Key Takeaways

📈 The dividend yield stands at 3.30%, above the five-year average of 2.84%, with a low payout ratio of 25% that leaves room for future growth and continued stability.

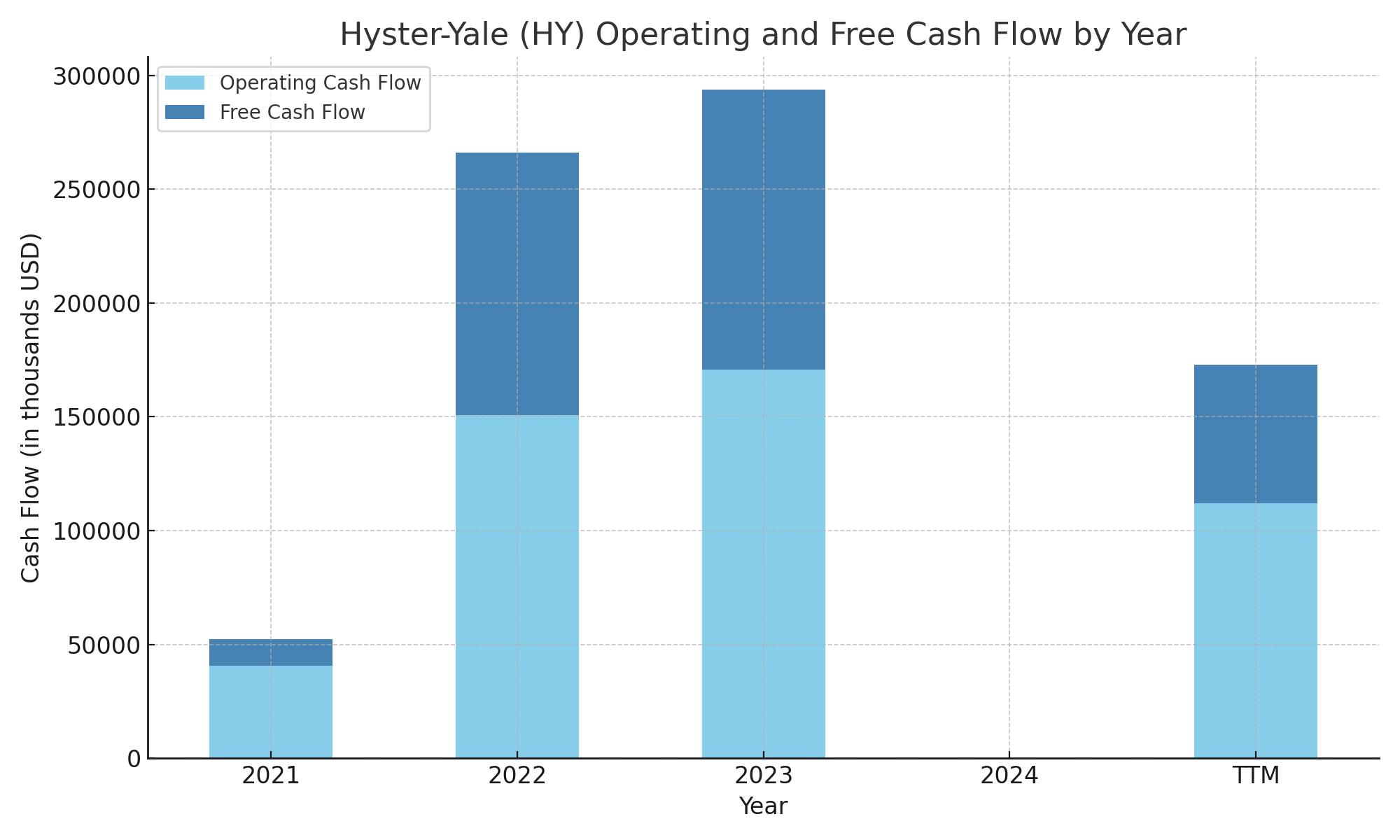

💵 Operating cash flow over the trailing twelve months totaled $111.9 million, with free cash flow at $61 million, supporting ongoing dividend payments and investment needs.

📊 Analysts recently downgraded the stock citing macro risks, but the consensus price target remains around $80, indicating cautious optimism for recovery.

Updated 5/16/25

Hyster-Yale, a global manufacturer of lift trucks and material handling equipment, has seen its stock fall sharply from a 52-week high of \$84.44 to around \$42.79. While revenue has recently dipped and earnings have come under pressure, the company continues to deliver a stable dividend and maintains a strong order backlog, signaling demand resilience in key regions.

Under the leadership of CEO Rajiv Prasad, the company is focusing on innovation and operational realignment, particularly through energy solutions like lithium-ion and modular systems. With a modest payout ratio and consistent cash generation, Hyster-Yale remains focused on long-term growth and disciplined capital management.

Recent Events

The last few quarters have brought a slowdown in the numbers. Revenue over the trailing twelve months came in at $4.16 billion, but that’s down 13.8% year-over-year. Meanwhile, earnings have felt the pinch, dropping more than 80% over the same period. That kind of swing can shake confidence, but for dividend investors, the more pressing question is: is the dividend still safe?

