ratio: 33.54%

📅 Last Dividend Date: April 22, 2025

⏱️ Ex-Dividend Date: April 1, 2025

📊 5-Year Average Yield: 2.78%

🧱 Dividend Growth Streak: Consistently upward

⚖️ Free Cash Flow Coverage: $736.5 million in levered FCF

Dividend Overview

At a glance, Ingredion’s yield might not leap off the page—it currently sits at 2.30%. But context is everything. That figure has dipped slightly from its 5-year average of 2.78%, and the reason isn’t hard to spot: the stock’s price has moved higher. When yield compresses because the stock climbs, it’s not a bad problem to have.

The dividend itself is backed by a solid payout rate of $3.20 annually. More importantly, it’s supported by real business results. The payout ratio is only 33.5%, which leaves a generous margin of safety. For dividend-focused investors, this is where you want to be—comfortably within the sustainable zone, with room to grow.

It’s also worth noting that the stock isn’t burdened by excessive leverage. Debt is managed well, and the company has ample free cash to meet its obligations while continuing to reward shareholders. Ingredion’s cash flows are dependable, not just in the past year but across cycles. And when those free cash flows consistently exceed dividend payments, it signals a dividend that’s not just stable—it’s sturdy.

Dividend Growth and Safety

This isn’t a company swinging for the fences with aggressive dividend hikes or flashy payout moves. Ingredion takes a more measured, methodical approach. Dividend increases have been regular and tied closely to earnings growth, which is precisely what you want from a business trying to deliver sustainable income.

Right now, they’re working with $1.3 billion in operating cash flow and $736.5 million in levered free cash flow. That kind of financial firepower gives the company breathing room to continue its shareholder returns without straining the business. Whether it’s through dividend growth, reinvestment, or balance sheet reinforcement, the resources are there.

The capital structure also adds to the comfort. A debt-to-equity ratio of 44.5% shows the company isn’t overextended, and that gives flexibility if market conditions turn. With $846 million in cash, Ingredion is in a position to weather slowdowns or seize on opportunities. From a dividend safety perspective, that’s a strong buffer.

Another interesting point is how institutions are treating the stock—over 93% of shares are held by them. That level of ownership tells you this is a company respected for its consistency. Short interest remains modest, which supports the view that this stock isn’t drawing speculative pressure.

Cash Flow Statement

Ingredion has posted strong operating cash flow over the trailing twelve months, reaching $1.3 billion. This is slightly down from the $1.44 billion generated in 2024 but remains well above previous years, highlighting consistent performance in core operations. Capital expenditures have been stable, landing at $328 million, which leaves a solid free cash flow of $976 million. That level of free cash flow puts the company in a favorable position to support dividends, invest strategically, and maintain financial flexibility without overextending itself.

Investing cash flow remained negative at $318 million, largely tied to ongoing capital investments. On the financing side, the company had a net outflow of $572 million, reflecting continued debt repayments and dividend distributions. Ingredion issued $730 million in new debt but repaid $499 million, suggesting careful debt management. Cash on hand stands at $852 million, lower than the previous year but significantly higher than pre-2023 levels, underscoring improved liquidity and a more robust financial position.

Analyst Ratings

📉 Ingredion has recently seen a shift in analyst sentiment, with some firms adjusting their outlooks. UBS downgraded the stock from “Buy” to “Neutral” on April 7, 2025, citing concerns over margin pressures and a more cautious near-term outlook. They also reduced their price target from $165 to $145.

📊 Oppenheimer maintained its “Outperform” rating but lowered its price target from $167 to $155 on April 22, 2025, reflecting a more conservative stance on revenue growth projections.

📌 The consensus among analysts is a “Hold” rating, with an average 12-month price target of $150.20. This suggests a modest upside from the current trading price.

🔍 These adjustments indicate a cautious approach by analysts, focusing on the company’s ability to navigate current market challenges while maintaining profitability.

Earning Report Summary

Solid Start to the Year

Ingredion got off to a solid start in 2025, turning in a performance that showed strength despite a few expected headwinds. Adjusted earnings per share came in at $2.97, comfortably ahead of expectations. On a reported basis, EPS was $3.00, which was down slightly from last year’s $3.23, but the drop was mainly because last year included a one-time benefit from the sale of their South Korea business. Strip that out, and the core business actually moved in the right direction.

Operating income looked healthy too. The company reported $273 million in adjusted operating income, which was up 26% compared to last year. That growth came largely from a better product mix and a tighter grip on operations. While total sales dipped 4% to $1.81 billion—thanks to lower prices, currency shifts, and the South Korea divestiture—most of the pieces that matter showed progress.

Segment Highlights

One of the bright spots this quarter came from the Texture & Healthful Solutions segment. It posted a 34% jump in operating income, helped by stronger demand and lower input costs. The Latin America side of the business also pulled its weight, with the Food & Industrial Ingredients segment there up 26%. Those gains were fueled by a mix of solid market conditions and tighter cost control.

Leadership’s View

CEO Jim Zallie pointed out that Ingredion’s local production model—making and selling most of its products within the same regions—helped buffer the company against global disruptions. He also stressed the company’s continued focus on long-term value and its ability to serve customers with high-quality, sustainable ingredient solutions.

Looking Ahead

Management raised its guidance for the full year, which speaks to their confidence. They’re now expecting adjusted EPS in the range of $10.90 to $11.60. Sales growth is expected to land in the low single digits, with operating income set to rise in the mid-single-digit range. Capital investments are expected to hit between $400 million and $450 million, much of it aimed at boosting production capacity and supporting sustainability goals.

Management Team

Ingredion’s leadership is anchored by CEO James P. Zallie, who has been at the helm since 2018. With a background in global specialties and a tenure that includes leading the Americas region, Zallie brings a wealth of experience to the role. Under his guidance, the company has focused on innovation and strategic growth.

Supporting Zallie is James D. Gray, the Executive Vice President and Chief Financial Officer. Gray is responsible for setting the financial direction of the company, ensuring fiscal discipline and strategic financial planning.

The executive team also includes Valdirene Bastos Evans, Senior Vice President and President of Global Texture Solutions, who oversees the development and execution of strategies in texture solutions. Larry Fernandes serves as Senior Vice President, Chief Commercial and Sustainability Officer, focusing on commercial strategies and sustainability initiatives.

Tanya Jaeger de Foras holds the position of Senior Vice President, Chief Legal Officer, Corporate Secretary, and Chief Compliance Officer, ensuring the company’s legal and compliance frameworks are robust. Michael Leonard, as Senior Vice President and Chief Innovation Officer, leads the company’s innovation efforts, particularly in protein fortification.

This leadership team collaborates to drive Ingredion’s strategic direction, focusing on innovation, operational excellence, and sustainable growth.

Valuation and Stock Performance

Ingredion’s stock has demonstrated resilience and growth over the past year. As of mid-May 2025, the stock is trading around 138.61, reflecting a 14.33 percent increase over the past year. The company’s market capitalization stands at approximately 8.82 billion dollars, with an enterprise value of 9.77 billion.

The stock’s price-to-earnings ratio is 14.21, which is below its five-year quarterly average of 28.3, suggesting potential undervaluation. The price-to-book ratio is 2.21, and the price-to-sales ratio is 1.2, indicating a reasonable valuation relative to its peers.

Analysts have set a consensus 12-month price target of 150.20, implying a modest upside from current levels. The company’s earnings per share is 9.65, with a free cash flow per share of 15.22, highlighting strong cash generation capabilities.

Ingredion’s financial health is solid, with a debt-to-equity ratio of 0.45 and a current ratio of 2.85, indicating a strong balance sheet and liquidity position. The company’s return on equity is 16.3 percent, and return on assets is 8.5 percent, reflecting efficient use of capital.

Risks and Considerations

While Ingredion has shown strong performance, several risks warrant consideration. The company’s operations are subject to fluctuations in raw material prices, particularly corn, which can impact margins. Additionally, foreign exchange volatility can affect international revenues and profitability.

Ingredion’s reliance on global supply chains introduces risks related to geopolitical tensions, trade policies, and transportation disruptions. Regulatory changes in food safety and environmental standards could also pose compliance challenges.

The company’s debt levels, while manageable, require ongoing monitoring to ensure financial flexibility. Furthermore, competition in the food ingredients sector is intense, with pressure to innovate and adapt to changing consumer preferences.

Environmental, social, and governance factors are increasingly important. Ingredion’s ESG risk rating is categorized as medium risk, indicating room for improvement in managing ESG-related risks and opportunities.

Final Thoughts

Ingredion’s strategic focus on innovation, operational efficiency, and sustainable growth positions it well in the food ingredients industry. The leadership team’s experience and commitment to long-term value creation are evident in the company’s performance and financial health.

The stock’s current valuation appears reasonable, with potential for modest upside based on analyst price targets. However, investors should remain cognizant of the risks associated with commodity price volatility, regulatory changes, and global supply chain dependencies.

Overall, Ingredion presents a compelling profile for investors seeking exposure to a company with a strong market position, solid financials, and a commitment to innovation and sustainability.