Looking closer, net income sits at just under $100 million and earnings per share are still a healthy $5.59. That’s more than enough to support the dividend, which remains well below these earnings levels. In fact, the payout ratio is just around 25%, which is considered conservative by any standard.

Debt is something to keep in mind here. Hyster-Yale carries about $484 million in total debt, with a debt-to-equity ratio north of 90%. That’s not out of control for a capital-intensive business, but it’s something to watch if revenue doesn’t stabilize soon. On the bright side, return on equity is a strong 21%, suggesting that the company knows how to make good use of its capital.

Key Dividend Metrics

💰 Forward Dividend Yield: 3.30%

📈 5-Year Average Yield: 2.84%

🔁 Payout Ratio: 25.04%

📆 Next Ex-Dividend Date: May 30, 2025

💵 Forward Dividend Rate: $1.41

📉 52-Week Price Drop: -43.04%

The numbers paint a clear picture. The dividend yield has moved higher as the stock has fallen, but the payout itself hasn’t skipped a beat. At 3.30%, investors are now getting paid more to wait, while the low payout ratio shows the company has breathing room.

Dividend Overview

Hyster-Yale’s dividend isn’t flashy, but it’s dependable. The company has kept the payment steady, even through rough earnings stretches. The current dividend rate of $1.41 annually hasn’t changed much, and that’s actually a positive for income-focused investors who value predictability over flash-in-the-pan growth.

One of the more attractive aspects of Hyster-Yale’s dividend is how affordable it is from a cash flow perspective. The business still generates positive operating cash flow—just over $111 million in the last year—and while free cash flow is tighter at $31.7 million, it’s still comfortably above the level needed to cover dividend payments.

What’s especially interesting is how HY now stands out more than it did a year ago. With the stock price nearly cut in half, the dividend yield has risen well above its five-year average. For income investors who look for value in overlooked corners of the market, this setup is becoming hard to ignore.

Dividend Growth and Safety

Hyster-Yale hasn’t made big moves in its dividend growth policy, but it doesn’t really need to. This is a company that plays the long game. Instead of chasing short-term praise with big dividend hikes, it’s focused on keeping the payout stable—and more importantly, safe.

That safety shows up in the numbers. The 25% payout ratio means the company is holding back the majority of its earnings, which can be used for reinvestment, debt reduction, or simply as a buffer in leaner times. This discipline matters when markets get choppy or when operating margins get squeezed.

While recent free cash flow figures are lower than some might like, they’re still in the black. That adds a layer of comfort for those holding for income. Even with earnings volatility, the company continues to throw off enough cash to cover what it owes to shareholders.

Looking ahead, the next ex-dividend date is May 30, and the company appears set to keep its schedule intact. For dividend-focused investors, it’s not always about the biggest yield or the most aggressive growth—sometimes, it’s about a company that keeps showing up, quarter after quarter, with a check in hand. Hyster-Yale fits that mold.

Cash Flow Statement

Hyster-Yale’s cash flow profile over the trailing twelve months reflects both operational strength and financial caution. The company generated $111.9 million in operating cash flow, a drop from the prior year’s $170.7 million but still solid, especially when compared to earlier periods. Free cash flow landed at $61 million, marking a step down from recent highs but remaining firmly positive, which supports its ongoing dividend payments and reinvestment needs.

Investing cash flow was a consistent outflow at -$50.9 million, largely due to capital expenditures, which are part of the company’s ongoing operational upkeep and growth investments. Financing cash flow showed an outflow of $43.7 million, driven by significant debt repayments exceeding new borrowings and a modest repurchase of shares. Hyster-Yale has been steadily reducing its debt obligations, signaling a focus on improving its balance sheet. The end cash position stands at $79.5 million, down slightly from the previous year but still maintaining a healthy liquidity buffer.

Analyst Ratings

📈 Hyster-Yale has experienced a series of analyst rating changes over the past year, reflecting the company’s performance and the broader economic environment. In June 2024, one firm upgraded the stock from “Market Perform” to “Outperform,” maintaining a price target of $90. This upgrade was driven by the company’s steady operational improvements and growing optimism around a rebound in industrial demand. Analysts pointed to efficiencies in cost structure and a focus on margin improvement as catalysts for long-term value.

📉 However, in May 2024, the same firm shifted its outlook and downgraded Hyster-Yale from “Outperform” back to “Market Perform.” The revised stance came amid renewed economic uncertainty and increased concern over the impact of trade-related disruptions and tariffs. Alongside this downgrade, the price target was adjusted downward from $75 to $50, reflecting a more tempered near-term view on profitability and demand trends.

🎯 As it stands, the consensus price target for HY sits around $80. This includes a high estimate of $90 and a low of $70, suggesting moderate upside potential from the current share price. Analysts remain divided, with some seeing value based on earnings power and capital discipline, while others are wary of cyclical exposure and margin pressures.

🧐 Overall, the sentiment among analysts suggests cautious optimism. There’s recognition of Hyster-Yale’s ability to generate returns and maintain a solid dividend, but also an awareness of the macro factors that could limit near-term gains.

Earnings Report Summary

Slower Quarter Reflects Industrial Headwinds

Hyster-Yale’s first quarter of 2025 wasn’t exactly a standout. Revenue fell to $910.4 million, down nearly 14% compared to the same quarter last year. That drop was felt in earnings too, with EPS sliding from $2.97 a year ago to just $0.49 this quarter. Net income followed suit, dropping to $8.7 million from last year’s $51.8 million.

The decline came mostly from the company’s core lift truck segment. Sales in the Americas and EMEA took a hit, though there was a bright spot in the JAPAC region. Larger truck demand and higher volumes helped soften the overall blow. Even with the dip in revenue, Hyster-Yale isn’t lacking in future business—their backlog actually climbed to $1.9 billion, and bookings surged 50% from the prior quarter. That kind of order activity suggests that this slowdown might be more of a breather than a long-term stall.

Leaning Into Strategy and Innovation

In response to the shifting landscape, Hyster-Yale is doubling down on its transformation strategy. The company is restructuring its Nuvera division to focus more on energy storage solutions, especially lithium-ion batteries and modular charging systems. They expect this realignment to trim $15–$20 million in costs annually starting later this year. At the same time, they’re integrating Nuvera costs into the broader lift truck business to better support their push into new energy solutions.

Eyes on Tariffs and the Road Ahead

Tariffs continue to loom large. With certain exemptions set to expire at the end of May, Hyster-Yale is taking steps to localize production—65% of sales are now fulfilled by U.S. factories. They’re also rolling out modular designs to allow greater flexibility across different manufacturing sites. These moves aren’t just about cutting costs—they’re about staying agile in an uncertain trade environment.

Looking into the next quarter, the company sees a bit of growth ahead but is tempering expectations on profit margins. Operating income is expected to dip slightly due to the short-term cost of adjusting to new tariffs. Capital expenditures are projected to land between $40 and $65 million, and cash flow from operations might be a touch below last year’s level.

Leadership remains optimistic. CEO Rajeev Prasad emphasized staying focused on innovation and cost control, while Executive Chairman Al Rankin reiterated their long-term goal of transforming how materials move across the supply chain. Their vision, even in a slower quarter, hasn’t wavered.

Management Team

Hyster-Yale’s leadership is anchored by a mix of seasoned executives and strategic thinkers focused on long-term growth. At the top is Rajiv Prasad, who has served as President and CEO since 2021. He brings steady direction to the company, guiding it through both expansion periods and more volatile stretches in the industrial space. His compensation structure, which is heavily tied to performance, signals a clear alignment with shareholder interests.

Working alongside Prasad is a team with deep operational expertise. Executive Chairman Alfred M. Rankin Jr. offers decades of leadership experience and continues to play an important strategic role. Charles Pascarelli, President of the Americas region, oversees what remains the company’s most crucial market. Meanwhile, Lauren Miller, the Chief Marketing Officer, leads brand development and market positioning across the global footprint. The average tenure among top executives exceeds three years, creating a sense of continuity that’s critical for executing long-range initiatives.

Valuation and Stock Performance

Hyster-Yale’s stock has had a bumpy ride over the past 12 months. Shares are currently trading around $42.79, after peaking at $84.44 and bottoming near $34.13 within the year. That kind of price swing captures not only the company’s own performance but also reflects broader pressures across the industrial sector. With a market cap of roughly $755 million, the company holds its place as a mid-cap name in a cyclical industry.

From a valuation standpoint, the stock is trading at a price-to-earnings ratio of about 7.6. That’s on the lower end, suggesting the market may be undervaluing the business relative to its earnings capacity. The price-to-sales ratio is also lean at 0.2, pointing to potential upside if investor sentiment improves. These figures imply the stock might be overlooked or simply discounted due to recent revenue softness. Either way, the valuation sits well below historical norms and industry averages.

Risks and Considerations

There are risks to weigh before taking a position in Hyster-Yale. Its business is tied closely to global industrial activity, particularly construction, logistics, and manufacturing. If economic conditions tighten or demand contracts in these segments, sales can be directly impacted. Additionally, ongoing supply chain complications continue to be a drag on operations, adding cost pressures and potential delays.

International exposure is another layer of complexity. While global markets offer scale and diversification, they also bring volatility. Currency shifts, shifting regulatory frameworks, and political risks can all affect performance. Then there’s the strategic pivot to energy solutions—particularly lithium-ion and hydrogen power systems. These are important long-term bets, but they also carry risk, given the capital required and the uncertainty of market adoption over time.

Final Thoughts

Hyster-Yale is not a flashy company, but it’s one with staying power. It serves a vital industrial niche, and its leadership has remained focused on adaptation and innovation even when the market has been tough. The fundamentals remain solid, and the long-term strategy is taking shape. While challenges persist, from macroeconomic uncertainty to tariff pressures, the company’s actions suggest a firm that’s not standing still. For investors who look for consistency, operational focus, and a shareholder-friendly posture, Hyster-Yale continues to be one to keep on the radar.